Börsipäev 4. detsember

Log in or create an account to leave a comment

-

Eile hilisõhtul tuli veel üks asjalik kommentaar härra Cramerilt, kes toetas positiivsete sõnadega LHV Pro all välja käidud Altriat (MO), uskudes, et 2008. aastal näeme ettevõtte poolt aktsiate tagasiostu programmi:

Altria (MO) has not been able to buy back stock ever since a judge ruled that it had to put $1.2 billion in escrow as part of the Engle case in Florida. They just got the $1.2 billon back. Buyback coming next year...

-

Capital Economics kurtis eile USA majanduse väljavaadete üle ning jätkuvalt usuvad nad, et 4. kvartali SKP tuleb negatiivne ning 2008. aasta 1. kvartali number võib ehk ääri-veeri siiski positiivne tulla, kuid +0.5%line prognoos 1. kvartaliks jätab võimalused lahti ka kaheks järjestikuseks negatiivse SKP kasvuga kvartaliks, mis tähendaks teoorias majanduslangust.

Intressimäärasid nähakse 2008. aasta keskpaigaks 3.5% tasemel (hetkel 4.5%), kuna majanduse probleemid vajavad odavama rahaga stimuleerimist. 11. detsembri miitingult ootavad nad langetamist 4.25% peale. Mures ollakse ka dollari pärast, mida selline langetamine kaasa võib tuua, seda enam, et on võimalik, et Pärsia lahe 6-st riigist koosnev GCC ühenduse liikmed võivad hakata oma valuuta fikseeritusest dollari vastu lahti ütlema.

Aga eks neid negatiivseid datapointe ole juba pikka aega kuhjunud ning tasub ikkagi 11. detsembri Föderaalreservi miitinguga arvestada. Seni on intresside langetamised kaasa toonud aktsiate tõusu ning lühikeste positsioonide omamine enne juba 6 kauplemispäeva pärast toimuvat Fedi miitingut ei tundu just kõige ahvatlevam mõte. Ja ma arvan, et sarnaselt mõtlejaid on turul teisigi….

Kas tänased mõtted lühikeste positsioonide omanikel ei võiks mitte olla:

Fool me once, shame on you;

Fool me twice, shame on me;

Fool me three times, shame on… who?? -

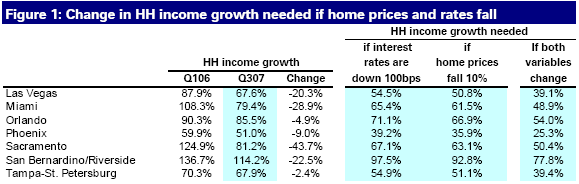

Deutsche Bank on tulnud välja huvitava kommentaariga majadeehitajate osas. Kolmandas kvartalis langesid elamute hinnad esimest korda suuremas mahus, vähendades nii rentimise-ostmise vahet ning põhjustades nii mitmetel turgudel suure muutuse ostujõus. Deutsche toob välja, et langevate intressimäärade ja elamuhindade tõttu võib kuni 66% riigist jõuda taas kord kinnisvarahindadeni, mis on inimestele taskukohased.

Elamute mediaanhinnad langesid kolmandas kvartalis 22-s linnas. Eelneval kvartalil langesid hinnad vaid 4s linnas. Sacramento led at -10.6% y-o-y but was joined by San Bernardino (-7.6%), Detroit (-7.3%) and Las Vegas (-7.1%).

Igas kvartalis kalukuleerib Deutsche kui palju peaksid elamuhinnad, intressimäärad, sissetulekud ja rendimäärad muutuma, et jõuda tagasi ekviliibriumi tasemele. Kõige tundlikumad muutujad on elamuhinnad ja intressimäärad. Q106 pidid sissetulekud tõusma Sacramentos 125% et jõuda taas tasakaalupunktini, täna on see protsent 81. DB: The big delta was the home price decline. If interest rates decline as well, this could provide another big push forward.

source: DB

Ma küll ei usu, et asjad veel kiiresti muutumas on, kuid järgmine lõik Deutsche poolt on huvitav:

66% of the markets could be affordable – up from 19% today At the end of the day, the most critical metric is affordability: does someone have the income to afford the house? We estimate that 19% of the country is in an “affordable” housing market. But if home prices fall 10% and rates come down 100 bps, about 66% of the country could be in “decent” shape.

Kui majadehinnad 2008. aastal 10% kukuvad, suureneb kindlasti laenude tagatiseks ära võetavate objektide maht – efekt töötab ka mõlemat pidi. Deutsche usub, et 10% langus jätab siiski veel paljude inimeste kodudesse piisavalt väärtust ning kuigi me ei näe mitmete aastate jooksul hinnatõusu, võib turu põhi juba käeulatuses olla.

Hetkel on vaid Sacramento turg, mis on näidanud 10-protsendilist langust elamute hindades ning ilmselt järgivad sama käekäiku mitmed teised. Samuti on raske öelda kui kiiresti see juhtub. Although Libor has fallen 50 bps, one-year mortgage rates have dropped only 20 bps as spreads have widened. So a recovery does not appear imminent, but if the Fed or other policy makers can get to those adjustment levels, it may restore some equilibrium to 66% of the country.

-

Saksamaa DAX -0.24%

Prantsusmaa CAC 40 -1.54%

Inglismaa FTSE 100 -1.08%

Hispaania IBEX -0.59%

Venemaa MICEX -0.20%

Poola WIG +0.02%

Aasia turud:

Jaapani Nikkei 225 -0.95%

Hong Kongi Hang Seng +0.77%

Hiina Shanghai A (kodumaine) +0.98%

Hiina Shanghai B (välismaine) -1.57%

Lõuna-Korea Kosdaq +1.44%

Tai Set +0.27%

India Sensex -0.38%

-

Find the Opportunity in a Bad Market

By Rev Shark

RealMoney.com Contributor

12/4/2007 8:09 AM EST

A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.

-- Winston Churchill

Since the beginning of November, the market has become very troubled. The focus has turned to the extent of the bad-debt issues and the slowing economy. Any good news is quickly buried as we wrestle with those two major issues. We had a pretty good bounce last week, but worries and concerns about the future have been growing and have cast a pall of gloom.

So how do we handle this difficult time in the market? It is quite easy to get caught up in the worry and despair and to feel as if we have no chance of making any money, but that isn't very productive. Ultimately, pessimism always robs us of profit-making opportunities. So it is important that we think positively, even in a sea of gloom.

That doesn't mean that we start thinking the market is going to bottom soon or dismiss the fact that the market is acting poorly. It means that we adapt to the environment and stay positive about our ability to find ways to make money.

The first step in cultivating a positive attitude in a difficult environment is to make sure you have a high level of flexibility. You should have plenty of cash in reserve so you don't feel undue pain in this poor market and are ready to make moves as events unfold. If you are heavily invested and losing money daily, you will find it impossible to maintain a positive attitude. Being able to react in a difficult market is paramount -- if you can do that, it is much easier to cultivate an attitude that is optimistic about finding ways to profit.

In the near term, the most likely catalyst for profits is the upcoming Federal Open Market Committee interest rate decision next Tuesday afternoon. I believe it is very likely that we will see another cut of 0.5 percentage points, and I expect that the market will begin to anticipate that in the next few days.

The market seems increasingly skeptical about the ability of the Fed to save us from all our problems, but it is still likely to be at least a little encouraged by a Fed that is willing to cut rates and pump up liquidity. Whether the market sees longer-term benefit from another rate cut is very questionable, but at least in the short term, the Fed should be a catalyst for some tradable action.

The important thing to keep in mind right now is that this market is breaking down and that we can't expect to find great opportunities through assuming that things are going to change. We have a lot of negatives right now, and we need to respect them while staying positive about ways to profit.

We have a negative start this morning as overseas markets were mostly negative and worries about more bad debt dominate. I'm looking for a long-side trade setup to develop, and this negative open is exactly what we need.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CRMT +17.0%, AZO +4.3%, SAFM +3.3%, CMGI +2.7%, CPWM +2.6%, SD +2.6%, ARW +2.2%... Other news: JMBA +12.1% (announces exclusive licensing agreement with Nestle to produce and distribute healthy ready-to-drink beverage), PWRD +9.6% (to launch closed beta testing for 'Chi Bi' on 12/18; also Cramer makes positive comments), PZE +7.0% (still checking), MBLX +4.8% (announces national release of gift card by TGT; positive broker comments following the news), CPKI +4.3% (Farallon Capital discloses 5.3% in SC 13D), PAY +3.7% (held conference call after the close to discuss restatement; stock is seeing multiple defenses this morning following call), APC +2.9% (announces oil discovery in West Tonga prospect), TASR +2.5% (receives follow-on orders from 2 law enforcement agencies), AGYS +2.3% (signs agreement to sell ORCL applications), DELL +2.1% (announces authorization of $10 bln of share repurchases), DAR +2.0% (Morgan Joseph notes November pricing strength continues), DT +1.6% (wins ruling in iPhone sales dispute - Bloomberg), RICK +1.3% (intends to focus acquisition efforts on east coast), FMCN +1.1% (hearing Pali Research starts coverage with Buy and $100 price tgt)... Analyst upgrades: CCOI +1.6% (upgraded to Outperform at RBC), VDSI +1.2% (upgraded to Buy at ThinkEquity), ALTH +1.0% (initiated with Buy at BofA).

Allapoole avanevad:

In reaction to weak earnings/guidance: PVH -5.3% (also approves $200 mln share repurchase), LAYN -4.2%, MDU -4.1%, ISLE -3.8%... Other news: TRMP -10.6% (discloses resignation of CFO), NFI -8.4% (pulling back after 150% gain in past two days), STKL -5.3% (announces secondary share offering), DSX -5.0% (still checking), BCS -5.0% (WSJ reports money-mkt funds likely still holding securities recently put on review for downgrade at Moody's), HCN -4.3% (announces offering of 3.5 mln shares of common stock), HOLX -3.5% (announces public offering of $1.3 bln of convertible senior notes), PLLL -3.5% (files for 2 mln share common stock secondary offering), SIRI -3.5% (down in sympathy with XMSR), NOK -3.1% (presents key tgts and forecasts for next 1-2 years at annual investor event; announces collaboration with TI and plans to acquire Avvenu), CYTK -2.9% (announces an abstract summarizing interim clinical trial data evaluating SB-743921), UCTT -2.9% (comments on court injunction for patent infringement on Celerity), RIG -2.8% (files for mixed shelf offering), MT -2.4% (acquires NSD Limited; plans to strengthen position in Brazil through tendering cash offer for remaining shares of ArcelorMittal Inox Brasil S.A.), UBS -2.0% (WSJ reports money-mkt funds likely still holding securities recently put on review for downgrade at Moody's), STKL -1.8% (announces secondary share offering), CFC -1.7% (still checking), BHP -1.6% (China's Baosteel mulls bid to counter BHP's $125 bln takeover offer for RTP - Reuters), RCII -1.3% (announces store consolidation plan; expects pre-tax monthly operating income benefit of $2-2.5 mln)... Analyst downgrades: XMSR -5.2% (hearing downgraded to Sell at tier-1 firm), RBS -4.4% (initiated with Underweight at Morgan Stanley; also lowered price tgt), LEH -3.2% (downgraded to Sell at Punk Ziegel, also ests reduced at JPMorgan), GS -2.4% (downgraded to Sell at Punk Ziegel, also estimates reduced at JPMorgan), BSC -1.9% (downgraded to Sell at Punk Ziegel), ORCL -1.7% (downgraded to Outperform at JMP), MS -1.5% (estimates reduced at JPMorgan), MER -1.3% (estimates reduced at JPMorgan). -

Kanada Keskpank langetas täna intressimäärad 4.25% peale. Arvestades, et Kanadas USA-laadseid probleeme eriti ei ole, on pigem sentimentaalse langetamisega, et anda ruumi ka USAle intresse allapoole tõmmata.

-

Soovitaks silm peale heita Fundtechile(FNDT) - aktsia on allapoole tulnud ning väärib neilt tasemetelt investeerimise eesmärgil ostmist. Lisaks igasuguste toetustasemete otsijatele võib ära märkida, et kaubeldakse otse 200-päeva eksponentsiaale keskmise peal.

Diskleimer: Oman FNDT aktsiaid pikaajalises investeerimisportfellis.

-

Briefing teeb kokkuvõtte Credit Suisse analüüsist, kus öeldakse, et Circuit City (CC) võib olla oma põhja ära teinud:

CC Circuit City shares may have hit rock bottom; co could be enjoying decent Christmas thus far - Credit Suisse (6.44 -0.02)

Credit Suisse says that CC still has numerous issues to grapple with, yet the co's involvement in the hottest retailing sector this holiday season may be a saving grace. Store checks, discussions with store employees, and comments from Sears lead firm to believe that CC is enjoying a decent Christmas thus far. Firm believes their prices are good, the help is fine, and for now the product cycle has likely given them a reprieve. Firm says, should that continue, CC shares may have already hit a near-term bottom. Firm values shares of CC at $8.50. -

10 kuulujuttu, mis Wall Streedil ringi liiguvad - Doug 'Karu' Kassi sulest:

1. A publicly held homebuilder will shortly file bankruptcy. (Hint: It currently trades for under $10 per share.)

2. More land deals -- similar to Lennar (LEN)/Morgan Stanley (MS) -- are on the plate.

3. Numerous capital infusions are in the process of being planned in the domestic mortgage insurance and origination areas - with acquirors in the real estate and finance areas.

4. Over there, a large bank bailout will be announced by year-end. (I think in Germany, again.)

5. Two large brokerage firms will announce major headcount reductions in the next week.

6. A handful of $1 billion to $5 billion hedge funds have already announced closure at year-end. A major commodities trading firm and several large fund of funds will close. Expect to read about these disclosures over the next 10 days.

7. Several sizeable cross-border mergers will be announced by year-end, and one $25 billion+ deal may be made public by next Monday morning. KKR Financial Holdings (KFN) will make a large consumer products acquisition by January's end.

8. Two brokerages will announce a change in strategists' assignments by year-end.

9. Friday's jobs number will be very weak, with a drop of over 50,000 jobs.

10. High-end retail sales have been sluggish. -

Cramer on pimpinud Altriat juba v2ga pikka aega.

-

antonel,

nii ta on jah. Kuna ta on ka ise aktsias pikk, pole see üllatav.