Börsipäev 6.märts

Kommentaari jätmiseks loo konto või logi sisse

-

Kas turgudel jätkub tugevust?

Täna avaldatakse enne turge 15.30 makronäitajatest uute töötuabiraha taotlejate arv ning jätkuvate taotlejate arv. ABK reitingu ülevaatamine on nii S&P-l, kui ka Moodysel väga terase luuubi all. Nafta futuurid kauplevad ikka uutel tippudel ning USD nõrgenenud jällegi EUR-i vastu, mis pärsib tugevalt turgude tugevust. -

6. märts?

-

Tänan Henno.

-

Futuurid indikeerivad USA tugudele altpoolt avanemist ning Euroopas tõmbab turge allapoole finantssektor. ECB ja BoE teatavad täna intressikärbete otsuse. ECB võitleb suureneva inflatsiooni piiramisega ning võimalused intressikärbeteks pigem puuduvad, BoE olukord on veidi parem, kuid ka nende poolt on lootus kärbeteks väike.

-

Üks huvitav artikkel WSJ poolt:

The Wall Street Journal reports Wilbur Ross has purchased $1 billion of beaten-down municipal bonds, a sign that some large investors are snapping up these investments after a recent selloff, taking advantage of the woes of a number of hedge funds that have been forced to sell to try to stay afloat.

Võlakirjaturg on viimastel päevadel näidanud ilusat tõusu nendel segastel ja probleemirikastel aegadel. Wilbur Ross ja Pimco siiski ei avalikustanud kellelt nad on võlakirju ostnud. -

Naftafutuurid kerkinud $105.95 peale ja hetkel kauplevad +1.20% tõusus $105.90 tasemel.

-

Reuters.com tetab sellisest uudisest:

Google is expected to receive unconditional approval from European Union regulators next week for its $3.1 bln takeover of DoubleClick, people familiar with the situation said. -

Wal-Mart teatas veebruarikuu same-store müügi +2,6%-lisest kasvust võrreldes eelmise aasta sama perioodiga. Analüütikud Thomson Financialist ootasid kasvuks +1,1%. Kogumahud kasvasid +5,6% $18.56 miljardini.

-

Euroopa Keskpanga Intressimäära otsuse järgne konverentsikõne nagu ikka 1 tund enne USA turgude avanemist. Ise suundun Trichet kõnet kuulama ning ka ülejäänud huvilistele pakun kuulamiseks järgmist linki. Fookuses siis inflatsioon, kommentaarid euro-dollari kursi suhtes ning milline võiks välja näha tulevane ECB intressimäärapoliitika (nt 2008. aasta keskel ja lõpus).

-

Euroopa Keskpanga poolt tänase intressinumbri osas üllatusi ei tule ning need jäetakse 4.0% peale.

-

Merrill Lynch tõstis Oracle (ORCL) reitingut neutraalselt osta peale.

-

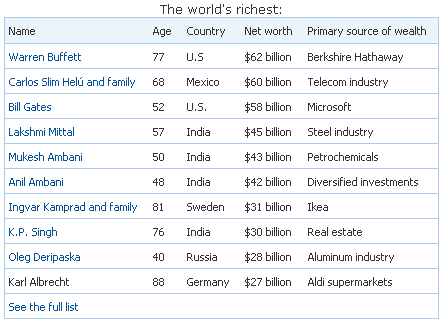

Mis investeerimisteemaline börsipäeva foorum see oleks, kui ma ei paneks siia uut Forbesi tabelit maailma rikkaimate inimeste kohta. On, kellest eeskuju võtta. Sedapuhku tabel otse MSN Money'st.

-

Pange link "See the full list" ka

-

-

Päris mitmed jaemüüjad on negatiivsete ootuste valguses suutnud turgu isegi üllatada.

Target reports Feb same store sales +0.5% vs -0.3% Briefing.com consensus

AnnTaylor reports Feb same store sales -1.7% vs -3.3% Briefing.com consensus -

Initial Claims 351K vs 360K consensus, prior revised to 375K from 373K

-

Wal-Mart Stores Inc. teatas juhatuse otsusest tõsta dividendimäära 8% 95 sendini 2008 aastal, mis lõpeb 31 jaanuar 2009.

-

Aasia oli roheline, Euroopa on punane ja USA eelturul poole protsendi jagu miinuses.

Saksamaa DAX -0.69%

Prantsusmaa CAC 40 -0.66%

Inglismaa FTSE 100 -0.92%

Hispaania IBEX -0.49%

Venemaa MICEX -0.12%

Poola WIG -1.21%

Aasia turud:

Jaapani Nikkei 225 +1.88%

Hong Kongi Hang Seng +0.99%

Hiina Shanghai A (kodumaine) +1.60%

Hiina Shanghai B (välismaine) +0.14%

Lõuna-Korea Kosdaq +1.10%

Tai Set +0.37%

India Sensex N/A (börs suletud)

-

No Good Reason to Buy Now

By Rev Shark

RealMoney.com Contributor

3/6/2008 8:32 AM EST

"The problem is not that there are problems. The problem is expecting otherwise and thinking that having problems is a problem." --Theodore I. Rubin

The market is struggling again this morning as margin calls hit Thornburg Mortgage (TMA) and creditors move to seize pledged assets. What is particularly troublesome about this development is that this is a mainstream lender that focused on high-quality jumbo mortgages and not the subprime instruments we have heard so much about.

In addition, there are a number of articles this morning about how illiquidity is infecting a number of other debt markets such as intrabank lending. The underlying problem is that we still have little guidance as to how bad the problem will ultimately be, especially if housing prices continue to decline.

On the wires, we even have Boston Fed Member Rosengren saying that credit problems are now starting to spill-over to "Main Street."

There is no question the economic picture is a gloomy one as the credit markets struggle to come to grips with a host of problems. Some market players keep hoping that the Fed will somehow wave its magic wand and cure these issues, but it appears the market simply has to work through these problems on its own. It is going to take time and it is a mistake to be impatient and to start looking for the market to suddenly improve when we are still trying to fully price in the extent of the debt market issues.

We have a soft start on the way this morning as there is little news to drive buyers. Retail reports are coming in and Wal-Mart (WMT) actually has good numbers. Oil continues its rise and with a host of commodities hitting record highs it is going to be tough to argue that inflation is "well anchored."

Tomorrow is a very important jobs report and I expect that the market will stay pinned down today as it awaits that news. The only real reason to buy at the moment is that we are slightly oversold on a technical basis. On the other hand, with so little positive news on the wires it is going to be tough for the bulls to get much traction as oversold conditions are slowly worked off.

At this juncture I see little reason to do anything other than some short-term trading. The market is showing few signs of forming a solid low and it is clearly going to take a while before things will be healthy enough to generate much upside momentum. The opportunities will come to make money with some longer-term plays, but it is still far too early to be thinking that way.

--------------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance/same store sales: UFPT +19.7%, SMSI +18.4%, CHIP +17.5%, DXPE +9.9%, FLOW +8.8%, BBI +8.6%, MATK +7.5%, SNUS +7.5%, OWW +7.4%, CMTL +6.8%, SONS +6.2%, URBN +6.0%, LVB +5.7%, ACUR +5.4%, SMRT +5.0%, PSUN +4.9%, HRB +4.4%, FINL +4.1%, HRS +4.1%, CTR +3.9%, TIVO +3.8%, AUO +2.6%, RAD +2.5%, MELI +2.5%, SHMR +2.5%, JWN +2.2%, ADCT +1.8%, PLCE +1.7%, ROST +1.6%, WMT +1.3%, ANIK +1.3%... Select gold and mining stocks showing strength, despite lower spot prices, with reports that South Africa will raise mines' power supply to 95%: GFI + 3.0% , HMY + 3.0% , BHP + 2.4% , RTP + 1.8% , LMC + 1.7% , GOLD + 1.2%... Other news: EXAS +65.1% (says updated screening guidelines of the American Cancer Society include new DNA technology for detecting colorectal cancer), OPTM +43.1% (still checking), EPCT +20.7% (earns milestone payment due to progress in Phase II trial for Azixa in melanoma metastases), TSRA +11.8% (addresses "mischaracterizations of patent validity and legal process"; Cowen makes positive comments), THRX +11.1% (FDA accepts for review THRX's complete response to approvable letter for Telavancin for the treatment of complicated skin and skin structure infections), PBT +4.6% (Cramer makes positive comments on MadMoney), RHD +4.1% (modestly rebounding after making new 52 week low yesterday), SHPGY +1.6% (still checking), INAP +1.5% (SoftLayer signs 5-year $40 mln contract with Internap to expand on-demand hosting platform across the United States), BHI +1.3% (discloses it starts a $500 mln commercial paper program), MOT +1.1% (Carl Icahn discloses increased stake of 6.3%, up from 5.0% prior stake), TASR +1.1% (receives two law enforcement orders; Suffolk County Police Dept and North Dakota Highway Patrol purchase TASER devices )... Analyst upgrades: MDR +3.8% (upgraded to Buy at Citigroup), ORCL +2.2% (upgraded to Buy at Merrill), FLR +1.9% (upgraded to Buy at Citigroup), DISH +1.3% (upgraded to Neutral at Credit Suisse), ENDP +1.0% (upgraded to Buy at Roth Capital).

Allapoole avanevad:

In reaction to weak earnings/guidance/same store sales: UDRL -22.4%, CWTR -20.4% (also downgraded to Hold at Roth Capital), WINS -14.2% (also downgraded to Hold at Roth Capital), ZUMZ -14.0% (also downgraded to Neutral from Buy at Piper Jaffray), MR -9.8%, AEO -8.4%, RWC -8.3%, OWW -7.7%, USMO -7.2%, AOB -7.1%, MWRK -6.5%, PETM -6.4%, RWT -6.4%, JCP -4.4%, GPS -4.2%, FCEL -4.0%, STEC -4.0%, BRLI -2.3%, EXC -1.8%... Select mortgage stocks showing continued weakness following TMA news related to margin calls: TMA -52.1% (discloses receipt of default notice from JP Morgan after TMA failed to meet a $28 mln margin call), CMO -14.7% (removed from Best ideas List at Keefe Bruyette), NLY -14.4% (removed from Best ideas List at Keefe Bruyette), RAS -12.2%, IMB -7.9%, ABK -7.4% (continued weakness from yesterday's huge ~23% decline), FRE -4.3%, FNM -4.2%... Select financial names showing continued weakness: MER -6.4% (discontinues First Franklin Mortgage Origination; amended the terms of its Exchange Liquid Yield Option Notes due 2032; estimates cut at Keefe Bruyette), LEH -3.8% (estimates cut at Keefe Bruyette), MS -2.6% (estimates cut at Keefe Bruyette), BSC -2.3% (estimates cut at Keefe Bruyette), WM -2.3%, C -1.9% (made no approach for capital, Dubai says - Reuters.com), WFC -1.8%, GS -1.7% (estimates cut at Keefe Bruyette), BAC -1.5%, UBS -1.2% (shares sink on Alt-A writedown talk - Reuters)... Other news: CIM -12.6% (still checking), MGI -6.8% (showing continued weakness following yesterday's huge decline), CSE -2.9% (still checking), TMS -2.4% (showing continued weakness), LCAPA -1.8% (still checking), HNSN -1.6% (files a $75 mln common stock shelf offering in an S-3), TOT -1.4% (still checking)... Analyst downgrades: MFA -19.4% (downgraded to Mkt Perform at Keefe Bruyette), ANH -15.4% (downgraded to Mkt Perform at Keefe Bruyette), SKS -4.9% (downgraded to Neutral at BofA), BDN -3.8% (downgraded to Underperform at RBC), DRE -2.4% (downgraded to Underperform at RBC). -

Kas kellegil on idee miks data jälle varem väljastati? :S

-

Naftafutuurid lähenevad jällegi tippudele, hetkel kaubeldakse +0.93% $105.50 barrel tasemel.

-

Kogu finantssektor langeb kivina, tulenevalt jätkuvast majanduslanguse ohust ja kodude rekordilistest sundmüükidest. Hoolimata jaemüüjate positiivsetest üllatustest ja tehnoloogiasektori tugevusest ei suudeta müügisurvele vastu panna, eriti veel USD jätkuva nõrgenemise ja naftahinna rekordtasemeteni jõudmisel.

-

hearing Chuck Norris sent few days ago letter to JPM saying „I SHORTED TMA“

-

AMBAC Fincl: Banks backstopping ABK share offering include those with and without other exposure to ABK, according to person briefed on the matter.

Peaks turule tuge andma. -

IBM kinnitas 2008 EPS prognoose $8.25 vs $8.24 konsensus ning 2010 EPS $10-11.