Börsipäev 11. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

USA makrouudistest on täna pool tundi peale turgude avanemist oodata tarbijausalduse näitu, mille puhul prognoositakse langust 16 aasta madalaimale tasemele. Tõusvad kütusehinnad ja suurenev töötus on piisavaks murekoormaks, et Michigani indeksile ennustatakse kukkumist märtsi 69.5 juurest 69-ni aprillis, Briefing on veelgi pessimistlikum ning ootab langust 68-ni.

-

Realmoney's tabel S&P 500 konsenuse kasumiootustest selleks ja järgmiseks aastaks:

Antud ootuste põhjal oleks 2008. aasta P/E 14.5 ja 2009. aasta P/E 13.6. Iseenesest ei ole tegemist kõrgete numbritega, kuid vaadates, et käesolevaks aastaks on prognoositud ligi 10%-list kasumikasvu, tasub prognoosidesse suhtuda skeptiliselt. Samuti on tabelist näha, et seoses riigi sekkumisega ja maksutagastustega loodetakse tugevat kasumikasvu aasta teises pooles.

Kui Q1 on kasv olematu ja Q2 negatiivne, siis Q3 puhul on kasumikasvu projekteeritud 13.6% ja Q4 puhul tervelt 55.2%. Viimane on tingutud neljanda kvartali ühekordsetest mahakannetest seoses krediidikriisiga. Lisaks tundub kahtlane, et kui Q4 olid kasumid $16.14, siis käesoleva aasta esimeseks kvartaliks oodatakse $22.82. Liiga suur vahe...

-

Bossid saavad täna kokku ning söövad lõunat. G7 rahandusministrid, suurriikide keskpankurid ja suuremate investeerimispankade (JPM, BAC, C, DB, LEH, MFG) tegevjuhid kogunevad Washingtonis, et tekkinud kriisist täpsemalt aimu saada ning võimalikke lahendusi arutada.

The G7 government leaders want to have a "clear understanding" of the state of global economy, the state of U.S. economy and the state of financial markets.

-

GE sees Q2 $0.53-0.55 vs $0.58 First Call consensus

GE sees FY08 $2.20-2.30 vs $2.43 First Call consensus

GE prelim $0.44 vs $0.51 First Call consensus; revs $42.2 bln vs $43.68 bln First Call consensus -

savi, ei huvita, rallime edasi, kyll näete

-

Morgan Stanley jaemüüjate märtsikuu numbrite osas väga rõõmus ei ole, pidades sellega seoses viimase aja rallit jätkusuutmatuks. Alla ootuste nõrk oli riidepoodide müük ning osade puhul kärbitakse ka kasumiprognoose:

We are lowering Q108 EPS estimates for M ($23.63),KSS ($43.72), JWN ($34.39), SKS ($12.71), GPS ($18.47), TJX ($30.88), ANF ($74.01), andAEO ($16.62) and raising our estimate for ROST ($31.53). We are taking up our 2008 WMT($54.66) estimate by 5 cents to $3.40, as it leveraged expenses on a 0.7% comp, due tocontrolled inventory levels/ lower mark downs.

Seni avaldatutest on ootusi suutnud ületada vaid ARO, BJ, COST, HOTT, JCP, ROST, BKE ja ZUMZ, üle 20 suurema jaemüüja on jäänud ootustele alla ning ca 10 ettevõtet on veel avaldamata.

-

Eelmises postis ära mainitud Ross Stores'i (ROST) müüginumbrid vähesid märtsis -2% (konsensuse ootus oli -3.8%). Lisaks tõsteti ka esimese kvartali prognoose. Arengud on igal juhul positiivsed ning lisaks MS-le on seda märganud ka JPM, kes tõstab samuti aktsia soovitust, sedakorda siis "overweight" peale.

-

GE nõrkuse taga peamiselt finantsüksus, mis väga suur üllatus ei tohiks olla. Guidance loomulikult halb, aga demandi osas oldi positiivsed. Praeguselt $33.4 (-9%) tasemelt tundub pigem buy olevat.

-

GE tulemuste mõju turgudele korralikult näha. Kui enne tulemusi indikeerisid USA futuurid 0.5% plussi siis nüüd kaubeldakse -0.6% juures. OMXS30 kukkus ligi 1,5%, DAX ligi 2% madalamal.

-

Selline so-so olukord, GE miss on ikka päris suur ja poleks üldse kindel, et see viimaseks jääb. Rahvusvahelised tulud olid tugevad, aga arenenud riikide tulude kasv (väljaspool USAd) 14%, no ma ei tea... kas püsib? Praegune kasumilangetus tuleneb igal juhul puhtalt USA arvelt.

-

Hoidke GE-st eemale, nad vajuvad selles kvartalis läbi $30 taseme. GE rohkem finantsettevõte ja sealt suunast kõvasti valu tulemas.

-

Sberbank on oma välismaa tulude suurendamise strateegiat tõsiselt käsile võtmas:

Germany's Der Spiegel writes April 11 that Sberbank is considering purchasing German investment bank Dresdne Kleinwort, owned by Dresdner Bank. April 10 newswires reported that Sberbank had discussed acquiring a German bank, according to Vedomosti.

Samas on siin tegu pigem kuulukaga, aga kus suitsu, seal tuld... Kui taolisi teateid ilmuma hakkab, võib spekuleerida, et ollakse aktiivselt ostuvõimalusi otsimas.

-

GE on vaid selles mõttes finantsettevõte, et pakub oma toodete-teenuste müügil ka finantseerimisvõimalust. Muidu on GE-l aga väga korralik tooteportfell energeetika ja infra sektorite tarbeks.

Kuid mis GE aktsiahinda puutub, siis see on EUR-vääringus viimase 5 aasta põhjade juures. Nii et EUR-is arveldava investori jaoks küllaltki kahtlane investeering.

Siinjuures ootaks muidugi US-i alati väga argumenteeritud kommentaare. -

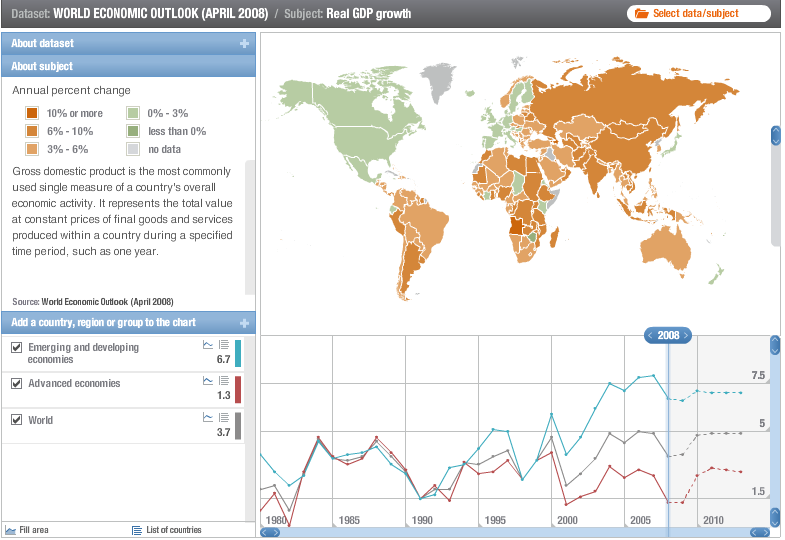

SA vihjas lahedale IMFi leheküljele, kust pärit ka allolev SKP prognooside visuaalne pilt:

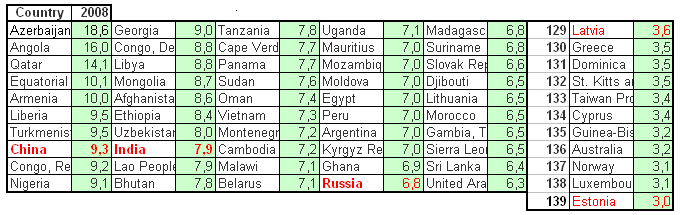

Tabelisse panin esimesed 50 käesoleval aastal kiiremini kasvavat riiki ja eraldi Eesti koos saatusekaaslastega:

USA paikneb 178 riigi hulgas tagant lugedes 5. kohal, nõrgemat majandus prognoositakse ainult Islandile (+0.4%), Itaaliale (+0.3%), Bruneile (-0.5%) ja Zimbwabele (-6.6%).

-

Saksamaa DAX -1.22%

Prantsusmaa CAC 40 -1.04%

Inglismaa FTSE 100 -1.24%

Hispaania IBEX -1.53%

Venemaa MICEX -1.84%

Poola WIG -0.52%

Aasia turud:

Jaapani Nikkei 225 +2.92%

Hong Kongi Hang Seng +1.99%

Hiina Shanghai A (kodumaine) +0.61%

Hiina Shanghai B (välismaine) +0.62%

Lõuna-Korea Kosdaq -0.12%

Tai Set +0.75%

India Sensex +0.72%

-

Madise 11/04/08 10:02 postituse osas ...

Ma ei tea kui täpsed on RealMoney andmed S&P 500 konsenuse kasumiootustest, kuid Reuters EcoWin annab S&P500 12 kuu forward P/E 13,75 vaid 1,5% kasumikasvu ootuse juures järgmiseks 12 kuuks -

Today's Reaction to GE Will Tell Us a Lot

By Rev Shark

RealMoney.com Contributor

4/11/2008 8:55 AM EDT

I have never been lost, but I will admit to being confused for several weeks.

-- Daniel Boone

The bad news is that General Electric's (GE) poor earnings report this morning is confusing already muddled market. The good news is that this is going to be a good test of how the market is going to deal with what is likely to be a very difficult earnings season.

Since the start of the second quarter, the market action has been the best of the year. We have had some rallies, some pockets of momentum and have held above key technical levels. However, there continues to be a heavy level of caution, and the tepid volume is a clear indication of the failure to truly embrace the idea that things are getting better.

Although the market has done a good job of holding up on poor news like the monthly jobs reports and the minutes of the Fed meeting, it has not had any good news to really get things moving. Not going down on bad news is a good sign, but if good news isn't eventually forthcoming, the selling pressure will eventually build up and we will start to drift down.

The poor GE earnings report and higher-than-expected import prices this morning are going to tell us if this market is healthy enough to handle bad news. The GE report is obviously coming as a surprise to the market, but it really shouldn't be a surprise that the weakness is due to financial services. The market has been struggling to price in issues in the financial sector for many months now, and this reaction to GE will tell us whether the market is now concerned that another barrage of bad news is likely to hit.

Technically the market is still in pretty good shape. The key level is the gap up open on April 1. The action yesterday helped the technical picture yesterday, but the lack of volume the last few weeks makes it hard to have any real conviction.

The market is muddled and confused, but some positives are starting to pop up. The reaction to GE today is going to tell us a lot about where things are headed as we start earnings season. If the market can shrug off GE, it bodes very well for the bulls, but confidence out there is shaky and it isn't going to be easy to get much upside traction going.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CDIC +16.1%, PRLS +11.1%, EXAC +5.8%, PZN +5.1%, FAST +4.0%, SJR +2.8%, BSET +2.1%, CTCT +1.3%, IRIX +1.1%... M&A news: TZIX +18.8% (to be acquired by Apax Partners for $22/share)... Other news: ADLS +11.7% (announces that, based on a productive meeting with the FDA, it plans to submit a New Drug Application in the third quarter of 2008 for its novel once-a-day oral antibiotic; also upgraded to Buy at Lazard), CVTX +10.8% (CV Therapeutics and Astellas announce FDA approval for Lexiscan injection), PDLI +10.6% (declares a special cash dividend of $4.25 per share; announces plan to separate its biotechnology operations from its antibody humanization royalty assets), BNS +6.9% (WSJ reports NCC draws interest of Bank of Nova Scotia), DAL +6.2% (continued strength following report that Delta-Northwest merger may be announced next week; also upgraded to Outperform at Credit Suisse), CCJ +2.9% (continued speculation that China signals takeover interest), FTE +2.7% (says 'no current plans' for major share buyback - Thomson), NCC +2.1% (draws interest of Bank of Nova Scotia - WSJ), ANGO +1.6% (offers to purchase certain Diomed assets in the United States and United Kingdom; co to pay $11 mln for assets), BHI +1.5% (Cramer makes positive comments on MadMoney), HRB +1.5% (Director Richard Breeden buys 2 mln shares at $21.61-21.89), NWA +1.2% (continued strength following report that Delta-Northwest merger may be announced next week; also upgraded to Outperform at Credit Suisse)... Analyst upgrades: CNTF +2.1% (initiated with Buy at Roth), CLNE +1.3% (initiated with a Buy at Lazard), MHS +1.0% (upgraded to Outperform at Credit Suisse).

Allapoole avanevad:

In reaction to weak earnings/guidance: DLA -14.3%, PWER -12.7%, ACPW -11.6%, GE -10.2% (also downgraded at tier-1 firm following earnings and downgraded to Neutral at Credit Suisse), FDRY -8.5% (also downgraded to Sell at BWS Financial), STSA -8.0%, INTV -7.8%, ETFC -2.3%, DNA -1.9% (also downgraded to Mkt Weight at Weisel)... Select financial names showing weakness: CIT -6.9%, FMD -5.3%, PMI -4.9%, WB -2.2%, MS -2.1%, BAC -1.5%, WM -1.5% (Bloomberg reports Goldman Sachs cuts their 2008-10 ests for Washington Mutual), GS -1.4%, C -1.3% (Business Week discusses C in the Inside Wall Street section)... Select solar stocks trading lower: AKNS -6.2%, SOLF -3.9%, JASO -3.6%, ESLR -3.5%, SPWR -2.5%, FSLR -1.5%... Other news: FRNT -75.2% (files for Chapter 11), PCOP -11.1% (Leslie Browne resigns as President and Chief Executive Officer), NVT -5.6% (has dialogue with EU over Navteq, Kauppalehti reports - Bloomberg), SNDK -3.8% (Needham expects conservative 2Q08 guidance and lower full year guidance and Barron's Online discusses SNDK in Weekday Trader column), HLF -3.8% ("The Fraud Discovery Institute" is out with a list of the "Top Ten Red Flags of Fraud at Herbalife"), CSG -3.0% (Q1 confectionery underlying sales growth 7% - Forbes), SI -2.9% (German shares drop on General Electric report, led by Siemens - Bloomberg.com), TYC -2.8% (still checking), NVDA -2.3% (still checking), JAVA -2.0% (AGYS announces it has amended the original earn-out agreement payable to former shareholders of Innovativ Systems Design, a Sun Microsystems reseller), PRU -1.0% (designates shelf registration statement and files prospectus supplement to effect resales of its floating rate convertible senior notes due December 15, 2037)... Analyst downgrades: ZRAN -8.6% (downgraded to Underperform at Jefferies), INTV -7.1% (downgraded to Equal Weight from Overweight at First Analysis), IDA -3.8% (downgraded to Underwt at JPMorgan), JCI -3.2% (downgraded to Neutral at JPMorgan), STX -3.1% (downgraded to Neutral at tier 1 firm), GRMN -2.3% (downgraded to Perform at Oppenheimer), ANF -1.9% (downgraded to Neutral at JPMorgan), RRGB -1.5% (downgraded to Mkt Perform at Wachovia), SIRI -1.2% (initiated with Sell at Merrill). -

Henno, nad on kasutanud First Call konsensust. Aga päris täpselt ei saa aru küll, kuidas P/E 1.5%-lise kasvu juures nii madal saab tulla.

-

Hearing Piper out with call to buy Solar names, saying it is changing sentiment on likelihood of House passing Solar initiative.

Varem tõstis Cowen TSLi kasumiprognoose. -

Oodatud "slight decrease" ei tulnud täna välja:

April University of Michigan Sentiment 63.2 vs 69.0 consensus

-

... nõrgim tase alates 1980. aasta juunist.

-

Pärast nõrka Michigani ülikooli sentimenti indeksit tõusis -50 bps cuti implied probability üle 50%.

-

...ainus häda on selles, et suurte lõigetega on käes üsna pea olukord, millest alates peaks opereerima "-" märgiga intressidega. Paar viimast padrunit võiks FED ikka sihitud laskudena ja ühekaupa ära kasutada. Kuigi mine tea, äkki -50bps ka tuleb. Mulle tundub, et seni on osad lasud pigem närvilised ja rabistavad olnud.

-

Finants on täna väga tugev: C, GS, LEH, MS, WFC plussis juba ning üritavad ka turgu tõsta, kas finantsi najal läheb tõusuks või jõud raugeb?

-

General Electric: Hearing GE downgraded to Hold at Citigroup

-

G7 source says G7 text will be slightly more negative on U.S. economy than in last G7 Communique.

Source says text will not be alarmist or use recession in connection with U.S.

Turgudel reaktsiooni uudisele ei esinenud, kuid finantssektor hakkab ära vajuma. -

C püsib veel suhteliselt tugev, mis hoiab turgu päris kõvasti. Kui C ka ära vajub võib näha suuremat languspäeva.

-

Kommentaatorid on varakult nädalavahetust pidama läinud, viimasest postitusest 3 tundi juba möödas. Ja börs muudkui kukub. Aga kaks rahulikumat päeva on õnneks ees.

-

Nagu eelpool mainitud, siis nii kui finantssektor ilmutas nõrkust tuli kogu turg alla. Pullide üritus oli väga tugev aga eks neilgi hakkab lõpuks jõud raugema.