Börsipäev 7. september

Log in or create an account to leave a comment

-

Täna jälgitakse põksuvate südametega kohe kindlasti tööjõuturu raportit - kui juulikuus lisati mittepõllumajandussektoris 92 tuhat uut töökohta, siis augusti konsensus Bloombergi andmeil on hetkel 100 000 peal. Ega turg ise ka väga ei tea, mis numbrit ta ootab, sest liiga tugev tööjõuturg ei laseks Fedil intresse kärpida ning jälle ülemäära nõrgad numbrid suurendavad majanduslanguse stsenaariumi realiseerumise tõenäosust ning turult kostuks kommentaare, et Fed on oma liigutamistega juba hiljaks jäänud.

Seega 'lliga head' raportit tõlgendataks negatiivses valguses ning ilmselt aktsiaturgudele parim stsenaarium oleks siis, kui kell 15.30 Eesti aja järgi avaldatavas raportis liidetud töökohtade arv hälbiks oodatust minimaalselt. -

Harley-Davidson(HOG) on vähendanud oma 2007. aasta kasumiprognoosi ning loobus 2008. aasta prognooside andmisest. Kui konsensusootus EPSi osas oli veel $4.12, siis täna avaldatud uus prognoosivahemik $3.69-$3.77 jääb sellele tugevalt alla ning viitab 2006. aastaga võrreldes EPSi 4%-6%list allajäämist. Järk-järgult on ikkagi kõigest hoolimata turule tulemas üha uusi märke tarbimisvõime vähenemisest.

-

Panen siia Briefing'ust ka väikese kokkuvõtte eilsest Alan Greenspani kõnest Washington D.C.-s, kus ta võrdles täna toimuvat 1987. ja 1998. aasta kriisidega.

The Wall Street Journal reports former Federal Reserve Chairman Alan Greenspan said the current market turmoil is in many ways "identical" to that which occurred in 1987 and 1998, when Long-Term Capital Management nearly collapsed. "The behavior in what we are observing in the last seven weeks is identical in many respects to what we saw in 1998, what we saw in the stock-market crash of 1987, I suspect what we saw in the land-boom collapse of 1837 and certainly [the bank panic of] 1907," Mr. Greenspan told a group of academic economists in Washington, D.C., last night at an event organized by the Brookings Papers on Economic Activity. Mr. Greenspan said business expansions are driven by euphoria and contractions by fear. While economists tend to think the same factors drive expansions and contractions, "the expansion phase of the economy is quite different, and fear as a driver, which is going on today, is far more potent than euphoria." The euphoria in human nature takes over when the economy is expanding for several years, and leads to bubbles, "and these bubbles cannot be defused until the fever breaks," he said.

-

Bank of America on Bear Sternsi downgrade'imas, langetades soovituse 'osta' pealt 'neutraalse' peale ning nihutab koos sellega ka oma hinnasihti $163 pealt $126ni.

-

Uute töökohtade arv augustikuus USAs vähenes. Valus löök pullidele ning futuurid liiguvad ka nobedalt allapoole(hoolimata sellest, et nüüd on intressimäära kärpimise tõenäosus väga oluliselt suurenenud):

:

Unemployment Rate 4.6% vs 4.6% consensus

Nonfarm Payroll -4K vs 100K consensus, prior 92K

Average Weekly Hours 33.8 vs 33.8 consensus

Average Hourly Earnings m/m +0.3vs +0.3% consensus

Töökohtade arv pole kordagi vähenenud alates 2003. aasta augustist! -

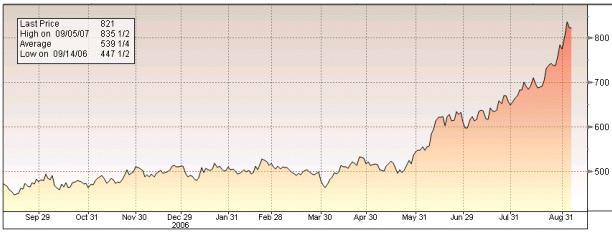

Olen üle hulga aja taas nisu graafiku üles otsinud, mis on viimasel ajal taas tippe teinud, kui tuli teateid, et Austraalia lõunaosariikide ekspordimahud on oodatust väiksemad, mistõttu mitmed riigid (nt Egiptus) on hakanud oma teravilja varusid suurendama hirmus, et mitte mingil juhul neist ilma ei jäädaks. Hiljuti avaldati ka Bloombergis üks vastavasisuline artikkel.

-

Don't Assume That Bad News Is Good News

By Rev Shark

RealMoney.com Contributor

9/7/2007 9:06 AM EDT

Many bulls got what they wanted, a weak jobs report, which is pushing up chances of more aggressive Fed interest rate cuts. The big question is whether this is a case of "be careful of what you ask for, you might get it."

There is no question that this report is weak, but we have to wonder if this is an indication of worse to come and whether a Fed interest rate cut is really sufficiently positive enough to offset a slowing economy.

The market has been so intently focused on the positive aspects of a rate cut that it has almost totally dismissed the fact that negative economic news does carry some real ramifications. The problems don't just magically disappear just because the Fed cuts rates.

Don't be too quick to assume that bad news is good news just because the Fed will act. Bad news of this type has a tendency to lead to more bad news, and the Fed will have its hands full in trying to deal with it.

-----------------------------

Ülespoole avanevad:

Gapping up on strong earnings/guidance: SWHC +6.0%, HOV +5.1%... Gold stocks seeing strength with gold futures at 4-month highs following weak employment data: GOLD +3.9%, HMY +3.5%, AU +3.5%, CDE +2.5%, GSS +2.3%... Other news: HEPH +18.3% (says preclinical data showlasting anti-tumor effect of Novel drug candidate), NTO +10.7% & AUY +3.1% (MDG also announced that third parties do not intend to make proposals to MDG -- AUY & NTO had previously made an offer), POZN +9.3% (POZN/AZN announce start of the PN 400 Phase IIIprogram).

Allapoole avanevad:

Gapping down on weak earnings/guidance: AMWSA -12.5% , HOG -7.1%, KKD -4.4%, NSM -4.1%... Other news: BZH -8.1% (receives purported notices of default related to its Senior notes), WYE -4.3% (Citigroup downgraded to Hold), LMC -4% (still checking), BCS -3.4% (Times of London reports the co is offering to underwrite the $1 bln rescue of another highly geared fund), MDG -3.3% (co says third parties do not intend to make proposals relating to an acquisition of MDG). -

Graafik sellest, kuidas futuurid pärast tööjõuraporti teatamist kukkuma hakkasid:

-

IMF to cut global growth forecast - CNBC

-

Goldman Sachs says expects 50 bps rate cut from fed at Sept 18 meeting after weak jobs report

spekulatsioonid 50 bp kärpele algasid kohe peale payrolls numbreid, nüüd siis hakatakse ka välja ütlema -

Juhul kui 'ootame' ='diskonteerime suure tõenäosusega sisse', siis reaalse liigutamise hetkel võib reaktsioon olla suhteliselt loid. Hetkel on muidugi neid oma ootuste väljaütlejaid veel vähe...

-

Hetkel on vähe, aga tuleb juurde :)

Bear Stearns expects Fed to cut rates to 5% on Sept 18, revises Fed funds forecast to Sept cut -

Vahepeal oli IMB halditud, nüüd on kauplemine aktsiaga jätkumas. Kalifornias asuva ettevõtte palgalehel on üle 8600 töötaja ning tegeletakse kinnisvaralaenudega - ja piirkonnas, kus kinnisvara olukord on olnud kõige hullem.

In our second quarter earnings release, we said that the second half of 2007 and 2008 would continue to be challenging for the mortgage and housing markets and for Indymac. In fact, the mortgage and housing markets are very difficult, and the private secondary markets have significantly worsened. The illiquidity in the secondary markets, and consequent significant and abrupt spread widening for all mortgage products except those saleable to the GSEs, have negatively impacted the profitability of our mortgage production division. As a result, we currently expect that Indymac will report earnings for the third quarter in a range of breakeven to a loss of $0.50 per share, (Q3 consensus is $0.45) driven mainly by the spread widening and a continued high level of credit costs. It should be noted that the impacts of spread widening and increased credit costs have been recorded almost exclusively as unrealized fair value adjustments as opposed to actual losses realized on the disposition of assets.

Lisaks kasumiprognooside vähendamisele tehakse ettepanek ka dividende 50% võrra kärpida. -

Kui Henno tegi algust erinevate analüüsimajade intressimäära langetamise ootustega, siis jätkan seda:

Barclay's expects three quarter point Fed cuts this year -

Üks tabel RealMoney'st intressimäära langetamise tõenäosuste kohta vastavalt fed funds future'itele:

FOMC Meeting, Period Rate cut odds September 18th 100% for 25 basis point cut; 40% for a 50 basis point cut* October 31st 100% for 50 basis points in cumulative cuts; 60% for 75 basis points in cumulative cuts* End of year 100% for 75 basis points in cumulative cuts (4.50% funds rate); 36% for 100 basis points in cuts End of Q1 2008 100% for 100 basis points in cumulative cuts; 50% for 125 basis points in cuts (4.00% funds rate)