Börsipäev 6. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Baltic Morning News

Olympic opens new casino. Olympic Casino opened a new slot casino in Estonia (in Jarve shopping centre Tallinn). The casino was opened on Feb 3 and investments into the new site amounted to EUR 1.6m (floor area 386sqm). The 67 slot machines make the new casino the biggest slot machine casino in Estonia. Olympic now operates 82 casinos in 5 countries, of which 24 are located in Estonia.

Vilniaus Baldai shows first positive signs. The Lithuanian furniture manufacturer Vilniaus Baldai announced it generated sales of LTL 10.489m in January, equal to a rise of 4.1% y-o-y. Although in absolute terms this is not stellar, it is quite solid on relative basis as the company has been struggling with declining sales (November -7% yoy, December -15% yoy, full year -9.5% yoy).

Rokiskio Suris boosts sales. The Lithuanian dairy company Rokiskio Suris posted January sales of LTL 55.69m, equal to a y-o-y increase of 42.8%. The result looks quite impressive as in 2006 the sales growth was only in low teens, i.e. if the company is able to post similar figures also in the coming monhts, it might become an interesting investment case.

Baltic’s currencies undervalued. According to the Big Mac index published last week, all Baltic currencies are undervalued against USD. Estonian kroon (EEK) is 23% undervalued, while Latvian lats (LVL) and Lithuanian litas (LTL) are 22% and 24% undervalued, respectively. Hence, price level in Baltics is quite similar. However, if you want to buy a really expensive Big Mac, you should go to Iceland (Icelandic kronur is 131% overvalued against USD). For the cheapest one, visit China. For full table, see http://www.economist.com/markets/indicators/displaystory.cfm?story_id=8649005.

SAF Tehnika Q2 expected today. The Latvian telecom equipment maker SAF Tehnika is expected to report their fiscal Q2/06-07 today. Much focus will be on Asian sales as well as on the success of the new high capacity SDH product line.

-

Mõnus, teed arvuti lahti ja vaatad, et juba nii palju raha esimese 7 minutiga teenitud. Pidu.

-

Majade müügistatistika koha pealt on päris palju pead murtud. 18. jaanuaril avaldatud uute majade ehituste arv(Housing Starts) 1642K oli suurem kui oodati ning samuti ületati eelmise kuu 1572K näitu. Seda tõlgendati kui positiivset sündmuste käiku majade ehituse ning kinnisvaraturul ning ellu kerkisid lootused, et ehk on põhi majadeturul saavutatud. Eile ilmus aga Wall Street Journalis väga hea artikkel sarnastel teemadel, mis selle teesi pooldajaid peaks pisut jahutama.

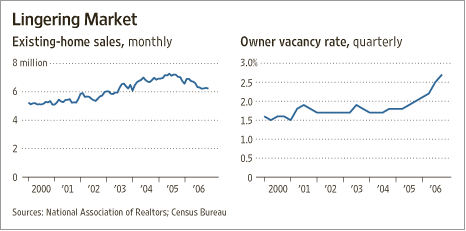

Nimelt on olemas üks üpriski vähejälgitud näitaja - homeowner vacancy rate. See näitab, kui palju on müügis maju, kus omanik ise reaalselt sees ei ela. Antud näitaja on jõudnud viimase 40 aasta rekordtasemele, mil seda üldse kirja panema hakati. Just viimasel aastal on tõus olnud eriti peadpööritav liikudes 2.0% pealt 2.7%ni ning 2006. aasta lõpus oli USAs müügis ca 2.1 miljonit tühja maja. Olgu ka mainitud, et enne 2006. aastat polnud see number kunagi üle 2% liikunud.

Väljavõtted antud artiklist:

The report, which usually gets little attention, sparked fresh concerns about the housing market. Goldman Sachs economist Jan Hatzius concluded in a report last Monday that rising vacancies signal that excess housing supply continues to grow -- and that new construction has to decline further this year, even after a 13% decline in new home starts in 2006.

Meantime, J.P. Morgan economist Haseeb Ahmed said the overhang of vacant housing stock could erode existing home values as sellers slash prices to move their vacant properties. Economists fear that many vacant homes are owned by speculators who are stuck with investment properties that they can't sell and may be under increasing pressure to drop their prices. "We are concerned that there could be downward pressure on prices for awhile," Mr. Ahmed says.

Such worries could cloud hopes for a swift housing rebound. Those hopes have been bolstered recently by signs that the market may be stabilizing. Sales, which fell sharply through much of last year, have leveled off in many metropolitan areas and mortgage applications have been rising.

/-/

Another factor that may have contributed to the high vacancies, says Mr. Hatzius of Goldman: newly constructed homes that are finished and awaiting occupants, but haven't sold.

The vacancy indicator may help distinguish between the sellers who have casually listed their house on the market to see what price they can fetch, versus sellers who are under real pressure to sell. The owner of a vacant home -- who may be squeezed by mortgage payments for the vacant home as well as a current residence -- could be more willing to drop the price to minimize the cost, than a homeowner who lives in the home and doesn't have to sell.

Jon Estridge, 34 years old, owned a pair of investment homes in Virginia that sat empty for several months last year. When the market slowed, it was difficult not only to find buyers, but also to find tenants who would pay enough rent to cover his mortgages. "It eats you alive," said Mr. Estridge, who works for the federal government. "The market is going down, and you are paying a mortgage."

He eventually sold one home last spring, after dropping the price. He bought the property for $395,000 and sold for about $35,000 less. The other home sold for $260,000 in late August after he dropped the price by about $30,000.

/-/

What's troubling is that speculators may not act like typical home sellers. When they sell their vacant home in a down market, they don't necessarily purchase another home. By contrast, people selling the homes they live in will most often buy another house -- thus fueling a healthy market of buying and selling.

Not surprisingly, buildings with five or more units -- which include condos that were magnets for speculators -- had the highest rate of vacancy. The vacancy rate among these units rose to 11% in the fourth quarter from 7% in the first quarter. For single-family homes, the vacancy rate rose to 2.3% in the fourth quarter from 1.8% in the first quarter.

Vastav graafik antud näitajast on selline: -

CIBC upgrades Kronos (KRON 37.74) to Sector Outperformer from Sector Performer and sets a $46 tgt, based on increasing confidence operations are improving and the co should be able to accelerate organic revenue growth in coming quarters through a revamp of its sales force comp, its expansion into the high growth HCM market and international expansion.

BofA initiates ANSYS (ANSS 49.70) with a Buy and sets a $61 tgt, as they believe the market has overlooked the co's significant exposure to aerospace, turbines and industrials while they see catalysts that include increased demand for simulation technologies among CAD users who are realizing increased cost savings from doing design simulations and aggressive marketing by CAD partners such as AutoDesk and Solidworks about the benefits of 3D design and simulation

Stifel downgrades CSX Corp (CSX 37.89) and Union Pacific (UNP 102.44) to Hold from Buy based on valuation. The firm also believes several other factor could limit the potential upside available to investors in these names over the near to intermediate term, including weak YoY traffic growth, decelerating unit rev growth. Firm believes Canadian National Railway (CNI), Burlington Northern Santa Fe Corp (BNI) and norfolk Southern (USC) are more attractively valued

First Albany upgrades Overstock.com (OSTK 14.66) to Neutral from Sell

ThinkEquity expects AKAM to beat their and consensus 4Q estimates and raise its 2007 forecast when it reports results on Wednesday. However, firm says with shares trading at over 48x consensus 2007 EPS, upside expectations may already be priced in at current levels. If the co's 2007 guidance does not meet investors' lofty expectations, the firm thinks shares will likely trade off. Nonetheless, they still think that Akamai is best-positioned to capitalize on the increasing use of the Internet as the de facto distribution channel for rich media applications, but recommend that investors be more selective buyers near the $50 level. Firm raises their tgt to $60 from $55.

-

In This Tape, Stay Nimble

By Rev Shark

RealMoney.com Contributor

2/6/2007 8:47 AM EST

Click here for more stories by Rev Shark

"Our dilemma is that we hate change and love it at the same time. What we really want is for things to remain the same but get better."

--Sydney J. Harris

Present market conditions present a particularly difficult dilemma for investors looking to make some moves. Although conditions are good and stocks are acting well, they are technical extended, momentum has slowed and good entry points are becoming increasingly hard to find. On the other hand, the market is not rolling over or falling apart. If you are trying to short this action you are fighting an uphill battle. If you are making money, it is on the long side.

Unfortunately, better buying opportunities aren't likely to arise until the market suffers some selling first and it simply is showing no signs of doing that. We can still knock out some long-side trades but we are relegated to a short-term approach now. There simply are not many good opportunities to put substantial capital into longer-term plays. The setups just aren't there because so many stocks have already made big moves.

Markets like these, while challenging, can be quite profitable if you approach them properly. If you keep time frames short and are constantly looking to move on to the next trade, you can rack up some good gains. The trick is to not be so aggressive that you give back a big chunk when we get a turn downward.

The market is extended but traders are still doing their thing and that creates some opportunities for those inclined to play that game. Eventually the bears will have a chance to make some money on the downside but that time is not now.

Overseas markets were strong overnight. Oil and gold are up. The big news event will be Cisco earnings tonight and that may help techs stay steady today. -

Väike mõistatus teile..

Miks MAMA rallib?

Auhind - otsin netist mõne anekdoodi või huvitava lingi:D -

nt. ZVUE ostis putfile.com'i

-

yep.