Börsipäev 22. oktoober

Log in or create an account to leave a comment

-

Varian Medical Systems (VAR) on kõige suurem vähi raviks mõeldud kiiritusseadmete valmistaja. Tööstus näitab kõrgeid kasvunumbreid, kuna rahvastiku vananedes Ameerikas oodatakse diagnoositud haigete tõusu 2010. aastaks 23% ja 2020. aastakse 50%. Barrons kirjutab, kuidas 1990. aastast 43-kordset tõusu näidanud Variani aktsiad on viimased kaks aastat kannatanud konkurentsist tuleneva surve all. Kui veel eelmisel aastal suudeti näidata kasvu, siis lõppenud majandusaasta teisel ja kolmandal kvartalil jäädi aastasel baasil müügiga alla, samuti kukkus kasum 24%.

Siiani on konkurentidest kõige enam tähelepanu saanud TomoTherapy (TTPY) ja Accuray (ARAY), mõlemad noteeriti börsil selle aasta alguses. Tegelikkuses aga ei kujuta kumbki ettevõte Varianile eriti suurt ohtu, nende müügimahud jäävad kahepeale alla 20% võrreldes Variani $1.6 miljardilise müügiga.

Varian hoiab ca 50% suurust turuosa ning kasvu aeglustumise peamiseks põhjuseks on hoopis haiglate väiksem tellimuste maht, mis omakorda on kõrgete intresside ja sektoris toimuvate ühinemiste tagajärg. Seetõttu ei tehta suuri kapitalikulutusi enne, kui ühinenud ettevõtted on integreerunud. Teisisõnu võib paari kvartali negatiivust tõlgendada, kui $3 miljonit maksvate seadmete soetamise edasilükkumist.

Varian teatab oma majandusaasta tulemused kolmapäeval, analüütikud prognoosivad müügitulude 10%-list ja kasumi 8%-list kasvu. Kasumiks aktsia oodatakse $1.79 ning jooksev P/E suhte oleks siis 23, mis on küllaltki kõrge tervishoiusektori keskmise 17-ga võrreldes. Kuid märgid positiivse trendi taastumisest neljandas kvartalis võiksid luua eelduse, et aktsia müügimahtude kasvu taastumise tõttu taas tõusma hakkaks.

-

Bloombergist vahva lõik iseloomustamaks tänast päeva:

``The market is going to have a bad day,'' said Edward Collins, who helps manage $41 billion at New Star Asset Management Group Plc in London. ``We are going to see a fall in equities, in sympathy with what happened in New York and what the G7 said and because of what Asia did.''

The yen rose to a six-week high against the dollar. U.S. Treasury notes increased, pushing two-year yields to their lowest level since 2005, as a decline in stocks fed demand for the relative safety of government debt.

Asian stocks fell the most in two months. U.S. stocks had their biggest drop in two months on Oct. 19 after earnings reports from banks, manufacturers and industrial companies heightened concern about the health of financial markets and the economy. U.S. stock-index futures declined today.

``Recent financial market turbulence, high oil prices and weakness in the U.S. housing sector will likely moderate'' the global expansion, officials said in a statement. -

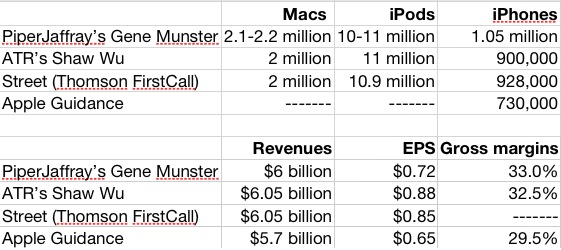

Täna peale turgu on oodata Apple (AAPL) kolmanda kvartali majandustulemusi. Paslik on enne vaadata, mida siis ettevõttelt oodatakse. Fortune on sellest kokkuvõtliku tabeli teinud:

Nagu näha, siis konsensuse ootuste kohaselt müüs ettevõte kvartali jookusl 2 miljonit Maci, 10.9 miljonit iPodi ja alla miljoni iPhone'i. Ettevõttele on olnud tegu igati sündmusterohke kvartaliga - kohtuhagi iPhone'i aku pärast, telefoni hinnakärbe, läbirääkimised Hollywoodiga ja Euroopa operaatoritega, kaebused Mac'ide halva ekraani üle jne. Sellest hooilmata on mitteametlikud ootused kerinud kõrgemale, kui eelpool toodud numbrid.

Kvartaliaruande kõige huvitavamaks kohaks on AT&T-st saadav tulu. Siiani on tegu olnud hästi hoitava saladusega, lisaks saab aimu uue iPodide perekonna käekäigust. Viimased peaksid olema tootmiskulude poolest 11% odavamad, mistõttu nende pealt teenitavad marginaalid on üsna mahlakad. Hinnangute kohaselt on uutel iPodide müügiedu suur ning eriti septembris tulenevalt koolialgusest.

Lisaks avaldavad täna veel tulemused Merck (MRK), Halliburton (HAL) ja Netflix (NFLX).

-

Fullermoney.com'lt ülevaatlik tabel globaalsete aktsiaturugude valuatsioonidest vastavalt septembrikuu ja oktoobrikuu seisuga, kust leiab ka kolme Balti turu OMX indeksid.

Järjestatud P/E suhte järgi: http://static.seekingalpha.com/uploads/2007/10/21/19_oct_pe.jpg

Järjestatud dividendimäära alusel: http://static.seekingalpha.com/uploads/2007/10/21/19_oct_dy.jpg

-

Tore vaadata, et esimeses tabelis ka Venemaa küllalt kõrgel kohal on. :)

-

Täna kirjutab WSJ.com väga huvitava artikli sellest, kuidas kinnisvaraturu jahtumine on jõudnud ka Euroopasse ning mõjutamas sealseid tarbijaid. Artikli lugemiseks vajuta siia.

Home prices in Spain more than doubled over the past 10 years, but the average price of an existing home has fallen slightly since July, according to real-estate agent facilisimo.com. France experienced its first quarterly home-price decline in almost a decade in the third quarter, according to its federation of real-estate agents, while Irish house prices in August were 1.9% below the year-earlier level.

The weakening home market could hit European economies. An expanding construction industry has fueled growth in Europe. Now, construction in Spain and elsewhere is easing. Also, some people said higher payments on their mortgages are cutting into their ability to spend.

-

UBS on andnud Altriale (MO) ostusoovituse, varasem soovitus oli "Neutral".

Teiste tänaste upgrade'de hulgast võib mainida veel Overstocki (OSTK), downgrade'i on saanud Sepracor (SEPR), American Express (AXP), Capital One (COF), Countrywide (CFC), Washington Mutual (WM) ja IndyMac (IMB).

-

Täna on majandustulemustega tulnud kaks mänguasjade tootjat – Hasbro (HAS) ja Jakks Pacific (JAKK). Varem on oma tulemused juba avaldanud Mattel (MAT) ning novembri alguses teeb seda Marvel (MVL).

Kui Matteli kasumile mõjusid negatiivselt mänguasjade tagasi kutsumine kokku kolmel korral, mille põhjuseks olid kvaliteedi- ja laste tervist ohustavad vead Hiinas toodetud mänguasjadel, siis tänased tulemuste avaldajad esinesid oluliselt paremini. Konsensuse ootusi ületasid nii Hasbro kui ka oluliselt väiksem Jakks. Kui kardeti, et negatiivne meediakajastus Matteli ümber on tarbija ettevaatlikuks muutunud, siis seda eriti ei täheldatud.

Hasbro tulud tõusid 18%, kasumit teeniti $0.95 aktsia kohta ning kuigi müügitulu eestvedajad olid rahvusvahelised turud, siis ka Põhja-Ameerika suutis näidata 10% suurust kasvu. Kui jätta kõrvale soodsad maksumäärad, siis teeniti kasumit $0.78 (analüütikute ootus $0.71) võrreldes eelmise aasta $0.58 vastu. Tulu suurimat kasvu näitasid Transformerite nukud, samas saatis müügiedu ka nt. Monopoli ja Scrabble't. Sisuliselt on head tulemused põhibrändidele keskenduva strateegia tulemus.

Samuti suutis kasvu näidata Jakks, tulu tõusis $318.4 miljonini ja kasumit teeniti $1.45 aktsia kohta vs eelmise aasta $1.26. Ka Jakks kinnitab, et tarbijal hoitakse silma peal, kuid praegusega ollakse rahul. Lisaks kinnitas ettevõte ka terve aasta prognoose.

Siiani on kõik kolm tulemused avaldanud tootjat viidanud ka majanduse olukorrale ning ollakse väga tähelepanelikult tarbijate olukorda jälgimas. Praegu ole nõrkus veel mänguasjade müüjateni jõudnud, kuid hinge kinni hoides oodatakse jõulusid, mil suuremate kulutuste põhjal on järeldusi kergem teha.

-

Taiwani valitsus kirjutas täna alla memorandumile 5 globaalse telekomiettevõttega ehitamaks välja WiMAX wireless interneti infrastruktuuri. Projekti maksumus on $664 miljonit.

Nendeks viieks osutusid: Alcatel-Lucent (ALU), Motorola Inc. (MOT), Sprint Nextel Corp. (S), Nokia-Siemens Networks (NOK), ja Starent Networks Corp. ( STAR). -

AlariÜ - kas saad lingi ka panna ?

-

Freementar, link.

-

Pärast reedest suurt langust USA aktsiaturgudel on nii Aasia kui Euroopa suurelt punases ning hetkel indikeerib eelturg USAs miinuse jätkumist ca -0.6% jagu.

Saksamaa DAX -1.23%

Prantsusmaa CAC 40 -1.70%

Inglismaa FTSE 100 -1.42%

Hispaania IBEX -1.84%

Venemaa RTS -2.07%

Poola WIG -1.59%

Aasia turud:

Jaapani Nikkei 225 -2.24%

Hong Kongi Hang Seng -3.70%

Hiina Shanghai A (kodumaine) -2.59%

Hiina Shanghai B (välismaine) -3.07%

Lõuna-Korea Kosdaq -2.29%

Tai Set -2.10%

India Sensex +0.31%

-

What Happens Next?

By Rev Shark

RealMoney.com Contributor

10/22/2007 7:25 AM EDT

Difficulty need not foreshadow despair or defeat. Rather, achievement can be all the more satisfying because of obstacles surmounted.

-- William Hastie

On Thursday, Oct. 11, the market experienced a particularly ugly intraday reversal. That prompted me to discuss the likelihood that we had begun the topping process that would eventually lead to a more substantial market pullback. The market subsequently struggled to hold up before finally succumbing and undergoing follow-through to the downside on Friday.

The action on Friday was particularly poor, with leading stocks falling sharply, poor breadth and heavy volume Even worse was that market participants were handed a very convenient excuse for selling in the form of a number of poor earnings reports from multinational companies that were supposed to benefit from strong worldwide economic growth.

Much of the bullish case for this market has been that even though the U.S. economy was slowing, there was unlikely to be that much damage because of the great strength in places such as China and India. The poor earnings on Friday from Caterpillar (CAT) , 3M (MMM) and Honeywell (HON) called that belief into question.

One of the great ironies of the recent market strength is that it was taking place primarily due to a friendly Federal Reserve that was cutting interest rates because of credit issues and a cooling economy. The market simply embraced the positive aspects of a rate cut without dwelling much on the negatives that pushed the Fed to act.

On Friday, the downside of a friendly Fed became clear to the broader market. There is no free lunch for the market. Interest rate cuts carry a price, and that price is some major economic challenges.

So now what? Was this selling on Friday just another temporary blip that will be soon forgotten, like so many others we have seen over the past year or so? Time and again, the market has roared back after a little scare and made fools of the bears who insist that this time the real problems are going to finally kick in and drive this market much lower.

I don't know whether this time it is different and whether a major downtrend is going to develop, but I do know that the proper course of action is to assume that things are going to get worse. Our job isn't to be stubbornly optimistic when negatives start to develop. Our job is to take defensive action, protect our capital and to be ready for worse.

Too many market participants tend to freeze when things turn down. Rather than cutting some stocks that are breaking down and raising some cash, they sit and hope that the market will regain its footing and bail them out. That might happen, but if you are wrong, the cost of such a passive approach can be quite high.

If you haven't already raised some capital, consider doing so even though the market is looking to open sharply lower this morning. That doesn't mean sell into the open, but look for some exit points. If you are wrong and stocks go straight back up, you can rebuy and think of the additional cost as an insurance premium. The great likelihood is that you will be able to find some better opportunities in the future with the cash you raise as the market struggles continue.

We have a sea of red as we kick off the week. There is some fear in the air this morning, and there was much discussion this weekend that the market is topping out as concerns about worldwide economic growth move to the forefront.

----------------------------

Ülespoole avanevad:

On strong earnings/guidance: CDS +10.3%, HAS +5.4%, CRNT +3.6%, RCL +1.9%... M&A-related: RTSX +46.1% (co to be taken private by Vestar Capital for $32.50 per share), GILT +7.6% (FT reports the co is working with bankers at UBS to evaluate interest from several strategic and private equity buyers in buying the co)... Other news: PLUG +38.0% (announces a purchase order for GenDrive fuel cell power units from WMT), CLWT +11.3% (announces it has recently been awarded contracts worth about $2.4 mln by a USA Aluminum co based in Qinhuangdao, China), NED +4.2% (new IPO on Friday, not seeing any news), TMA +2.5% (co's CEO buys 1 mln shares at $9.50), PTR +2.2% (stock gained 2.2% in Hong Kong after it said it expects its yuan-denominated shares to start trading in Shanghai on 11/5 - Bloomberg.com).

Allapoole avanevad:

On weak earnings/guidance: SGP -7.8%, LMC -5.8%... Chinese stocks under pressure following 3.7% drop in Hang Seng, 2.6% in Shanghai overnight: CPSL -7.6%, TBSI -7.6%, JRJC -7.1%, ZNH -6.4%, CHNR -6.2%, RCH -6.1%... Other news: BHIP -13.9% (announces private placement financing), FTEK -7% (Downgraded to Sell at Merriman Curhan Ford), CFC -6.2% (downgraded, tgt cut at Lehman), TARR -5.8% (completes additional $91 mln of property sales). -

Iraq Pres says Turkish Kurd Rebel group to call Ceasefire, on TV - DJ

-

Sellel nädalal taas eluasemete statistika. Ei ole sugugi isu üheski asjas pikaks minna.

Banc of America analyst Daniel Oppenheim forecasts a 6 percent decline existing home sales, reflecting slowing demand in the end of the quarter. Oppenheim expects an 8 percent decline in September new home sales, citing tighter mortgage lending standards and continued falling prices. -

Kui Google'il minu mäletamist mööda oli konsensuse löömine EPSi osas keskmiselt 21 senti, siis Apple'il 20 senti. See näitab ka, et ootuste täitmisega kohe kindlasti ei lepitaks, vaid oodatakse enamat.

AAPL has beaten consensus $0.20 or more each of the past three qtrs and by $0.11 in the year ago qtr. -

Netflix (NFLX) ületab analüütikute ootusi igas elemendis ning kaupleb järelturul ligi 18% kõrgemal:

Reports Q3 (Sep) GAAP earnings of $0.23 per share, $0.08 better than the Reuters Estimates consensus of $0.15; revenues rose 14.8% year/year to $294 mln vs the $286.8 mln consensus. NFLX reports total subscribers of 7.02 mln vs 6.8 mln street expectation (company guidance 6.7-6.9 mln). NFLX reports churn 4.2% vs 4.5% street expectation . Co issues upside guidance for Q4, sees GAAP EPS of $0.09-0.16 vs. GAAP $0.04 consensus; sees Q4 revs of $297-302 mln vs. $284.54 mln consensus. -

Tulemuste tabel taaskord uuendatud.