Börsipäev 4. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Täna olulisemaks sündmuseks loetud jaanuari tööjõuraport oli kahetine. Jaanuaris loodi 146 000töökohta, mis oli oodatust vähem. Samas oli tööpuudus 5,2%, kui oodati numbrit 5,4%.

-

Rev Shark:

Jobs Report Falls in the Middle

2/4/05 8:46 AM ETThe new jobs number is a bit light with 146,000 new jobs vs. the 188,000 expectation but the unemployment rate came in at 5.2% vs. the expected 5.4% The raw jobs number is considered more important but the lower rate does help stem the damage a bit. I'm no economist but I'm puzzled by the continued disconnect between the employer survey, which is the jobs number, and the household survey, which is the unemployment rate. They have not correlated for quite some time, which can be interpreted in a number of ways.

The market reaction to the numbers is pretty mild. We had a very slight dip and are now back close to even. The market generally prefers job growth that is not too hot and not too cold and we seem to be a little to the cool side, but not bad enough to proclaim that the economy is ailing.

Beware the First Move Off Jobs Number

2/4/05 8:08 AM ET"People Believe a 'Fact' That Fits Their Views Even If It's Clearly False"

-- Wall Street Journal report

The above article discusses an academic study finding that once we have a certain mindset about a topic we find ways to reject facts that are inconsistent with our views. In order to confirm this thesis, all you have to do is talk to someone about politics.

But it also has great application in the stock market. Investors tend to focus on news, events and facts that confirm their prevailing sentiment no matter how questionable their interpretations. They ignore or minimize events and facts that conflict with their prevailing views.

That is a particularly important concept to keep in mind this morning as the January jobs report is released. Investors like to classify reports such as this as "good" or "bad" depending on expectations reported by the media. If we beat expectations it is good, and if we don't then it's bad. That seems pretty cut and dried but as anyone who has been in the market for a while knows, beating expectations is no guarantee the there will be a positive reaction.

The reaction to news depends on the prevailing mindset of the broader market. If the market is predisposed to be bullish then it will tend to find a way to view what seems to be negative news as positive. We hear arguments such as "it is already priced in," or that some small individual component of the news is of particular significance. The market always finds a way to interpret news in a manner that is consistent with its current attitude.

That brings us to the big question this morning: What is the prevailing mindset of the market as we await the jobs report? Are investors inclined to look for the good and find reasons to justify buying, or are they leaning toward a negative view that will justify selling?

The bounce over the past week or so after hitting a low on Jan. 24 is evidence that buyers were feeling some desire to be back in the market after the ugly start to the year, but their buying interest has lacked real vigor. They have be cautious and have not been ready to fully embrace the idea of a recovery. The pullback yesterday helped confirm the current skittishness of the bulls.

With that backdrop in mind the likelihood is that the market will have a tough time fully embracing even a solid jobs report. Investors are skeptical and uncertain, as is illustrated in the technical picture, and they are not going to abandon that attitude easily. A "good" report is likely to generate some initial buying but the mixed feelings of investors are likely to result in some fairly aggressive profit-taking.

In this type of environment there is a high likelihood that the initial reaction of the market to the news will be a quick reversal. There is sufficient uncertainty and lack of clarity that the first move in the market will seem suspect and invite investors to sell or buy, as the case may be.

We will see soon enough. The key numbers to watch for are 188,000 new jobs, unemployment rate of 5.4%, earnings up 0.2% and work week hours of 33.8.

Early action is positive but that is irrelevant as await the economic news. European markets are generally positive while Asia was mixed. Oil is trading up.

Gary B. Smith:

-

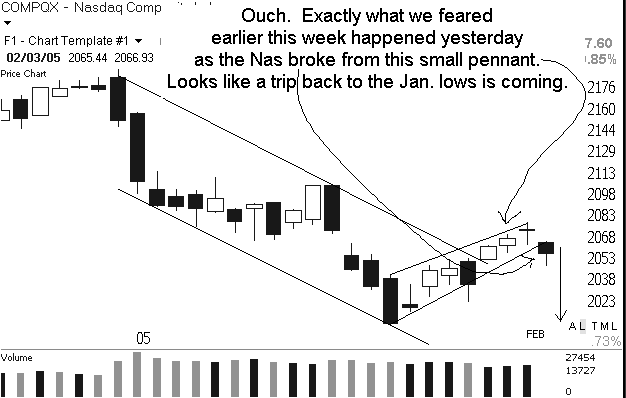

Eilne languspäev ajas pullid närvi:)

-

Pooljuhtidelt täna selle aasta tugevaim tõus (SMH +3,17%). Põhjuseks Prudential'i analüütik Mark Lipacis, kes tõstis kogu sektori reitingu "unfavorable" pealt "favorable" peale. Tundub, et pooljuhtide suurimat probleemi - ähmast tulevikku - suutis analüütik oma kommentaaridega mõnevärra hajutada. Mehe arvates saabub madalseis esimesel poolaastal ning kolmandast kvartaliks peaks taas müük kasvama hakkama (nii YoY kui QoQ baasil).

Üks suurimaid tõusjaid on Texas Instruments (TXN), mille reitingu Pridential tõstis "overweightile" varasemalt "neutralilt" (+6,10%). Pisut nõrgemad on aga programmeeritavate loogikaseadmete tootjad Xilinx (XLNX) ja Altera (ALTR), kelle osas analüütik negatiivsem oli.