Börsipäev 31. detsember - Head vana-aasta lõppu ja veelgi paremat uut!

Log in or create an account to leave a comment

-

Meeleolukat aastavahetust kõigile! Kuid ära ei tohiks unustada ka ohutust - nädalavahetusel teatas näiteks Baidu.com (BIDU), et pühade puhkusel Hiinas hukkus 27. detsembri õnnetuses ettevõtte finantsdirektor (CFO) Shawn Wang. Kuigi otsest mõju ettevõtte tulemustele selles sündmuses ei nähta, mõjub see töötajate enesetundele ja tootlikkusele lühemas perspektiivis kindlasti negatiivselt

Aktsiaturud USAs peaksid täna olema avatud täispäev - investeerimiskontolt saab tehinguid teha Eesti aja järgi kuni kella 20ni, LHV Traderi vahendusel on võimalik selle aasta viimasest kauplemispäevast maksimum välja võtta. -

Täna kell 17.00 Eesti aja järgi teatatakse olemasolevate majade müüginumbrid novembrikuu kohta. Nagu mäletate, olid uute majade müüginumbrid reedel ikka eriti nadid.

Tänasest raportist oodatakse aasta baasile viiduna 5 miljoni maja müümist. Oktoobris oli see näitaja 4.97 miljonit, septembris 5.03 miljonit, augustis 5.48 miljonit ning juulis 5.75 miljonit. Viimasel kahel kuul on majade hinnad võrreldes aastataguse perioodiga keskmiselt vähenenud ca 5%. -

Fears are mounting that Merrill Lynch will be forced to write down between $10bn and $15bn worth of assets related to CDOs ... when it reports financial results next month.

-

Ja link ka: http://www.guardian.co.uk/business/2007/dec/30/merrilllynch.subprimecrisis

-

Losses arising from America’s housing recession could triple over the next few years and they represent the greatest threat to growth in the United States, one of the world’s leading economists has told The Times.

Robert Shiller, Professor of Economics at Yale University, predicted that there was a very real possibility that the US would be plunged into a Japan-style slump, with house prices declining for years.

Professor Shiller, co-founder of the respected S&P Case/Shiller house-price index, said: “American real estate values have already lost around $1 trillion [£503 billion]. That could easily increase threefold over the next few years. This is a much bigger issue than sub-prime. We are talking trillions of dollars’ worth of losses.”

He said that US futures markets had priced in further declines in house prices in the short term, with contracts on the S&P Shiller index pointing to decreases of up to 14 per cent.

“Over the next five years, the futures contracts are pointing to losses of around 35 per cent in some areas, such as Florida, California and Las Vegas. There is a good chance that this housing recession will go on for years,” he said.

Professor Shiller, author of Irrational Exuberance, a phrase later used by Alan Greenspan, the former Federal Reserve chairman, said: “This is a classic bubble scenario. A few years ago house prices got very high, pushed up because of investor expectations. Americans have fuelled the myth that prices would never fall, that values could only go up. People believed the story. Now there is a very real chance of a big recession.”

He pointed out that signs at the beginning of 2007 that had indicated that some states were beginning to experience a recovery in house prices had proved to be false: “States such as Massachusetts had seen some increases at the beginning of the year. Denver also looked like it had a different path. Now all states are falling.”

Until two years ago, each of America’s 50 states had experienced a prolonged housing boom, with properties in some – such as Florida, California, Arizona and Nevada – doubling in price, fuelled by cheap credit and lax lending practices to borrowers who ordinarily would not have been able to secure a mortgage. Two years ago, the northeastern states of America became the first to slide into a recession after 17 successive interest-rate rises between June 2004 and August 2006 hit the property market.

Last week, new numbers from the S&P/Case Shiller index showed that house prices had declined in October at their fastest rate for more than six years, with homes in Miami losing 12 per cent of their value.

http://business.timesonline.co.uk/tol/business/economics/article3111659.ece -

jyriado 31/12/07 12:01 posti juurde sobiv lisa

NY Post: Merrill (MER) in talks with Chinese and Middle Eastern sovereign-wealth funds to raise capital. -

MER, C ja JPM - 3 ponksu poissi, kes viimasel ajal kõige suuremaid tolmukeeriseid (loe: jutte mahakirjutamistest) seni üles keerutanud.

-

Kui Euroopast rääkida, siis nähakse ikka häid aegu börsidele - muidugi üks eeldusi siinjuures on aga intressimäärad, mida ECB ja Inglismaa Kekpank peaksid Euroopas langetama hakkama.

Bloomberg.com reports that Citigroup sees 'double-digit' gain in European stocks as central banks cut interest rates to boost economic growth. The firm believes European equities should be supported by lower rates, macro resilience, earnings growth, reasonable valuations and liquidity and expects the U.K.'s FTSE 100 Index to reach 7,000 by the end of 2008. The firm thinks European stocks, measured by price relative to earnings, are cheaper than U.S. and Asian equities. World economic growth is likely to decline to 3.4% in 2008 from 3.7% this year, with the U.S. economy showing 'resilience' rather than falling into recession, assuming the Federal Reserve cuts interest rates, according to Citigroup. -

USA turud on aasta viimast päeva alustamas miinuspoolelt, kogunisti poole protsendi jagu altpoolt avaneb tehnoloogiasektori liikumist kajastav QQQQ.

Saksamaa DAX N/A (börs suletud)

Prantsusmaa CAC 40 -0.23%

Inglismaa FTSE 100 -0.31%

Hispaania IBEX N/A (börs suletud)

Venemaa MICEX N/A (börs suletud)

Poola WIG N/A (börs suletud)

Aasia turud:

Jaapani Nikkei 225 N/A (börs suletud)

Hong Kongi Hang Seng +1.62%

Hiina Shanghai A (kodumaine) N/A (börs suletud)

Hiina Shanghai B (välismaine) N/A (börs suletud)

Lõuna-Korea Kosdaq N/A (börs suletud)

Tai Set N/A (börs suletud)

India Sensex +0.40%

-

Wiping the Slate Clean

By Rev Shark

RealMoney.com Contributor

12/31/2007 8:44 AM EST

"We will open the book. Its pages are blank. We are going to put words on them ourselves. The book is called Opportunity and its first chapter is New Year's Day." -- Edith Lovejoy Pierce

One of the great things about investing is that you can have a fresh start anytime you'd like. All you have to do is sell your positions and start over again. The end of the year is a particularly good time to do this. Investment returns from the past year are now wiped off the screen and we start at zero.

This past year has been a much more difficult one for investors than the major indices indicate. Although the Nasdaq is up over 10% for the year, much of that gain is due to strength in a small group of big-cap stocks such as Google (GOOG) , Apple (AAPL) , Microsoft (MSFT) and Research In Motion (RIMM) . The market has been a narrow one and the average stock has not fared that well. The Russell 2000 index of small stocks is probably more representative of the average stocks and it has declined around 2% for the year.

Regardless of those facts, the slate is wiped clean at the close today and it is up to us to find ways to prosper in 2008. Dwelling on the past is only helpful in that it helps us avoid making similar mistakes in the future.

In the end the lessons are always the same. Stay open minded, be flexible and don't be stubborn in holding on to a particular view of the market when it isn't acting the way you think it should.

My No. 1 investing resolution for 2008 is to be more aggressive. That means increasing the size of trades but, more importantly, it means acting more vigorously as market conditions change. I want to be a more aggressive buyer when I think things are turning up, but I also want to be more decisive about changing my position when the market isn't cooperative.

Today is a good day to reflect on what changes we plan on making in 2008 as the trading is likely to be slow and random. Sentimentrader.com points out that over the last 15 years the last trading day of the year has consistently been negative. Most of the positioning has been done and folks are just doing a little clean-up before the New Year's break.

That negative bias is at work in the early going. Overseas markets are mostly soft and we have a slightly negative open on the way. The news wires are very quiet but we do have some housing data coming up that may see a reaction.

-------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: JADE +81.6%, ASHW +2.3%... M&A news: TMY +85.7% (to be acquired by T.M.I. for $3/share)... Other news: DPTR +18.6% (announces strategic investment by Tracinda), VG +7.5% (will not have to pay Nortel to settle patent spat - DJ; to pay AT&T to settle patent dispute - Reuters), CHINA +4.0% (still checking), BBGI +4.0% (Gabelli Funds raises stake to 16.67% from 14.97%), AVNX +2.9% (recommend buying during overreaction - BWS Financial), ASTI +2.8% (extends gains after Friday's 25% surge), ASHW +2.3% (shares a compelling value, maintain Buy at B. Riley), MYL +1.4% (confirms announcement of final FDA approval for new drug application of Balsalazide Disodium Capsules), UA +1.1% (Credit Suisse makes positive comments), PBR +1.0% (near Friday's close, Ken Heebner on CNBC refers to new discovery that was announced by PBR earlier this year).

Allapoole avanevad:

General news: TIN -39.9% (completes its FOR spin-off), COGT -11.9% (mentioned negatively in Barron's), PZE -9.8% (pulling back following Friday's late day surge -- see archives for comments), SLXP -5.7% (confirms launch of COLAZAL authorized generic with Watson; downgraded to Sell at Piper Jaffray, also tgt lowered to $8.50 from $14 at Soleil), ADPI -4.8% (showing slight weakness after last week's 70% surge), MGIC -2.0% (announces sale of Advanced Answers on Demand to Fortissimo Capital for the sum of $17 mln in cash), HITK -1.5% (acquires Midlothian Laboratories for $5 mln in cash), BIDU -1.2% (announces CFO passed away). -

Ülalolevast Sharki kommentaarist on näha, et Sentimentrader.com'i järgi on viimased 15 aastat aasta viimane kauplemispäev olnud negatiivne. Pole just kuigi lohutav teadmine, kuid olekski ehk aeg mõni väike erand siia sisse tuua...

-

Olemasolevate majade müük vastab ootustele

Existing Home Sales 5.00 mln vs 4.97 mln consensus; +0.4% m/m; prior revised to 4.98 mln from 4.97 mln -

vahetult majade müügi eel tuli negatiivsema sisuga uudis ...

09:57 Defaults on insured mortgages rise 35% to record - Bloomberg

Bloomberg reports defaults on privately insured U.S. mortgages rose 35% in Nov from the same month last year, an industry report today showed, adding to evidence the U.S. housing slump is deepening. The number of insured borrowers falling more than 60 days late on payments jumped to 61,033 last month from 45,325, according to data from members of the Mortgage Insurance Companies of America. The missed payments, often a prelude to foreclosure, represented a 2.9% increase from Oct and marked the first time defaults topped 60,000 since at least 2001. (Stocks mentioned include: PMI, MTG) -

kuid turg teeb väikse kergendusralli, sest reedese põrumise järel uute majade müügis kardeti ka olemasolevate osas ilmselt konsensusest kõvasti hullemat

-

Olen siia vahel ikka ka tehnilisi pilte pannud ja teen seda ka täna - sedapuhku meeldib mulle RMi all kirjutava Dan Fitzpatrick'u valikutest Nokia graafik:

Olukord muutub oluliselt huvitavamaks, kui aktsia liigub kas üle $40 või kukub alla $35.

-

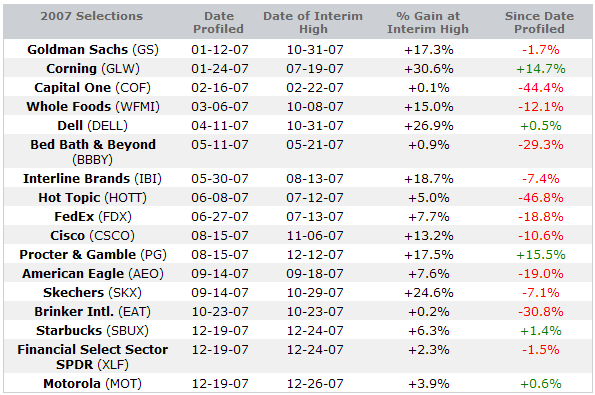

Briefingu rubriigis Bargain Hunting huvitav lugu sellest kuidas nende varasemalt üsna edukas stockpicking aastal 2007 totaalselt ebaõnnestus, äkki Joel või Oliver saavad selle tabeli siiagi riputada, ma ei saa seda ise mugavasse formaati viia ...

-

2004, 2005 ja 2006 - neil aastail ei olnud Briefingu Bargain Huntingu tabelites ühtegi negatiivse tootlusega ideed. 2007. aasta puhul on pilt ikka totaalselt erinev, näidates veelkord, kuivõrd keeruliseks on aktsiate portfelli valimine muutunud.

-

Rohkem täna vist arvuti taha eriti ei satu - seega soovin ette ära minu poolt toredat ja kasumlikku uut 2008. aastat kõigile !

-

Head vana aasta lõppu kõigile ning uueks aastaks soovin tervist ja rohkesti rõõmsaid hetki.

-

Kui USA aktsiate valimine on muutunud nii raskeks, siis miks üldse sellega tegeleda?

USA elanikel võib tõesti raske olla väljapoole vaatamisega, kuid eestlastel ei tohiks see probleem olla. Mis vahet seal on, kas osta aktsiaid USAst, Soomest või UKst. LHV Investeerimiskontol saab osta neid kõiki.

Enamus USA aktsiaid kauplevad ajuvabade valuatsioonide juures. Seda nii minerite, utility stockide, kui tech aktsiate osas. Rääkimata kasvuaktsiatest (millega kaasneb meeletu risk, et ühel heal päeval jääb EPS konsensusele 1 sendi alla ja siis oled poolest oma rahast ilma).

Miks üldse osta USA aktsiaid, kui Euroopas saab sarnase stocki poole odavamalt? -

Head uut aastat kõigile!

Masendav, isegi uue aasta esimesle tunnil ei saa LHV-st üle ega ümber :) -

Head uut aastat kõigile ka minu poolt.

-

Head Uut Aastat 2008 kõigile LHV-foorumlastele !!!

-

Head uut aastat !! Ja sooviks näha rohkem ratsionaalsust ja vähem emotsioone investeerimises ning kindlasti ka teistes valdkondades. Kuigi see on vist rohkem minupoolne "wishful thinking" :)

-

Uut ja vana teile ka minu poolt!

-

Head uut aastat kõigile !!

-

Head uut aastat teile kõigile !

-

head uut aastat!

-

HEAD UUT AASTAT! Heasoovlikkust ja tolerantsust!

-

Head Uut Aastat!

-

Rõõmsat ja teguderohket ja tõusvat Uut Aastat meile kõigile!

-

HEAD UUT AASTAT! Hoian pöialt kõigile headele inimestele siin selleks aastaks!

-

Head ja edukat uut aastat kõigile ka minu poolt!

-

head uut aastat!!!

-

Head uut aastat!

-

Edukat uut aastat!