Börsipäev 28. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

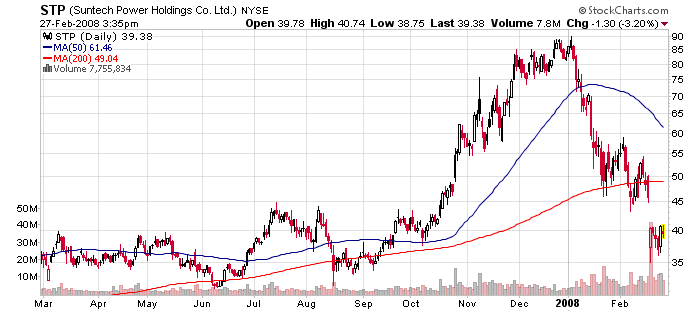

Citigroup on alustanud Suntech Power’i (STP), kes on üks maailma juhtivaid päikesepaneelide tootjaid, katmist „Osta“ reitinguga. Solar sektor on viimasel ajal kõvasti peksa saanud, kuid tegemist on pigem loomuliku korrektsiooniga pärast hullumeelset rallit ja pikaajaliselt on story jätkuvalt atraktiivne.

Citi arvates on tegemist parima valikuga paljude Hiina tootjate hulgast, sest Suntech omab tänu suurematele tootmismahtudele konkurentide ees kulueeliseid, näiteks tooraine hankimisel. Samuti on ettevõttel väljakujunenud maine ja kliendid võtmeturgudel nagu Saksamaa, Hispaania ning USA.

Sektori suhtes üldiselt on Citi 2008-nda aasta väljavaadete osas positiivne, sest:

1)...nõudluse osas ei ole jahenemise märke märgata.

2)...ületootmist takistab tooraine ehk polüräni defitsiit. Reaalseks probleemiks võib see kujuneda alles 2009-nda aasta teises pooles, mil polüräni tootmisvõimsus suureneb oluliselt.

3)...hiljutise aktsiahindade korrektsiooni tulemusel on paljud riskid juba sisse hinnatud.

Ajalooliselt on Suntech kaubelnud keskmiselt 33-kordsel järgneva 12 kuu oodataval kasumil. Citi ootab 2008-ndaks aastaks 63%-list kasumikasvu ehk $1.65 suurust lahjendatud kasumit aktsia kohta. Seega seatakse hinnasiht $55 tasemele, mis annaks investoritele praeguse aktsiahinna juures 40%-lise preemia.

-

Sten, see oli eile õhtul väljas.

-

Tõsi, korrektsuse huvides oleks pidanud ka kuupäeva lisama. Samas ma usun, et antud info pole oma väärtust selle ajaga kaotanud ja võiks pikemaajalistele investoritele huvi pakkuda. Kindlasti ei olnud see mõeldud lühiajalise trading call'ina :)

-

Seda küll, trading callina oleks see pealegi üsna pekki läinud :) BofA solarite downgrade pani kogu sektorile paugu kirja.

-

See seletab ka üleeilset korralikku tõusu.

-

The Wall Street Journal kirjutab, et lähiajal võib tulla halbu uudiseid finantssektorisse. Täna pärast turgu tuleb tulemustega American International Group (AIG) ning homme Swiss Re. AIG puhul arvatakse, et maha kandmisele võib minna sama suures mahus varasid, mis läks oktoobris-novembris ehk siis $4.88 mld. Suurt mahakandmist oodatakse ka Swiss Re-lt.

Mõni hetk tagasi teatas ABN Amro, et enne splitti kantakse maha veel $2.36 mld eest varasid. -

Täna enne turgu (15:30) on tulemas USA 4kv GDP, ootus +0.8% ning eelmise nädala esmaste abirahataotlejate number, ootus 350K

-

GDP Annualized +0.6% vs +0.8% consensus

-

Esmaseid abirahataotlejaid 373K vs 350K konsensus

-

Ei suuda uskuda et ka täna otsustakase negatiivset ignoreerida...

-

Saksamaa DAX -1.46%

Prantsusmaa CAC 40 -1.75%

Inglismaa FTSE 100 -1.25%

Hispaania IBEX -0.86%

Venemaa MICEX -1.23%

Poola WIG -1.13%

Aasia turud:

Jaapani Nikkei 225 -0.75%

Hong Kongi Hang Seng +0.44%

Hiina Shanghai A (kodumaine) -0.80%

Hiina Shanghai B (välismaine) +0.07%

Lõuna-Korea Kosdaq +0.65%

Tai Set +1.48%

India Sensex -0.01%

-

The Action Is Good, It's Still a Downtrend

By Rev Shark

RealMoney.com Contributor

2/28/2008 8:51 AM EST

The tragic or the humorous is a matter of perspective.

-- Arnold Beisser

It can be quite helpful to consider the stock market from a variety of different perspectives. Things can look quite different if you just slightly adjust the things you are looking at.

For example, Doug Kass notes that the DJIA is 10% off the low it saw on the SocGen mess on Jan. 22. That accounting is correct, but if you eliminate those two days of wild action following the Martin Luther King holiday when the Fed cut, the Nasdaq is very close to unchanged from where it was on Jan. 18 and is barely off its closing lows. It would be quite a stretch to call the action since Jan. 23 a meaningful rally, but that seems to be the perspective of many market players.

The other major indices have done a bit better than the Nasdaq, but if you look at the big picture without the unusual spikes of those two crazy days in January, it is pretty clear that the market has gone nowhere. Some individuals stocks have certainly done well, as is always the case in any market, but overall we are bouncing along near the lows and struggling very hard to turn up.

What has been interesting about the last few days is that the market has been holding up very well despite the quite poor news flow. We aren't seeing intense selling as more negatives are pondered, but market players are bottom-fishing some of the stocks that have not bounced at all, such as Apple (AAPL) and Google (GOOG) .

This makes a good argument for the proposition that the bottom is in, and if you consider that the market has been holding in a trading range for over a month now, an upside bet doesn't seem like too bad an idea.

On the other hand, the bigger downtrend is still clearly intact and if you consider how lame the bounce has been with the distraction of the SocGen mess, it is easy to conclude that the market is still in poor health.

While I like seeing the market shrug off bad news and hold within a trading range, I still don't have any great confidence that we have the juice to commence a better and more lasting uptrend. We have been churning recently, and while that helps us build support, the buyers need to show more sustained resolve.

I'll stay open-minded, but I see no reason to change my opinion that we are enjoying nothing more than a respite within a bear trend.

We have a soft start as we await the second day of testimony by Ben Bernanke. The news flow is slow and overseas markets are mostly negative.

--------------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: AVCI +16.0%, DBRN +12.9%, NKTR +11.5%, LSR +8.7%, CRM +8.6%, CTRP +7.2%, MIDD +7.0%, VISN +6.7%, BRKR +6.0%, NRF +5.5%, FLS +5.4%, FLR +5.3%, MANT +4.5%, NUVO +3.6%, LTD +3.3%, AHT +3.1%, ZINC +3.1%, GEF +2.6%, UHT +1.8%, TELK +1.5%, GIFI +1.3%, MRX +1.2%... Other news: IMMC +22.2% (announces FDA clearance of the CellSearch circulating tumor cell kit for monitoring patients with metastatic prostate cancer), VRNM +12.8% (awarded U.S. Department of Energy grant to speed enzyme development for cellulosic ethanol production), DARA +10.0% (continued momentum from yesterday, announces appointment of new director to board), LTON +8.3% (PT Media Nusantara Citra extends tender offer for 6 mln ADS at $3.80), REGN +8.3% (announces that the FDA approves co's ARCALYST for treatment of cryopyrin-associated periodic syndromes), WPL +7.0% (has retained Merrill Lynch to review strategic alternatives; co postpones earnings release), XNPT +6.9% (Xenoport and GlaxoSmithKline report 'positive' top-line results of final pivotal trial of XP13512/GSK1838262 for restless legs syndrome), EOG +5.5% (still checking), RMBS +3.3% (still checking), APPL +2.5% (presents at Goldman Sachs conference; on track to sell 10 mln iPhones this year, unlocked phones are sign of great demand ), LVLT +2.5% (Level 3 and IBM announce patent cross-license)

Allapoole avanevad:

In reaction to weak earnings/guidance: SEED -33.5% (also announces it has licensed a new genetically modified corn to officially introduce the next generation of corn product into China), AIRN -17.2%, PDGI -16.1%, FIRE -12.1% (also announces Wayne Jackson to step down as CEO), S -11.3%, DRCO -9.4%, MYL -8.7%, SFI -8.1%, ESPD -7.9%, WG -5.6%, AMSF -5.4%, COWN -4.3%, WNR -4.0%, GSIG -3.8%, GMR -3.0%, GMKT -2.9%, SWX -2.8%, IPGP -2.4%, CEDC -2.4%, SHLD -2.1%, TS -1.8%, CDR -1.8%, ARNA -1.3%... Select gold stocks showing weakness despite higher spot prices: DROOY -2.6%, GFI -1.8%, GOLD -1.7%, AAUK -1.4%... Other news: NGSX -39.7% (announces preliminary results from second Phase 3 clinical trial in HIV-DSP; primary and secondary endpoints do not achieve statistical significance), TMA -22.0% (may have to sell assets to meet margin calls), YTEC -4.2% (raises target of nation-wide POS installation base from 20k to 25k by the end of 2008), DHI -4.1% (down in sympathy with TMA), DSTI -3.9% (CFO Raja Venkatesh resigns, effective March 14), IMB -3.2% (still checking), UBS -3.0% (still checking), NNN -2.5% (prices offering of convertible notes; common stock or a combination thereof at an initial conversion price of $25.42 per share), FRX -1.5% (announces amendment to Bystolic Agreement; announces FRX will commercialize, develop and distribute Bystolic), -

Miks SIGM täna nii raskelt kukub, teab keegi kosta?

-

Nafta hind on taaskord saavutanud uue rekordi: Crude Oil makes new all time highs at $102.35

-

Ning juba uus rekord $102.75 barrel.

-

1Hope,

Ausalt öeldes SIGMi 10%lised liikumised ei olegi väga ebanormaalsed. Tegu on väga kõrge beetaga aktsiaga, mis tähendab, et turu liikumist kiputakse mitmekordselt võimendama ka ilma uudisteta. -

Nafta hind rühib ülespoole ning on selge, et $100 pealt naftat lühikeseks müünud kauplejate stoppe on täna terve päev raginaga läbi löödud.

-

Bernanke Testimony “It’s not in my text book”

“It’s not in my Text Book”

Bernanke finished his testimony today and what a shambles it appears to be. “Did you lower rates to defend the Stock Market?” answer was “Yes!” The underestimation of the mess that the FOMC appears to be in just belies words. Bernanke not for the first time appears to be on the ropes. The Housing market is now being referred to as a crisis and not a mild correction as was the case when Bernanke took over in 2007. It is concepts like this that is fast destroying the credibility of not only Ben and the FOMC but also in the US Markets and more particularly the USD. It is as though it is now open season on the US Dollar. Free rein to this has just been presented by Ben at this testimony. As an old market stalwart of 30 years it is clear that the academic cannot find any references in his text books to get him out of the mess. The reality is that he has now admitted that the January inter meeting rate cut was as a direct result of keeping the Stock Market from collapse. All this achieves is telling the market that the FOMC will move rates every time the Stock Market is under pressure. This was what the UK did when it was being dumped from the ERM back in the 90’s, it opened the door for the market to bring it on because they knew what would happen. The problem that exists for Ben is that he has a limited amount of bullets in the gun and a sealed shut credit market. Cutting rates is not bailing anyone out all it is doing is damaging confidence in the US and its ability to get over this issue. The main reason is clearly because the FOMC has been delusional in the first instance to allow the housing disaster to occur, second, they didn’t accept that lending to people on unemployment benefit would go terribly wrong and finally they have not got a cure. The FOMC did not and no one has ever torn the credit agencies apart for their role. They are talking about regulation after the horse has left the stable and taken the ferry to China. Fractured credit markets only repair with higher interest rates. That is my personal experience looking back at all credit crises since 1973. It is a case that prime borrowers will always be prime borrowers and bad ones will always be bad. The pain has to be taken but it is the FOMC and the US government that are unwilling to take the correct medicine. Inflation negates debt, this is fact and if Ben and his team of academics bothered to look back at past episodes it is inflation that has eventually got the Banks out of the mire. This is real economics and not the statistical rubbish that is taught now. The problem is that we have a FOMC that are taking surveys as gospel and not real data

The truth is inflation is destroying the consumer and corporate alike and the FOMC and Bernanke are standing by as it is happening. This disaster requires drastic action. One to restore faith in the US Dollar and two in the US itself! Unfortunately, Ben just cut a shadow of a man who is clearly out of his depth. The truth is that the markets have now been given a free put and call by Ben. Sell equities, buy FED Funds and sell the Dollar. Equities fall, Ben cuts and the Dollar sinks. Vicious circle. In the house opinion, it is clear that the US Dollar is not going to be pretty going forward and secondly, the equity markets will come under pressure and the FOMC will cut again further weakening the US Dollar. Inflation will keep rising and so the problems get deeper. Ben should be watching facts like China is now Japan’s largest trading partner surpassing the USA. This is not good! Our view is that the carry should continue to be pressured and the safety currencies like the CHF and Yen should continue to benefit. We still hold that Sterling is in just as deep a problem as the US and this has yet to react. There will be a catalyst to trigger the UK into problems but this has yet to manifest itself. The truth is Sterling is already saying that the problems are bad and likely to get worse. -

Dell jääb oma tulemustega prognoosidele alla. Aktsia hetkel -3%.

Dell reports Q4 (Jan) results, misses on revs; to buyback at least $1bln in Q1 (20.87 +0.10)

Reports Q4 (Jan) earnings of $0.31 per share, includes multiple charges and gains may not be comparable to the First Call consensus of $0.36; revenues rose 10.5% year/year to $15.99 bln vs the $16.27 bln consensus. In the first quarter of fiscal 2009 the company expects to spend at least $1 billion to repurchase its shares." -

ESEA üllatas korralikult

revs 31.5m ja net 15.3m (ma ootasin mingi 26 ja 11) -

Tänu Dellile on ka kuubikud peale turge 0,5% miinuses. Homme saab huvitav olema.

-

mõned numbrid ESEA 2008 tulemustest

käive 82.1m

EBITDA 61.7m

net 40.7m

rahamasin -

rahamasin kyll,aga millegipärast see aktsia hinnas ei kajastu?

-

Aga stocki myygist saadud raha muudkui seisab ja seisab :(

-

mis tähendab, et on raske leida häid diile. samas on hea, et nad iga hinna eest ei ole nõus tehinguid sõlmima.

Raha kuskile ei kao, sellega saab maksta võlga, maksta dividende, osta osalusi ka teistes ettevõtetes jne.

tänaseks on raha kontol üle 104m ehk ca. 3.6$ aktsia kohta

näiteks kogu võla tagasi maksmine tähendaks 4.8m lisa bottomline alla, kokkuhoitud intresside näol

aga loomulikult näeks parema meelega käibe ja tulude kasvu suunatud investeeringuid -

pakungi et dividende tõsteti tänu sellele seisvale rahale..aga noh asi seegi.

-

dividende on tõstetud vastavalt kasumi kasvule, payout ratio on ca. 50% juures

ja viimane tõstmine oli vaid 1 sent