Börsipäev 28. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Rev Shark:

Rough Picture, but Don't Dismiss the Positives

2/28/05 8:18 AM ET"True leadership must be for the benefit of the followers, not the enrichment of the leaders."

-- Robert Townsend

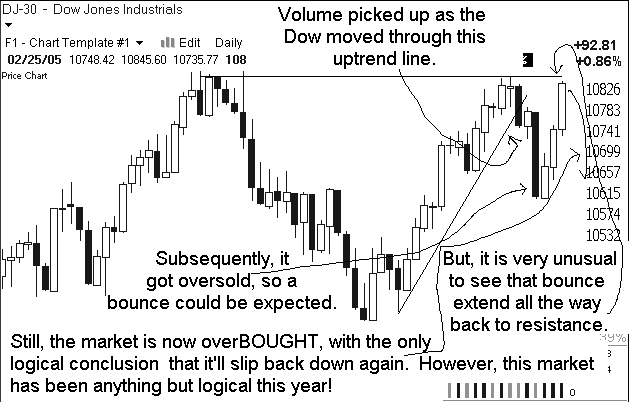

After faltering badly last Tuesday the market found its footing and moved nicely higher the past three days. The S&P 500 and DJIA are challenging their highs of 2005 and appear to have some upside momentum. The Nasdaq has been lagging but the semiconductor sector has been acting better and that is making the bulls more optimistic that technology stocks may start to outperform.

Despite the generally strong action on the surface there are some problems with recent market leadership that can't be ignored. Leadership has primarily been in defensive stocks such as oils, metals, homebuilders, steels and cyclical issues. Strength in these type of stocks is not necessarily good for the broader market.

Strong oil can push the S&P 500 up but it will eventually take a toll on the rest of the market because rising oil prices are little more than a tax on industrial production. There has been some good strength in semiconductors, which makes for much better leadership and can be a major positive if it continues. The ideal situation for the market would be a rotation out oils and cyclicals and into technology, biotechnology and smaller-caps. That would be a promising sign of broad market momentum.

I've been extremely cautious about the market after the very poor day last Tuesday. Although the market bounced strongly since then I found few buying opportunities. The leading sectors -- oils, homebuilders and metals/steels -- are just too extended to offer favorable entry points. Many of these stocks were up quite strongly on Friday and are in nose bleed territory.

I was surprised that even with strong breadth overall that there were very few stocks moving up big outside of those defensive sectors. Volume has not been there and the quality of leadership is suspect.

However, the markets are not in bad technical shape overall and we can't be too quick to conclude that this move is doomed to fail. Yes, we'd like to see oils and homebuilders cool off and some other groups assert themselves but the action isn't so troubling at this point that we need to head for the bunkers. On the other hand I am holding an extremely large cash position right now mainly as a function of not being able to add much long exposure during the move Thursday and Friday.

The bottom line is that I don't like the present market leadership and the rather light volume, but the broader technical picture of the S&P 500 and DJIA is pretty darn good and the strength in semiconductors is promising, so we can't be too pessimistic. We have a full economic agenda this week and that is going to affect this market.

The bears' best hope now is that oil will continue to dog the market and that interest rate concerns will build. If economic reports start showing some signs of inflationary pressures we are likely to see some selling pressure. However, if that occurs we may also see some rotation into lagging Nasdaq stocks at the expense of defensive groups.

The early action is slightly positive. We have a couple merger deals but oil prices are up, the dollar is weak and overseas markets are up moderately.

Fasten your seatbelts, it should be an interesting week.

Gary B. Smith:

-

Gapping Up

RETK +41% (to be acquired by SAP), USFC +24% (to be acquired by YELL), SRA +21% (BIIB/ELN Tysabri news seen as positive for SRA, TEVA +11%, SHR +6.4% and CHIR +3.5%), ONCY +20% (receives FDA clearance to begin a Phase I/II clinical trial), BOOM +8.1% (continues 29% move on Friday), CTMI +7.3% (announces dismissal of patent suit), RAD +4.1% (strong, flu-driven sales creates trading opportunity -- Goldman), MYL +3.3% (terminates KG merger), SINA +3.3%, GRU +2.3%.... Under $3: MCEL +48% (co and Dow Chemical announce joint development program), FFED +41% (reports Q4 results), DLGS +21%, NYER +5%.

Gapping Down

BIIB -40% (also Deutsche dowgrades to Sell; Bear Stearns downgrade) and ELN -65% announce voluntary suspension of Tysabri, EMITF -12.1%, PDLI -8.3% (in sympathy on BIIB/ELN), INNO -7.4% (reports Q4 results), F -5.7% (BofA cuts to Sell), KG -5.4% (terminates deal with MYL), DNDN -5.1%, VTAL -3.5%, YELL -3.4% (to acquire USFC), SEPR -3.3% (in sympathy on BIIB/ELN), GM -3.2% (BofA cuts to Sell), NOVL -3.2% (downgraded to Underweight at Prudential), TIF -3.2% (reports JanQ), MAY -1.7% (to merge with FD), AMGN -1.3% (Govt's competitive acquisition program seen as a negative for AMGN).