Börsipäev 19. november - sel aastal jõuluvana ei tule?

Kommentaari jätmiseks loo konto või logi sisse

-

Tegin natukene pattu ning panin huvilistele Pro alla üles reedese analüüsi Citigroupilt Swedbanki ja SEBi kohta. Käistletud on natukene ka inflatsiooniteemat ning kinnisvaraturgu Baltikumis.

-

See ka mõni patt....

-

Sel juhul head lugemist : )

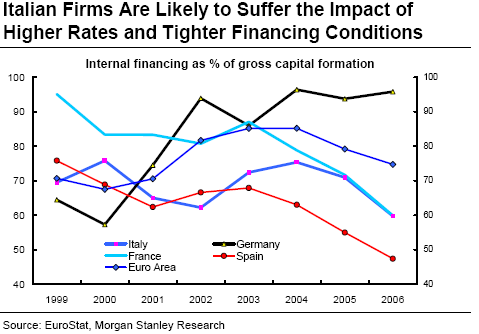

Morgan Stanley on teinud huvitavat statistikat riikide kaupa Euroopas. Võrreldes Euroopa keskmisega, kasutavad Itaalia, Hispaania ja Prantsusmaa firmad vähem omafinantseeringut ja rohkem laenuraha. Kui krediidiprobleemid suurenevad, peaks nende riikide ettevõtete situatsioon kehvem olema võrreldes näiteks Saksamaa firmadega.

Kommentaar ka Euroopa tarbija kohta: Consumer spending looks set for a slowdown after an unsustainably strong first half of the year. After all, wages are barely rising once we account for inflation, and both tax pressure and interest rates have risen in the recent past. Forward-looking consumers are likely to react, allowing their savings to rise and their consumption growth to fall.

Viimasel ajal on palju räägitud Doug Kassist ning tema on peale oma ringreisi Euroopas suurimaid Euroopa indekseid shortima hakanud, viidates just tarbija isegi suuremale potentsiaalsele nõrkusele kui USA-s. Raske uskuda, et tarbija Euroopas keerulisemas situatsioonis on, kuid tarbimiskulutusi võidakse küll tublisti koomale tõmmata.

USA aktsiaturgude futuurid on hetkel indikeerimas päeva algust nullis. Naftahind aga 1.2% kõrgemal.

-

Merrill Lynch upgrades Yahoo! (YHOO 26.82) to Buy from Neutral

-

Sel aastal jõuluvana ei tule?

USA jaemüüginäitajad tõotavad tulla sel jõulumüügihooajal hädiseimad alates 2002. aastast - J.C. Penney Co (JCP), Starbucks (SBUX) ja FedEx (FDX) on läinud nädalal aina tugevamalt märku andnud jahtuvast majanduskliimast ning seeläbi ka tarbimisest.

PICTET: ‘‘The reports this past week indicate that things are really bad,’’ Patricia Edwards, a Seattle-based money manager at Wentworth, Hauser & Violich, said Nov. 16. Her firm manages $11.9 billion in assets, including shares of several store- chains. ‘‘Early indications are this is going to be a much slower time going forward than previously expected,’’ she said.

The surge in borrowing costs and the worst U.S. housing slump in 16 years are discouraging consumers from spending, analysts said. Retailers reported slowing sales in September and October, and analysts said chains catering to middle-income customers may be hurt the most in the next six weeks.

FedEx Corp., the second-largest U.S. package-shipping company, cut its profit forecast on Nov. 16 for a second time because of rising fuel costs and weak freight demand.

Shares of retailers have been plunging since the holiday sales season started Nov. 1. The Standard & Poor’s 500 retail index is down 9 percent this month, including a 23 percent drop by J.C. Penney, the third-largest U.S. department-store chain.

The holiday selling season’s losers may be the companies that don’t manage to adjust their variable costs like store hours and advertising to compensate for decelerating sales. Such discipline helped Macy’s Inc. and Williams-Sonoma Inc. affirm their profit forecasts this past week.

-

Lowe's raporteeris oma kolmanda kvartali tulemused ning andis samas ka neljanda kvartali prognoosid, mis olid päirs koledad - juhtkonna sõnul samas ka konservatiivsed. SSS prognoos viimaseks kvartaliks jääb -3-5% vahemikku:

reports Q3 (Oct) earnings of $0.43 per share, includes $0.05 gain, may not be comparable to the Reuters Estimates consensus of $0.41; revenues rose 3.2% year/year to $11.56 bln vs the $11.78 bln consensus. The company expects comparable store sales for Q4 of -3-5%.Co issues downside guidance for Q4, sees EPS of $0.25-0.29 vs. $0.36 consensus.

"The home improvement consumer remains pressured by the ongoing housing correction, tighter credit standards in the mortgage market, and rising financial obligations, but we believe our guidance for the fourth quarter reflects these factors and is appropriately conservative given the uncertainties that exist," Niblock concluded.

"Pressures on our industry are likely to continue well into 2008, but we remain committed to our goal of providing great products and unmatched customer service and capitalizing on opportunities to ensure we gain profitable market share regardless of the level of industry growth."

-

Lühike ülevaade, mida võib Dow teooriale põhinedes aktsiaturgude olukorrast välja lugeda.

-

Artikkel sellest (vene keeles), kuidas Vimpelcom (VIP) kavatseb vallutada Aasia ja MTS (MBT) Aafrika turge.

-

USA suurimate indeksite futuurid on 0.5% miinuses. Goldman on downgradenud Citigroupi, uskudes, et järjekordsed $15 miljardit kirjutatakse krediidiprobleemide tõttu maha. Aktsia eelturul üle 2.5% miinuses. Võimatu öelda selle peale, kas aktsia on üle või alahinnatud kuid annab märku jätkuvalt riskitasemest.

-

NC vahendusel

Euroseas (NASDAQ:ESEA): Target upped to $21 from $17 at Oppenheimer

Oppenheimer is out on Euroseas (NASDAQ:ESEA) raising their tgt to $21 from $17 as they believe the company is poised to realize meaningful fleet growth. Accordingly, ESEA has the potential to deliver solid YoY earnings growth in 2008, even if dry-bulk rates stagnate. Furthermore, ESEA's balanced fleet mix of dry-bulk and container vessels should enable the company to participate in the currently strong dry- bulk rate environment while, at the same time, increasingly capitalizing on the rapidly growing inter-Asian container trade, which appears to be well suited for the company's small container fleet. Management's chartering and S&P strategy should continue to drive solid ROIC performance.

With the shares currently trading at 7.0x 2008 EPS estimate of $2.05, a 28.7% discount to dry- bulk universe (net ESEA), the firm believes ESEA presents compelling value in light of its growth potential.

Notablecalls: The dry-bulk space continues to be among traders' favs here. With the stock down over 1/3 over the past couple of weeks and OpCo coming out with such strong comments, it's due for a bounce. Also, note that technically, the stock rests right above its 200MA. -

Speedy, correct me if I´m wrong - Esea raisis stocki müügiga a 107 m$. Kuskilt jäi meelde, et drybulk-carrierite hind on kuskil 50-100 m$, st. et saadud papi eest saavad nad osta 2 uut (st. kasutatud) laeva?

-

loe selle aasta pressiteateid

saad pildi ette erinevate laevade hindadest ja palju nad sisse võiksid tuua -

seelle laeva hinna võtsin DRYS-i pressikast, vaevalt et esea numbrid eriti erinevad sellest, olen kyll esea omadel silma peal hoidnud, kuid pole laeva hindade jutule sattunud, eks otsin vanematest

-

Goldman on downgradenud Citigroupi ja samas usub Dow Jones tõusu 1600 juurde? Kui suure osakaalu Citigroup annab Dow Jones koosseisus?

-

OK, panamax M/V Trust Jakarta maksis siis 28,6 m$. Augustis ostetud laev 24m$. Selliseid saaks siis 4tk. Samas DRYS-i preesikast:

To build a new panamax costs $53 mil, but a five-year-old panamax would cost $85 mil, Mavrinac says. Once the company buys a used ship, the ship can be put on the water right away to take advantage of strong spot rates, but it will take two to three years for a new ship to be delivered. DryShips didn't want to wait

Laeva suurusest küll juttu pole, ju siis asi selles -

Henno, kui sa meie vahendatud kirjutisest infot võtsid, siis jutt käis S&P 500st. Mul ei ole küll hetkel aega otsida, aga mälu järgi tähendas transpordi kukkumine mitte ainult DJIA langemist, vaid kõikide laiapõhjaliste indeksite (sh S&P 500) kukkumist.

-

WN

siis tasub alustada sellest, et teha selgeks, mis on ESEA erinevus võrreldes teiste sektori firmadega?

näiteks võrreldes DRYS'ga -

Madis

S&P500 jah, Dow 1600 oleks veidi pessimistlik :)

Veidi susserdasin, sest Sinu loos oli juttu nii Dowst kui S&P500st, aga kas finantssektor pole mitte suurim S&P500 suurim komponet ja seal omakorda Citigroup suurim komponent? Veidi vastukäivad on need arvamused igal juhul? -

Henno, tõepoolest annavad indeksile enam kaalu finantsettevõtted:

Finantssektor moodustab hetkel 20.4% indeksist ning Citigroup on tõesti sektori üks suuremaid komponente (ainult BAC on suurem), moodustades indeksi koosseisust 1.32%. Kuigi Citi downgrade'mine ja turutõusu ootused on vastuolulised, siis üks ei välista teist. Lisaks oodatakse paljude turuosaliste poolt finantssektoris veel aastalõpurallit ning lõpetuseks - nii suure maja, nagu Goldman Sachs, üks arm ei peagi teadma, mida teine teeb. :)

-

Saksamaa DAX -0.74%

Prantsusmaa CAC 40 -0.44%

Inglismaa FTSE 100 -1.09%

Hispaania IBEX -0.64%

Venemaa MICEX -1.26%

Poola WIG -0.25%

Aasia turud:

Jaapani Nikkei 225 -0.74%

Hong Kongi Hang Seng -0.56%

Hiina Shanghai A (kodumaine) -0.88%

Hiina Shanghai B (välismaine) +0.54%

Lõuna-Korea Kosdaq -0.60%

Tai Set -2.52%

India Sensex -0.33%

USA on päeva alustamas ca -0.3% kuni -0.4%ga.

-

Don't Fall Off the Balance Beam This Week

By Rev Shark

RealMoney.com Contributor

11/19/2007 7:56 AM EST

Happiness is not a matter of intensity but of balance and order and rhythm and harmony.

-- Thomas Merton

Thanksgiving week presents us with an intriguing mix of market conditions. There is no question that the mood has been sour recently as investors contemplate how bad the bad-debt fallout will be and whether the Fed will ride to the rescue once again. However, we have already suffered a fairly good pullback, and the holiday spirit around Thanksgiving historically tends to produce some pretty good trading action.

The key to profits right now is balance. The negatives are piling up and the technical condition of the market is deteriorating. We have to respect that fact and make sure we take some defensive action. We need to have some cash on hand in order to take advantage of further weakness and we need to make sure we don't let losses grow too great if the downtrend accelerates further.

While there is much danger lurking, there is also the potential for some big rallies. We saw a good example last Tuesday, when the DJIA gained 320 points. If your timing is right there were some nice gains to be had. We have subsequently given back a big proportion of that advance, but that helps set us up for another sudden and substantial spike.

What we have to watch for are signs that the negativity is growing too great, as that is the condition that tends to lead to quick rebounds. When nervous and uncertain market players throw in the towel out of frustration, fear or disgust, the snap back up can be surprisingly strong. Of course, it isn't easy to time such things, and more often than not the mood feels so bleak during the selling pressure that it is tough to even consider the idea of timing.

So, balance is the name of the game this week. On one hand, we need to make sure we recognize and appreciate that this market is acting very poorly and we need to be defensive. On the other hand, we also want to be opportunistic and be ready to make some money on the long side should the right conditions occur. How you approach this market depends much on your style and time frame. This is not a good environment for passivity. You have to be ready to move if you hope to profit from the volatility we are likely to see, and it is very important that you not let shorter-term trades turn into investments if they don't work as you hope.

We have some softness this morning as Goldman downgrades Citigroup (C) to sell, China restricts bank lending to cool speculation and overseas markets struggle. If you are looking to play some upside this week, it is probably better that we don't see a euphoric Monday morning open that tends to invite selling. There are a lot of traders out there looking for typical Thanksgiving strength and they are going to give it a try at some point and may make seasonality self-fulfilling.

-----------------------------

Ülespoole avanevad:

In reaction to earnings/guidance: DHT +13.54%, CSUN +8.5%...Other news: NTOL +86.3% (agrees to be acquired for $4.40 per share), NX +38.8% (announces plan to separate its Building Products and Vehicular Products businesses), PHRM +38.0% (CELG to buy for $72 per share), ELNK +11.7% (considering strategic alternative for municipal wireless business), DISH +10.4% (Barron's reports T may be interested in buying DISH, also upgraded to Buy at Citi), BIDZ +6.8% (profiled in Investor Business Daily), CTB +5.7% (authorizes stock repurchase up to $100 mln), CRNT +3.3% (initiated coverage at Lehman), ONXX +2.9% (announces FDA approved sNDA for Nexavar tablets for unresectable hepatocellular carcinoma), GME +2.3% (Cramer gives positive comments, initiated with neutral at tier-1 firm), RIG +1.7% (announces contract estimated revs at $569.4 mln), STJ +1.6% (Cramer gives positive comments)...Analyst upgrades: STP +2.7% (hearing tgt raised to $100 at tier-1 firm), YHOO +1.4% (hearing upgraded to Buy at tier-1 firm), QCOM +0.7% (upgraded to Overweight at JPMorgan).

Allapoole avanevad:

In reaction to weak earnings/guidance: LOW -4.0%, VAL -4.0%, CYBX -3.4%, TDG -2.8%, FMCN -1.2%...Other news: SIFY -14.7% (SABA and SIFY announce they will work together to deliver learning platform and services to India), ACGY -5.6%, LOGI -4.2%, LMC -3.8%, FNM -3.7% (prices $500 mln of preferred stock at $25), AAUK -3.6%, BHP -3.5%, ABB -3.5%, LVS -3.2% (negative comments from Barron's), CELG -2.7% (CELG to buy for $72 per share), WYNN -2.6% (negative comments from Barron's), BZP -2.4% (files $266 mln common stock shelf offering)...Analyst downgrades: DFS -4.3% (hearing downgraded to Sell at Tier-1 firm), UBS -3.1% (downgraded to Sector Perform at CIBC), C -2.9% (hearing downgraded to Sell at tier-1 firm), VMW -2.8% (in reaction to Barron's comments), FNM -2.5% (downgraded to Market Perform at Friedman Billings), ETFC -1.7% (hearing downgraded to Sell at tier-1 firm), MER -1.2% (hearing downgraded to Sell at tier-1 firm). -

Henno, Goldman langetas Citigroupi hinnasihi ka kõigest $33 tasemele, kus aktsia hetkel ka kaupleb.

-

Commercial property now under pressure

WSJ reports the value of commercial real estate, which nearly doubled in the past seven years, is now starting to decline due to the credit crunch, according to a report set to be released today by Moody's Investors Service. The report found that the value of commercial property declined 1.2% in September from the previous month. Particularly hard hit were apartments in the West and office property in most states other than California. The report is an early sign that the commercial-property sector is being dragged down by the growing reluctance of lenders to extend credit for anything related to real estate, which in turn could create a new drag on the economy and additional problems for investors. Declining commercial-property values could lead to an increase in default rates on commercial real-estate loans and on commercial mortgage-backed securities. No one is predicting that defaults in the commercial sector will come close to rivaling those in the housing sector.

-

LOW kaupleb hetkel üle 7% madalamal. Just niipalju on investoritel usku (housinguga seotud) jaemüügi tulevikku. Ootused jõulumüügi osas hakkavad kahtlemata alla tulema, mis võib tegelikult pakkuda ka võimalust üllatuseks.

-

SPY 12. oktoobri põhi on 143.7, mistõttu seal ilmselt päris palju stoppe üleval ning ka ostupool enne seda taset võiks olla paksem. Kui läbi ei vajuta, võidakse bidde päeva jooksul hakata tasapisi ülespoole nihutama. See-eest läbivajumise korral võime näha pullide kapituleerumist.

-

Turg üritab päeva põhjadest põrgata - laua pealt on viimasel ajal väga palju raha ära võetud, mis tähendab, et kui põrge peaks tulema, võib see ootamatult väga kiiresti võimenduda, kui raha hakkab mängu tagasi tulema. Hetkel on suhtumine veel väga ettevaatlik.

-

Kui olukord on paanika-hõnguline võivad turul taas üles kerkida jutud võimalikest intressimäära kärbetest - seda polegi nii väga raske ette kujutada, arvestades mitu korda varem on need turule päästerõnga ulatanud.

-

Tänase 10y treasury tootluse (4,08%) juures on stabiilne pikaajaline ettevõte P/E-ga 20-25 täitsa ok investeering. Sellepärast PEP, KO, MO on üle mõistuse tugevad.

-

tahtsin öelda pikaajalises perspektiivis stabiilne...

-

MCD ja JNJ ka :)

-

MCD kõrvale oleme vaadanud ka BKC'd, kelle vaba rahavoog peaks eelduste kohaselt moodustama turukapitalisatsioonist 2008. aastal ca 5.5%, 2009. aastal 5.7% ning 2010. aasal 6.4%. Pole sugugi halvad numbrid stabiilselt tegutseva ettevõtte kohta.

-

Järelturul tuleb Hewlett-Packard tulemustega, mis lööb ootusi.

HPQ Hewlett-Packard beats by $0.04, beats on revs; guides Q1 EPS above consensus, revs above consensus; guides FY08 EPS above consensus; announces $8 bln buyback (49.44 -1.31)

Reports Q4 (Oct) earnings of $0.86 per share, excluding non-recurring items, $0.04 better than the Reuters Estimates consensus of $0.82; revenues rose 15.0% year/year to $28.3 bln vs the $27.44 bln consensus. Co issues upside guidance for Q1, sees EPS of $0.80, excluding non-recurring items, vs. $0.77 consensus; sees Q1 revs of $27.4-27.5 bln vs. $27.04 bln consensus. Co issues upside guidance for FY08, sees EPS of $3.32-3.37, excluding non-recurring items, vs. $3.26 consensus. Co also announced an $8 bln buyback. -

Speedy,

Mismoodi puudutab drysi ja esea äri erinevad kontseptsioonid laevade turuhinda? See, et drys tegutseb spot-marketil ja rendib laevu lühiajaliselt kallimate tariifidega ja esea annab laevad rendile pikaajaliselt (väiksemate tariifidega) ei muuda seda, et mõlemad ostavad kasutatud laevu ja nende hinna määrab turg. Laevade hinnalipikute erinevused lihtsalt imelikult suured mõlema firma teadetes. -

sama suurusega laevade hinnad sõltuvad ka nende vanusest

drys laevad on suuremad kui esea omad ning ka uuemad