Börsipäev 4. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

JP Morgan downgrades Lowes (LOW $67.07) to Neutral from Overweight, saying they are more cautious with the co in the face of macro housing activity and forward earnings expectations

BofA upgrades Exxon Mobil (XOM 58.47) to Buy from Neutral and $65 tgt, as they expect growth will start to return to the upstream portfolio from 2006 with production expected to close up to 5% organically following years of little visible growth

First Albany upgrades Warnaco Group (WRNC 26.32) to Buy from Neutral with a $31 tgtBofA downgrades Citigroup (C 49.29) to Neutral from Buy and $50 tgt on valuation and a cautious industry view

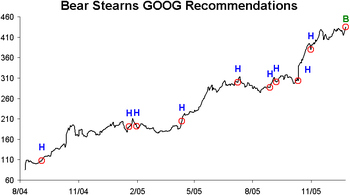

GOOG Google upgraded to Outperform at Bear Stearns; tgt upped to $550

Bear Sterns upgrades GOOG to Outperform from Peer Perform and raises their tgt to $550 from $360, reflecting their long term belief in the fundamentals & the burgeoning Google Ecosystem. They believe the co is in the midst of nurturing its own Ecosystem, much like MSFT and IBM did in the past. The firm says that the co's Ecosystem has 5 main attributes: GOOG's size is developing new sectors as a derivative; GOOG's direction & partners should have a resounding effect on existing companies; the Ecosystem should act as selfreinforcing to the co; GOOG's hardware competency is underrated, and a significant advantage; and the Ecosystem growth should create an economic "lift" for GOOG

Keefe Bruyette upgrades Morgan Stanley (MWD, $58.31) to Outperform from Market Perform and raises their tgt range to $66- $68 from $57.50 saying they believe the sentiment surrounding the stock as well as profitability could turn more positive over the course of 2006, which coupled with the historic underperformance of the shares, presents a high probability that the shares will do well in 2006

Jefferies downgrades Burlington Resources (BR $87.72) to Hold from Buy based on COP's announcement that it planned to buy the co in a cash and stock deal and the fact that continued investment in BR represents an investment in a major oil company with less upside

Thomas Weisel downgrades Garmin (GRMN $67.36) to Outperform from Peer Perform, saying strong Q4 priced-in checks highlight necessary operating changes that they believe could limit share appreciation in 06

Goldman Sachs downgrades Office Depot (ODP 32.00) to In Line from Outperform based primarily on valuation.

Jaffray names Adobe (ADBE 38.52), Apple (AAPL 74.75) and Avid (AVID 55.05) as Top Picks for CY06, as they believe the cos have a healthy base of customers, are likely to benefit from identifiable changes in the industries in which they are focused, and have catalysts coming in the form of significant new product introductions. They believe these three cos also have the greatest potential for upward estimate revisions and multiple expansion

-

Rev Shark:

Market Could Go Either Way -- and Fast

1/4/2006 9:04 AM EST"The only difference between dreams and achievements is hard work."

-- Chris Bollwage We started off 2006 impressively. After a shaky start the bulls put together a very strong intraday reversal and when news of the FOMC minutes hit, the momentum kicked into high gear. We had one of the biggest positive reversals in quite some time and went out near the highs of the day.

Despite yesterday's very positive action, skepticism is high. Many don't expect this strength to last long. The thinking is that this is just some knee-jerk beginning-of-the-year manipulation, and that the FOMC interest rate posture was already well know and didn't justify new buying.

Rather than hope and dream about which way the market may be headed, we need to do some work and dig deeper into the situation. The first thing we want to look at is the charts. The major indices are all somewhat similar. We had a slow rollover during the month of December and then a sharp spike up yesterday. That spike put us back over certain important resistance levels but we still have some ways to go before testing the recent highs.

The key now is that the bulls prove that the sharp gain yesterday was not just a flash in the pan. They need to hold on to the majority of the gains and show some inclination to buy dips from this point. All they need to do is hold steady for a few days to claim success.

The technical patterns are not ideal but are better than last week. The one-day spike back up is a start but the buyers need to show some resolve and keep on pushing. If they disappear and let the market slip back down quickly we will be in big trouble, especially because there is so little underlying support once we hit the lows we saw last Friday.

We will have to be especially diligent now in monitoring the market action. We are at a juncture where we could easily get some momentum going and challenge recent highs or quickly roll over and take out the lows we saw on the last day of 2005. I certainly would like to see the market start a run but the move yesterday can't be totally trusted. If the bulls are ready to do some hard work they may prevail, but we will have to wait and see.

Futures have reversed into positive territory after looking shaky in the early going. Gold is up sharply again, oil down slightly and overseas markets are holding steady. Google (GOOG:Nasdaq) was passed over for the S&P 500 club once again but an upgrade is taking some of the sting out of it.

Position: No positions in stock mentioned

-

Analüütikud:

-

irw@Beari recommendations graafik

-

Head uut aastat!

rõõm tervitada, aga samas ka räige kurvastus, müüsin oma 2 viimast jan cal täna maha, aga hull lugu see, et juurde osta ei saa, ja veel hullem see, et inv kontolt pole lootustki uusi soetama hakata, või ehk? -

kahju, et riq pikalt kadunud on, on ju aegu lainud.....