Börsipäev 8. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Maagaasihiid Chesapeake Energy(CHK) teatas eile peale börsi, et on toomas turule täiendavad 30 miljonit aktsiat(aktsiate lahjenemine ca 6.9%), millest laekuva tuluga vähendatakse ettevõtte miljarditesse küündivat laenukoormat(puhtalt pikajaline võlg $8 miljardit). Aktsia paari protsendi jagu minuses.

Murelikke teadete osaliseks sai eile õhtul taaskord tehnoloogia sektor. Xilinx(XLNX) teatas, et näeb 3. kvartalis müügitulu langust –2 kuni –5% varasema oodatud +2% kuni +5% asemel. Teate peale on aktsia eelturul üle 5% minuses.

Nafta osas valitsevad turul segased tunded. Spekulatsioone on kuulda igasuguseid. Wall Street Journal Online'st saab lugeda, et võib oodata ka tootmise samale tasemele jätmist, kui OPEC'i liikmed 14. detsembril kogunevad.

According to the WSJ Online, with oil prices back above $60 a barrel and the global economy slowing, OPEC is likely to refrain from further tightening its oil spigots when the cartel meets Thursday in Nigeria, according to senior cartel officials. But in an indication that oil prices are likely to remain lofty, the OPEC will be poised to cut output if needed, with an eye on large stockpiles of crude stored around the world, these officials said. Oil prices could still fall in the next few days, and the world's supply-and-demand balance remains volatile. But barring big moves, cartel officials said, OPEC probably won't call for a reduction in output when cartel ministers gather next week in Nigeria's capital, Abuja.

--------

JP Morgan alandab Xilinx(XLNX) soovitust: Overweight » Neutral

Wachovia alandab YUM! Brands(YUM) soovitust: Outperform » Mkt Perform

Stifel Nicolaus downgrade'ib Countrywide'i(CFC): Buy » Hold

Prudential alandab 3M( MMM) reitingut: Overweight » Neutral. Hinnasihti alandatakse: $92 » $84

Banc of America Sec alustab Deere'i(DE) katmist. Nendepoolne soovitus : Neutral $108

HSBC Securities kinnitab Goldman Sachs'i(GS) reitingut: Neutral. Muudab hinnasihti: $198.90 » $215.80

Banc of America Sec upgrade'ib LM Ericsson'i(ERIC) soovitust: Neutral » Buy -

Average Workweek 33.9 vs 33.9 konsensus

Hourly Earnings +0.2% vs +0.3% konsenus

Unemployment Rate 4.5% vs 4.5% konsensus

Nonfarm Payroll 132K vs 105K konsensus -

Barronsis Bear Stearnsi hinnang finantssektorile -

WE ARE MAINTAINING our Market Overweight rating on the large-cap bank sector for 2007 because we believe the combination of stable or declining short-term interest rates with continued positive U.S. and global economic growth will provide a supportive environment for banks, both as companies and as stocks.

We agree with the broadly held view that credit losses will go up from a current level that is well below historical averages, but we believe the rise in losses, provisions, and reserves will continue to be at a slow pace.

Eraldi mainitakse positiivselt ära Bank of America, JPMorgan Chase ja Bank of New York-Mellon.

Samuti usutakse ülevõtmiste jätkumisse. Viimast kinnitaks järgmine seik -

WSJ: Bank of America Corp. could be about to make a bid for British retail and investment-banking group Barclays PLC in a deal that would create the world's biggest bank, according to analysts at Merrill Lynch.

Barclays, the United Kingdom's third-largest bank by market capitalization, would give Bank of America a significant international presence in each of these markets as well as a major U.K. retail and commercial bank and the U.K.'s biggest credit-card business.

Toetub selline arvamus BofA vajadusele laienede rahvusvaheliselt ja samuti ettevõtte CFO Al de Molina hiljutisele lahkumisele.

-

U.S. STOCK INDEX FUTURES JUMP AFTER STRONGER-THAN-EXPECTED PAYROLLS DATA

-

Shark räägib taaskord, et pehme maandumise stsenaariumi täitumisse on turg valmis üha kriitilisemalt suhtuma, kuna aktsiate tõus on olnud niivõrd järsk. Samuti on juttu rotatsioonist - eelkõige tehnoloogiast välja ning sisenemisest energiasse.

Caution Off the Jobs Number

By Rev Shark

RealMoney.com Contributor

12/8/2006 9:13 AM EST

Click here for more stories by Rev Shark

"One of the common denominators I have found is that expectations rise above that which is expected."

George W. Bush

The primary issue confronting the market as we ponder this morning's job data is to what degree the market is expecting the Fed to cut rates early next year. There has been increased speculation that the economy is slowing and inflation is contained enough that the Fed will be in position to actually cut rates fairly soon.

The market has benefited for some time now from what looks like a very rare event, a soft economic landing. It really has been an ideal situation for equities that inflation has been fairly tame and the economy still holding up very well. We have had very little to change that view in recent months and that is probably the main driving force behind this rally; it truly has been a Goldilocks environment.

This morning there seems to be more wariness about the possibility that this fine economic balance might be upset. Nothing has really changed yet but it is obviously an issue that is becoming more prominent. When we throw in the fact that the market is very technically extended, we have to be particularly vigilant to see if the soft-landing thesis is being questioned more harshly.

In the early going the signs of the rotation I have been discussing so much lately seem to be picking up steam. Oil and gold are hot while technology is seeing some pressure. Overseas markets were weak and we have a flat start but there seems to be some nervousness in the air today. -

Lisame ka suuremad varajased liikujad

Ülespoole avanevad:

CMOS +18% (reports OctQ, guides JanQ revs above consensus; also upgrades from Needham and Canaccord Adams), PXPL +18% (extends yesterday's 17% move), ENCY +14% (receives FDA clearance to resume clinical trials for TBC3711), DLB +5% (Cramer bullish on Mad Money), DIVX +4.4% (extends multi-yr deal with Google), TGEN +3.1%, ANDW +2.9% (OpCo upgrade), IMMU +3.6% (extends yesterday's 10% move), TOMO +2.6%, EBAY +2.4% (Cramer bullish on Mad Money, calls it a value play), BCS +1.8% (BofA may interested in buying co citing Merrill--DJ), DIS +1% (Cramer bullish on Mad Money).

Allapoole avanevad:

TSM -19% (reports Nov revenue in 6-K filing), CENT -12% (reports SepQ, also multiple downgrades), SWHC -8% (reports OctQ, guides below consensus), ACOR -10% (FDA recommends an additional Phase 3 trial for Fampridine-SR), XLNX -6.2% (guides lower, also JP Morgan downgrade), CHK -4.4% (prices offering), ACLS -3.8%, TECD -3.4% (JP Morgan downgrade to Underweight), HTGC -2.8% (files amendment to stock offering), YRCW -2.8% (multiple downgrades), UBSI -2.8%, TYC -2.4% (Pru downgrade to Underweight), ERTS -2% (NPD data released), TTM -1.9%, ATW -1.8% (reports SepQ, misses by $0.04), IPG -1.8% (Wal-Mart to reopen ad account review), YUM -1.8% (Wachovia downgrade), SIRI -1.3% (BWeek article: Obstacles to an XM, Sirius Merger). -

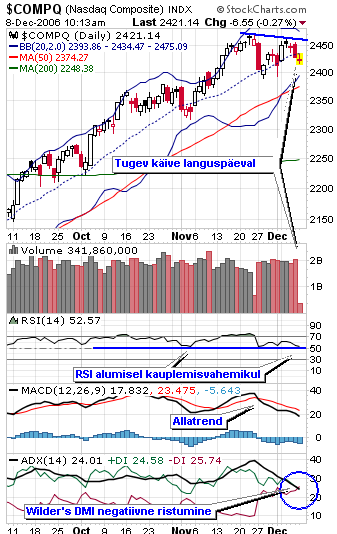

Täna suurt eelmistes börsipäevades toodud kommentaaridele lisa ei ole märkida. Küll aga võiks tuua paar negatiivset signaali taas välja. Nimelt on Wilderi DMI muutunud ka negatiivseks, juhul, kui punane joon, ehk -DI jääb ülalpoole +DI taset ning ADX, ehk must joon hakkab tõusma - peegeldab see allatrendi algust. Eilne kauplemspäev oli suhteliselt suure käibega. Volatiilsusindeks VIX tegi eile üle mitme kuu kõrgtaseme ning nagu näha, pole 200 päeva libisev keskmine enam kaugel.

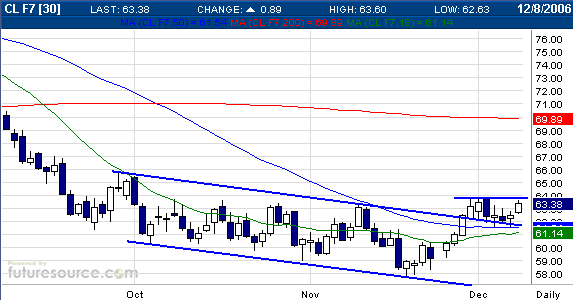

Toornafta olukorda kirjeldab jästi juuresolev graafik. Nagu novembri lõpus välja tõin, murti välja mõnekuisest kauplemisvahemikust, 50 päeva ja 200 päeva libisevast keskmisest ning nüüd on võimalus testida 64 taset.