Börsipäev 25. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Rev Shark:

"I have never been lost, but I will admit to being confused for several weeks."

-- Daniel Boone

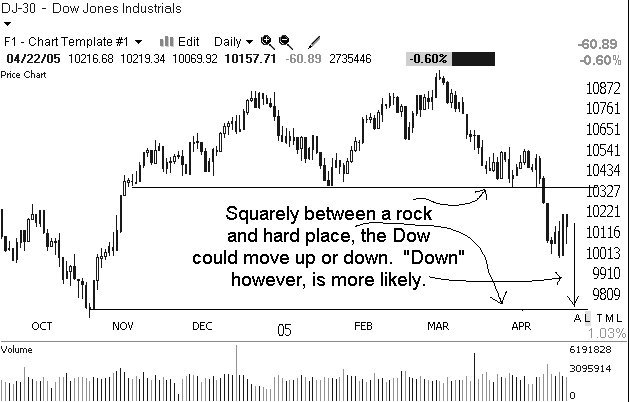

The increased market volatility over the past week has left many folks feeling confused and uncertain. A week ago Friday it looked like we were ready for a major meltdown but then we rallied, gave it back and then had the best day in years. Finally we finished off the week with poor action that completely ignored the big rally on Thursday.

If you are looking for logic in this action, stop looking because there isn't any. Market participants simply are uncertain. There is a contingent that is convinced that after a lousy start to 2005 a bottom is close. Their theory is that the Fed is almost done raising interest rates, and that inflation and the economy aren't that big of a worry. They are trying to catch the turn and have been able to put together enough buying enthusiasm at times to bring in some money from the sidelines and squeeze some shorts.

On the other side of the battle are the bears, who believe we are in for a long, difficult summer. They argue that rising interest rates, inflation and a stumbling consumer have not been fully priced in to this market. They see no reason for the downtrend to end at this juncture.

So who's right? The market doesn't know, and that is why we are seeing the increase in volatility. The sides are fairly evenly matched and they're battling back and forth until there is some clarity, or one group manages to seize control.

What we need to keep in mind as we start the new week is that an increase in volatility usually signals important junctures. Out of the confusion and uncertain, some consensus will eventually emerge. It may be the big turn that the bulls are hoping for, or it may be the setup for another painful downleg that the bears are looking for.

Our job now is to look for signals on which way things may break. There are some who will want to anticipate the move. They will use a variety of arguments and logic to support which way we are moving but no matter what they may claim there is very little hard evidence to support their predictions.

Successful investing is about finding an edge and exploiting it. In a market that changes direction on a daily basis there is no edge if you have a time frame longer than a day. This is not a time to become impatient. Sit back, identify a plan of attack for the time when an edge does emerge and watch the market action. Many folks are going to wear themselves out trying to predict this market and when they are done and gone you will be in position to profit.

We have a quiet start shaping up. There are merger deals in the oil and Internet advertising sectors helping the mood a little. Crude oil hit the $56 level in early trading. Overseas markets are doing little.

-

Gapping Up

PCO +20% (to be acquired by VLO), LEXR +11.4% (Barron's highlight), KENT +41%, VSEC +10% (gets large Navy contract), XXIA +6.2% (two upgrades), BEAV +5.6% (reports Q1), CHRT +5.6% (Goldman and Merrill upgrades), CD +5.5% (reports tonight), STTS +5.3% (Merrill upgrade), ADSX +5.3%, RMBS +4.5% (announces developments in Patent and Antitrust Cases), PLAY +4.2% (CSFB upgrade), MU +3.7% (Smith Barney upgrade), HANS +2.2% (coverage initiated), AAPL +2% (CSFB upghrade), SEPR+1.7% (reports Q1).... Under $3: CIEN +7.3% (Piper upgrade), ALTI +5.4% (co and Bateman Engineering initiate 2 projects in their joint venture).

Gapping Down

SIMG -8.6% (announces 4 board resignations), BIOI -7% (reports Q1), DCLK -4.3% (to be acquired for $8.50/sh in cash) FRO -2.4%, RIMM -2% (fairly negative WSJ article), VLO -1.7% (to acquire PCO), AIG -1.7% (faces further troubles after new review - Financial Times). -

G. B. Smith:

-

Täna taas chat, reedel kogunes kokku üle 40 inimese.

-

Üks turuosaline nimetas praegust turgu "yo-yo turuks", võimsad liikumised üles ja alla kordamööda, suuna ennustamine väga keeruline.

-

taseri kohta on message boardis ikka head naljad

viimase hüppe taga et - poola ostab ühe stun guni :) -

SCSS järelturul +15.45% :)