Börsipäev 16. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Gapping Up

OVNT +44% (to be acquired by UPS), IPMT +17% (receives proposal from CEO to acquire co), PACT +17% (reports Q1 results), CTIC +9.6% (reports positive Phase 3 data for Xyotax), CELG +5.8% (announces Revlimid data), DNDN +5.2% (Phase 3 clinical data), TASR +4.6% (extends recent rally), ARIA +4.3% (clinical data), NFLX +4% (Thomas Weisel upgrade), INSP +3.4% (announces $100 mln stock repurchse plan), XMSR +3.3% (surpasses 4 mln subscribers), IMCL +2.9% (reports Erbitux data), PLMO +2.6% (Treo 650 Smartphone now available to Verizon customers).... Under $3: XNVA +11%, GNTA +10% (provides clinical data for Genasense), TMTA +8% (AG Edwards upgrade).

Gapping Down

ONXX -16% (provides Sorafenib clinical data; Wachovia downgrade), PSUN -7% (JP Morgan downgrade), LTD -4.3% (reports AprQ; guides lower), BRCD -4.1% (to restate 2002-2004 financials), VEXP -3.2% (profit taking after 11% move Friday), TELK -2.8%, DNA -2.3% (provides clinical data for Omnitarg), LOW -1% (reports AprQ; misses by $0.02)... Under $3: BIOM -7% (clinical data presented). -

Rev Shark:

Sifting Clues for a Rotation Into Tech

5/16/05 8:40 AM ET"Success in almost any field depends more on energy and drive than it does on intelligence. This explains why we have so many stupid leaders."

-- Sloan Wilson

As we kick off a new week the primary issue we need to contemplate is whether technology stocks have the energy and drive to lead this market. Last week we saw oil, steel, metals and cyclicals continue their recent struggles. As these stocks sold off there were signs that cash was rotating into bigger-cap technology stocks. The rotation looked like it was fully underway Friday morning but the market reversed hard before partially recovering into the close.

The primary objection that many have to technology leadership is based on fundamental concerns. They simply don't believe that the stocks can be justifiably bought based on their prospects. There is a large contingent that will argue that the valuations of technology are really quite attractive but that doesn't really matter much in the shorter term. The primary issue in the short run is whether investors who are fleeing oils and the like will embrace the group.

One of the problems is that we are entering the time of the year when the stock market, and technology issues in particular, are weak. The old saying is to "sell in May and go away" while the market struggles with the summer doldrums.

Seasonality certainly shouldn't be ignored but keep in mind that it doesn't always operate as it should. We saw a particularly good example of that in January when the market skidded to start the year, which was not the usual seasonal action. Keep in mind the idea of seasonality in technology stocks but don't be overconfident that it will play out the way it should. Other factors, such as cyclical money looking for a place to go, can easily undermine the seasonal tendencies.

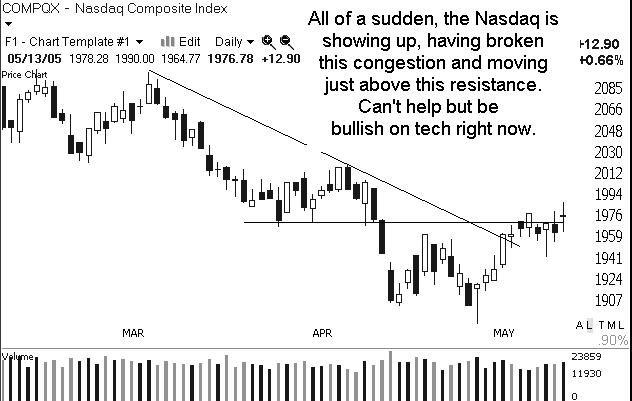

The best evidence of a technology rotation is that the Nasdaq 100 was the strongest of the major indices in the past week, and strong positive moves from the likes of Cisco (CSCO:Nasdaq) and Intel (INTC:Nasdaq) were the drivers. At midday Friday it looked like the market may have been having some second thoughts about the idea of technology leadership but the Nasdaq and Nasdaq 100 are definitely acting better than the other indices.

Even if we do see more rotation into technology stocks there are still plenty of headwinds to contend with. Technically there is plenty of significant overhead; the Nasdaq has been building a base but it's been a struggle and upside momentum has been limited.

Two other major issues confronting the market right now are problems at major hedge funds and the talk about stagflation and a hawkish fed. Those two items can easily kill a fledging rotation into technology.

Another concern is that the sharp drop in crude oil has not been of greater benefit to the market. Oil was blamed for much of the recent slide in the market but now that it has softened it doesn't seem to have produced much market benefit. The logical and obvious question is whether there are things at work other than oil, such as interest rates and hedge funds, that are affecting the market.

We have an interesting battle shaping up and it won't be an easy one for either the bulls or bears. We have a positive open on the way as crude oil traded below $48 but the Monday morning optimism changes fast.

No positions in stocks mentioned

Gary B. Smith: