Börsipäev 6. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

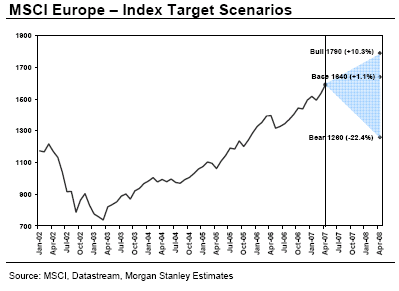

30. mail tõime välja LHV Pro all Morgan Stanley nägemuse aktsiaturgude osas ning märkisime, et MSi arvates on riski/tulu suhe 'lühemal ajahorisondil' turgudel päris kehva. Languse ulatus võib olla tunduvalt suurem kui tõusupotentsiaal. Nüüd saame sellekohast kinnitust veelgi. Lühidalt kajastasime MS arvamust järgmise kokkuvõtva pildiga:

The Telegraph raporteerib, et Morgan Stanley on soovitanud klientidel vähendada osakaalu Euroopa aktsiaturgudel peale kolme võtmeindikaatori "Full House" müügisignaali indikeerimist esmakordselt peale internetibuumi lõhkemist.

Teun Draaisma, USA investeerimispanga Euroopa aktsiastrateeg, ütles, et kolmekordne hoiatus on väga jõuline signaal ning see on endast märku andnud vaid viiel korral alates 1980. aastast. "Intressimäärad tõusevad ning on jõudnud kriitilistele tasemetele. See loeb rohkem kui ettevõtete kasv, mistõttu me arvame, et mid-cycle ralli on läbi. Meie mudel prognoosib 14-protsendilist korrektsiooni järgneva kuue kuu jooksul, kuid asi võib olla veelgi tõsisem," ütles Draaisma.

Strateegi mainis, et MSCI indeks, mis koosneb 600-st Euroopa ja Briti aktsiast on kukkunud keskmiselt 15.2% peale "Full House" signaalisaamist järgneva kuue kuu jooksul (25.2% peale 1987. aasta septembrit ja 26.2% peale 2002. aasta aprilli).

Täpsemalt signaalidest: The first of the three signals Morgan Stanley monitors is a "composite valuation indicator" that divides the P/E ratio on stocks by bond yields. It measures "median" share prices that capture the froth of the merger boom, rather than relying on a handful of big cos on the major indexes. "If you look at all shares, the P/E ratio is at an all-time high of 20," he said. The other two gauges measure fundamentals such as growth and inflation, as well as risk appetite. Morgan Stanley is not predicting a recession, believing bond yields will fall during a correction and act as an "automatic stabilizer" for the world economy. Once the mkt shakes off the latest excesses, it's back to the races.

Euroopa aktsiaturud on käitunud ka intressimäärade tõstmise hirmus ka tulevikus ning eile välja toodud $DAX indeks on kukkunud ca 1.6%.

Barrons raporteerib, et kuulus SAC Capital on suurendanud oma osalust noortele suunatud riiete müügiketis Hott Topic (HOTT). SACraporteeris 5.1-protsendilisest osalusest ehk 2.3 miljonist aktsiast, mis on tunduvalt kõrgem kui esimeses kvartalis raporteeritud 245000 aktsiat.

SAC, mida juhib miljardär Steve Cohen, on asunud aktsiaid ostma peale 22.5-protsendilist kukkumist aastaga. Kuigi HOTT on näidanudkaks aastat negatiivset võrreldavate poodide müügitrendi, suutis firma täita viimasel kvartalil prognoose. Teiselt kvartalilt oodatakse kahjumitaktsia kohta 2-4 senti. Kuigi SACi huvi põhjuseid on keeruline hinnata (firma ise keeldub prognoosimast), usub InsiderScore.comi Ben Silverman, et peale suurt langust on aktsia SACi arvates alahinnatud.

Huvitav on ka asjaolu, et SAC omab osalust päris mitmetes teismelistele suunatud jaemüüjates, kuid on nüüd oma positsioone ümber mängimas.Vähendatud on osalust Pacific Sunwear (PSUN), Tween Brandsis (TWB) ja Urban Outfitters (URBN) ning suurendatud lisaks HOTTile American Eagle Outfittersis (AEOS) ja Charlotte Russe Holdingsis (CHIC).

-

ECB tõstis intressimäärasid 4% peale. Tõstmine igati oodatud ning hetkel euro dollari ja jeeni vastu kauplemas päeva põhjade juures.

-

Stifel tõstab oma söehindade prognoose ning lisaks ka mõningaid hinnasihte ettevõtetel:

Stifel is raising their coal price forecasts and adjusting their expectations for U.S. coal miners' earnings outlooks to reflect those higher prices and as well as recent trends in shipped volumes. The firm says their new earnings ests are 8% below consensus for 2007 and 6% below the Street for 2008. The firm also raises their tgt on CONSOL Energy (CNX) $58 from $52, and on Peabody Energy (BTU) to $64 from $55. The firm says for Peabody, their EPS ests remain below consensus for 2Q07 and for the full years 2007 and 2008, but they continue to view Peabody and CONSOL as the best-positioned U.S. coal producers through the end of the decade, and continue to recommend new investment in these two firms. For the remaining U.S. coal mining equities, they maintain their Hold ratings despite the improving outlook for earnings in 2008-2009, as they believe the recent rally in coal mining shares has already discounted much of the good earnings news.

-

Bonds Could Turn Tide Against Bulls

By Rev Shark

RealMoney.com Contributor

6/6/2007 8:01 AM EDT

Click here for more stories by Rev Shark

Change begets change. Nothing propagates so fast.

-- Charles Dickens

Trying to time major market turns is an impossible task. The market is inundated with those who attempt to do so and virtually no one does it with any precision. Despite the very poor record of prognosticators, they keep on trying because if they do get it right it can pay off quite nicely.

Luckily for most small investors, it isn't necessary to play the prediction game. They are small and nimble enough to adjust after things begin to shift and can easily contain damage without being overly anticipatory. The key to success isn't to predict a market shift in advance but to recognize when there is a real shift taking place that merits aggressive action.

Over the past few days a rise in interest rates has started to catch the attention of market players. Bonds are starting to break down, and rates are moving over key resistance levels. Because so much of the recent market move has been a product of "cheap" money chasing deals, this obviously can have tremendous repercussions. So far, the rise in rates in minor enough that it isn't going to have that big of an impact, but that can change very quickly.

Higher rates also are an increased expense for businesses and they also make equities less attractive compared to bonds that offer high yields.

The bottom line is that if interest rates are beginning to rise and, more importantly, the market is focused on that change, then we have the makings of something that could turn the tide of this market. It is still too early to jump to that conclusion, but it isn't too early to start watching more carefully for signs that interest rates are starting to matter.

Keep in mind that once change begins to take hold, it begets more change. The little things that didn't matter and were shrugged off in a strong market suddenly become negatives of some magnitude when the market mood shifts.

We have a weak open this morning as an interest rate hike of a quarter-point by the European Central Bank is the focus. That certainly raises the possibility of increasing rates in the U.S. as well.

Let's see if this develops into something more. Time and again the market has battled back from these issues, but the bulls have been looking just a tad less energetic recently.

-----------------------------

Ülespoole avanevad:

Gapping up on strong earnings/guidance: GES +5.1%... Jana Partners and SAC Capital seek sale of AMTD, suggest SCHW and ETFC as merger partners: AMTD +5.3%, ETFC +3.1%, SCHW +1.3%... Other news: IVAN +17.9% (co 'successfully' demonstrates final key commercial configuration of heavy oil upgrading technology), TBUS +11.1% (announces orders for TwinVision color electronic destination sign systems), ACAD +10.2% (positive Cramer mention), TAL +5.9% (exploring strategic alternatives, including possible sale), GNVC +3.0% (co holding conference call at 8:30 E.T. to review data presented at ASCO), RACK +1.9% (still checking around), OPWV +1.7% (Unstrung reports there is still talk that Sybase could be waiting in the wings with an offer).

Allapoole avanevad:

Gapping down on weak earnings/guidance: PNRA -9.8% (reports May same store sales, lowers Q2 guidance), COO -7.3%, CPRT -3.7%... Other news: XTLB -26.2% (provides update on Phase 1 clinical trial of XTL-2125), HSOA -6.3% (continued pressure after yesterday's ~10% sell-off following cautious newsletter mention), FRO -3.3% (trading ex-dividend of a $1.50 cash dividend), AAUK -2.4%, GFI -2.2% (announced total attributable mineral resources of $251.7 mln oz and ore reserves of 93.8 mln oz). -

Energia raporti avaldamise järel vajus ka see sektor punasesse. Nii mootorkütuste kui distillaatide varud suurenesid oodatust oluliselt rohkem. Rafineerijad(SUN, VLO, TSO), kes on madalate mootorkütuse varude tõttu viimase aja 'hitt-kaup' olnud, kaotasid kohe pärast raporti avaldamist oma väärtusest enam kui punkti

-

mulle meeldis see, et päev ei lõpetanud põhjas:), ehk mina tugevalt karune, ja homseks on aasia tugevalt miinuses, euroopa ka ja usa alusatb miinusest, ehk tuleb põrge ja reedel enam ei juleta kätte midagi jätta, ehk miinus suur!

-

Siiski-siiski... Hiinlased ei lase ennast segada Euroopa ja USA turgude eilsest miinusest. Shanghai protsendi jagu plussis, kuigi ülejäänud Aasia miinuses.

-

Mis te muretsete, Shanghai teeb paari nädala jooksul uued tipud. Shanghai korrektsioonid on kõik sarnast rada pidi käinud.

Iga päev lisandub Hiinas ligi pool miljonit uut investeerimiskontot, kütust jätkub raketil.