Börsipäev 13. aprill - LHV PRO Cutter&Buck (CBUK) võetakse üle

Kommentaari jätmiseks loo konto või logi sisse

-

Täna hommikul võivad kõik LHV Pro idee Cutter & Buck (CBUK) aktsionärid rõõmustada. Nimelt võetakse ettevõte üle New Wave Group AB (OMX Stockholmi mid-cap ettevõte - NEWA B) poolt. Mõlema ettevõtte juhtkonnad on tehingu osas ühel meelel ning CBUK aktsionärid saavad ühe aktsia eest $14.38. Ilmselt peaks tehinguga lõpule jõutama maikuu lõpus. Idee tootluseks kujuneb ca 20% ning paljudele avanes võimalus ilmselt aktsiaid meie soovitustaseme hinnast ka soodsamalt saada.

Edu investeerimisel,

Oliver Ait -

Google teatab oma tulemused järgmisel neljapäeval - 19. aprillil. Tulemuste eel on aga CIBC ettevõtte oodatavat kasumiprognoosi tõstmas. EBITDA ja kasumiprognoosi tõsteti 3-5%.

CIBC notes that GOOG reports on April 19, and they expect a strong Q1 with 15% sequential rev growth behind acceleration in int'l revs from query strength and forex benefit. Firm raises their rev, EBITDA, and earnings ests by 3-5%, and recommends that investors to buy ahead of the print. In addition, firm sees further upside to consensus ests for 2007-08, which could come from higher int'l query growth and monetization, revenue potential from MySpace/YouTube deals, and their view that operating expenses and tax rate could be lower than expected.

Pro all ‘muude analüüside’ segmendis kajastatud ja paljudele klientidele silma jäänud NIHD on jätkanud oma põikpäiset ülespoole liikumist. Stifel on täna ettevõtte subscriberite lisamise prognoose tõstmas ning esile tõstetakse Mehhikot ja Brasiiliat.

Stifel says for NIHD, they are increasing their 1Q07 net subscriber addition forecast to 279,200, up from their previous est of 259,200 with the upside coming from both Mexico and Brazil. Due to the higher gross subscriber additions, as well as the 2% negative FX impact, firm lowers their 1Q07 EBITDA forecast to $190.8 mln from their previous $199.5 mln est, while their rev est also is coming in slightly to $707.1 mln in the Q, from their previous $712.1 mln forecast.

Tänased majandusandmed, mis aitaisd eelturul futuuridel ülespoolele liikuda

Trade Balance -$58.4bln vs -$60.5 bln consensus

Core PPI m/m unchanged vs +0.2% consensus

PPI m/m +1.0% vs +0.7% consensus -

When Stupid Is Smart

By Rev Shark

RealMoney.com Contributor

4/13/2007 8:07 AM EDT

Click here for more stories by Rev Shark

"In my experience, there is only one motivation, and that is desire. No reasons or principle contain it or stand against it."

-- Jane Smiley

Despite a plethora of negatives, market players still have a great desire to keep on buy stocks. Bad news, such as the FOMC minutes on Wednesday, simply provide a buying opportunity for those frustrated folks who are holding too much cash and fretting about being left out as the market powers steadily higher.

The market has produced so few meaningful pullbacks that the buyers don't even bother to stay patient for more than a day. They know bad news will be forgotten so quickly that they barely hesitate before jumping back in. We saw a particularly good illustration yesterday when a little softness at the open enticed the dip buyers who then drove us straight up all day.

The behavior is probably more Pavlovian than anything else but that doesn't mean that it isn't the smart behavior. It works. It has consistently been the road to profits, so denigrating those "reflexive, unthinking" buyers of weakness is just sour grapes by the intellectuals who know all the reasons why the market is doomed to fail.

Our job as investors isn't to intellectualize about why the market should do this or that; our job is to make money and if the way to do that is to do something that might seem stupid, we are going to do it anyway. The only measure of success in this game is profits and if that means embracing seemingly irrational and stupid market behavior, then that is what we need to do.

I guarantee you that at some point the character of the market will change and the dip buying behavior will prove to be the source of great pain for many who have come to rely on it but so far that time has not yet arrived. We are at a particularly interesting juncture now: the significant reevaluation in the posture of the Fed is clear in the minutes, earnings season is coming up, and it's the beginning of negative seasonality.

For now we keep those negative arguments and possible catalysts in the back of our minds and respect the action in front of us. That action is a persistent desire to buy stocks, and until that ends the negative arguments are meaningless.

We have a negative start to the day as we await the PPI number. European markets were mildly higher on continued strength in oil but Asian markets were down on some poor earnings reports. General Electric posted a positive report and is trading up slightly on the news. -

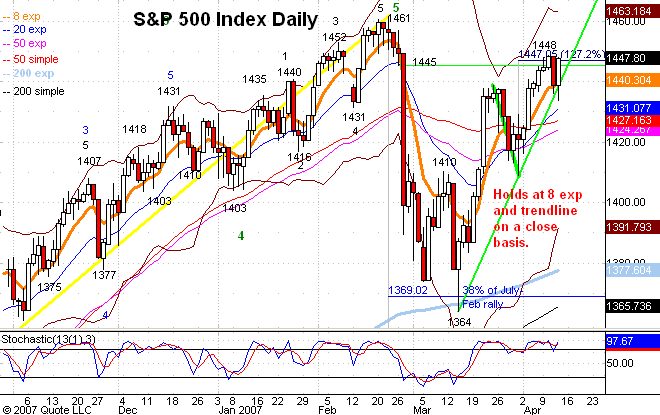

Trendijooned hetkel veel püsimas, kuid vastupanu endiselt jõus.

Ülespoole avanevad:

FCSX +7.1%; DYAX +46.0% (DX-88 for hereditary angioedema meets primary and secondary endpoints in Phase 3 trial), ANDS +16.8% (ANA380 exhibits activity in vitro against multiple clinically relevant hepatitis B virus mutants), SLM +12.3% (FT reports that SLM is in talks to be bought out by private equity), AVRX +8.4% (profiled in Inside Wall Street on BusinessWeek Online), MRK +5.5% (raises Q1 and 2007 EPS above consensus), SAP +3.8% (positive Merrill comments and comments by deputy CEO on order growth), NLY +3.3% (Cramer positive on stock), DNDN +3.3%.

Allapoole avanevad:

SMTL -15.5%; GNVC -5.4% (profit taking following yesterday's strength), EPD -2.8% (Shell affiliate sells Enterprise Products Partners common units), TM -2.7%, AAPL -1.8% (delays Leopard operating system release). -

Täna ma õppisin tööl, et LHV foorumis käimine on, kui masturbeerimine.

Esiteks, keegi ei tunnista avalikult, et ta seda teeb. Kui seda ei saa, muutub tuju pahuraks. Kui saad, siis on lõbu ainult loetud minuteid.

Kokkuvõttes pakub lõpp produkt rahuldust ainult endale.

:) -

Väga huvitav võrdlus muidugi. Aga edaspidi üritame siis samuti rahuldustpakkuvat produkti toota. 10 punkti igal juhul jyriadole : )

-

Dollar rises broadly after G7 source says communique won't change language on currencies - Reuters