Börsipäev 26. september

Kommentaari jätmiseks loo konto või logi sisse

-

Kui veel USA mõistes öösel olid futuurid sügavas miinuses, siis avanemise lähenedes on üha positiivsemad meeleolud võimust võtnud. Aasia turgudest on India Sensex jõudnud 17 000 punktini ning optimism tundub ootustes, et USA Föderaalreserv on intressimäärasid veelgi langetamas (ja dollar tegemas uusi põhju euro vastu) taaskord pinnale kerkimas.

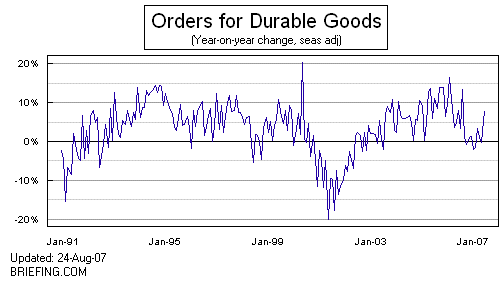

Peo võib ära aga rikkuda tänane kestvuskaupade tellimuste augustikuu raport (avaldatakse kell 15.30 ET), millelt oodatakse -4.0%lt langust - nii suurt miinust ei ole nähtud vähemalt 4 aastat. Veel juulikuus oli tõus +6%. Seega saavad turuosalised varsti aimu, kui palju USA majandus ikkagi jahtumas on:

-

Freddie Mac boss on Aasia ringreisil rahustamas sealseid investoreid - rea Aasia riikide valitsused ja keskpangad on Freddie Mac mortgage võlakirjade suurostjad ... nii 30-40% emissioonide mahust ... veel mõni aeg tagasi hinnati neid võlakirju riskitasemelt väga lähedal seisvateks USA riigivõlakirjadele

Väidetavalt ei ole vaatamata USD nõrkusele huvi mainitud võlakirjade vastu Aasias nõrgenenud ja Freddie Mac ei usu USA majanduslanguse saabumist, kuid möönab eesolevaid probleemseid aegu -

Mis Freddie Macil muud ikka üle jääb, kui kinnitada, et asjad hulluks ei lähe..

-

Kestvuskaupade tellimused kehvad:

Durable Goods Orders -4.9% vs -4.0% consensus

Durable Goods Orders ex-trans -1.8% vs -1.0% consensus -

Ardour Capital, kes esmajoones katab just energiatehnoloogia ja alternatiivenergia sektorit, alustas päikesepaneelide tootjate katmist. First Solar (FSLR) ja Suntech (STP) on saanud "Hold", Sunpower (SPWR) "Accumulate" ja Trina Solar (TSL) "Osta" soovituse. Viimase kohta tuuakse välja kulude kokkuhoiu võimaluse ja potentsiaalselt madalama räni hinna.

TSL koha pealt on ka Cowen positiivselt meelestatud, viidates juhtkonnaga kohtumisel saadud sõnumile, et nõudlus on tugev ja hästi prognoositav ning hinnad on stabiilsed. Töös on ka lepingute sõlmimine mitme ränipakkujaga. -

Tundub, et praegu ei ole USA-s vahet, mis majandusuudised tulevad.

Kui on head, viivad turgu üles, kui aga on halvad, siis loodetakse jällegi FED-i rate cut`i peale, ja turg läheb ikkagi üles...

Karudel pole kohe kuidagi tegevust... -

Bubble13, kestvuskaupade tellimustele tõesti futuurid järele ei andnud ning pigem tõusid.

-

Madis, see TSL uudis on muidugi tore, sest oman aktsiat 4-ndat päeva:)

-

Euroopa turud:

Saksamaa DAX +0.46%

Prantsusmaa CAC 40 +1.17%

Inglismaa FTSE 100 +1.22%

Hispaania IBEX +1.51%

Venemaa RTS +1.63%

Poola WIG +0.15%

Aasia turud:

Jaapani Nikkei 225 +0.21%

Hong Kongi Hang Seng N/A (pühad)

Hiina Shanghai A (kodumaine) -1.62%

Hiina Shanghai B (välismaine) +0.37%

Lõuna-Korea Kosdaq N/A (pühad)

Tai Set +1.29%

India Sensex +0.13%

-

Traders Can Always Find a Reason to Buy Stocks

By Rev Shark

RealMoney.com Contributor

9/26/2007 8:51 AM EDT

Never awake me when you have good news to announce, because with good news nothing presses; but when you have bad news, arouse me immediately, for then there is not an instant to be lost.

-- Napoleon Bonaparte

Despite a steady flow of negative news, the market continues to act extremely well. Yesterday, we had profit warnings from retail giants Target (TGT - commentary - Cramer's Take - Rating) and Lowe's (LOW - commentary - Cramer's Take - Rating) as well as a dismal third-quarter earnings report from home-builder Lennar (LEN - commentary - Cramer's Take - Rating). Consumer sentiment fell and housing numbers continue to be quite poor, although a bit better than expected.

This morning in The Wall Street Journal there was an article about how these negatives may combine to dampen holiday spending, but there was also an article about how money is flowing into technology stocks and that the group may have further to go.

Trying to reconcile the poor economic and financial news with the strong action in the market is nearly impossible. The attitude is that bad news is good because it means the Fed will cut interest rates and prevent too much of an economic slowdown, and good news is good because then we might not suffer that much of an economic slowdown.

What it all boils down to is that folks want to buy stocks, and they are finding good reasons to do so. Trying to argue about the logic of it is not going to get us very far when emotions are in the present state. There is money to be made, and talking about the theoretical possibilities of how the economy will unfold, even if quite dire, seems silly when so many stocks are so hot.

One troubling aspect of the recent action is that it has been narrow. A small group of high-beta, big-cap technology stocks such as Apple (AAPL - commentary - Cramer's Take - Rating), Research In Motion (RIMM - commentary - Cramer's Take - Rating), Garmin (GRMN - commentary - Cramer's Take - Rating), Google (GOOG - commentary - Cramer's Take - Rating) and the like have been hot, and some groups such as China stocks and solar energy are attracting aggressive momentum traders. At the same time, small-caps have struggled and even the S&P500 is looking quite mild by comparison.

Speculative action isn't a bad thing at all. It can easily expand and start dragging along other areas of the market. Where it is a problem is when traders become increasingly desperate as they chase a shrinking group of stocks. That results in huge moves in a few names but presents the dilemma of having to pay up big or sit on the sidelines.

The August durable goods report just hit and was a bit weaker than expected, but the reaction is quite mild. The market continues to not worry too much about negatives as it focuses instead on momentum.

Overseas markets were strong overnight, and we have a good open on the way. Apparently, all news is good news, and if you don't believe it you'll be left behind.

-----------------------------

Ülespoole avanevad:

Gapping up on strong earnings/guidance: RHT +5.9%... China-related stocks and solar stocks gapping up on continued momentum this morning: China stocks include: XFML +20.3% (co announced an investment by The Yucaipa Companies), CDS +16.2%, CLWT +12.4%, CTDC +10.1%, CBAK +8.5%, KUN +8.5%, NOEC +7.3%, CPSL +7.2%, TSTC +6.5%, SDTH +6.4%... Solar stocks (there are several solar conferences taking place this week): ASTI +6.9% (co presents at UBS conf today at 1:00 E.T.), AKNS +4.8%... Chinese solar stocks: CSUN +20.3%, SOLF +6.6%, CSIQ +6.1%... Other news: EBS +31.2% (signs $448 mln three year contract with Department of Health and Human Services), CNIC +24.3% (SEC closes its investigation of CNIC with a recommendation of no enforcement action), VERT +20.7% (still checking for anything new), SCON +7.9% (continued momentum), LOCM +7.8% (co releases UK site from beta), GM +5.7% (reaches tentative agreement with UAW).

Allapoole avanevad:

On weak earnings/guidance: RECN -16.5% (also downgraded at 5 brokers), GB -9.7%... Other news: FMT -18.7% (co and Gerald Ford in discussions regarding revised investment terms), CGPI -14.2% (announces results of Phase 2 dose-finding study of Incyclinide did not demonstrate a greater reduction in inflammatory lesions), LSCC -7.1% (block trade cited), UA -2.6% (downgraded to Neutral at UBS), S -2.3% (downgraded to neutral at tier 1 firm), AGU -1.6% (downgraded to Sector Perform at CIBC), BHP -1.5% (Richards Bay Coal Terminal curbed after derailment on transport line), CS -1.1% (said it will cut about 150 jobs). -

Bubble13...eks ta ole pigem selline kahe teraga mõõk. Võtame kas või sellesama kestvuskaupade graafiku. Suurem langus jääb silma kohe 2000-2002. Mida tegi aktsiaturg sel ajal? Kukkus... Mida tegi Föderaalreserv sellel ajal? Langetas intressimäärasid... Ehk balansseerimine köie peal on lõbus seni, kuni sealt alla ei kukuta. Praegu panustataksegi pigem sellele, et majandus jääb köiele püsima ning boonuseks saame veel intressimäärade kärpimised.

-

jyriado, nendest on TSL tõenäoliselt kõige mõistlikum valik. Hind tundub suhteliselt normaalne isegi siis, kui mitte võrrelda teiste solar-rakettidega, vaid ülejäänud tehnoloogiasektori ettevõtetega.

-

USA tööjõuturust annavad aimu ka employment agency'd RECN ja RHI. Esimene neist pani oma tulemustega pange ...

-

Septembri viimane kauplemispäev on reedel ning sellega lõppeb ka 3. kvartal ettevõtete ja igasuguste fondide jaoks. Et oma klientidele toredaid kirju aktsiaturgude tugevusest kirjutada ja uut raha juurde meelitada, võivad fondijuhid oma müügisoove edasi lükata. SPY on juuli alguset kukkunud -0.3%, QQQQ tõusnud lausa +7.8%... "Kas pole mitte ilusad tootlusnumbrid?", kõlab fondijuhi kirja esimene lause...

-

Kas keegi MOVI toimetamisega kursis on. Mis saab edasi!?

-

Goldman Sachs (GS) langetab Merrill Lynchi (MER) kolmanda kvartali ja 2007. aasta prognoose hüpoteek -ja võimendatud laenude nõrkuse tõttu.

-

Credit Suisse tegi sama juba hommikul: Credit Suisse notes they reduced their 3Q07 single point est on MER

-

dol: MOVI toimetamisi jälgin, midagi head pole. Praegu peavad nad pingutama, et ei delistitaks.

http://www.dmwmedia.com/news/2007/08/22/movie-gallery-receives-two-nasdaq-notices

Movie Gallery Receives Two Nasdaq Notices

Submitted by Mark Hefflinger on August 22, 2007 - 11:18am.

Dothan, Ala. - Movie Gallery, the financially struggling firm that is the nation's second-largest movie rental chain behind Blockbuster, announced on Wednesday that it has received two notices from the Nasdaq that its shares are in danger of being delisted from the exchange.

The company is in violation of the Nasdaq's $1 minimum share price rule, as well as its $15 million minimum market value requirement; Movie Gallery has 180 days to regain compliance on the first matter, and 90 days to address the second.

Dothan, Ala.-based Movie Gallery, which operates 4,550 stores under the Movie Gallery, Hollywood Video and Game Crazy brands, last week was granted extensions on debt payments from some of its lenders.

The company said it had missed payments due to significantly weaker than expected second quarter results. -

Spekuleeritakse, et Warren Buffett on huvitatud Bear Stearns'is (BSC) osaluse soetamisest. Aktsia teinud kiire hüppe üles, hetkel +11%:

15:13 BSC Bear Stearns: Follow up on NY Times report on potential Buffett stake (126.61 +12.37) -Update-

NY Times reports the co is in serious talks with several outside investors, including Warren Buffett, about selling as much as 20% of the co, people briefed on the discussions said today. Other investors who have expressed an interest in buying a minority stake include the BAC, WB and two Chinese institutions — the Citic Group and China Construction Bank, these people said. Such expressions of interest will help bolster Bear and its chief executive, James E. Cayne. As always in discussions surrounding any sale of the bank, price is the main issue and these talks, like others, could founder. Mr. Cayne has traditionally demanded so steep a premium from outside investors, sometimes as high as 40% above the share price, that a deal has been difficult to consummate. Mr. Buffet, in particular, reached out to Mr. Cayne about a month ago, the people briefed said, when the stock was approaching its one-year low of $100. The mechanics of the deal remain unclear, although it is likely that the structure would be in the form of convertible stock, similar to Bank of America's deal with Countrywide. -

FMD hüppas minutitega $38 pealt $40-$41 juurde, kui tuli uudis, et SLM buyout diil on katkestatud:

http://biz.yahoo.com/prnews/070926/new104.html?.v=21 -

väga põhjalik ülevaade FMD hetkeseisu ja tuleviku kohta - kuigi holderi seisukoht, siiski adekvaatne imho

First Marblehead: Multiple Uncertainties Hide Underpriced Stock

selles tekstis väljatoodud SLM oht on praeguseks siis kõrvaldatud