Börsipäev 27.november

Kommentaari jätmiseks loo konto või logi sisse

-

WSJ kirjutab Wal-Marti (WMT) teemadel. Üle kümne aasta prognoosib jaemüügigigant negatiivset võrreldavate poodide müüki. Viimati nähti langust 1996. aasta aprillis. Seda vaatamata palju promotud geneerikuteprogrammile ja langevatele kütusehindadele. Analüütikud on ka väitma hakanud, et Wal Marti SSS ei kajasta enam üldist jaemüügitrendi. Ühest küljest söövad kindlasti paljud konkurendid WMT lõunat, kuid teisest on mitmed väga suured ettevõtted seotud otseselt lepingute kaudu WMTga, mistõttu mõju kindlasti on. Üldiselt algas pühademüük edukalt ka suurte allahindluste tõttu ning suur osa ostudest tehti krediitkaardiga (ughly $17 out of every $100 spent in the U.S). Artikkel ise siin.

-

Täna kirjutab ka Barrons erinevatest potentsiaalsetest ülevõtukandidaatidest. Tüüpiline peale sellist M&A sadu.

Barron's reports some large companies that could be taken private are Gap (GPS), Micron (MU), Bed Bath and Beyond (BBBY), Nike (NKE), Liz Claiborne (LIZ), EMC (EMC) and Costco (COST). Energy deals generally have involved strategic buyers, but that could change. Potential targets include Apache (APA), Valero (VLO), Hess (HES) and Transocean (RIG), which have low p/e multiples and generate lots of cash. In the consumer sector, Avon (AVP) has been the subject of buyout rumors lately. According to a Merrill Lynch client note, analyst Christopher Ferrara placed Kimberly-Clark (KMB) and Este Lauder (EL) atop a list of companies that could benefit from greater financial leverage. Potential candidates in the tech sector, according to CreditSights, include cash-rich analog semiconductor companies like Linear Technology (LLTC), Maxim Integrated (MXIM) and Analog Devices (ADI), as well as Altera (ALTR) and Xilinx (XLNX).

Lisaks arutatakse lahti GOOG puzzle, väites, et aktsia on ülehinnatud. Põhjusena tuuakse nõrk tarbija ning reklaamituru jahtumine, lisaks optsioonidega seotud kulud.

Barron's reports shares of Google (GOOG) appear due for a correction based on slowing growth and bloated expenses. Analysts on average expect the co to earn $13.70 in 2007, up from an estimated $10.31 this year. That's a prospective gain of 33%, which looks great until compared with the 81% increase in earnings that Google is on track to produce in 2006. In either case, those estimates are inflated. They ignore about $1 a share of stock-option expense, while giving the co about $1 a share of credit for the interest earned on its $10.4 bln cash hoard. If analysts accounted for option expense and ignored interest income, '07 estimates would shrink to roughly $11.70 and the p-e multiple would climb to 43. Also, the price advertisers are willing to pay for search keywords has fallen. The average price paid to buy a search word across the Web in the second quarter -- $1.27 -- has declined 11% from the start of the year and 34% from the peak of $1.93 in April 2005. So far, companies have made up the difference on volume, but it's a trend worth watching. Fred Hickey, editor of the High-Tech Strategist newsletter and a Barron's Roundtable member, is convinced the consumer is slowing. He expects the slowdown to hurt Google's advertising and stock price, too. "I know (Google stock) isn't worth $500 a share," he says.

-

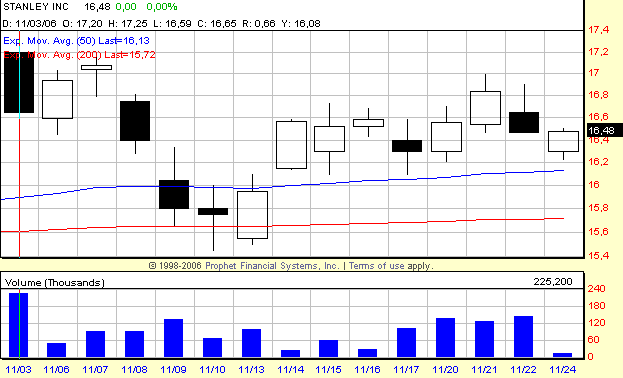

Stanley Inc (SXE) saab täna kõvasti tähelepanu.

Citi:

➤ We are initiating coverage of Stanley with a 1H (Buy, High risk) rating. Our$21 target price is based on a 20x forward multiple off our calendar 2008estimate of $1.00 and our use of an EBITDA-based "take-out" analysis.

➤ Our near-term ests of $0.07 for Dec-2006 and $0.57 for FY07 (both GAAP) areat or ahead of company guidance, which we believe to be conservative.

➤ Stanley’s 60/40 split of defense (including DHS) and civilian contracts and“off-budget” revenue gives Stanley a stable revenue base in the event ofshifting government priorities or budget cuts. Good recent signings and thesuccessful Morgan acquisition build on this base to provide growth.

➤ Risks include the upcoming renewal of its passport processing contract and atight labor market for security-cleared employees.

➤ We highlight SXE's rev visibility and its rev and EBITDA growth potential asattractive attributes in an otherwise unexciting federal IT services space. Buy.

Stifel initiates Stanley (SXE 16.48) with a Buy and a $21 tgt saying SXE with grow faster than its peer group driven by is strong position in several growth areas including, Army equipment reset, the impact of Base realignment and Closure, and passport related services...

Wachovia initiates Stanley (SXE 16.48) with a Market Perform, as their positive view toward the market opportunity, company positioning, management, and financial outlook, is only offset by current valuation..

-

Goldman Sachs näib olevat Venemaal strateegiat muutnud. Kui Aton Capitali ülevõtmine ei õnnestunud siis nüüd selline uudis: Goldman Sachs is hiring up to 60 people for its Moscow office, two months after receiving its first Russian securities brokerage licence. The US investment bank has a large pipeline of deals, including next year’s $2bn (€1.5bn) flotation of state-owned Vneshtorgbank and the initial public offering of OGK-3, a subsidiary of the electricity monopoly.

-

Piper Jaffray raises F5 Networks (FFIV 73.11) tgt to $100 from $72, as the Advanced ADC Platform market is expected to grow substantially faster than the overall ADC market and this bodes well for F5

Prudential initiates NYMEX Holdings (NMX 132.21) with an Underweight and $112 tgt, as they feel NMX should be valued in line or below other derivatives exchanges, given competition and unlikely takeout prospects

BofA upgrades Lowe's (LOW 30.00) to Buy from Neutral and raises tgt to $43 from $31, as they believe 2007 will be a trough year for earnings, which will set the stage for a recovery in 2008 and fell LOW is capable of weathering the downturn better than most given market share gains and cost discipline

ThinkEquity raises Apple (AAPL 91.63) tgt to $110 from $100, based on likely upside to their Retail Store revenue estimate of $1.45 bln for Q107.Saying their proprietary "Black Friday" survey of Apple Retail stores across the nation indicates likely upside to their Retail Store rev est of $1.45 bln for 1Q07. Firm believes that AAPL's Retail Store is a clear differentiator and a significant catalyst for further CPU share gains and profit margin expansion.

Rochdale initiates Collectors Universe (CLCT 12.46) with a Buy and $20 tgt, as they believe the co is in the early stages of its multi-year development strategy and new services including diamonds and gemstones are massive investment opportunities

Merrill initiates Cerner (CERN 48.20) with a Buy

BofA initiates Trubion (TRBN 15.99) with a Buy and a $23 tgt

ValueClick (VCLK) downgraded to Hold from Buy at Citigroup

Kuigi Aasia aktsiaindeksid kerkisid, näitab Euroopa taaskord nõrkust:

-

Tehniline pilk turule. Nagu ka reedel mainitud sai, tundub, et turg on lühiajaliselt üleostetud ning aeg on korrektsiooniks. Tehniliselt ning eelnevate perioodide info põhjul võiks oodata maandumist Bollingeri eraldava 20 päeva libiseval keskmisel, kuid seekord ütleb ka sisetunne (mis see veel on?), et turg võib pigem üle reageerida kui jääda kuhugi toetuma. Sest, nagu näeme viimasel ajal üha rohkem jälgitava investorite hirmuindeksi VIX graafikult, toimus viimasel kauplemispäeval VIX väärtuses gap up ülesse, mis annab signaali sellest, ilmselt on turg muutumas praeguste kõrgtasemete suhtes ebakindlamaks. Hetkel oleksin pigem ootel ning vaataksin, kuidas VIX käitub 50 päeva libiseva keskmise suhtes. Ebakindluse ja volatiilsuse tõusul aga on täiesti alust, sest pühade-eelsed ja -aegsed turgude prognoosid on ebalevad ning fundamentaalses plaanis nõrk majandus, langev dollar suurendavad määramatust ning pessimismi. Black Friday poolikule punastes toonides sulgenud kauplemispäevale järgneb tänane Cyber Monday, seega lähipäevade tehniline pilt läheb üha huvitavamaks.

Tehniline pilk turule. Nagu ka reedel mainitud sai, tundub, et turg on lühiajaliselt üleostetud ning aeg on korrektsiooniks. Tehniliselt ning eelnevate perioodide info põhjul võiks oodata maandumist Bollingeri eraldava 20 päeva libiseval keskmisel, kuid seekord ütleb ka sisetunne (mis see veel on?), et turg võib pigem üle reageerida kui jääda kuhugi toetuma. Sest, nagu näeme viimasel ajal üha rohkem jälgitava investorite hirmuindeksi VIX graafikult, toimus viimasel kauplemispäeval VIX väärtuses gap up ülesse, mis annab signaali sellest, ilmselt on turg muutumas praeguste kõrgtasemete suhtes ebakindlamaks. Hetkel oleksin pigem ootel ning vaataksin, kuidas VIX käitub 50 päeva libiseva keskmise suhtes. Ebakindluse ja volatiilsuse tõusul aga on täiesti alust, sest pühade-eelsed ja -aegsed turgude prognoosid on ebalevad ning fundamentaalses plaanis nõrk majandus, langev dollar suurendavad määramatust ning pessimismi. Black Friday poolikule punastes toonides sulgenud kauplemispäevale järgneb tänane Cyber Monday, seega lähipäevade tehniline pilt läheb üha huvitavamaks.Ebalevatel aegadel lähevad hinda need aktsiad ja sektorid, mis majanduse konjuktuurist eriti ei sõltu, või millest on tavaks saanud abi otsida. Vaata näiteks kulla ja hõbedaindeksi XAU graafikut, mis on viimasel kahel kauplemispäeval tõusnud üle 200 päeva libiseva keskmise ning reedel tehti gap ülespoole ning murti läbi novembri alguses 142,61 juures tehtud vastupanutase.

Tehnilises plaanis on üsna huvitava mustriga Gerdau Ameristeel (GNA), mis sulges +3,20% plussis. Kuigi 200 päeva libiseva keskmise vastas toetust ei tehtud ning põrgati juba varem, ootan ülespoole liikumise jätkumist - küll on toetus tehtud 50 päeva libiseval keskmisel. Positiivsed signaalid: MACD, MACD Histogramm, STO, Bollinger.

Juba mõnda aega on oma kokku kuivanud volatiilsuse tõttu tähelepanu all PG, mis väsinud indikaatorite tõttu tundub üsna huvitav breakdown kandidaat.

Tehnilises plaanis tundub, et ka FDO on lühikeseks müümise kandidaat, arvestades, et STO on üleostetud, vastupanu 2x testitud 50 päeva MA all ning käive on kokku kuivanud.

Miinuses indeksite futuurid annavad märku, et ilmselt tuleb turul avaneda täna negatiivsetes toonides.

-

Shark rõhutab, et praeguses olukorras ei saa siiski nõrkusest turul veel rääkida. On oodata, et gap down'id ostetakse kiiresti üles ning alles siis tasuks ettevaatlikumaks muutuda, kui mõni allamüük kiiresti ostjaid ei leia. Samuti rõhutab ta, et kuigi praegusel turul on neid, kes ootavad, et saaks sisse osta, on ka neid, kes tahavad oma kasumeid kaitsta. Kui kasumikaitsjate ülekaal osutub võimsamaks, võib ka korralikku langust oodata.

Profit From Fund Fears

By Rev Shark

RealMoney.com Contributor

11/27/2006 8:41 AM EST

Click here for more stories by Rev Shark

"An utterly fearless man is a far more dangerous comrade than a coward."

-- Herman Melville

Fear is always the paramount emotion in the market. Fear of missing profits drives investors to chase extended markets while fear of losing money pushes them to sell when there is weakness. Right now there is almost no fear of losing money; the focus is on trying to rack up more gains and not be left behind.

Given the many institutions that have lagged recently, it shouldn't be a big surprise that they are anxious and focused on finding ways to make a profit. For many they have no choice but to jump on fast-moving, high-momentum stocks like AAPL, RIMM, FFIV or GOOG and hope they can rack up profits at a pace faster than the overall market.

What will be particularly interesting as the year winds down is the struggle between holding on to the big gains realized since July vs. trying to rack up even more gains. Obviously there are some market players who have caught a nice ride over the past four months and are looking at a pretty good year as a result. They will be loath to give back those gains. If the market begins to pull back it will be very interesting to see how quickly they will head for the safety of cash if their returns start to slip.

On the other hand there are plenty of folks unhappy with their returns and fearful they will underperform. Many of these investors trade on the long side only and can only profit by buying stocks that go up. Sitting passively in cash in hopes that they will make up performance as the indices fall is not an attractive strategy to the "active" manager. They want to make moves so that they at least give the impression to their investors that they are earning their money.

At this point, talk about a pullback is just idle speculation. We have not had a meaningful dip in weeks and the dip buyers are pouncing on even a hint of weakness. Each day last week we opened down and the dip buyers jumped in and turned us back up. It has been such an automatic way to profit that we have to expect that action to persist for a while. It's only after a few failed bounces that the dip buyers will be less aggressive.

What will be particularly interesting if the dip buyers lose their energy is the level of concern about protecting recent gains.There are plenty of folks who would like to buy a stock like AAPL at a lower price but there are also those who have some big gains in recent months who won't want to give them back as we enter the end of the year.

We have a shaky start this morning as the weak dollar and talk about slowing auto sales is weighing on European stocks. Asian markets rebounded a bit from weakness last week. Oil is up slightly and the dollar is getting hit hard once again, which is driving up gold.

At the time of publication, De Porre had no positions in stocks mentioned, although holdings can change at any time. -

Tänase turu suuremad ülespoole avanejad:

PNTR +46% (momentum continues, stock rose as much as 200% on Friday), SEED +26% (reports JunQ), SIMO +12% (WR Hambrect says its channel checks indicate qtr tracking above expectations), TRBN +4.8% (a number of firms initate coverage on this recent IPO), CTTY +4.7% (extends momentum, +30% in 2 days), SCT +4.5% (MassMutual and Cerberus will invest $600 mln in SCT to gain control), KRY +4.3% (extends momentum, +20% in 7 days), LMRA +3.5%, ATEA +3.3%, AUDC +3.1% (First Albany upgrade), ZVUE +2.7% (momentum name, extends recent gains), RMBS +2.2% (positive Amtech comments), HOFF +2.2% (Raymond James upgrade), LOW +2% (BofA upgrade), GFI +1.4% (files annual report), BBY +1.3% (Credit Suisse believes BBY is finishing up Q3 very strongly), AAPL +1.1% (ThinkEquity raises tgt to $110)... Under $3: WFII +13% (Army contract), MEMY +5% (completes enrollment for clinical trial).

Allapoole avanevad:

SORL -10% (prices stock offering), JAS -4% (profit taking after +19% move last week), VRTX -3.5% (mentioned negatively in Barron's), XING -3.1% (reports Q3 revs), SPPI -3%, ASMI -2.9% (co to stop subsidising front-end operations), VCLK -2.7% (Citigroup downgrade), JCG -2.3% (CIBC downgrade), NOK -2%, QGEN -1.4% (extends recent weakness). -

Eelpool mainitud GOOG kaupleb suhteliselt raskelt täna

-

oodatud korrektsiooni moodi paistab, eks näha ole kas päeva lõpuks kosub või otsib veel põhja poole

-

jah, hetkel kindlasti liiga äkiline kukkumine

-

Napalmilõhnaline on see situatsioon küll praegu. Arvestades, kuidas lemmik AAPL peale targetitõstmist käitub ning kuidas broker/dealerid (MER, LEH, GS, BSC jne) lausa allapoole kimavad ilma hingamisruumita.

-

Dow ja S&P500 on hetkel juuli põhjast tõmmatud trendijoonest läbi vajunud.

-

ise ootaks homme ka balti turul midagi taolist, või kuidas näete homset päeva

-

Kui päev lõpetatakse põhjade lähedal, siis võib kasumivõtmine levida ka muudele turgudele. Euroopas on üht teist juba ka toimunud.

-

Kas mitte kahtlaseks ei kisu veidi juba?

-

kakkus jah... mina likvideerisin enda USA seisu. Eks näis mida huvitavat sellest tuleb, hetke tasemetelt igatahes uuesti ei julgeks suurt midagi osta. Väga loodan, et langus on homme Eesti turul sarnane kuigi see ujus juba täna vastuvoolu :D

-

PALM lowers Q2 non-GAAP EPS guidance to $0.15-0.16 vs $0.22 Reuters consensus; revs $390-395 mln vs $442.33 mln Reuters consensus. The revenue shortfall is due primarily to a delay in completing the certification process for a product that the co had previously expected to ship within the quarter. "Smartphone sell-through across our existing products is strong, reflecting solid business fundamentals in the face of significant competitive pressure... However, our Q2 FY07 revenue will be constrained by a delay in certification of a key product. We now expect to start shipping the Treo 750 for the U.S. market early in Q3 FY07. Our Treo 750v launch in Europe is doing quite well, and we expect international revenue for Q2 FY07 to be strong." (Stock is halted)