Börsipäev 3. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

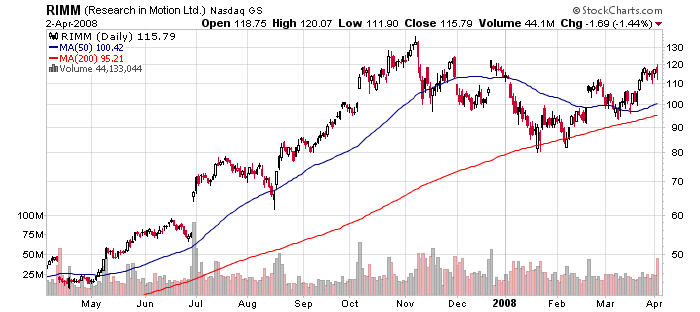

Research in Motion’i (RIMM) eile õhtul avaldatud 2008. majandusaasta 4. kvartali tulemused suutsid jätkata traditsiooni ehk lüüa analüütikute konsensust. Seekord ületati ootusi nii kasumi (EPS $0.72 vs $0.70 konsensus) kui ka käibe ($1.88 mlrd vs $1.68 mlrd konsensus) osas.

Mis veelgi olulisem, investorite kartusi, et RIMM ei jää jahtuvast majandusest puutumata, rahustati järgmise kvartali prognooside tõstmisega. 2009. majandusaasta 1. kvartaliks oodatakse kasumit aktsia kohta $0.82-0.86 (vs $0.75 konsensus), käivet $2.23-2.30 mlrd (vs $2.02 konsensus) ja teenusekasutajate kasvu (Net sub additions) $2.2 mln (vs $2.16 mln konsensus). Seega võib öelda, et kuigi aktsia hind oli ligi 50% kosunud jaanuari põhjadest ja koos sellega ka ootused olid kõrgele kruvitud, suutis RIMM siiski turule heameelt valmistada.

Morgan Stanley sõnul on RIMM’i näol tegemist parima kasvulooga sektoris. 1. kvartali prognoosid olid tugevad hoolimata agressiivsest konsensuse ootusest ja sellest tulenevalt kergitatakse 2009. majandusaasta kasumiprognoos $3.65 aktsia kohta (+17% võrreldes varasemaga) ja käibeprognoos $9.74 miljardini (+16%). Siiski arvatakse, et aktsia võib siit tasemetelt teha läbi korrektsiooni, sest valuatsioon on läinud kopsakaks ja jätab liialt vähe upside’i. Lisaks säilib Morgan Stanley hinnangul oht, et kasvutempo võib alaneda tänu üldise majanduskliima halvenemisele, kuigi hetkel sellest märke näha ei ole.

Samas märgitakse võimalikud katalüsaatorid, mis võiksid 2009. majandusaasta prognoosidele lisa tuua:

1) Mobiilioperaatorite tugi uutele toodetele.

2) Uute mudelite ja teenuste esitlemine 13.-15. mail toimuval Wireless Enterprise Symposium’il.

3) Oodatust parem 3G mudeli, mille müügiga alustab mai lõpus AT&T, vastuvõtt.

-

UBS-i poolt täna langetatud Cisco Systems (CSCO) reitingut eelnevalt "osta" soovituselt "neutraalse" peale.

-

FirstFed Financial (FED) sai Credit Suisse käest reitingu langetamise osaliseks, "outperformilt->neutraalse" peale ning mis kõige olulisem hinnasihti langetati tervelt 50% $60 pealt $30 peale, just tänu välja antud laenude kvaliteedile.

-

Oppenheimer upgrades Marathon Oil (MRO 47.47) to Outperform from Perform and sets a $60 tgt, based on valuation, one of the lowest P/E and P/CF multiples in the oil and gas sector and an implied reserve value that is the lowest among peers.

Marathon Oil (MRO) on Citigroupi sektori top pick, millest Joel on teinud 8. veebruari börsipäeva foorumis kiire ülevaate. Meeldetuletuseks: Citi hinnangul oli ettevõtte valuatsioon naeruväärselt madal ("Valuation: this is getting ridiculous!") ja hinnasihiks seati $82, mis praeguse $47.5 hinna juures tähendaks 73%-list tootlust.

-

(WFR) MEMC Elec langetab 1 kvartali prognoose:

Co issues downside guidance for Q1 (Mar), sees Q1 (Mar) revs of approx $500 mln, compared to previous guidance of $560 mln, vs. $559.23 mln First Call consensus. Co sees Q1 gross margins of approx 52%, compared to previous guidance of approx 54.8%. Co experienced accelerated buildup of chemical deposits inside the new expansion unit at its Pasadena, Texas facility. These buildups occurred multiple times, and each instance required downtime of several days for premature maintenance to clean and re-stabilize the unit. The combination of these items caused the utilization of the Pasadena facility to be approximately 20% lower than Q4 and resulted in much lower than anticipated output.

Aktsia eelturul kukkunud -10.98% $68.10 peale, eilne sulgemishind $76.39.

-

FED oleks ka praeguselt tasemelt pikaajaliselt hea short. Kes veel mäletab, siis alla 20% FEDi väljastatud laenudest olid tagatise ja laenuvõtja sissetulekuga tõestatud. Ülejäänutel polnud kas ühte või teist ning 20%-l polnud kumbagi.

-

Citigroup usub, et DRAM ja NAND mälude tootja Micron'i (MU) puhul on eile õhtul avaldatud tulemuste järel tegemist soodsa ostukohaga. Kuigi tulemused jäid käibe osas ootustele alla, siis tänu kulude kärpimisele suudeti näidata paranevat rahavoogu ja kasumit. Reiting ning hinnasiht jäävad samaks - vastavalt "Osta" ja $10. Lühidalt näeb Citi tees välja järgmine:

This is the Classic Buying Opportunity for MU — Micron appears to be executing well on cost cutting and pricing is stabilizing. This leads us to conclude that estimates are bottoming. Meanwhile, the stock is trading at .76x our C2008 book value estimate, up from its recent lows but still at historically low levels. With pricing showing signs of stabilizing and the effect of dramatically lower capex yet to be felt, this is the classic buying opportunity for MU shares, particularly as it coincides with a likely bottom in the semiconductor sector as a whole.

Lisaks vahendab Briefing, et üks suurtest analüüsimajades on oma müügisoovitusest täna loobunud: MU Micron: Hearing upgraded to Neutral from Sell at tier 1 firm. -

Indeksfutuurid kerges languses, kuid EBAY ja RIMM annavad turgudele tuge ning ka MU tugevalt ülespoole liikunud. Hetkel ootused makroandmetel:

15.30 töötuabiraha taotlejate arv

17.00 ISM teenindusindeks -

Initial Claims 407K vs 366K consensus, prior revised to 369K from 366K

-

Ja turg alla....

-

VCGH tuli eile 25% alla seoses CFO lahkumisega

võtmeisikute lahkumine toob alati alla liikumisi, kas reaalselt see ka businessile mõjub on ise küsimus ?

esmaspäevast ka tulemuste hilinemine, kuid CEO ütles:

I would like to stress that this delay has nothing to do with any errors in accounting and we believe that we will exceed our 2007 earnings guidance of $0.43 per diluted share.

eelturul pikaks -

üle 400K minev number on majanduslangusele iseloomulik, kuid nädala numbrid on väga volatiilsed, pigem peaks vaatama trendi ... selline järsk muutus halb uudis aga igal juhul

-

Kui Henno mõtet edasi arendada, on need Initial Claims numbrid tegelikult suhteliselt mõttetud, raha nendega ei teeni ja ei kaota ka.

Aga tore on siis, kui need erinevad konsensusest, sellisel juhul on vähemalt korraks põnev ja saab igasuguseid vandenõuteooriaid välja mõelda. :) -

Initial claims negat number võib olla lühiajaliselt sentimenti muutev küll. Eilne ADP (kuigi ADP pole eriti kindel leading indicator) positiivne number kindlasti pani mitmed turuosalised arvama et homne NFP ei olegi kuigi hull. Praegune initial claims aga võib neid panna oma arvamust muutma.

Intressifutuurid ja nägemused intressilanguseks suhteliselt volatiilsed. 25 bps cut aprillis praegu kindel, pärast eilsed ADPd 50 bps cuti tõenäosus vähenes, praegu jällegi tõusis (24% tõenäosus). -

momentum

tänane initial claims on perioodi kohta, mis ei lähe enam homse NFP arvestusse :) -

Saksamaa DAX -0.98%

Prantsusmaa CAC 40 -0.88%

Inglismaa FTSE 100 -0.70%

Hispaania IBEX -1.18%

Venemaa MICEX -0.70%

Poola WIG -0.72%

Aasia turud:

Jaapani Nikkei 225 +1.52%

Hong Kongi Hang Seng +1.64%

Hiina Shanghai A (kodumaine) +2.94%

Hiina Shanghai B (välismaine) +1.78%

Lõuna-Korea Kosdaq +0.21%

Tai Set -0.06%

India Sensex +0.52%

-

Lack of Follow Through Is Cause for Concern

By Rev Shark

RealMoney.com Contributor

4/3/2008 9:05 AM EDT

When you get right down to the root of the meaning of the word "succeed," you find that it simply means to follow through.

--F. W. Nichol

Since the first of the year, what this market has been missing has been the ability to follow through to the upside. We will have a solid day, and then the buying fizzles and the mood quickly turns sour once again. After each of our last three big moves, the market quickly rolled over and the gloom spread once again.

It really isn't that surprising that this is occurring. All you have to do is pick up the morning newspaper, and you can't help but be a little worried about all the economic issues we are facing. Now we even have Fed Chairman Bernanke using the term "recession," for the first time, and even though he is trying to sound optimistic, it certainly hurts the mood of investors when they hear that we are still grappling with ways to deal with our many economic ills.

While the market tends to look forward and discount the future, the problem is that we just have too many unknowns, and we don't know how bad things are going to get. The poor weekly unemployment numbers that just hit (which are now over 400,000) are certainly making it clear that things are getting worse and not better.

The best hope for this market is that it can hold above key technical support, and that we can climb the old Wall of Worry. However, to do that we need at least a little undercurrent of hope that sucks in sufficient buyers to make others think that maybe this market can continue to work higher.

I'd really like to be more optimistic, but the very poor news flow is killing the ability of this market to get good follow through going. I'm particularly concerned that the jobs numbers are now going to make it clear that a full-blown recession is kicking in, and that is likely to scare off any new buying.

We still haven't undone the positives generated by Tuesday's big move, but I'd be surprised to see buyers jump in with the jobs data that is due out tomorrow.

Proceed with caution and make sure you focus on protecting capital.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ATSI +23.3%, ANGO +12.6%, XIN +8.3%, TMWD +6.9%, SCHN +4.7%, RBN +4.1%, MU +4.1% (upgraded to Neutral at tier 1 firm), , RPM +3.7%, SYT +3.7%, RIMM +3.3%, STZ +2.8%... Other news: CBLI +11.6% (says DoD awards it a contract to develop Protectan CBLB502; shall not exceed $8.9 mln in development funding), LDK +7.4% (signs a ten-year wafer supply agreement with Moser Baer Photo Voltaic), DNDN +7.3% (announces $47 mln registered direct offering), CVP +7.2% (modestly rebounding after yesterday's 50%+drop), VCGH +5.7% (Donald Prosser has been named interim Chief Financial and Accounting Officer), MEDX +4.8% (announces Ipilimumab program continues to move forward; previously-stated guidance remains unchanged), CCU +4.5% (Federal judge orders CCU case back to state court - Bloomberg), BLX +3.5% (still checking), MRVL +2.8% (up in sympathy with RIMM and MU), CPST +2.5% (announced that it received a $2.6 mln follow-on order from its Switzerland-based distributor for its C200 MicroTurbine systems), TASR +2.4% (Sports Authority to carry TASER C2 personal protectors), ACI +2.2% (Cramer makes positive comments on MadMoney), SGP +1.7% (announces productivity transformation program; looking to generate $1.5B of annual savings)... Analyst upgrades: NCC +4.7% (upgraded to Outperform at Bear Sterns and upgraded to Equal Wt at Morgan Stanley), EBAY +3.0% (upgraded to Buy at Merrill).

Allapoole avanevad:

In reaction to weak earnings/guidance: SQNM -19.9%, WFR -9.9%, PRST -8.3%, HNI -6.9%, MTRX -6.4%, RT -4.3%, LNDC -2.0%, XRIT -1.6%... Select financial names showing weakness: BCS -3.5%, COF -3.1%, CS -2.7%, DB -2.2%, WB -2.1%, ING -1.9%, LEH -1.6%, MS -1.6% (Lehman lowers their 2008 ests), WFC -1.6%, BSC -1.5%, BAC -1.4%, MER -1.4% (Lehman lowers their 2008 ests), C -1.3%, JPM -1.1%, GS -1.1% (Lehman lowers their 2008 ests)... Other news: GRMN -11.4% (CFO interviewed by Reuters, sees Q1 revs down 40-50% sequentially -- this equates to ~$609-730 mln vs $731.5 mln consensus), MESA -3.2% (says YoY available seat miles decreased 13.74% in March 2008), AXA -2.8% (still checking), CHIC -2.6% (announces preliminary results of its modified Dutch Auction tender offer), CIT -1.6% (ceases student loan originations), HLX -1.3% (sells interest in Deepwater Fields for $165 mln), FRE -1.2% (prices new $3 billion three-year reference notes security)... Analyst downgrades: BLKB -5.7% (downgraded to Underperform at Jefferies), WIT -3.6% (downgraded to Sell at tier 1 firm), LYG -3.1% (downgraded to Sell at tier 1 firm), FIRE -2.9% (downgraded to Sector Perform at RBC), CSCO -2.8% (downgraded to Neutral at UBS), KBW -2.1% (initiated with Sell at Stern Agee), AFL -2.0% (downgraded to Neutral at BofA). -

Kas keegi teab mis jama on, et ma ometi vaatan USA maj. numbrite avaldamist onlines kuid siiski reageerivad valuutaturud 5-10 min ennem uudiste väljumist ja krdi õigesti. Kas kusgilt lekib enne välja või???? :)

-

ISM Services 49.6 vs 48.5 consensus

-

Turg üritas kosuda peale ISM indeksi teatamist, kuid hetkel rebitakse suuremad indeksid ikka allapoole. Volatiilsusindeks VIX on +2% tõusus ning turg väga närviline.

-

Tööjõuturuga ikkagi seotud ;)

-

Merrill Lynch tegevjuht John Thain teatas, et ettevõttel ei ole likviidsusprobleeme ning ei vaja lisakapitali kaasamist, finantssektor tõusis selle peale päris tugevalt ning viis kaasa kogu turu. MER on 2007 aasta lõpust kaasanud Mizhuo pangalt, Singapuri fondilt ja teistelt $12.8 miljardi ulatuses kapitali. Suuremad indeksid rebinud ennast 0.2% jagu tõusu.

-

eks enne uudiseid tehakse ju prognoosid ja nende põhjal otsustatakse. Üldjuhul on prognoosid üsna täpsed, aga vahest lähevad ka mööda.