Börsipäev 8. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

10-aastaste võlakirjade yield’id on jõudnud kõrgeimatele tasemetele alates 2002. aasta maist. Põhjuseks arvamus, et majanduskasv ja inflatsioon ei jäta keskpankadele muud valikut kui intressimäärasid tõsta. Eilne võlakirjade müügilaine oli viimase 3 aasta suurim. 10-aastase võlakirja tulusus tõusis USAs hommikul korra isegi 5.25%ni. Üpriski atraktiivne määr juba.

Bloombergi andmetel hinnatakse nüüd 44%-lise tõenäosusega, et Fed on sunnitud detsembris intressimäärasid 0.25% võrra kergitama. Veel kuu aega tagasi hinnati selle tõenäosuseks 0%. Samas, arvestades kinnisvaraturu seisu, võib nende määrade kergitamine valusaks kujuneda.

Saksamaa DAX – 0.56%

Prantsusmaa CAC –0.21%

Londoni FTSE –0.46%.

Aasia eilse USA turu kukkumise järel korralikult punane.

Jaapani Nikkei 225 –1.52%

Hong Kongi Hang Seng –1.4%

India Sensex –0.86%

Hiina see-eest taas plussis. -

Shark mõtiskleb, et kas veebruari languse ja praeguse kiire kukkumise vahel saab paralleele tõmmata või mitte ning juhib tähelepanu, et kui veebruaris sai langus alguse pelgalt Hiina aktsiaturgude kukkumisest, siis nüüd on põhjus fundamentaalsemat laadi - globaalselt tõusvad intressimäärad. Ise pooldab ta suuremat sularaha osakaalu portfellis.

Use Cash in a Shifting Market

By Rev Shark

RealMoney.com Contributor

6/8/2007 8:24 AM EDT

Click here for more stories by Rev Shark

The entrepreneur always searches for change, responds to it, and exploits it as an opportunity.

-- Peter Drucker

The market rally that began last August finally looks like it is in danger of coming to an end. The culprit is higher interest rates. Higher rates act as a tax on business by increasing the cost of capital, and they also suppress valuations by lowering the present value of the stream of future earnings.

Interest rates are always an issue for the market, but they are of particular importance right now because much of what has been driving the market has been private-equity deals and acquisitions. Those deals are made possible because investors have been able to borrow huge amounts of capital at very favorable rates. As interest rates rise, it becomes much harder to find good deals

That's what the current selloff is all about, but what do we do about it? The good thing about this sort of market shift is that it eventually creates a new crop of opportunities. Frankly, I'm pleased to see this sort of shake-up because I was finding it tremendously difficult to do anything meaningful in a market that was so technically extended. It was obvious that the move was unsustainable, but there was no way to know how long it could continue. Hence I was very underinvested and using a short-term time frame.

So now we finally have the shakeout, and we have to devise a game plan to take advantage.

The first thing to consider is whether we really are undergoing a change in market character. We had a similar, dramatic dip back at the end of February that not only was shrugged off but led to an even more dramatic rally. Many market players are hopeful that we will see that happen again. It is possible, but the issue driving the correction at this point -- interest rates -- is a more fundamental one with wider-reaching tentacles than Asian equity prices, which caused the early selloff.

Assuming the market is going to shrug this off and go straight back up is not the smart bet. You need to take some defensive action just in case the market really is undergoing a character change. That may be wrong in the end, but it is far more important that you protect your capital in case this really is a market shift.

If you have some cash, you have flexibility to take advantage of opportunities that will arise. Even if you think the market is shifting into a downtrend, there are going to be some bounces along the way that will allow you to profit by making some buys.

Additionally, many good stocks have become extended over the last few months and will start to offer up favorable entry points as the market corrects. The key is to not be impatient and rush in too quickly. Identify the stocks you like, take a minor position and then follow them as the chart plays out and sets up.

The biggest mistake that most investors make when trying to buy weakness is that they do it too aggressively. They buy too early and too big and then when the stocks continue to languish, emotions kick in and they bail out for a loss. Moving small and slow gives you staying power in a difficult market environment.

The key right now is to make sure you have the flexibility of cash. Look to dump your most marginal positions, even if it means taking a loss. That cash will eventually be much more valuable if the market continues its struggles and better opportunities arise.

I do not believe that the market is going to roll over and die, but I do believe it is going to be much more choppy and random for a while. The bulls are going to try to regain the upside momentum, but I don't think they will be able to succeed like they did after the last market dip. That means more-active trading is FINALLY! going to be a more rewarding approach than it had been when stocks were going straight up.

We have a weak start this morning, but nothing too dramatic. Overseas markets were down across the board and market players are quite skittish. Oil and gold are trading down sharply. -

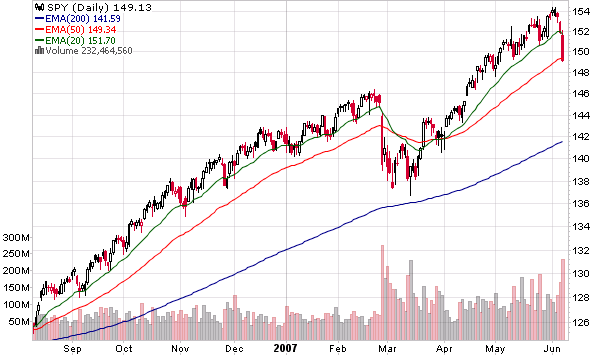

Toon täna välja SPY (SPDR S&P500) graafiku. Kui viimasel 10-l kuul on turg alati tuge leidnud 20-päeva eksponentsiaalselt keskmiselt, siis eile kolistati sellest tugevasti läbi ja sulguti 50-päeva eksp-keskmisel. Viimase aasta jooksul on 20-päeva keskmisest läbi kukutud niimoodi üksnes veebruarilõpu languse ajal.

-

USA turg alustab oma kauplemist täna +0.1%lise plussiga

Ülespoole avanevad:

Gapping up on strong earnings/guidance: NSM +9.2% (MXIM +3.4% in sympathy), CAE +5.8%, ZQK +2.6%.. ITC bans the import of future models of 3G handsets incorporating QCOM chipsets: TXN +2.0% (also in sympathy with NSM), QCOM +1.9%, BRCM +1.8%... Other news: AVNR +7.5 (announces both doses of Zenvia meet primary endpoint), KMGB +4.6%, EON +2.3% (added to tier-1 firm's buy list), AKAM +1.8% (competitor Limelight IPO opens for trading today, also AKAM upgraded to at WR Hambrecht), DNA +1.5% (upgraded to Buy at Deutsche Bank).

Allapoole avanevad:

Gapping down on news: HSOA -8.8% (cautious Street.com article), TLAB -3.4% (downgraded at two firms this morning), NT -3.0% (initiated with a Underperform at Credit Suisse), AU -1.9% (announces preliminary May 2007 revenue), AZN -1.8% (Bloomberg.com report AZN's Brennan seeks New Drugs in acquisitions).