Börsipäev 6. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Rev Shark:

Another Dip Could Set Us Up for a Rally

4/6/05 8:35 AM ETThey who lack talent expect things to happen without effort. They ascribe failure to a lack of inspiration or ability, or to misfortune, rather than to insufficient application. At the core of every true talent there is an awareness of the difficulties inherent in any achievement, and the confidence that by persistence and patience something worthwhile will be realized. Thus talent is a species of vigor.

-- Eric Hoffer

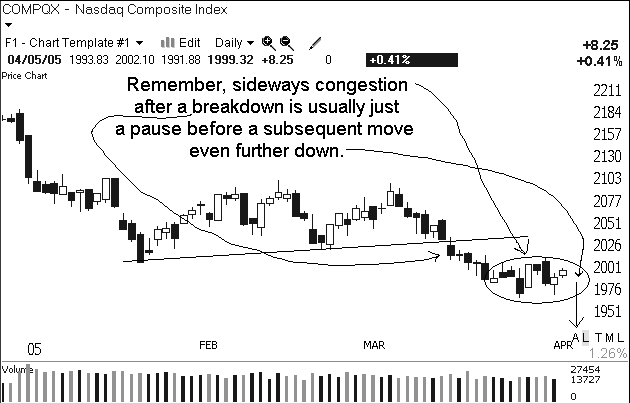

Although the market has been in positive territory the past two days, the effort by the bulls has been lacking: Volume was light and breadth mediocre; institutional buying was seemingly absent; there was some weakness in crude oil to help matters, but that opportunity was squandered. This buying lacked the vigor that signals the possibility of a sustained upturn, and we need to continue to be cautious.

The market has yet to prove that it is ready to produce a meaningful turn. Monday and Tuesday's action looks more like a classic dead-cat bounce that can't be trusted, rather than the start of a new up-leg.

One of the things the market loves to do after a downtrend is rally just enough to pull in the overanxious bulls who are hoping and praying for a rally. These folks will become excited at the first signs of strength and rush to put their capital to work. But once they are fully invested the market gleefully pulls the rug out from under them. The resulting disappointment is when we start seeing the sort of negative sentiment that leads to meaningful market lows.

This is the reason V-shaped recoveries in the market shouldn't be trusted. The failure of the first bounce after a downtrend is a trap for bulls that leads to the sort of disappointment, disgust and despair that leads to meaningful lows.

My feeling is that one more dip that takes out the 1165-1170 support level in the S&P 500 would be the perfect setup for a rally into earnings season. The breach of that support would trigger stops, increase negativity and help produce a washout.

That is the scenario I have in mind as I contemplate this market. What happens is going to depend a great deal on crude oil. We have inventory numbers coming up this morning at 10:30 a.m. EDT and that will be a market-moving event, so keep that on your radar screen.

We have a positive start on the way. Oil softened a bit overnight and overseas markets were slightly positive. We have some mediocre earnings and guidance to worry about in the technology sector but it isn't having too much effect yet.

Gary B. Smith:

-

Gapping Up

HGSI +9.1% (positive clinical data), GLBL +8.2% (awarded 3-year ONGC pipeline replacement contract), ALKS +6.3% (says JAMA publishes positive results of Phase III study), VEXP +11% (momentum from yesterday's 221% move), NTAP +4.7% (co and IBM team to take on EMC; Morgan Keegan upgrade), INTV +4.6% (reports FebQ), ELN +4.4%, ADSK +3.9% (raises guidance), BIIB +2.5% (Phase III study of Rituxan met its primary endpoint), NYER +20%, OXGN +15% (started with a Buy at Wells Fargo; tgt $7)... Comm IC stocks are strong: BRCM +2% (Merrill upgrade), PMCS +2.7% (Merrill upgrade), ALTR +2.4% (Merrill upgrade)... Under $3: PAX +125% (may receive bid from Byron Allen).

Gapping Down

Gapping down on disappointing earnings/guidance: SEBL -10.7% (also downgrades from Jefferies, Needham, Wachovia), SCHN -9.2%, RIMM -4% (also Garban cuts to Sell; $55 target), NABI -3.3%... Other News: SIRI -2.5% (Goldman initiates with Underperform), MAMA -7.6%. -

A liquidation of speculators’ long positions could add to selling pressure on gold in the near term.

The rally in gold from under $300/oz in early 2002 has been underpinned by consistent U.S. dollar weakness. At the same time, bouts of U.S. dollar strength have caused corrections in the gold price, and the latest rally in the greenback is no exception. The dollar’s recent strength in part reflects the fact that speculators have been closing their net short positions given more hawkish Fed commentary. Surprisingly, however, speculators maintain very long gold positions, which will be vulnerable if the U.S. dollar remains firm in the near term as we expect. Bottom line: gold prices look vulnerable to further correction. BCA Research, 4/6/2005

-

Eestlased on päris asjalikud (new window): Voipster Licenses On2 Video Compression for Voice-Over-IP Products

Video Compression Brings Face-To-Face Collaboration to Peer-to-Peer Software