Börsipäev 23 - 24. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Nädalavahetusel on Prudential apgreidinud PIXR, aktsia teeb täna vist suurema liikumise

-

Rev Shark:

Advantage: Bulls

5/23/05 8:40 AM ET"I want more, and I know I shouldn't."

--Anakin Skywalker, Revenge of the Sith

Following the best week for the market so far this year the bulls are hungry for more. They have managed a very sharp turn in the market that has already gone further than many thought possible. Is it reasonable to expect that this upside move can continue?

Let's consider the positives. The most obvious is that bulls have momentum. There are a lot of folks out there who enjoy trying to call market turns but the simple fact is that the market has a tendency to trend higher (or lower) than most people feel is reasonable. My advice when we were in a downtrend was not to be too quite to anticipate that it will end. Now that we are in an uptrend my advice is the same. Don't be overly anticipatory. Until there is some firm evidence to the contrary, don't assume that the current trend will not persist.

Other recent market positives are the series of strong closes. In good markets buyers tend to step up at the close, and the Nasdaq has closed at or near its highs the last five days in a row. Leadership from technology and the struggles of oils and cyclicals is also a plus. Money is shifting and we are seeing signs of emerging leadership from groups that are better for the market.

Despite the positives any reasonable person who looks at the charts of the major indices knows that they shouldn't expect this up move to continue uninterrupted. The indices are extended, there is formidable overhead resistance and we need to consolidate gains. However, the very fact that so many people want, need and expect the market to pull back makes it less likely to do so. That is especially so since most sentiment measures remain quite negative and many market participants are not well positioned.

We saw a particularly good example on Friday of how an extended market can become more extended. That phenomenon is even more likely to occur when there is a large supply of poorly positioned market participants. When there are a lot of underinvested bulls and anxious shorts, dips in the market don't last long. They are pounced on quickly and then as the market reverses and moves up the folks on the sidelines who missed the buying opportunity panic and start chasing the market higher.

The best thing that could happen for the bulls right now is for the market to rest and consolidate a bit. A pullback would shake out the short termers and weak holders and allow the bears to regain some of their confidence. The chances of this market rolling over and going straight down at this juncture are quite low unless there is some surprising news. A lot of folks missed out on this move and they are going to be looking for a chance to do some buying on weakness.

It should be an interesting week. We have positive action out of the gate, which is always suspect on Monday mornings. The key to measuring the market's strength will be watching the action on a pullback after the open.

-

Gapping Up

PIXR +5.1% (Prudential upgrade), GERN +7.1% (gets FDA clearance for cancer compound; up in sympathy: ASTM +4.7%, STEM +3.8%), PCAR +3.8% (discussed favorably in Barron's), MTLK +12% (announce first wireless LAN product), PSDV +11% (analyst mentions on CNBC), HMY +8.7%, DHB +8.3% (wins Army contract), BWNG +7% (mentioned in Barron's), ANTP +4.4%, TINY +4.3% (analyst mentions on CNBC), AAPL +1.7% (reports indicate co may consider using Intel chips).... Under $3: CIEN +7.1% (Merrill upgrade -- CNBC).

Gapping Down

BCGI -58% (downgraded to Sell at Kaufman; tgt cut to $1 following Friday's ruling that BCGI willfully violated patents held by Freedom Wireless), ABRX -17% (suspends manufacturing operations, announces product recall), ABLE -4.1% (profit taking after 53% move on Friday). -

kusagil foorumiteemas ammustel aegadel oli ajaloolisi tootlusi välja toodud, kas on keegi, kes mäletab kus ja äkki on ka viitsinud statistikat täiendada?

-

fire, milliseid ajaloolisi tootlusi?

-

kuude lõikes: talse, nasdaq, djia

-

Eile õhtul tulid DNA silmaravimi Lucentise esialgsed tulemused, mis toonud EYETi eelturul alla 9USD, QLTI ligi dollari, REGN ,mis valmistub sama mehhanismiga ravimi tootmiseks on paarkümmend senti üles biditud

mis puudutab EYET, siis Merrilli arvates on worst-case aktsia jaoks 14USD, sest EYET on 6USD cashi -

Olen mõelnud, et mis siis saab, kui Pfizer võtab Genentechi üle. Mis siis EYETist saab? Tuletan siiski veel meelde, et EYET turuväärtus on $14 juures siiski $600 mln!

-

Ma loodan, et ei pea oma kasutajanime henrynenry`ks vahetama

kui ma nüüd jälle uitmõtteid hakkan panema.

Pakun, et Jänkidel on punased külla tulemas.

Mina väljun Intelist täna ja loodan, et teen seda ühes vahepealses tipus.

Väidan seda, kuna liiga kaua on juba roheline oldud (mina niikuinii) ja eelturg koistab allapoole.

Vaielge, kui teil on tõendeid vastupidise kohta.

Võibolla kogu turu kohta on see liiga üldistav aga väiksed vaatavad ikka suure poole. -

Pigem on huvitav, et QLTI nii palju kukkunud on. Ta sai juba varem kõvasti peksa, kui EYET konkureeriva ravimi turule tõi ning sealt enam eriti midagi ei loodetagi.

-

yks comment:

News is pretty sparse this morning... The biggy is EYET which currently has support around 13.95.. I am watching this stock carefully as it can deliver a dollar to the upside.... I am guessing it will go over 15 if she bottoms around 13.80 to 14... MEDIUM TO HIGH RISK -

DNDN ka täna uudisega väljas:

R0: Dendreon Announces Results of D9905 Phase 2 Study of Provenge in Patients wi [FDCZTJP]

09:05am EDT 24-May-05 PR Newswire - First Call Wire (Dendreon Corporation) DNDN

Dendreon Announces Results of D9905 Phase 2 Study of Provenge in Patients with

Early Stage Prostate Cancer

Data Presented at the American Urological Association Annual Meeting in San

Antonio

SAN ANTONIO, May 24 /PRNewswire-FirstCall/ -- Dendreon Corporation

(Nasdaq: DNDN) today announced results of an open-label Phase 2 study of

Provenge(R) (APC8015) as a mono-therapy in men with rising PSA post definitive

local therapy (androgen-dependent prostate cancer). Provenge is the Company's

investigational immunotherapy for the treatment of prostate cancer. The

study, referred to as D9905, suggests that Provenge as a single agent may lead

to improved PSA doubling time (PSADT) in patients with early stage prostate

cancer. PSADT is the time it takes for the prostate-specific antigen (PSA)

value to double. This is used to help predict the possibility of metastasis

and time to death in early stage prostate cancer. The data were presented at

the American Urological Association annual meeting here today.

"We are very encouraged by the findings of this study investigating the

use of Provenge as a mono-therapy in men with earlier stage prostate cancer,"

said Robert M. Hershberg, M.D., Ph.D., Dendreon's chief medical officer. "We

believe Provenge may have the potential to alter the course of treatment in

early stage prostate cancer and may offer a compelling alternative to either

watchful waiting or the use of androgen ablation therapy in this early stage

of disease recurrence. We look forward to completing enrollment of our

ongoing large Phase 3 study P-11 very soon, which is examining Provenge in

patients with androgen-dependent prostate cancer." -

Rev Shark:

We Need a Pullback. Really

5/24/05 8:28 AM ET"Progress is impossible without change, and those who cannot change their minds cannot change anything."

-- George Bernard Shaw

The market continues to progress at an unsustainable pace but that doesn't mean we are going to crumble and go straight down. We badly need a rest so that the short termers and weak holders can be shaken out and stronger buyers can move in. A pullback will go a long way in setting the stage for further upside.

Despite the impressive rally many bears seem more confident than ever that doom and gloom are right around the corner. This rally has done nothing to soften their view about the many problems we face. In fact, it seems to have convinced them further that the market is made up of morons and fools who are destined to lose wheelbarrows of money when the market finally comes to understand how bleak the future will be.

The skepticism is one of the biggest positives the market has going for it right now. There hasn't been much good news that would drive investors to embrace this market, but we are rallying anyway. The explanation for this is simple: market participants had become too negative and were overdiscounting the problems of the future.

Even with better action in recent days there continues to be a very low level of optimism. Worries about stagflation, oil, the level of earnings, real estate bubbles and so on dominate the news. There are few positives on the horizon, but in the perverse world of Wall Street, lots of worries tend to be a good thing. Markets tend to go up when all of the news has been bad and is already reflected in the market.

One of the big positives the bulls have going for them is that there are an awful lot of folks who have not changed their minds about the market. Even many of those who are enjoying this rally don't trust it to last for long. The wall of worry is formidable and the market can go a long way as it climbs it.

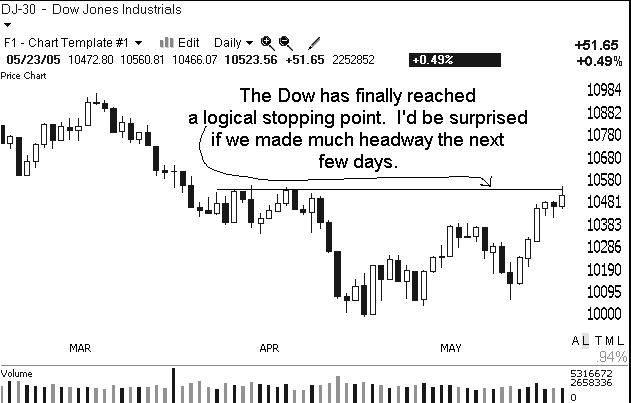

We are now into day three of "this market is really extended and needs to rest." It looks like we have a little softness to start the day and both bulls and bears would feel better if we pull back. However, there seems to be a significant supply of underinvested bulls who are ready, willing and able to jump on any dip. Until they cool off it's going to be tough for us to base much.

So the song remains the same: The market is looking good but needs to consolidate recent action. Don't confuse a healthy rest with the beginning of the end of this rally. If it doesn't kill us, it will make us stronger.

We have a pullback on the way to start the day. Overseas markets were generally lower and oil is holding steady despite talk of increased supplies.

Gary B. Smith:

-

Gapping Up

DNA +3.7% (positive clinical Lucentis data for Wet AMD; up in sympathy: IMGN +15%), NYNY +14% (announces mgmt changes), TIVO +12% (started with a Strong Buy at First Albany; tgt $16), ISIS +12% (announces collaboration with Pfizer), LTON +7% (reports Q1; ThinkEquity upgrade), NGEN +5.9% (issued patents), GEOI +4.6%, ORCT +4.2% (its Corrigent unit will chair a panel at upcoming Supercomm exhibition), NAPS +3.9% (competition uncertainty has pushed the stock to attractive levels -- Piper), ABLE +3.5% (bounces after 8% drop yesterday), DXPE +3.5% (extends recent momentum), TASR +2% (files 10-Q and amended 10-K), SHOP +1.9% (Deutsche upgrade).... Under $3: JDSU +7% (to acquire privately held Acterna; Smith Barney and Needham upgrades), LVLT +5.9% (director purchases 200K shares).

Gapping Down

EYET -41% (Genentech's positive Lucentis data; also Morgan Stanley downgrade; also QLTI -8.5% down on the news), DDS -11% (reports AprQ; misses by $0.08), APSG -11% (to buy Dynamics Tech for $30 mln), ELTK -20% (reports Q1), CCRT -6.9% (announces sales of $250 mln senior convertible notes), TTC -4.1% (reports AprQ), NKTR -4.1%, MSCC -3.9% (AG Edwards downgrade), BOOM -2.6% (profit taking after 20% move yesterday), DLTR -2.1% (Wachovia downgrade), GDT -1.9% (did not disclose a flaw in defibrillator for 3 years - NY Times). -

võtsin nats EYET here

-

Hundi chat?

sB -

out EYET +30cents, ei viitsi.

-

wolff jah

-

LHV Pro all ka mõned uued huvitavad analüüsid.

-

Järgmine General Motorsi (GM) võla daungreid täna, sedapuhku siis Fitch langetab junki peale.

-

LHV Pro all veidi uuendatud RedEnvelope (REDE) teemat. CEO ostis täna hommikul aktsiaid ning lisaks sellele pikemalt juttu ka ühest huvitavast kaasaktsionärist.

sB -

Eyetech Announces Conference Call to Reiterate Confidence in Macugen(R)

(Pegaptanib Sodium Injection)

NEW YORK, May 24 /PRNewswire-FirstCall/ -- Eyetech Pharmaceuticals, Inc.

(Nasdaq: EYET) announced that it will hold a conference call to reiterate its

confidence in Macugen and discuss issues presented by a potential competitor's

recently released preliminary, top-line clinical trial data for the potential

use of an antibody fragment in the treatment of neovascular age-related

macular degeneration (neovascular AMD). Neovascular AMD is the leading cause

of blindness in people over 60 years of age.

(Logo: http://www.newscom.com/cgi-bin/prnh/20050407/EYETLOGO )

Conference Call and Webcast Information

Eyetech will hold the conference call and simultaneous webcast on

Thursday, May 26, 2005, at 8:30 a.m., Eastern Time. Live audio of the

conference call will be available to investors, members of the news media and

the general public by dialing 888-275-0218 (in the United States) or

706-679-7756 (internationally). -

EYET eelturul juba 14.07 ehk +8.65% eilsega võrreldes.