Börsipäev 17. oktoober

Log in or create an account to leave a comment

-

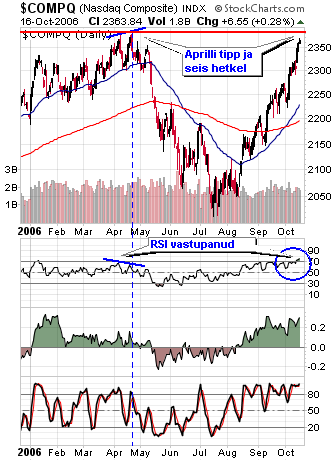

Põgus tehniline kommentaar. Sentiment on olnud harjumatult optimistlik, nii volatiilsus kui put/call ratio on väga madalal. Ülevoolavalt optimistlikus olukorras tuleks olla ülimalt ettevaatlik, kuigi üles liikumine on kestnud juba mõnda aega, on praegune tase juba äärmiselt riskantne. Indeksid on liikunud oma uute tippude poole ning üha huvitavam näib Nasdaq seis. Millises seisus ollaks enne suuremat korrektsiooni? Vaadates aprillis tehtud tippe ja tänast taset, siis eriti palju viimasest aprilli 2378,3 tasemest puudu ei ole jäänud. On positiivne, kui aprillikuu lagi murtakse (kõrgem tipp), negatiivne, kui seda ei saavutata (madalam tipp). Praeguselt RSI tasemelt (jõutud üle 70) ma eelmisest tipust suurt ülespoole murdmist ei näe. Täna on indeksite futuurid miinuspoolel, negatiivne start - tulemas tervistav tühjendusmüük.

-

sobib, ma tõmbasin eile vähe koomale

-

A Little Caution May Be in Order

By Rev Shark

RealMoney.com Contributor

10/17/2006 9:06 AM EDT

Click here for more stories by Rev Shark

"To know when to retreat; and to dare to do it."

-- The Duke of Wellington, in response to the question "What makes a great General"?

With earnings season upon us, extended technical conditions, and pundits on television talking about the "best tape in six years," even the most optimistic bull needs to consider some strategic retreat. Retreat doesn't mean turning bearish or being negative; it simply is a tool to reduce risk and to make sure you don't let hard-won gains slip away.

Too many market players see things in black and white. If you are bullish you buy aggressively and stay long until you turn bearish, at which point you sell everything and stand aside. The experienced market professional takes a much more flexibile approach. Even though he may be bullish about longer-term market prospects, he may be an aggressive seller in the short term to better position himself for future profits.

Selling is a form of retreat and as the Duke of Wellington taught Napolean at Waterloo, it can be used to great strategic advantage when the opposing forces seem overwhelmingly strong. Recently the bullishness wafting around this market has started to reach extreme levels. We had not had any meaningful pullbacks and the idea that the market will continue straight up without a pause has been embraced widely.

This morning we have a number of problems that may suggest that a strategic retreat may be called for. Goldman Sachs cut its opinion of Intel on the eve of its earnings tonight, the core PPI numbers are quite a bit higher than expected and we have a flood of extended stocks that are due to announce earnings. If nothing else a little caution to protect recent gains would be a smart move.

We are off to a weak start. Overseas markets pulled back, gold is down a bit but oil is holding steady. The focus will quickly shift to upcoming earnings reports and that is going to make things extremely tricky.

At the time of publication, De Porre had no positions in stocks mentioned, although holdings can change at any time. -

Majandusstatistika poole pealt – täna tulid PPI numbrid, homme juba CPI numbri(mis on inflatsiooni seisukohalt tähtsad):

Tootjahinnaindeks langes –1,3% vs –0,7% konsensus

Tootjahinnaindeksi tuumikosa tõusis +0,6% vs +0,2%

PPI tuumikosa +0,6% tõus oli üllatav. Turule see hästi ei mõju ning nüüdseks näitavad seda juba ka futuurid, mis viitab turu tugevalt negatiivsele algusele.

Pinged Põhja-Koreaga seoses on jätkuvalt kirgi kütmas. Põhja-Korea ametnikud nimetavad ÜRO resolutsioone justkui ‘sõja kuulutamiseks’. Lisaks on täna avaldanud arvamust nii Jaapani kui ka Lõuna-Korea valitsuse ametnikud, et Põhja-Korea võib olla valmistumas veel üheks tuumapommi katsetuseks.

Alati tasub kursis hoida end sellega, mida mõjukad inimesed turuolukorrast arvavad. Silma jäi miljardärist hedge-fondi juhi T. Boone Pickens’i eelmisel nädalal avaldatud mõtteavaldus, et ta usub, et naftahind maksab aasta lõpuks $70.

Allapoole avanevad:

Gapping down on disappointing earnings/guidance: STLY -11%, ELY -11% (guidance only), UFPI -7.3%, SIFY -3.1%, WERN -3% (also Wachovia downgrade), PPDI -2.7%... Other News: SAPE -11% (co says it may restate results; CEO resigns), IFON -9.4% (Kaufman downgrade; cuts tgt to $7.50), UCTT -4.4% (JP Morgan downgrade), SWFT -3.2% (Stephens downgrade), AMLN -2.9%, YHOO -2.2% (Cowen downgrade ahead of tonight's Q3 report), ACGY -2.1%, LRCX -1.8% (Lehman downgrade), INTC -1.5% (Goldman downgrade ahead of tonight's Q3 report), LLY -1.5% (to acquire ICOS), BRCM -1.5%, AKAM -1.5% (Canaccord Adams downgrade)... Under $3: MEMY -13% (halts drug study on FDA concerns), GNBT -12% (files 10-K). -

Koos ülejäänud turuga, liiguvad tugevalt allapoole ka jaemüüjad. Tooksin välja, et Wal-Mart(WMT) on praeguseks ca viimased poolteist kuud toetust pakkunud tasemest $48 peal täna siis läbi vajunud ning sellest allpool sulgumine ei oleks kindlasti hea signaal.