Börsipäev 19. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Nagu eilses börsipäevas mainisin, tasub jälgida, mida on öelda Washington Mutualil (WM) oma konverentsikõnes subprime olukorra kohta. Turule ei ole see enam ilmselt saladuseks, kuid et hoida asjadel silm peal, siis kindlasti on kasulik sündmuseid jälgida.

WM ütles, et on vähendamas oma subprime osakaalu ning esimeses kvartalis oli antud segmendi osakaal 30% võrreldes aastataguse 70% tasemega. Ettevõtte sõnul on nad tunnetamas majadehindade dramaatilise hinnatõusu aeglustumise efekti ning prognoosivad edaspidiseks jätkuvalt nõrka keskkonda, mis omakorda tõstab krediidimaksumust. Ettevõte on lisaks subprime osakaalu vähendamisele ka kitsendamas kvalifikatsioonistandardeid.

Co is taking specific steps regarding sub-prime loans: co will no longer offer "no doc" sub-prime loans, candidates will be required to provide full documentation. Also, co will not offer sub-prime loans with an initial term below 5 yrs. Also, co will now require tax escrow accounts.

Eile teatas WSJ lisaks järgmise uudise, mis räägib samuti laenustandardite kitsendamisest:

Countrywide Financial (CFC), Option One Mortgage and Merrill Lynch's (MER) First Franklin Financial unit told employees and mortgage brokers this week that they would no longer offer so-called 2/28 subprime loans, ones that carry a relatively low fixed rate for the first two years and then jump to a much higher, floating rate, often more than 10%.

Eile tuli tulemustega ka IBM, pakkudes käibe osas päris kena üllatuse, samas oli ettevõtte maksumäär kvartalis madalam kui tavaliselt, mis pakkus kasumi osas lisa. IBMi puhul ootused kindlasti madalad ei olnud, kuid aktsia kauples järelturul natuke üle 3% plussis - suurem osa kasvust oli orgaaniline.

Reports Q2 (Jun) earnings of $1.50 per share, excluding $0.05 gain, $0.03 better than the Reuters Estimates consensus of $1.47; revenues rose 8.6% year/year to $23.77 bln vs the $23.06 bln consensus. Co reports software revs $4.78 bln, up 12.7%.

-

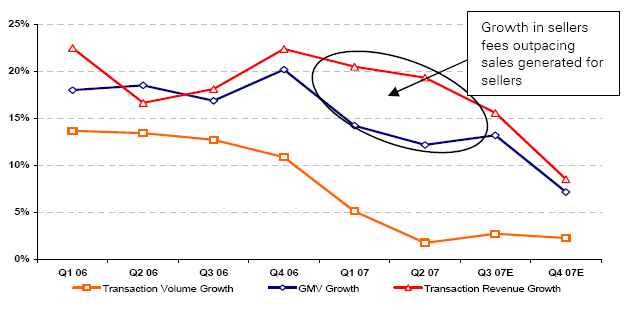

Kui tulemuste eelvaates kirjutasin mitmetest probleemidest seoses eBayga ning peale tulemusi, et kokkuvõttes taandub ettevõtte käekäik GMV kasvule, siis hea on vaadata, et mõni analüüsimaja neile probleemidele ka tähelepanu pöörab.

Deutsche Bank on andnud eBayle “hoia” reitingu peale tulemusi, mis lõid nende ootusi, kuid peamiselt seetõttu, et valuuatefekt pakkus positiivset üllatust ning maksumäär oli madalam. Analüüsimaja arvab, et eBay peab tõstma tehingutemahtusid ja core listingut ning lisaks stabiliseerima äri USA-s ja Saksamaal. DB usub, et eBay jääb kauplema $30 tasemete lähedale.

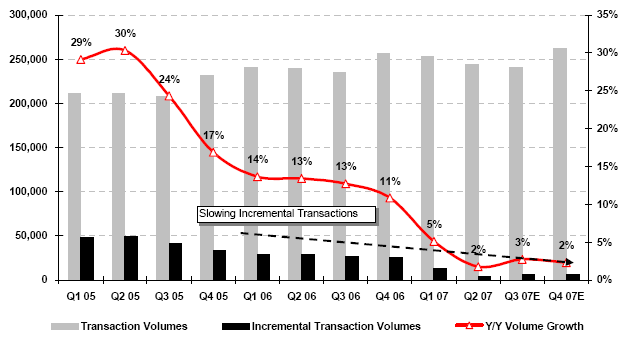

Peamiste probleemidena tuuakse välja 2Q põhjal ostutiheduse langus (keskmine klient ostab 4-5% vähem tooteid aastas) ja tehingukäibed, mis on 2% kõrgemad y/y, võivad hakata aasta lõpus langema, surudes nii firma kuludestruktuuri. Kui DB-l on õigus prognooside osas, on eBay madalam valuatsioon võrreldes teiste internetifirmadega ehk põhjendatud, sest järgmised pildid (by DB)just kõige ilusamad ei paista.

-

Täna hommikustest tulemustest pisike ülevaade. Soovitan taaskord visata peale pilk ka meie tulemustetabelile, mida pidevalt uuendame.

Motorola (MOT): Reports Q2 (Jun) earnings of $0.02 per share, excluding non-recurring items, $0.02 better than the Reuters Estimates consensus of ($0.00); revenues fell 19.3% year/year to $8.73 bln vs the $8.64 bln consensus. MOT shipped 35.5 million handsets - in-line with guidance. Co sees Q3 EPS flat to slightly up from Q2 EPS of $0.02, consensus $0.05. While the company does not expect the Mobile Devices business to be profitable for the full year, it does expect its financial results to improve in the second half of the year.

Hershey Foods (HSY): Reports Q2 (Jun) earnings of $0.35 per share, excluding non-recurring items, in line with the Reuters Estimates consensus of $0.35; revenues were unchanged from the year-ago period at $1.05 bln. Co issues downside guidance for FY07, sees EPS of $2.25, ex-items, vs. $2.46 consensus. "For the second half, we expect sequential improvement in organic net sales that will result in full year 2007 growth in the low-single digit range. Higher dairy costs will continue to pressure margins for the balance of the year, and combined with our commitment to brand investment, will result in a mid-single digit decline in earnings per share-diluted from operations for 2007. We are taking the appropriate steps to ensure that Hershey enters 2008 with a strong foundation both in the U.S. and within key global markets that represent attractive long-term potential"

Wesco (WCC) Reports Q2 (Jun) earnings of $1.17 per share, $0.10 worse than the Reuters Estimates consensus of $1.27; revenues rose 13.6% year/year to $1.52 bln vs the $1.57 bln consensus. "End market activity was slower than expected during the quarter resulting in core sales being essentially equal to last year's second quarter. The shortfall in core sales growth resulted primarily from an unanticipated decline in utility expenditures for distribution materials and, as experienced in the first quarter of 2007, lower commercial construction activity. Our business model is sound and we believe market conditions will be favorable in the second half of 2007."

Bank of America (BAC) Reports Q2 (Jun) earnings of $1.28 per share, $0.08 better than the Reuters Estimates consensus of $1.20; revenues rose 7.8% year/year to $20 bln vs the $18.49 bln consensus.

-

Emotion Drives the Market During Earnings

By Rev Shark

RealMoney.com Contributor

7/19/2007 7:22 AM EDT

Let's not forget that the little emotions are the great captains of our lives and we obey them without realizing it.

-- Vincent Van Gogh

What can make trading during earnings season so tricky is that while we focus on numbers, it is emotions that will ultimately determine our faith. The numbers themselves are not inherently good or bad. What will determine their impact are the expectations and emotions of market players.

The early stages of earnings season seemed to indicate that investors are setting a high bar for success. The major reports in the first few days of reporting season have all been subject to selling. Intel (INTC) , Yahoo! (YHOO) , Coca-Cola (KO) , Johnson & Johnson (JNJ) and Merrill Lynch (MER) were all weak following their numbers even though the reports weren't bad at all.

This morning we have three more solid reports to consider, IBM (IBM) , Juniper (JNPR) and eBay (EBAY) . eBay sold off immediately last night and is flat this morning, but IBM and Juniper are trading up nicely. It is going to be extremely instructive to see whether those stocks can hold their gains over the next couple of days.

The problem for a stock like IBM is that even though the numbers are good, the stock has traded straight up since the beginning of March, and we have to wonder to what degree the good news was expected. The fact that analyst estimates were exceeded would seem to indicate that expectations were too low, but it is a mistake to think that analysts reflect the thinking of the broader market. Exceeding estimates is no guarantee that a stock is undervalued and will continue to trade higher. What will determine that are the emotions that are in play.

We still have hundreds of reports to come, and we can't be too fast to jump to the conclusion that a certain theme is in place. The mood can shift quickly, and as we seen for a long time now, we're in an uptrend that is not ending easily. Despite the chorus of negative argument from the bears, this market has stayed strong and is showing few, if any, signs of breaking down or even pausing. Earnings season always holds the capacity to change that, though, and we have to contemplate the reaction to reports and stay very vigilant.

The market is set to open strong following the late rebound yesterday and good earnings reports last night. Europe was up strongly overnight as some good earnings report over there helped matters.

We have reports tonight from Google (GOOG) and Microsoft (MSFT) that are sure to have a market impact. Google is up big since mid-May and expectations are very high there. Microsoft always manages expectations well and is unlikely to disappoint, even though Vista is an absolutely terrible product, in my opinion. After wasting plenty of time and money dealing with Vista, I'm actually rooting for Microsoft to suffer a bit for foisting that poor excuse for an "improvement" on the public before it was ready.

So the market is at an important crossroads as earnings season continues. The bulls have momentum at their backs, but the bears have high expectations and some extended prices. We simply need to keep a very watchful eye on how a good earnings report like those from Intel and IBM are treated.

I am going to be out the remainder of today and most of tomorrow to deal with some personal business. So good luck, and go get 'em.

--------------------------------

Ülespoole avanevad:

Gapping up on strong earnings/guidance: AVCI +24.1%, CBST +12.9%, CTXS +10.3%, SYNL +10.0%, KLIC +9.3%, JNPR +8.2%, SAP +6.5% (BOBJ +3.9% in sympathy), MOGN +6.0% (SUPG +5.0% in sympathy), SWKS +5.5%... M&A: WLSC +19.9% (to be acquired by parent co of Algeco for $2.2 bln or $28.25/share in cash), PRTR +20.5% (to be acquired by M&T Bank; transaction valued at approximately $555 mln)... Other news: CLWR +12.8% (co and SprintNextel to accelerate and expand the deployment of a mobile broadband network using WiMAX), BWTR +11.5% (continued momentum following yesterday's 12%+ move higher), FL +8.1% (NY Post reports FL is once again considering putting itself up for sale), LOCM +4.1% (announces acquisition of PremierGuide).

Allapoole avanevad:

Gapping down on weak earnings/guidance: SMIT -25%, NVEC -8.9%, VMC -5.5%, SPWR -3.5%, UNH -3.4%, NUE -2.9%, HSY -2.8%, ISIL -2.5%, LOGI -1.8%, EBAY -0.8%... Other news: PEIX -4.6% (announces the resignation of CFO Douglas Jefferies), LMRA -8.1% (announces shelf registration of $50 mln mixed securities offering), M -3.1% (WWD reports Kohlberg Kravis & Roberts wants to close on a deal for Macy's, but turmoil in the debt financing mkts might get in the way). -

Nüüd ka minupoolne järelvaade Nucori(NUE) tulemustele antud ning seega kõigil eile eelvaates väljatoodud neljal ettevõttel kommentaarid all. Loe neid siit.

-

Kui Blackstone (BX) hind annab indikatsiooni private equity ülevõttude tulemuslikkuse kohta, siis on asi huvitav. Aktsia on langenud taaskord uutele põhjadele...

-

Erko tänase lüürilise pealkirjaga avaloo saab väga hästi siduda 17. juuli börsipäevas kommenteeritud Universal Forest Productsi (UFPI) situatsiooniga, kus ettevõtte juht andis oma nägemuse edasi remonditurust.

-

Tänase broker/dealerite languse üheks põhjuseks on kuuldavasti Goldman Sachsi (GS) mortgage-backed toodete reitingualandamised. It ain't over till its over..

-

Väljavõtted Föderaalreservi protokollist:

FOMC anticipated core inflation to be 'relatively subdued'

Fed says housing sector biggest downside growth risk, likely to remain drag on growth for some time

Fed says rising mortgage delinquencies, subprime problems could crimp credit availability, housing demand

Fed minutes say that downside risks to growth "more balanced" than at time of May FOMC meeting

FOMC judged risk of prices not easing was 'predominant' worry, FOMC saw some risk of 'deterioration' in price expectations

FOMC agreed sustained price 'moderation' not yet convincing

Fed says housing activity likely to contract for several quarters, new home inventories "quite elevated"

Fed says participants judged labor market remained "rather tight", especially for skilled workers

Fed says inflation pressures may be sustained by resource use, energy and commodity prices, dollar drop

FOMC saw housing as 'key source of uncertainty'

FED says participants saw sustained moderation in core inflation not yet "convincingly demonstrated" -

Google jääb ootustele kasumi osas alla - aktsia järelturul üle 4% miinuses.

GOOG prelim $3.56 vs $3.59 Reuters consensus; revs $3.87 bln vs $3.87 bln Reuters consensus

GOOG prelim revs ex traffic acquisition cost revenue $2.72 bln vs $2.68 bln First Call consensus -

Masendav, kuidas turg selle peale reageerib. Shordiks kõiki neid aktsiaid, mis homme tulemused avaldavad... tõenäosus selle pealt teenida on suurem, sest viimased päevad näitavad, et turg müüb ka oodatavate tulemuste puhul hinna alla.

-

jyriado, ma ei näe, et siin midagi väga masendavat oleks. Investorid istuvad korralike kasumite otsas ning ootused on arvestades turu tõusu ikka suhteliselt kõrged. Nagu ka Google eelvaates kirjutasin, on väga palju juba hinnas sees ning väikseimgi negatiivsem kommentaar võib põhjustada müügi..

-

Seda ma mõtlengi, et masendavad ootused on kõigil, nagu ootaksid kõik mingit suurt imet. Väike silmapööritus..:)

-

Jõudsin ka tänase börsipäeva järgse tulemuste tabeli uuendamisega lõpule. Kuigi esimeses tulbas raporteeriva EPSi näitajaga on näha väga palju ootusi ületavat rohelist värvi, siis viimases tulemustele järgnevas aktsia liikumise tulbas on olulises ülekaalus see-eest aktsia hinna langemist näitav punane värv. 'Sell the news' efekt väga paljudes aktsiates.