Börsipäev 4. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Rev Shark:

When the Market Turns, You Won't Be Left Behind

4/4/05 8:32 AM ET"The reason why worry kills more people than work is that more people worry than work."

-- Robert Frost

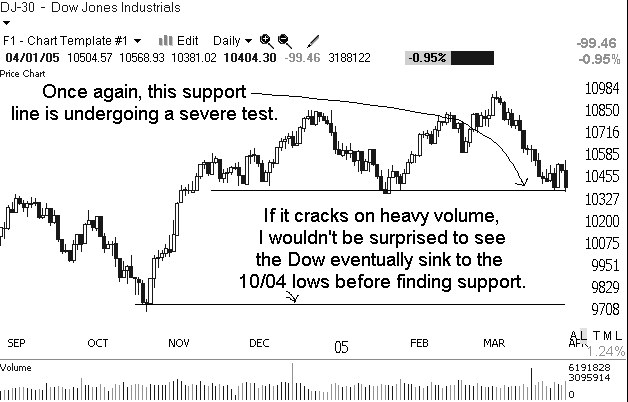

There are many good reasons to worry about this market; rapidly rising crude oil prices, signs of inflation and increasing interest rates are the most prominent, and these concerns are clearly reflected in the technical condition of the indices, which are extremely weak and struggling to hold at recent lows.

What happens to many investors in a poor market environment like this is that they spend all of their time and energy in unproductive worry. They feel incapable of action and don't try to better position themselves. The inclination is to embrace the arguments that good times are just around the corner and that if we are patient just a little bit longer things will turn and all of our problems and worries will disappear.

Maybe that will happen but the losses while you wait can put you in a deep dark hole that won't be escaped easily even if the market does begin to rally. In poor markets like this the hardest thing to do is to take precautionary action. We just want to ignore it and hope that things will look better later on. The long-term buy-and-hold investing strategy suddenly becomes much more appealing because it allows us to ignore the short-term pain and focus on hope for tomorrow.

The best thing you can do in this market is bite the bullet and deal with it head on. If your portfolio is bleeding, raise some cash and play defense. When the market does start to look better you can reenter and the likelihood is that you will be able to find plenty of good stocks that are even cheaper than they are today.

You aren't going to miss the big move in the market if you raise some cash and wait for better technical action; good markets will give you plenty of time to put your capital to work. If you miss the first few days, or even weeks, the likelihood is that you are still further ahead if you played good defense.

Traditional Wall Street's idea of defensive investing is to sit and do nothing while your stocks sink. Don't fall into that trap. Do some selling in poor market environments and don't worry about being left out. You won't be.

Oil is up again strongly this morning and the indices are struggling. There were some hopes Friday that the weak jobs report would relieve some of the inflationary pressure but the ISM prices paid report ended that hope. So now we have both weak economic growth and inflationary pressure. It's a tough one-two punch for this market to contend with.

Thanks to Cody for doing a nice job filling in last week. I appreciate it greatly.

Gary B. Smith:

-

Gapping Up

KKD +9.6% (announces $225 mln financing), MWD +3% (speculation that HSBC Holdings is considering a bid for co), AIG +3% (Morgan Stanley upgrade), ENER +4.3% (extends recent momentum), CRIS +14% (announces second major collaboration with Genentech), SIMC +8% (extension of 66% move last week).... Small cap energy stocks are on the move on higher crude prices and the Unocal/CVX merger : BDCO +14%, GEOI +10%, MSSN +9.4%, FUEL +12%, IVAN +3.5%, USEG +3.8%... Under $3: SRXA +38% (announces new order for TRAC), NTOP +9% (co and Motorola expand joint relationship), PPHM +8% (positive clinical data on Tarvacin).

Gapping Down

UCL -5.6% (to be bought by CVX; premium not as much as investors had thought), RIMM -2.7% (CRN reports that Microsoft's forthcoming Windows Mobile upgrade is designed to be a BlackBerry killer), NTIQ -10% (guides lower), ATPL -8.5%.... Under $3: AAII -13% (says it is likely to file for bankruptcy), IMNR -9% (auditors express a going-concern qualification). -

Need, kes aasta lõpus võtsid LHV foorumites mainitud FNM raamatupidamisprobleemide kohta käivat tõsiselt said head teenistust. Hind tollal oli $72. Ise võtsin siis 2006 juuni puti str 55 ($0.85) ning müüsin kuu-poolteist hiljem $1 maha. Hind nüüd juba $6.

-

Oleks huvitav kuulda mida rahvas arvab?

Orbital Sciences Corp (NYSE:ORB) $9.6, P/E=3.2, EPS=3 -

Kui kedagi huvitab, siis Morgan Keegani comment MSM kohta:

seni olen sealt häid picke saanud.

One stock our analyst recommended this morning was MSC Industrial (MSM). He was pounding the table on the stock. They are reporting tomorrow morning.

our analyst he considers the recent pullback in MSM shares to be un-warranted

- This stock has normally traded at a 30% premium to the S&P, but is now at a 7% premium

- Company will report 2QA tomorrow, and we expect no surprises vs our 2QE of $0.39

The stock has been under a lot of pressure. We consider the pullback un-warranted, the stock is our best idea in the group -

Täna hommikul sai just LHV turukomitee raames arutatud, et see hooaeg on olnud vähe kasumihoiatusi. Täna tuli senisele lühikesele nimekirjale mitmeid täiendusi: SBYN, RSAS, PLCM, MENT, MROI, NMSS, sealhulgas kõik allapoole. Väiksemad nimed, aga teatud mõju võib turule avaldada ikkagi.