Börsipäev 24. september

Kommentaari jätmiseks loo konto või logi sisse

-

Harman (HAR), mis oli siiani kindel ülevõtukandidaat KKRi ja GS Capital Partnersi poolt $120 eest aktsia kohta, tegi reedel päris dramaatilise languse läbi. Probleemid ilmnesid tegelikult juba juuli lõpus peale tehingu edasi lükkamist Q3-st neljandasse kvartalisse. Reedel teatas Harman (HAR), et endised kosilased ei ole enam tehingust huvitatud, viidates äritegevuse ebasoodsale situatsioonile:

"KKR and GSCP have informed Harman that they believe that a material adverse change in Harman's business has occurred, that Harman has breached the merger agreement and that they are not obligated to complete the merger. Harman disagrees that a material adverse change has occurred or that it has breached the merger agreement."

Tegemist oli $8-miljardilise ülevõtuplaaniga ning sellest taganemine on kindlasti selline sündmus, mis meelitab kohale palju advokaate ning kulud saavad arvatavasti kopsakad olema. Hoolimata sellest taganetakse ning arvan, et see on päris huvitav sündmus arvestades, et finantsettevõtted on M&A aktiivsust päris heas valguses näidanud. Viimastel kvartalitel on see olnud tugev ning edasiseks prognoositakse samuti tugevust. Samas võivad sellised tehingud ülevõtjaid hirmutada küll ning üldiste fundamentaalnäitajate halvenedes ei ole ülevõtutehingud enam atraktiivsed. Meenutagem, et oleme siiski M&A aktiivsuse tippudel, kust ruumi alla tulla ilmselt on.

Natuke teisel teemal. Citigroup on väljas huvitava analüüsiga RF Micro Devices Inc (RFMD) osas. Analüüsimaja arvates on aktsiahind selgelt tegemas põhja ning eelseisvad katalüsaatorid peaksid aktsiat kergitama käesoleva aasta neljandas kvartalis ning 2008. aastal. Kaubeldes 15.2x 2008. aasta citi prognoositaval kasumil ($0.41 vs konsensus $0.38), diskonteerib aktsiahind juba ajalukku jäänud negatiivsed mõjud (1H07’s Polaris II käibe vähenemine, Motorola nõrkus, pettumust valmistanud marginaalid) jättes välja käesoleva aasta lõpus paranemise Motorola tellimustes, 2008. aasta SIMD diili mahtude suurenemise ning marginaalide paranemise potentsiaali.

Citi väidab, et hetkel on riski/tulu suhe hea ning nende arvates võiks aktsia kerkida pea 40% hinnani $8.6. Samas on potentsiaalne langusruum nende arvates vaid $5.8ni ning seetõttu soovitatakse aasta lõpuni aktsiaid osta.

Eelmisel nädalal tuli Aasiast indikatsiooni Motorola komponentide tellimuste kohta, mis on paranenud. See mõjub just eriti hästi RFMDle, kuna 1Q2007 moodustas MOT 33% käibest. 2Q2007 oli MOT osalus juba käibest kõigest 12% tänu üleliigsete varude korrigeerimisele. Kui Motorola tellimused on tõesti paranenud, siis on RFMD-l potentsiaali päris tugevaks käibekasvuks (citi: Reflecting a turn we increase our C3Q07 revenue estimate $5M to $243M - Street $239M; CIR/Street EPS $0.06).

Citi: Catalyst Profile Is Attractive, Valuation Cheap – RFMD’s valuation is among the most inexpensive in our coverage across EPS, book and sales parameters, an attractive base given looming estimate revision positives and a likely favorable shift in stock psychology as SIMD deal benefits are more fully appreciated and modeled. We expect the shares to trade steadily higher on October’s results/outlook and then November’s analyst day, and regard an expected tripling in operating margins (from 4% now to 12% by end-2008) as powerful propellant to shares appreciation in the next twelve months. Reiterate Buy.

-

Barronsis huvitav lugu broker'ite kohta, kus öeldakse, et M&A osakaal on tuludest järgi andmas. Tõestust sellele saab kas või Oliveri siintoodud HAR näitest. Väike inglisekeelne kokkuvõte:

Barron's reports Wall Street's record volumes aren't returning anytime soon. In fact, the trend looks to be moving in the opposite direction. The brokerage stocks "have bounced, but their risk/reward still isn't favorable," says Brian Rauscher, director of portfolio strategy at Brown Brothers Harriman. "The pace of downward earnings cuts is still accelerating." So, for Q3 so far, M&A deal volume has shriveled to $881 bln, little more than half of the second quarter's record of $1.7 trln.

The picture isn't much better in the world of global underwriting. In Q3 of '06 $1.9 tln of securities were underwritten; with a week to go in this year's Q3, the underwriting total is about half that, $1.07 trln, and showing little sign of reviving. "We may have bottomed out, but were not going back to where we were," says Richard Peterson, director of capital markets at Thomson Financial. Part of the problem is that the issuance of structured products has dried up. "There has been a secular change in [the brokers'] core markets," says Dick Bove, an analyst at Punk Ziegel. Their profits from structured products, hedge-fund activity and the LBO boom are likely to decline over the next year or two. If revenues stay low, the firms will need to slash expenses for the new environment. Warns Bove: "They're going to knock off 10% to 20% of their employees easily."

-

Lisan siia ka enne Citi poolt mainitud RFMD graafiku:

-

Kui eelmisel nädalal sai Motorola positiivseid kommentaare Cowenilt, siis täna tõstab RBC firma reitingu "Outperform" peale varasema "Sector Performi" pealt.

-

Citigroup tõstab Apple'i hinnasihti $185 peale $160-lt.

-

USAs on intresside langetamine teoks saanud ning likviidsuskriisist enam väga ei räägita. Ka inflatsioon on suuna alla võtnud, kuigi intresside langetamise tulemusena võib olukord taas muutuda. Küll aga on olemas ka üks ohver - dollar on kõvasti pihta saanud, vahepeal sai ühe euro eest juba $1.413. Kui S&P 500 aasta algusest toimunud 8% suurune tõus konverteerida eurodesse, oleks indeks ytd üleval ainult 1%.

Sellel nädalal võib oodata ka paari majandussündmust, homme meie aja järgi kell 17 avaldatakse olemasolevate majade müüginumbrid, mida oodatakse langevat 5.55-le miljonile. Samal ajal tulevad ka tarbija kindlustunde numbrid.

Nädala jooksul on oodata kahe majadeehitaja majandustulemusi, teisipäeval enne turgu Lennar ja neljapäeval enne turgu KB Homes. Mõlema puhul oodatakse kahjumi teenimist. Lisaks avaldatakse neljapäeval uute majade müüginumbrid. Loomulikult oodatakse müügi vähenemist siingi, müügis olevate majade hulk ja nende eest küsitav hind on lihtsalt liiga kõrged ega vasta turuolukorrale.

Kolmapäeval on uudised kestvuskaupade tellimuste kohta, peale eelmist kahte küllalt tugevat kuud peaks august olema nõrgem. Langust juhib transpordisektor ning eriti oodatakse vähenemist lennukite tellimuste osas. Kolmapäev toob ka Bed Bath & Beyondi tulemused.

Lisaks mahub nädala sisse hulgaliselt kõnesid Fedi regioonipankade presidentidelt, ühtlasi oleme jõudmas kolmanda kvartali hoiatuste perioodi, kus samuti võib ette tulla üllatusi. Selle nädala viimaseid uudiseid oodatakse reedest, kus loodetakse saada kinnitust, et inimeste sissetulekud ja kulutused on kasvanud.

-

Nagu mainitud, siis Citi on täna Apple Inc (AAPL) kommenteerimas, tõstes ettevõtte EPS prognoose ning hinnasihti. 2008. ja 2009. aasta prognoose kergitatakse tänu kõrgematele marginaalidele ning madalamatele tegevuskuludele. Konsensusest kõrgemad prognoosid viivad Apple hinnasihi $185 peale.

Peamise pointina tuuakse välja analüüsimaja checkid, mille kohaselt PC-de müük kulgeb prognoositust paremini neljandas kvartalis. Septembri kvartali PC-de müügi arvu tõstetakse 2-lt miljonilt 2.17 miljonile tänu iMacide momentumile. Samuti kommenteeritakse, et DRAMi ja flashi hinnad on taas langemas, mis toetab marginaale.

Lisaks on iPhone tootmisplaan langenud mõistlikule tasemele (3.8-4 miljonit ühikut CY07) ning peale hinnalangust on potentsiaali rohkemakski. Mitmed katalüsaatorid on firmal veel ees: oktoobris Mac OS Leopard, novembris iPhone Euroopas ning 2008. aasta esimesel poolel 3G iPhone. Ning jääme ka ootama Volkswageniga koostöös iCari ; ) -

Föderaalreserv valmis oma intressimäärapoliitikat igatpidi ümber mängima - vastavalt vajadustele. Pole just parim keskkond ettevõtetel investeerimisotsuste tegemiseks:

Fisher says recent trends in inflation and expectations gave fed "wiggle room" to adjust policy

Fed's Fisher says Fed can make further corrections in monetary policy in either direction if needed -

Väike järelkaja RBC Motorola upgrade'ile. Nimelt põhjuseks siis nende nägemus, et Motorola mobiiltelefonide müügitrendid on üha tugevnemas. RBC usub küll, et nad võivad oma calliga fundamentaalsetest paranemismärkidest rääkides pisut vara väljas olla, kuid usuvad, et järgmise paari kvartaliga peaks tulema kinnitust, et Motorola tooteportfell on teinud suure sammu edasi ning mobiiltelefonide segmendile seatud kasumlikkuse eesmärgid saavad täidetud.

-

Aasia turud tugevalt rohelised, Euroopa pisut värvikirevam. USA alustab päeva 0.2-0.3% plusspoolelt.

Euroopa turud:

Saksamaa DAX -0.15%

Prantsusmaa CAC 40 -0.09%

Inglismaa FTSE 100 +0.37%

Hispaania IBEX +0.51%

Venemaa RTS +0.79%

Poola WIG -0.32%

Aasia turud:

Jaapani Nikkei 225 N/A (turud suletud)

Hong Kongi Hang Seng +2.74%

Hiina Shanghai A (kodumaine) +0.56%

Hiina Shanghai B (välismaine) +0.09%

Lõuna-Korea Kosdaq N/A (turud suletud)

Tai Set +1.22%

India Sensex +1.70%

-

The Market Will Do What It Wants

By Rev Shark

RealMoney.com Contributor

9/24/2007 8:02 AM EDT

Happiness does not come from doing easy work, but from the afterglow of satisfaction that comes after the achievement of a difficult task that demanded our best.

-- Theodore Isaac Rubin

As we kick off a new week, the market continues to bask in the afterglow of the Fed interest rate cut. There seems to be increased confidence that the problems that were starting to blossom have now been addressed and that the market is in good shape to move higher from here.

Certainly we are in pretty good shape technically. After the big spike up last Tuesday following the half-point interest rate cut, we have held up well and given the short-terms time to move on and stronger buyers the chance to move in. We have exactly the sort of basing action you like to see following a big move, and that bodes well for further upside.

With the Fed on our side and promising technical setups, we should be feeling pretty good about this market. Many folks certainly are, and the action in many stocks is quite good. Still, it is hard not to have some niggling concerns about the fundamentals underlying this market. There are an awful lot of negatives out there, and the market is acting as if they are of little consequence.

The U.S. consumer is being squeezed on several fronts -- energy prices have been spiking to record levels, the dollar is at record lows (making foreign goods more expensive and global investors less apt to buy our assets), it is much harder now to obtain the credit necessary to fuel the type of spending that we've seen over the past few years, there are still serious troubles in the housing market, inflationary concerns are starting to pop up again and the overall economy is slowing.

These are not insubstantial worries, but perhaps the market feels they are discounted and/or being addressed by the Fed. That seems overly optimistic, but the present market action is not indicative of any major negative. In the back of my mind, I keep struggling with the illogic of a market that is hitting new highs at the same time the Fed thinks we have sufficient negatives to cut interest rates aggressively. I have a very hard time reconciling that we can so easily address problems without suffering any real pain.

One thing I have learned more than once, however, is that it is better to defer to the price action of the market rather than to impose my logic on it. The market beast will always prevail in the end, so I'm better off trying not to outsmart him. That doesn't mean that I don't contemplate how fundamentals might develop and affect the course of the market, but I certainly don't want to anticipate that to a great degree. All those worries and concerns need to be relegated to the corner until there are some signs that they really do matter.

We have a slightly positive open shaping up. Asian markets were quiet due to a holiday, and Europe is mixed as financials weigh on the action. Gold is up again and oil is trading down slightly from record highs.

---------------------------

Ülespoole avanevad:

M&A related news: CCBL +34.1% (to be acquired by ARRS for either $13.75 per share in cash or 0.9642 shares of ARRS)... China stocks continue to see momentum, with news out on select names: YZC +10.3%, PTR +9.2% (gets approval for a Shanghai share sale), ACH +7.8%, CPSL +7.8%, CSUN +6.9%, CSIQ +4.6% (signs agreement to build 300KW 'Suzhou solar demonstration park)... Other news: NTMD +11.1% (co says BiDil gains broad preferred status on pharmacy benefit plans), ASTI +9.7% (continued momentum), ZINC +8.8% (positive Cramer comments), ZVUE +8.8% (continued momentum following Friday's 50%+ move), CTIC +7.2% (co announced it began a confirmatory phase III clinical trial of combination chemotherapy for women with advanced non-small cell lung cancer), BHP +6.0% (newspaper reported the co will say it has uncovered what may be the world's largest gold resource), ANW +5.4% (mentioned positively in Barron's), AAPL +1.8% (tgt raised to $185 at Citigroup), DELL +1.6% (confirms it will partner with GOME on retail sales in China).

Allapoole avanevad:

On weak earnings/guidance: HAR -8.8%, ADTN -7.6%... Other news: ZNH -11.1% (Chinese airlines seeing volatility on Cathay/CEA news, not seeing anything specific to ZNH), CEA -10.3% (China Eastern (CEA erased an 8% gain to finish down 10.5% in China as expectations waned that Cathay Pacific would buy part of the Shanghai-based carrier), PGLA -5.3% (announces PI-88 Phase 2 results did not meet its primary endpoint for lung cancer), CRXL -4.7% (stock is trading lower following MRK's halt of experimental AIDS vaccine study that used CRXL's PER.C6 technology), TSO -2.6% (tgt cut at Caris), TMA -2.5% (still checking for any news), RHT -2.3% (downgraded to Neutral at Credit Suisse), BCS -2.2% (downgraded to Underperform at Bear Stearns), DB -2.2% (debt bill may hit 1.7 bln euros), SIRT -2.1% (downgraded to Mkt Perform at Piper, downgraded to Neutral at JP Morgan). -

DHR's taas short (PRO idee)

vahepel ei ole midagi muutunud

mõned upgrade'd on hea võimaluse loonud -

speedy, siiani ei ole meie teesis mitte midagi muutunud tõesti ning ei ole tahtnud ka shordist välja astuda. Huvitavaks tasakaaluks meie pikkadele ideedele ning fundamentaalpilt on aina kehvemaks minu arvates muutunud. Rääkides Pro ideedest, siis Gmarket (GMKT) teeb täna üpriski huvitavat tõusu (hetkel +8,3%)...

-

Päris huvitav. Kogu selle äkilise tõusu peale turul teevad Homebuilderid (SPF, MTH, TOL, LEN, PHM, KBH, BZH, RYL) uusi põhju. BZH hetkel -7%.

-

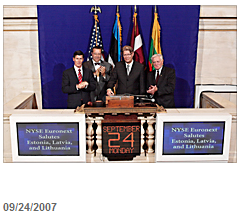

Päevalõpuküsimus laiale ringile :) millise riigi president täna so 24.09 NYSE'l closing bellil osales?

-

NYSE Welcomes Presidents from the Baltic States of Estonia, Latvia, and Lithuania

09/24/2007

The Presidents of the Baltic States of Estonia, Latvia, and Lithuania visit the NYSE. In honor of the occasion, President Toomas Hendrik Ilves of Estonia, President Valdis Zatlers of Latvia and President Valdas Adamkus of Lithuania ring The Closing Bell®. -

nice:)

-

Paganus. Magasin maha selle kella. Kas kordust ei saa kuskilt näha?

-

Ja et see tõesti nii ka oli, siis panen siia pildi:

-

Siin natuke suurem pilt

Kas veebis mingit salvestust ka on? -

Nii palju täpsustan, et

CPSL tõusis päeva lõpuks +50% !!!

Uskumatu lugu ... -

ja CSIQ +15%

-

speedy conzales

kui pika nägemusega DHR`is short oled?

tulemused on tal 18 okt... -

parem loe Pro'st, pole minu idee

"ees on kasvutu aasta" on põhiargument, siit võid järeldada mõndagi

tulemused ja prognoosid ongi need, mis tõenäoliselt hinda jahutavad,

vahepeal on seltskond 3sendisest dividendist leili läinud