Börsipäev 13. aprill - Apple ja AMD

Kommentaari jätmiseks loo konto või logi sisse

-

Rev Shark:

Fed-Induced Lovefest Might Be Seeds for Market Change

"It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change."-- Charles Darwin

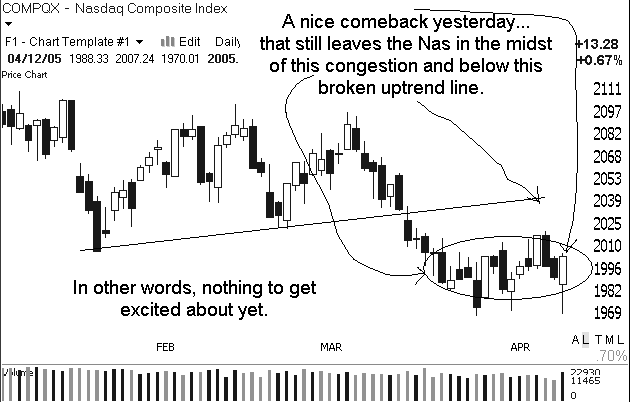

Following one of the slowest and most dreary trading days of the year Monday, the market provided some very interesting drama Tuesday. Market participants started off the day looking particularly negative. Breadth was 3-to-1 negative and sellers were throwing stocks into the deep dark abyss in efforts to appease the stock gods.

We actually had a taste of the much discussed but seldom-seen phenomenon of capitulatory selling, where investors simply give up in despair and sell with little regard for price in order to escape their misery.

Negativity was at extreme levels when the FOMC released the minutes from its March meeting. There was some talk about inflationary pressures but indications were that the FOMC would not be making half-point jumps in rates anytime soon. In addition to the easing of concerns about inflationary pressures crude oil was down almost $2.

The combination of intense negativity and news that wasn't nearly as bad as many had feared set the stage for a big, bold rally. Volume picked up sharply and the buyers drove us higher for the rest of the day. What looked like the start of another leg down in the morning had turned into an impressive day of accumulation by the close.

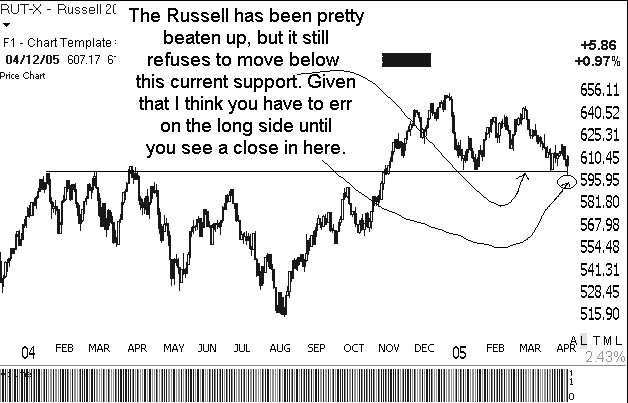

The big question now is whether the market is undergoing a meaningful change, or the action yesterday was an aberration that will soon be forgotten as our struggles continue. Obviously we can never be certain but there are some reasons that we may want to become more adaptive and be increasingly responsive to the possibility of change.

There have been two major concerns dogging the market lately: higher oil prices and inflationary concerns. The market has been struggling with pricing in the possibility of increased interest rates in the future. Although it has been obvious for some time that inflationary pressures have been increasing, the market lost its composure when some actual signs of those pressures became apparent.

The action yesterday is a sign that maybe the market is beginning to feel that inflation and interest rate hikes are now starting to be more fully priced in. Recognizing the problem and preparing to deal with it is the first sign of health.

In addition to grappling with inflationary pressures, the market also got some help from a steep drop in crude oil prices. That weakening was ignored the past few days but after the big reversal yesterday it may become more important.

A third positive is that we are now entering earnings season and, believe it or not, there are going to be some good reports for the market to consider. There will be some disappointments as well, but there should be some good news for the bulls to focus on, and that should help attract some money.

We aren't out of the woods yet but there are promising signs of change afoot. However, we need solid follow-through at some point -- it doesn't have to be today but fairly soon. The buyers have to show that they are willing to step up.

I received an awful lot of comments from readers about how this market is doomed to continue its descent. There is a lot of negativity and bearish sentiment is quite high, which is a positive.

We have a quiet start shaping up this morning. Oil is down once again and overseas markets are mostly positive. It is promising to be a very interesting battle.

-

G. B. Smith:

-

Gapping Up

ELN +16.5% and BIIB +2% release positive data on Tysabri.... Other News: KOSP +7.5% (co and Barr announce settlement agreements), MCD +3.2% (guides above consensus), BWNG +18% (Thomas Weisel upgrade), DECK +2.5% (RBC upgrade), MWD +1.4% (reports of more top banker resignations).... Under $3: MCEL +18% (awarded contract from US Dept of Energy), BFLY +16% (reports March sales), TBUS +11% (co provides update).

Gapping Down

HDI -11% (reports Q1; beats by a penny but lowers guidance; RBC downgrade), IMCL -8.8% (Erbitux delay; multiple downgrades), CPWR -11% (guides MarQ below consensus), WTSLA -8.4% (postpones 10-K), GRA -8.4% (CL King comments that asbestos bill may not be imminent), FDRY -8% (lowers guidance; downgrades from Merrill and BofA), ASML -6.1% (reports MarQ, but sees Q2 order intake down from Q1), PCLE -5.2% (guides lower; AVID -3% down in sympathy), IMDC -4.6% (FDA panel rejects IMDC's silicone breast implant; merger partner MRX -4.7% down in sympathy), SSCC -3.1% (guides lower), SGR -2.1% (prices secondary offering). -

Ma pole ever kõhutunde peale mänginud, aga miskipärast on jube kindel veendumus, et AAPL täna jälle (!) biidib ootusi rämedalt ja rallib afterhoursil kõvasti, vähemalt 2$.

Distsipliini mõttes võtan ilmselt väga väikse positsiooni, eks näis, kas osutub õigeks. -

Nice :)

sB -

Fit,

Mis hinna pealt sisse läksid või plaanid minna? -

Fit pushib AAPLi LHV foorumis üles :)

-

MRK ja PFE liiguvad

-

Jah, kõik taksistid ja keraamikud siis ostavad ja Fit müüb juba oma positsiooni kasuga maha! Kustutada sellise kasutaja akkaunt! :)

Tegelt ma tahtsin seda märkida, et AAPL on viimastel kordadel enne tulemusi samamoodi alla müüdud nagu viimastel päevadel. Ma usun ka pigem järjekordset biitimist. -

Ai, siin võib nüüd jääda see ohtlikult irooniline mulje mu eelnevast sõnavõtust. Tegelt ma kõrval areneva tsenseerimisteema juures seda meelt, et peremees teeb oma kodus reeglid ja teiste asi on neid järgida või minema kõndida. Seega eelmine oli huumor, mitte peen iroonia. TISKLAIMERI LÕPP ;)

-

Jajah... sellised firmad, kes ennast peremeheks ja kuningaks pidasid, hakkasid juba rohkem kui 10 aastat tagasi Eestist kaduma vähehaaval. See oli lihtsalt repliigi korras, teeks ettepaneku hoida see foorum siiski tänase börsipäeva teemadel.

-

Fit-ilt v6iks ni m6ndagi 6ppida, vahemalt tema oskust teiste inimestega suhelda, ta v6ib kyll ironseerida, aga teeb seda meeletult sympaatselt. ))

-

"Te ei tunne mind veel", müristas leitnant Dub. :)))

Aga AAPL positsiooni võtan otse enne sulgumist, ei viitsi vahepealset närvilisust taluda. -

üks kaader aktsia - DVID.

-

... mida shortida ei saa.

-

"“Te tunnete mind võib-olla ühest küljest, aga nüüd saate mind tundma ka halvast küljest! Ma panen iga mehe nutma!””

sB -

siuke küsimus: kuidas sellest aru saada, et aktsiat ei saa shortida??

-

Marek, LHV Trader annab koheselt sellekohase veateate näiteks.

Pärast börsi AMD ja AAPL, tähelepanu, valmis olla ... -

hope you sold the pop.

sB -

AAPL ilus (kas piisavalt ilus?), AMD halted

-

16:32 AAPL Apple Computer: note that on AAPL, iPod shipments 5.3 mln... while above the mid-pt, is not above the 5.6 mln top-of-range number

AAPL kõigub nulli ja napi plussi vahel. -

AMD teeb Spansioni IPO. Sellepärast vist kauplemine seisab ka. Lisaks veel tulemused.

-

AMD teeb Flashi osale IPO

http://www.thestreet.com/_yahoo/tech/chriskraeuter/10217420.html?cm_ven=YAHOO&cm_cat=FREE&cm_ite=NA -

Kauplemine seisab ikka tulemuste pärast, IPO uudis tuli välja kell 23.10 ja aktsia jõudis selle peale 70 senti tõusta.

Nüüd tulemused suht koledad ja paar punkti ilmselt alla. Kes selle Spansioni peale mängis ja näiteks $17.65 pealt ostis ... uhh -

Väga keeruline öelda, mis siin olulisem on. Ma usun, et pigem jääb lähinädalatel 17.50-st kõrgemale. Ise ostsin 1000 aktsiat eile 16.84-ga.

-

Afterhours andis 30 senti kasumit kohe peatselt pärast close'i. So i took it ja ei hoidnudki tulemusteni. Oportunist nagu ma olen.

-

AMD Advanced Micro misses by $0.06, beats on revs, gross margins below street expectations

Reports Q1 (Mar) loss of $0.04 per share, $0.06 worse than the Reuters Estimates consensus of $0.02; revenues fell 0.8% year/year to $1.23 bln vs the $1.21 bln consensus. Gross margins came in at 34%. "In the typically seasonally down second quarter, AMD expects processor sales to be flat or down slightly. Because of Spansion's SEC Form S-1 filing today, AMD is not providing guidance for the Flash memory business". -

Protsessorite müük on ikkagi väga hea. Aastane kasv 31%. See on ikkagi põhiline, mille tõttu investeerimisfirmad seda soovitavad mõne aasta perspektiivis ja see n-ö "memory grupp" on pigem osa, millest vist kõik juba ammu lahti tahavad saada. Huvitav, kas pärast IPO-t ei pea AMD enam seda äri ka konsolideerima. Siiani oli 60%-line osalus.

-

No selle IPO läbi müümine saab huvitav olema.

-

Mulle tundub kiirel vaatlusel, et protsessorite müük on täitsa OK, kuid flash unit on täiesti metsas. Aga spin-off on kindlasti hea uudis.

-

Ma arvan, et isegi kui AMD saaks oma 60%-lise osaluse eest 1mld USD, siis see oleks juba positiivne. Minu jaoks on selle äri väärtus maksimaalselt 10% AMD väärtusest, kuigi käibes on osakaal pigem 1/3.

-

Käis läbi number $600 mln Spansioni eest. Aga see pole ilmselt kõige olulisem Tähtsam on see, et AMD saab lahti unitist, mis a) toodab kõva kahjumit ja b) annab Intelile võimaluse neile kõvasti survet avaldada.

-

aga minu arust ei olnud seal täpsustatud, kas AMD müüb kogu osaluse.

-

Pikemal pilgul tundub ülalmainitud paar punkti kukkumist ilmselt liialdusena, nii hullud tulemused pole. Halt oli ka plaanitud ilmselt enne IPO uudist avaldada.

Tänane ja homne liikumine ikka kangesti keeruline ennustada, sõltub palju ka homsetest analüütikute arvamusest. -

Ilmselt homme hommikul üks-kaks AMD upgrade ka. Saab näha.

sB -

WASHINGTON, April 13 (Reuters) - Spansion Inc., which makes

Flash memory for various electronic products, said on Wednesday it

is seeking to raise as much as $600 million in an initial public

stock offering. -

40% sellest Spansionist kuulub kummalistel tingimustel ju Fujitsule.

-

AAPL

Oppenheimer said that with the June quarter, Apple will no longer offer the same details it now does for its computers -- Apple breaks out iMac (including eMac and Mac mini), iBook, PowerBook and Power Mac quantities. Oppenheimer said that starting with the June quarter, Apple will only report aggregate desktop and laptop sales. -

17:49 AAPL Apple Computer on Conf Call: co states share of hard drive MP3s about 90%; flash base went from 0% to 43% in Feb (41.04 -1.62)

See shufflega saavutatud 43% turuosa on lihtsalt amazing, turg oli selliseid mängijaid juba enne ju täiesti täis. Uskumatu. -

AMD puhul 31% protsessorimüügi tõusust läheb suur osa eelmiste kvartalite arvele.

Tulud prosest sel kvartalil 750M vs 730M eelmine kvartal. Osaliselt võib napi tõusu sessoonsuse arvele panna.

Flash mälude eraldamine on kindlasti hea uudis praeguses turusituatsioonis, kus turg flashi hinnad alla surub. Võimalik, et tegelikkus on midagi muud, kuid mulle tundub, et IPO tehti peamiselt seetõttu, et õiglase hinnaga ostjat üksusele ei leitud. Pikemas perspektiivis on tegemist siiski märkimisväärselt kasvava turuga ja AMD, müües selle, muutub automaatselt umbes poole väiksemaks ettevõtteks. Muideks, eelmise aasta märtsi kvartalis oli AMD mälu müük suurem kui prosedel (vastavalt 628M ja 571M). Tõsi, prose kasum 67M vs mälu 14M.

Kokkuvõtteks siis AMD pärast eraldamist fundamentaalselt tugevam, aga oluliselt väiksem.

Võimalik, et seni on intel hinnasõjaga ennast veel tagasi hoidnud ja teinud põhilise rünnaku AMD nõrgimale osale - flashile. Võites lahingu, on etapp nr 2 protsessorid. Mõlemal rindel korraga 100% jõuga rünnata poleks intelil olnud otstarbekas. Proseturul hinnalanguseks veel ruumi jätkub. Raske öelda, kes peale jääb. -

Kui Intel ostaks vabaturult Spansioni kokku...

huhh mihuke mõte. Jube kohe. -

Spansioni müügijhinnaks pakutud ca. $600 mln., Intelil cashi 17.7 mlrd :) Aga raskem näha neil ratsionaalset motivatsiooni selle üksuse ostmiseks.

Lisaks - vaadake sentimenti pooljuhtide sektoris, sellise kahjumis flashi-firma IPO võib päris keeruline ära müüa olla. -

AAPL puhul paistab imho kõige positiivsemalt silma see, et nad müüsid Mac-e rohkem kui jõulukvartalis. iPod läheb oma teed aga installed base suurendamine on Apple jaoks elulise tähtsusega. Praegu paistab, et iPod-ide müük tõuseb kiiresti veel kvartal või kaks ja siis ilmselt stabiliseerub kusagile c.a 10-15% tõusu peale või muutub flatiks. Nii, et imho on neil max kvartal aega millegi täiesti uuega lagedale tulla kui nad tahavad momenti säilitada.

-

Apple-i kohta:Rothbort says the after-hours selloff was "perplexing."

"The stock should not be where it is now," he says. "This is going to be an easy $50 stock. No doubt about it. The only question is whether [the market] allows it to get there."

Eks näeb. Loodan selle pealt kõva kasumi saada :) -

Hm, kes AAPL -ile tule otsa pistis? Suht posit tulemused ju

Eelturul kohati -6%

Comments? -

Income, minu arvates on aktsia parajalt ülehinnatud, võiks rahulikult ca 30% madalamal olla, kui mitte rohkem

-

sellised liikumised positiivsete uudiste peale näitavad, et tugevust eelistatakse müüa, mitte osta. võimalik, et turgudel on ees ootamas täielik pullide kapitulatsioon, mille järel alustada uuesti eelmiste tippude poole rühkimist.

-

Heh. Vähemalt ei hoidnud ma AMD straddlet üle tulemuste

-

"Apple is in your den, Apple is in your living room, Apple is in your car and, of course, Apple is in your pocket with iPods," Jobs told the audience at the San Francisco event.

WSJ kirjeldab uut toodet iTV järgmiselt:

Apple unveiled the new device, which it is temporarily calling iTV, at an event here that also showcased a deal with Walt Disney Co. to offer movies for sale over the Internet, the first of a wave of licensing deals Apple hopes to strike with Hollywood studios for films. Apple also revamped its entire line of iPod portable gadgets -- trimming sizes and adding storage capacity -- in hopes of keeping sales of the device strong during the crucial holiday shopping season.

The iTV device, expected to sell for $299 when it goes on sale in the first quarter of next year, comes after years of efforts by high-tech companies to provide technology for moving content purchased on the Internet off computer screens and onto television screens that are at the center of home entertainment.

Such a device is regarded as key to enabling mass-market acceptance of the growing range of movies, television shows and other videos that media companies are making available online. While most such attempts to do so have met with middling results at best, entertainment companies believe Apple's track record in the music business with the iPod and iTunes Music Store could give iTV a better shot at success.

iTV tundub päris huvitav ja õige tee. Mis puutub iPodidesse, siis midagi väga põrutavat siit välja ei tulnud. Andmemahud suuremaks, mõõtmed väiksemaks. Pigem hakkab Walkmani meenutama see asi. Apple poe leheküljelt jääb silma reklaam "College students, buy a Mac and get a free iPod nano."

-

Thomas Weisel does not believe AAPL's added movies to its iTunes download store is unlikely to directly threaten NFLX in the near term, given there is no rental option at this time (purchase only), the content library is limited, download times appear long, and the hardware product bridging PC content to the TV (iTV) will be expensive ($299). AAPL's iTunes service includes only 75 films from Disney studios, vs. NFLX's 65,000 titles available for rental. While firm believes the co is likely to rapidly add to its library, through additional studio partners and additional Disney films, they believe many movie studios are 1) cautious about generally giving too much power to AAPL in the movie space and 2) specifically concerned over AAPL's pricing, which appears to top out at $14.99 for new release movies (vs. AMZN's more flexible pricing and higher top price point of $19.99/film). Firm believes that it may be years before AAPL gets a broad catalogue of older movies is available online, primarily due to complications clearing music and other rights. Firm says while iTV may help solve a critical roadblock to content distribution over the Internet and the interface demonstration looked impressive, at a price point of $299 they believe this is unlikely to ramp quickly or directly threaten NFLX's business, at least in the near term.