Börsipäev 10. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Rev Shark:

Know Market's Character Before Trusting It

10/10/2005 8:57 AM EDTReputation is what men and women think of us. Character is what God and the angels know of us.

-- Thomas PaineAfter a solid performance in September in which the market shrugged off a plethora of problems, the market ran into some problems last week. The big question for us to ponder is whether this was just some short-term behavioral problem or the beginning of a major change in character. What makes this question particularly worrisome is that there are so many problems for this market to contend with and it is going to take some real strength of character and fortitude to work higher from here.

One positive is that the negatives are generally well recognized by the market. It is a lot easier for the market to deal with these issues and price them in if everyone is aware of them. The big problem that was highlighted last week is inflation and a hawkish FOMC. The word "stagflation" is out there, and in the world of the stock market, there aren't many problems that are worse than that, especially in the early stages where the market has yet to discount the impact.

Rather than go through the long list of hurdles the market is facing, we simply need to contemplate the charts of the major indices. We have problems and the light-volume bounce on Friday after three days of selling did nothing to change the picture. The market is downtrending, and until the technical action improves, we have to be extremely careful about hoping that the character of the market will change.

This is an environment in which talk is cheap. The bulls can come up with all sorts of excuses and promises and try to reassure us that we should put our trust in the market, but this truly is a situation where actions speaks louder the words. The market is like an unruly adolescent who is willing to tell us whatever he thinks we want to hear, but has no intention of doing what he says. Until behavior changes, we can not be trusting.

Earnings season starts this week, which may make for some better pockets of action, but it really doesn't kick off in earnest until Oct. 18. The good thing about earnings is that there will be interesting individual trading, and we won't be quite as focused on the macro environment.

Oil and energy stocks were bashed last week and it is going to be interesting to see how they act. Continued pressure on oil is obviously a market positive, but the big drop did little to shore up the market last week. If oil continues to fall, it is going to be a market positive, but we are still dealing with prices that are high enough to keep consumer sentiment and inflationary concerns very high.

We have a positive start this morning. A deadly earthquake hit in areas of Pakastan and Afganistan in which many al Qaeda members, including bin Laden, are believe to be hiding, so watch for the bulls to talk about that. Oil is flat and gold is up again. Overseas markets are mostly positive. Market indications are positive, but as always, we can't be too trustful of Monday-morning optimism. It has a tendency to fade away quickly.

Gary B. Smith:

-

NFLX 28.90

on mõni hea põhjus ?

uudiseid ei leia

või lihtsalt tavapärane +5% -

No news.

sB -

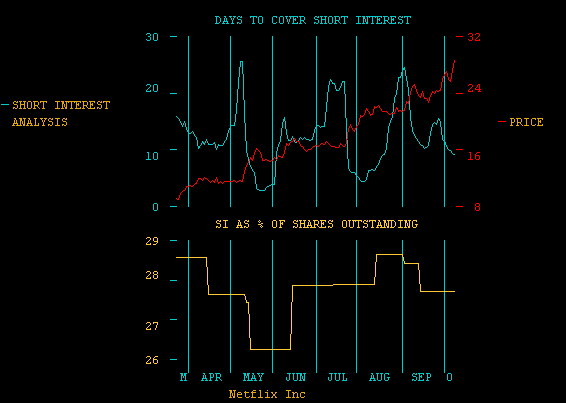

Mis see NFLX short ratio hetkel on? Yahoo näitab, et 12. sept oli float'st jätkuvalt 30% e. 15 mil aktsiat shorditud. Kerge neil ei ole...

-

Minu pilt selline:

-

Keegi DSCM-i oskab kommenteerida? Kuidas suhtuda sellesse, et Vice President Kathy Gersch lahkus ettevõttest? Asja ajab keeruliseks see, et ta ju alles 8 kuud tagasi võeti tööle... ja lisaks veel tekib küsimus, et kas lahkumine pole seotud DSCM-i poolt avaldatavate tulemustega 27. oktoobril?

PS - aktsia on viimasel ajal väga hõredalt treidinud...lack of interest?

Kommentaarid teretulnud! -

Tegu oleks juba nagu null-likviidsusega aktsiaga...Muidu keskmine ikka 300 000 aktsia kanti päevas, viimastel päevadel on täiesti ära vajunud. praegu alla 20 000 isegi!