Börsipäev 9. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Paar olulisemad teadet turgudelt.

Tallinna kaubamaja aktsiaga kauplemine peatatud, aktsiaonäride üldkoosolek.

Harju Elektri dividendisaajate nimekirja fikseerimine.

MICEX täna suletud, 9. mai ju ikkagi -

Allianz 1Q puhaskasum -65%; 2008 aasta eesmärkide täitmise suhtes ollakse skeptilised. Aktsia avanes Xetral -1.4%

-

Jahtuv USA majandus ning kallinevad toorainehinnad löövad muuhulgas ka BMW aktsia hinda. Aktsia ilma oluliste uudisteta, kuid tänu ex-dividend kuupäevale avanenud -4%, ehk 36.24 EUR. Firma maksab dividendi 1.08 eurot aktsia kohta.

-

Balti turgude patriootidele OMX Balti 10 indeksi 6-kuu graafik mõtisklemiseks. Kas põhi käes või karuturu ralli?

-

USA futuurid on jätkanud eilset järelturu kukkumist ning hetkel ollakse kauplemas viimase 2 nädala põhjadel (S&P 500 futuurid ES siis eelkõige). ES on -0.45% punases.

-

Ragnar, mida näitab ca 2 aasta graafik?

-

Kahe aasta graafik näeb välja selline

-

kui üldse, siis on huvitav vast kolme aasta graafik. Sellised savised turud kaotavad 40-50% oma väärtusest üsna kergesti, siis hakatakse neid jälle pisut vaatama.

-

Üks kohalik majandusleht vahendab Kauppalehtit, et "Soomes on Sampo Pangast seoses uue internetipanga juurutamisel tekkinud probleemidega lahkunud tunduvalt rohkem kliente, kui üldiselt arvati.".

Kas kellelgi on andmeid, mis firmad teevad Skandinaavia pankadele interneti-panganduse IT süsteeme?

Hansal on selleks vist ühisfirma Tieto Enatoriga? -

SEB pangal on oma itifirma, mis aegajalt tegutseb ka muude projektidega, näiteks osaleb riigihangetel :) Vähemalt mõnda aega tagasi osalesid.

-

Ja USA futuurid jätkuvalt pool protsenti miinuspoolel.

Saksamaa DAX -1.33%

Prantsusmaa CAC 40 -2.00%

Inglismaa FTSE 100 -1.40%

Hispaania IBEX -1.20%

Venemaa MICEX N/A (börs suletud)

Poola WIG -0.41%

Aasia turud:

Jaapani Nikkei 225 -2.06%

Hong Kongi Hang Seng -1.52%

Hiina Shanghai A (kodumaine) -1.19%

Hiina Shanghai B (välismaine) -0.75%

Lõuna-Korea Kosdaq +0.62%

Tai Set -0.41%

India Sensex -2.01%

-

Market Now Faces Numerous Hurdles

By Rev Shark

RealMoney.com Contributor

5/9/2008 8:27 AM EDT

To see what is in front of one's nose requires a constant struggle.

-- George Orwell

Over the last two months, the market has rallied on better-than-expected earnings and economic data which have helped to support the theory that the worst of the credit crisis is over. The general market consensus is that we have priced in all our problems and woes, and that we will slowly but steadily see an improvement in the market from here.

The million-dollar question for us to ponder is whether this belief that the worst is over is really correct. The bulls' argument is that the market certainly knows what the issues are and the discounting mechanism has taken them into account. There is no secret about the issues we face, and we are now looking beyond them and can see the light at the end of the tunnel.

The bears' argument is that the bulls are simply too optimistic and hopeful. They can provide a long list of things such as housing, inflation, commodity and food prices and more losses from the likes of AIG (AIG) to illustrate their point. The argue that things just aren't as good as the bulls would like to believe, and even if the worst is over, we aren't going to go up in a smooth and steady manner.

I believe quite strongly that we are at a junction now where the idea that the worst is over is going to be more carefully scrutinized and will cause some market weakness. We have a number of factors combining here that will make further upside much more difficult.

Technically, we are extended and momentum is slowing. While we are still holding over key areas of support, there are some cracks appearing, and it won't take much selling to cause some technical breaches.

Seasonality is now starting to work against us. We are entering a traditionally weaker time of the year, and as earnings season winds down, that will no longer serve as a positive catalyst like it did over the last month or so.

Much of the recent rally was a product of low expectations, and as hopes have climbed that will no longer be working for us. Economic reports have generally been better than expected lately, and that has gone a long way in supporting the "worst is over" idea. Unfortunately, higher expectations means that we are more prone to selloffs when we have earnings news like we have this morning from AIG.

The continued rally in crude oil prices also prevents a market hurdle. While the market has generally been able to shrug off the advance in crude prices over the last several years, we are now getting to a point where the acceleration is affecting sentiment and causing some real worries about inflation.

Despite some pretty obvious negatives, the indices have been holding up fairly well. I suspect that is just some stubborn hope that will eventually give way as the market fails to advance. As always, we need to let the price action be our guide, but the conditions remain ripe for some downside.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: PCLN +13.7%, GSIT +12.5%, SRVY +12.4%, SYX +12.2%, DAR +10.5%, OSIR +10.5% (also Osiris and NuVasive enter into definitive agreement for Osteocel; OSIR to sell business for $85 mln to NUVA), INT +9.1%, RNWK +8.0% (also announces intention to spin off Its casual games business), AYR +7.3%, BSQR +7.2%, SD +7.2%, QSFT +6.7%, POM +5.8%, ADPT +5.5%, AES +5.4%, LUNA +5.3%, TRLG +5.0%, GUID +4.6%, RICK +4.2%, TBSI +4.1%, SLH +3.9%, ATVI +3.4% (also upgraded to Buy at Kaufman), CNQ +2.6%, SONS +2.6% (also upgraded to Buy at Jefferies), WINS +2.6%, TI +2.3%, CCU +2.2%, VRSN +2.0%, NVDA +1.5% (also upgraded to Buy at Stifel Nicolaus)... Other news: HRS +10.5% (WSJ reports that co may consider a sale), SPAR +6.7% (receives $56.4 mln order for production of MRAPs), NAT +5.9% (Cramer makes positive comments on MadMoney), SNCR +2.5% (still checking), OII +1.3% (profiled in Barron's Online)... Analyst upgrades: FSLR +2.6% (initiated with Buy at Citigroup), RAIL +2.1% (initiated with Buy at Jefferies).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CCOI -12.7%, LLNW -11.8%, DRQ -9.7%, AGO -9.4%, BID -9.0%, MGI -8.9%, AIG -7.4% (also announces a plan to raise approximately $12.5 billion in capital; ratings also downgraded at S&P and Fitch), BRKS -7.3%, ESIO -6.4%, ZINC -5.8%, SWC -4.9%, NGAS -4.9%, FMD -4.6%, MYL -4.1%, ICFI -3.1%, PEC -3.1% (also downgraded to Neutral at Robert W. Baird)... Select financial names showing weakness in premarket trading: CIT -2.9% BCS -2.5% MBI -2.1% DB -1.4% WM -1.2% GS -1.1% FNM -1.0%... Other news: ORA -6.4% (files for 3.1 mln share common stock secondary offering), SNY -5.2% (drops on Schweizerhall plans for Plavix copy - Bloomberg.com), NOK -2.9% (still checking), HLF -2.8% ("Fraud Discovery Institute" issues update to report on HLF related to Venezualan operations), MT -2.1% (announced that it filed suit against Esmark), HOV -1.4% (announces pricing of its 14 mln shares of common stock offering of $9.50)... Analyst downgrades: ESLR -4.8% (initiated with Sell at Citigroup), IPAS -4.3% (downgraded to Hold at Morgan Joseph), ENER -3.8% (downgraded to Neutral at Broadpoint Capital), HBC -2.2% (downgraded to Underweight at Morgan Stanley), GDP -2.0% (downgraded to Reduce at Suntrust), CELG -2.0% (downgraded to Neutral at Credit Suisse), DRS -1.9% (downgraded to Market Perform at FBR and downgraded to Hold at Morgan Joseph), SWSI -1.7% (downgraded to Sector Perform at RBC), AMSC -1.6% (downgraded to Hold at Jefferies), MCD -1.3% (hearing removed from Conviction Buy List at tier 1 firm), PSS -1.1% (downgraded to Hold from Buy at Soleil). -

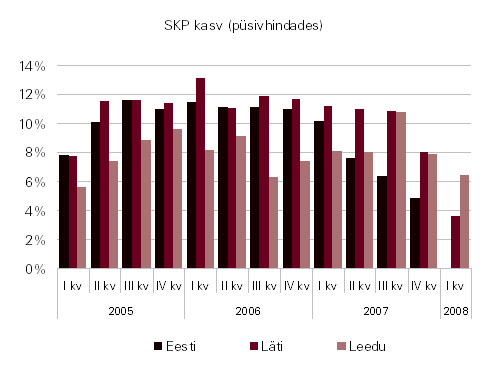

Kes oli see usin isik Balti riikide SKP graafikute ülesriputamisel ;) ? (eelmisel kvartalil)

-

Aga pange see Läti +3,6% esimene indikatiivne number ka juba sisse (ja lisaks võiks see graafik ka makro teemasse imbuda :P )

-

Läti Q1 kukkumine päris karm...

-

Former Federal Reserve Chairman Alan Greenspan indicates the worst of the credit crisis will pass once investors 'fully' anticipate the likely losses on securities tied to subprime and other mortgages, where defaults have surged - Bloomberg

-

SOLF tegi huvitava liikumise

any clue ?

(long SOLF) -

Samas suurusjärgus liikus täna ka LDK, aga seda saab ehk seletada heade tulemuste ootusega. Tulemused esmaspäeval peale sulgemist.

-

vaata ikka päevasisest liikumist

-

Mnjaa, hoopis teine pilt :) Kuna ka SOLF short ratio on päris suur, siis võibolla hakkas mõni suur short katma ja tõmbas ka teised kaasa? Või siis liikus mõni kuulujutt, mis teemal, võib vaid oletada,

-

Millise ajahorisondiga SOLF-is pikad olete ja mida positiivset sellest stockist arvate?

PS! Juhuslikult jäi silma, et yahoos 1y Target Est: 108.45 (vist viga?). Aktsia ise 14.87. -

Solar on minu jaoks pikemaajaline, ei oskagi ajahorisonti pakkuda. peab jälgima arenguid. hetkel on selle kauba järgi nõudlus kasvav. viimasel ajal on tootjaid toorme nappus kummitanud.

mul on sellest sektorist kaks:

STP on minu jaoks selline safe play, nad on suutnud tagada endale toorme ostudeks ressursid ja tarnijad, vaja lasta ajal oma tööd teha

SOLF on selline oportunistlik play, guidance ütleb, et marginaalid saavad 2008 olema under pressure, samas suurendavad oma tootmisvõimsusi suveks 50%. ma arvan, et praegune hind juba arvestab negatiivsema stsenaariumiga. teiste solaritega võrreldes kauplem madalamatel kordajatel.

a need Yahoo numbrid on küll müstilised -

Reedesel järelturul andis kasumihoiatuse logistikahiid FedEx (FDX). See on tõsine ohu märk, mis näitab, et tõusvad kütusehinnad on ettevõtete otsuseid tugevalt mõjutamas. Mai kuuga lõppeva kvartali kasumiprognoosi kärbiti varasema $1.60-$1.80 pealt nüüdseks siis $1.45-$1.50 peale. Päris arvestatav langus, seda enam, et Wall Streeti konsensusootus oli enne tänast $1.69 ehk uuest vahemikust 10%-15% enam.

Aktsia oli hoiatuse eelselt päeva jooksul kukkunud juba 3% ning peale turgu lisandus sellele veel üle 3%. FedExi liikumist selle hoiatuse peale tuleks kohe kindlasti esmaspäeval jälgida, kes turu suuna kohta pead murravad.

-

ma olen VCGH'd juurde ostnud, esmaspäeval tulemused

see postitus on valgele neegrile, et tal oleks midagi jälle shortida

aga teistele peaks ütlema nagu Fly: if you buy vcgh because of this post, you may loose money

(ise ostsin sõprade ees uhkustamiseks, et olen stripiklubide omanik)