Börsipäev 30. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Aasia täna päris korralikus miinuses, kuna Hiina valitsus kergitas börsimulli jahutamiseks stamp tax'i (maks aktsiatehingutelt). Maks tõsteti 0.1 protsendilt 0.3 protsendini.

Hiina CSI 300 INDEX -5,02% SHANGHAI SE A SHARE INDX -4,69% SHANGHAI SE B SHARE INDX -8,62% Hong Kong HANG SENG INDEX -1,07% Käive ka väga korralik.

Arvestades, et Balti turud tihti Aasia sentimendi kiiluvees liiguvad, võiks sealne kukkumine täna taustinfona meeles olla...

-

http://www.bloomberg.com/apps/news?pid=20601087&sid=aV0XeZyd6IMk&refer=home

Üldiselt võiks paar eelmist selle aasta seest toimunud Hiina jõnksu teisi turgusid juba "vaktsineerinud" olla. Enamjaolt ollakse juba vast harjunud mõttega, et varem või hiljem sealt see langus tuleb ja pigem loodetakse sellega koos ostukohta näiteks Euroopas. CEE jms pahna käitumist on muidugi pisut keerulisem oletada, kuna üldiselt langev BRIC võiks negatiivselt mõjuda ka CEE+Russia kombinatsioonidele. Aga kst. -

Mina Hiina ja Balti turu suhtes liiga tugevat seost ei näe - Balti turgude tõus aasta algusest on olnud väike, Hiina tõus seevastu võimas. Kui tõusu puhul korrelatsiooni pole, siis miks see peaks olema languse puhul?

Balti turgude puhul kardaks enim nn suvist vaikelu, kus nii ostjad kui müüjad randa üle kolivad - turg muutub väga õhukeseks ning tavapärasest veidigi suurem kogus võib hindu suurel määral mõjutada. -

mina usun, et kui ikka hiinas (aasias) närvilisus suureneb, siis hakkavad ka usa investorid suvele ja õhukesele turule mõtlema, ehk turul eeldused korralikuks kukkumiseks, millest ei pääse euroopa ega eesti!

-

aga kukkumisest on neil kes OEg-d 6 ostnud või AAPL-i 114 pealt ostavad muidugi raske aru saada!

-

ehk on LHV töötajatel võimalik välja tuua graafik tarbijausalduse indeksi võrdlus näiteks nasdaqi graafikuga? aastate lõikes?

minu teadmist mööda peaks tarbijausaldus olema kõrgel koos aktsiahindade tipuga, vastab see tõele??? -

Upser, viimase 16 aasta tarbijausaluse graafik näeb välja selline:

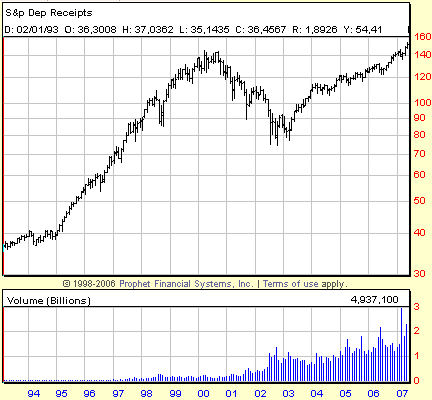

Ja sättisin alla SPY graafiku, kus aastad on enam-vähem kohakuti.

-

Huvitavad kommentaarid on kerkinud esile seoses Hiinaga. Bullishness on ikka suhteliselt suur ning bloomberg teatab, et mitmete analüütikute arvates potentsiaalne langus Hiinas on isoleeritud ning teisi aktsiaturge ei mõjuta. Lühikesed kommentaarid FT-st on päris huvitavad:

“The grand strategy is to gradually deflate the bubble but not to prick the bubble,” said Steven Sun, analyst at HSBC in Hong Kong.

Despite the sharp initial drop on Wednesday, most analysts do not expect the tax increase to have a significant impact on the market and predict that other measures will follow if retail investors continue to put new money into equities.

The likely measures include making it easier for Chinese investors and institutions to invest overseas, an increase in domestic initial public offerings and other share sales and the launch of an equity index futures contract. Some analysts also expect further increases in interest rates.

If the market still continues to rally, the authorities might consider imposing a capital gains tax on share trading, although officials fear this could prompt a collapse in share prices.

Tundub, et lisaks rahapoliitikale tehakse kõike, et emotsioone vaos hoida.

-

Kas mingi Hiina aktsiaindeksi futuure hakatakse kauplema? Millisel futuuribörsil? See oleks hea instrument Hiina aktsiaturgude krahhistsenaariumi mängimiseks.

-

Morgan Stanley raises their tgt on Apple (AAPL 114.35) to $150 from $110.

Coca-Cola (KO) upgraded to Buy from Hold at Citigroup

Merrill Lynch downgrades Glaxosmithkline (GSK 52.06) to Sell from Neutral

Citigroup initiates Steel Dynamics (STLD 46.30) with a Buy and a $58 tgt.

Mööblipoodide kett Williams Sonoma (WSM), langetab oma kasumiprognoose (jättes aasta siiski suhteliselt samale tasemele): Co lowers EPS guidance for Q2, to EPS of $0.14-0.18 from $0.16-0.20 vs. $0.18 consensus; sees Q2 revs of $855-873 mln vs. $861.51 mln consensus.

Sõnastus on siiski huvitav ning kinnitab taaskord kinnisvaraturu mõju jaemüügisektorile: "As we look forward to the balance of the year, we are remaining cautious in our guidance - particularly in the short-term. We continue to see higher inventory levels among our competition, and are concerned about the ongoing pressure of industry-wide markdowns and rising raw material costs. Both of these factors could lead to a further deterioration in the overall macro-environment and lower gross margins.

-

LHV Traderi vahendusel saab kaubelda Hong Kongi futuuridega, aktsiafutuuridest on Hiinaga seotud järgmised ettevõtted:

ALUMINUM CORP OF CHINA LIMITED

BANK OF CHINA LTD - H

BANK OF COMMUNICATIONS CO-H

CHINA CONSTRUCTION BANK

CHINA LIFE

CHINA PETROLEUM & CHEMICAL

CHINA TELECOM CORP LIMITED

HUANENG PWR INTL INC

PETROCHINA CO. LTD.

PING AN INSURANCE GROUP CO OF CHINA

-

Why We Should Worry About China

By Rev Shark

RealMoney.com Contributor

5/30/2007 8:08 AM EDT

Click here for more stories by Rev Shark

"Those that set in motion the forces of evil cannot always control them afterwards."

-- Charles W. Chesnutt

The indices are under some pressure this morning as Chinese stocks dived 6.5% following the increase in a "Trading Tax," which I discussed yesterday. Although the tax is quite small and mostly irrelevant in view of the level of gains that have been produced in the China market, it is significant because it indicates the Chinese government's intent to cool off stocks.

No one seriously questions the fact that China stocks -- particularly the Shanghai "A" shares -- are in a speculative bubble. The A shares are traded in a closed market and have performed far better than their counterparts on the Hong Kong exchange. The A shares are up a whopping 74% so far this year following a rise of 126% last year. The average PE is over 40 but the most worrisome aspect of the market is that new accounts are being opened at a staggering rate of 300,000 a day, and stories about average individuals sinking all their assets into the market and giving up jobs to play the market are appearing every day.

The problem for the Chinese government is to cool speculation without killing the market. They don't want stocks to go down; they just don't want them to go up at such a ridiculous pace. Unfortunately, it is nearly impossible to control markets in that manner. Once the beast is released there is no way to stop it. At times things will become excessive and eventually some folks are going to suffer some real pain.

It is obvious Chinese officials are trying to keep things from getting too hot so that when the inevitable correction comes the pain won't be quite as bad. One additional issue that complicates things is the widespread belief that China is anxious to paint a positive, progressive picture as host of the 2008 Summer Olympics. A stock market crash would be a very shameful event and many believe that will keep efforts to cool the stock market somewhat contained.

China is important to our market because it has helped keep worldwide speculation perking along. Who can say that our market is too expensive when you have China trading at much higher multiples?

This morning we have a pretty good-sized hiccup in China and that is causing weakness worldwide. We had a very similar breakdown back in early February that led to a week of weakness but that was soon shrugged off and we moved higher even faster than we had been before the correction.

You can bet there will be plenty of folks looking for another very short-lived correction but let's keep in mind that conditions are changing as we enter summer and the recent climb in the market shows some signs of stress.

We have a sharp dip indicated at the open. Overseas markets are down across the board with most of Europe trading down about 1%. Oil is stable after taking a big hit yesterday and gold is down slightly. -

Hiina turg lõpetaski päeva tugevas miinuses. Shanghai A indeks –6.5%, B indeks –9%. Üle poole aktsiatest sulgus maksimaalse lubatud languse ehk –10%ga. Negatiivsed sündmused Aasiast on ka Euroopat ja USAt raputamas, viimane alustab ca -0.6%lise langusega.

Täna kell 14.00 USA idaranniku aja järgi avaldatakse Föderaalreservi protokoll (FOMC Minutes).

Ülespoole avanevad:

Gapping up on strong earnings/guidance: CWTR +12.0%, DBRN +4.5%, PVH +3.0%... M&A: CDWC +3.5% (confirms it will be acquired by Madison Dearborn Partners for $87.75/share... Other news: OPWV +4.2% (Unstrung discusses ongoing rumors of higher bid in Openwave), BIIB +3.6% (announces $3 bln share repurchase through a modified "Dutch Auction" tender offer), TASR +2.5% (announces two orders).

Allapoole avanevad:

Gapping down on weak earnings/guidance: SOLF -20.5%, IBKR -5.5%, BGP -5.6%, JOYG -4.4%, FRO -3.0%... China-related stocks gapping down after 6.8% overnight sell-off in China: SNDA -5.1%, CAF -4.6%, KONG -4.4%, TSL -4.3%, XFML -4.0%, SOHU -3.9%, EFUT -3.8%, FFHL -3.7%, FMCN -3.6%, GCH -3.4%, SINA -2.2%, BIDU -1.7%, CTRP -1.3%... Chinese solar stocks under pressure on combination of weakness in China and in sympathy with SOLF earnings: JASO -5.9%, CSUN -5.0%, CSIQ -4.7%... Other news: IOMI -8.6% (continued pressure), TINY -6.0% (still checking), DEEP -3.6% (initiated with a Neutral at JP Morgan). -

Läksin QLD ga lühikeseks ja QID ruulib täna !

Kas langus on ka jätkusuutlik, selles on küsimus! -

Ehk on võimalik Londoni börsilt TALV kaubeldavate aktsiate hulka lisada?

-

Muideks, ajalooliselt on Hiina stamp tax olnud isegi 0.5% peal. Seega vajadusel saab seda maksu veelgi tõsta. Näiteks 1997. aastal tõstis valitsus stamp tax’i 0.3% pealt 0.5% peale, mille tagajärjel järgmise 4 kuuga Hiina aktsiaturg kukkus 30%. Sedapuhku on küll likviidsusolud pisut teistsugused...

-

Dol, rate.ee ka ruulib?

-

Tundub, et tarbijausaldus võib suhteliselt hästi näidata tipu ligidust, aga nii nagu '95-'00 on ka praegu võimalus siiski veel rohkem ülespoole liikumiseks. Vahepeale tuleb ikka mõni korrektsioon, aga, et -15 -20% on siiki vähetõenäoline.

-

Street

Mis see rate.ee on, seleta mulle vanale inimesele! -

NOVC laseb tõusust õhku välja, võimalus languse pealt teenida.....!

-

dol,

Kui mina noor olin, olid inimesed paremad ja lapsed olid korralikud. Kasitud suuga ja pahandust ka nii palju ei teinud.

Rate.ee ongi selle põhipõhjus, et noorsugu tänapäeval nii hukas on. -

Velikij

....hm. me peaks vist eakaaslased olema! -

Aga tüdrikud ruudulistes seelikutes olid hulka mõnnamad, kui tänapäeva hilpudes :)

-

jah mis seal salata.

-

Maailm on hukas ja selles on süüdi rate.ee