Börsipäev 15.mai

Kommentaari jätmiseks loo konto või logi sisse

-

Eilse CPI +3.9% kohta on enamus analüütikud skeptilised, kus märgiti bensiini hinna languseks 2% kuigi tegelikkuses bensiini hind tõusis, mille peale toimus turgudel päevalõpus ka väike kasumivõtt. Alustati just enim võitnud tehnoloogiasektorist ning sealsetest staaridest AAPL, GOOG. Mis saab täna edasi, kas pullid suudavad tasemeid hoida? Järgnevad päevad on turu suuna jaoks ülimalt tähtsad, ning tuleks teraselt jälgida turu liikumisi.

Tänasel börsipäeval kujuneb valdavaks suunamuutjaks hulk avaldatavaid makroandmeid, blue chipide käitumine ja silmas tasuks pidada ka toornafta hinna liikumist. Ei tohiks ära unustada ka lähenevat optsioonireedet, kus turud tavaliselt keskmisest volatiilsemad.

15.30 Töötuabiraha taotlejate arv, Empire state indeks

16.00 Rahandusministeeriumi andmed

16.15 Tööstustoodangu raport

16.30 Võtab sõna jällegi Ben Bernanke - kus päeva teemaks pangandussektor ning nende riskid

17.00 Philadelphia Fed

-

Euroopa börsid samuti kerges languses peale H&M ja Barclay tulemuste avaldamist, kus viimane kandis maha esimeses kvartalis $3.3 miljardit. Euroopat toetab veidi Saksamaa ja Prantsusmaa oodatust kiirem 1 kvartali majanduskasv, vastavalt Saksas GDP 1.5% vs oodatud 0.7% ja Prantsusmaal GDP 0.6% vs oodatud 0.4%.

-

Credit Agricole, Natixis, KBC teatasid täna samuti mahakandmistest ning kasumi suurest langusest, mis ei jää Euroopa turgude poolt kindlasti märkamata.

-

see bensiinihinna langus on tõeline müstika, seda on kuidagi seletatud ka või?

kui võtta kasvõi USO aastane graafik võrdluseks siis peaks olema +100%

muidugi nafta ei ole bensiin aga siiski -2% tundub kuidagi väga inimeste lollitamisena -

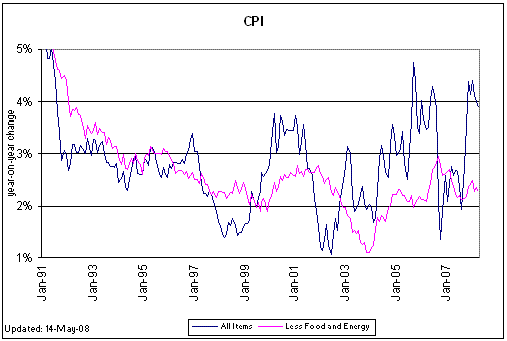

Eilsest CPI'st siis pisut. Andmed on ajaloolisele infole tuginedes sessoonsusega läbi korrigeeritud ;) Ehk siis sealt tuleb ka erinevus tänasest reaalsest inflatsioonist ja 'ametlikust inflatsioonist', mida üritatakse siis laiali hajutada. Paras absurd. Tegelikult tõusid kütusehinnad aprillis USA tanklates +10%.

-

Joel

Aga vaata ka seda kuidas seasonal adjustment varem on CPI-d mõjutanud, äkki leiad viimase 12 kuu jooksul ka kuid, kus kütusehinnad on langenud, kuid CPI energia komponent näitab tõusu ja on ka CPI-d kergitanud seeläbi, november 2007 ja jaanuar 2008 on võimalikud kandidaadid. Võib-olla on siis ka reaaalne inflatsioon olnud madalam kui ametlik inflatsioon?

Pealegi, seasonal adjustments metoodika CPI arvutamisel ei ole mingi suur saladus, ma olen skeptiline nende skeptiliste analüütikute suhtes, kes sellega arvestada ei oska :) -

Kui mõtlema hakta, siis on mõiste 'reaalne inflatsioon' väga huvitav kontseptsioon. Kas see tähendab, et selle saamiseks korrigeeritakse inflatsiooni niflatsiooniga ja saadakse nn. inflation adjusted inflation?:-)

-

Henno, seasonal adjustment ei ole loomulikult mingi saladus. Kevadel on tavaliselt hinnad kõrgemad ja sügisel madalamad, kui driving season läbi saab.

Aga tarbijahinnagraafik:

Kütusehinnagraafik:

Meil on USAs tegu siiski üpriski tavapäratult kõrge inflatsioonilise keskkonnaga, mistõttu ma kipun olema skeptiline aktsiaturu rallimiste peale, mis 0.1%punktilise erinevuste peale sesoonsusega läbi korrigeeritud inflatsiooni tulemusena tuleb :) Aga kui suve järgselt kütuse hinnad oluliselt ei lange (nagu ta seda ajalooliselt teinud on), siis pole tänasest sesoonsest korrigeerimisest muidugi ka palju tolku, mida 2007. aasta ilmekalt tõestas.

-

Senaator Charles E. Schumer (New York) on palunud FTC-l uurida Countrywide Financial Corp. (CFC) tegevust ning algatada vajadusel pankrotiavaldus.

Sen. Charles E. Schumer, D-NY, has asked the Federal Trade Commission to open a probe into beleaguered mortgage lender Countrywide Financial Corp. after courts in several states ruled the company used heavy-handed or illegal tactics in bankruptcy proceedings against debtors. Schumer made the request in a letter to FTC Chairman William Kovacic, citing "cases in multiple states in which Countrywide attorneys were reportedly forced to withdraw motions that incorrectly contended that debtors were delinquent on payments." Schumer also raised concerns about the lender's admission in court that it had sometimes "re-created" delinquency or foreclosure letters that were never actually sent to delinquent borrowers. Countrywide is due to be acquired in an all-stock, $4 billion by banking giant Bank of America in the third quarter. -

Briefing on teinud hea kokkuvõtte Wall Street Journalis ilmunud artiklist, kuidas üha kõrgustesse tõusnud terase hinnad on edasi lükkamas suurprojektide ehitamist.

WSJ reports relentless increases in the price of steel are halting or slowing major construction projects world-wide and investments in shipbuilding and oil-and-gas exploration, setting the stage for a potential backlash against steelmakers... Globally, steel prices are up 40% to 50% since December, and industry executives say they haven't hit their peak... "We have not yet seen that prices have peaked, what we have seen is the costs increasing every month," said MT CEO Lakshmi Mittal on a conference call with reporters. Iron-ore prices have risen 71% this year. Two other crucial steelmaking ingredients, coking coal and scrap steel, have doubled in price. The run-ups are part of a broader surge in raw-materials prices amid tight supplies and soaring global demand, fueled in part by the rapid industrialization of China, India and other developing nations... The world's voracious appetite for steel shows little sign of easing. In Turkey, a new shipyard, once completed, will need 100,000 tons of steel a year. And demand in the U.S. is rising, despite a sluggish economy... Steelmakers are taking steps to cut their costs. To shield themselves from higher raw-material prices, more of them are acquiring their own iron-ore and coal mines or deposits, as well as producers of scrap steel.

-

Initial Claims 371K vs 370K consensus, prior 365K

NY Empire State Manufacturing -3.2 vs 0.0 consensus -

Initial Claims 371K vs 370K consensus, prior 365K

nädala numbrid on väga volatiilsed, sagedasti trendi määramiseks kasutatav 4 nädala keskmine tuleb grammikese alla, välja kukub 375K nädal, põhimõtteliselt siis ollakse flat tasemel, mis vähemalt ajaloolise kogemuse põhjal ei viita majanduslangusele, varasemalt on majanduslanguse eel pikalt üle 400K liigutud -

April Industrial Production -0.7% vs -0.3% consensus, prior revised to +0.2% from +0.3%

April Capacity Utilization 79.7% vs 80.1% consensus

Tööstustoodangu langus päris korralik. -

Bernanke kõne samuti juba hakanud ning esimesed infokillud ka meieni jõudnud:

Bernanke "strongly" urges finance firms keep raising capital - Bloomberg -

USA turud on tänast päeva nullist alustamas.

Saksamaa DAX -0.27%

Prantsusmaa CAC 40 -0.45%

Inglismaa FTSE 100 +0.28%

Hispaania IBEX -0.36%

Venemaa MICEX -0.10%

Poola WIG -1.01%

Aasia turud:

Jaapani Nikkei 225 +0.94%

Hong Kongi Hang Seng -0.08%

Hiina Shanghai A (kodumaine) -0.55%

Hiina Shanghai B (välismaine) +0.23%

Lõuna-Korea Kosdaq +0.21%

Tai Set +0.82%

India Sensex +2.21%

-

A Pivotal Juncture

By Rev Shark

RealMoney.com Contributor

5/15/2008 9:15 AM EDT

Who shall forbid a wise skepticism, seeing that there is no practical question on which anything more than an approximate solution can be had?

-- Ralph Waldo Emerson

The bullish case for this market is quite simple. The worst of the bad debt issue is over, the economy will suffer only a minor recession at worst, the housing market is at a bottom and inflation is mild and under control.

That sounds pretty darn promising, and if that is indeed the case, we should be watching for this market to march steadily higher in the months ahead.

The skeptical bears say that this is typical bullish hopefulness that you expect to see during bear-market bounces. The optimists are very quick to embrace the view that all our problems and woes have now been acknowledged, embraced and discounted. The bears argue that market players are way too sanguine about our economic state and that sooner or later the reality will become clear and we will suffer another downleg.

Unfortunately for the bears, they are overanticipating market weakness and have ended up causing some upside spikes when they are surprised by unexpected positive news. Yesterday was a particularly good example when the better-than-expected inflation numbers hit. The bears argue that the government numbers are an outright fiction, but the strong market reaction sent them scrambling to cover shorts and look for long-side exposure. Late in the day, the market apparently came to realize that maybe the bears have a point, but that didn't prevent a bit of a market frenzy before a late-day selloff.

That leaves the market at an interesting juncture. Technically we have now been turned back twice at key overhead resistance in the S&P 500 at 1420. The 200-day simple moving average of 1428 also lurks above. The 1420 area is an extremely obvious technical level, and everyone is going to be keyed on that area. A move above would likely trigger some buy stops and give us at least a short-lived spike.

On the other hand, the nasty reversal yesterday is indicative of a "blow-off" move where overoptimistic buyers expend their emotion and buying power and now don't have the juice to do it again without at least a little rest.

While I haven't been shorting this market lately, I've been wrongfully skeptical of the bulls' ability to keep this bounce going. I continue to be quite wary of how much longer we can run off the March lows without at least a rest, but the bulls have been quite impressive so far, notwithstanding yesterday's reversal. We have to respect the bulls at this point and not be too quick to count them out.

What is making this market even more tricky lately is the very high level of volatility in oil and commodities as the dollar moves around. The swings in some of the groups that have led for most of the year are quite severe and making trading very tricky. Even if the broad indices act well, that doesn't mean that the key leading sectors to date are going to continue to lead.

So I'm keeping an open mind and looking for some developing themes to exploit. This morning we have very mixed action as market players try to sort out what the sharp reversal yesterday indicated.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: BBI +14.0%, SINA +12.3% (also upgraded to Buy at Citigroup), FUQI +8.1%, YGE +6.7%, MPEL +6.1%, EJ +5.9%, SSRX +5.0%, A +4.5%, BT +4.1%, TSTC +3.9%, FREE +2.4%, FEED +2.2%, JCP +2.0%, PRGN +1.4%... M&A news: CNET +42.5% (to be acquired by CBS for $11.50 a share)... Select solar stocks showing continued strength: ASTI +7.8%, SOLF +7.6%, CSUN +4.9%, ESLR +4.0%, SOL +1.9%, SPWR +1.7%, FSLR +1.2%... Other news: IDMI +14.3% (announces updated data from Mifamurtide Compassionate access program; data shows it is well-tolerated while showing signs of disease control), RCH +7.7% (continued strength following yesterday's 40%+surge higher), WGOV +6.2% (Cramer makes positive comments on MadMoney), ABK +4.6% (modestly rebounding after issuing response to Moody's comments late in trading session yesterday), UBET +4.4% (still checking), QGEN +2.5% (still checking), MT +2.5% (still checking), APC +2.1% (signs agreement with Anadarko as foundation shipper for bison pipeline project), YHOO +1.0% (Carl Icahn is moving ahead with proxy battle for yahoo - sources)... Analyst upgrades: ELOS +4.3% (upgraded to Buy at Merriman), TIVO +3.3% (upgraded to Market Perform at FBR), ITRN +3.0% (upgraded to Overweight at tier 1 firm), CEL +1.8% (upgraded to Buy at Jefferies), RIG +1.2% (initiated with Buy at UBS), NE +1.0% (initiated with Buy at UBS).

Allapoole avanevad:

In reaction to weak earnings/guidance: SLRY -30.9% (also downgraded to Market Perform at Wachovia and downgraded to Hold at Needham), SSTR -29.2%, YTEC -10.7%, CTRP -10.2% (also downgraded to Neutral at Susquehanna), PRCP -10.0%, WH -8.1%, BRCD -6.9% (also downgraded to Average at Caris), STV -5.8%, OESX -4.9%, FSRV -4.7%, CSH -4.1% (also announces intention to close Ohio lending locations), TK -4.0%, BX -3.3%, SNS -3.0%, ITW -1.5%... Other news: SDTH -9.8% (announces proposed offering of $100 million convertible senior notes), BCS -2.3% (takes close to $2 bln writedown - Reuters)... Analyst downgrades: CN -3.0% (downgraded to Sell at Deutsche Bank), SPR -2.2% (downgraded to Neutral at Cowen), CEC -2.1% (downgraded to Hold at Keybanc), KNX -2.0% (downgraded to Neutral at UBS), MCHX -1.5% (downgraded to Neutral from Positive at Susquehanna), NSM -1.2% (downgraded to Neutral at Merrill). -

Henno eelmisele postitusele lisaks siis seoses Initial Claimsi ja ajaloolise majanduslanguse osas.

1990-1991. aasta majanduslanguse ajal olid need keskmiselt 430 000 (vahepeal on USA rahvaarv aga kasvanud...seega kui hakata seda %na elanikest läbi korrigeerima, siis täna võrduks see ca 500 000), 2000-2001. aasta majanduslanguse ajal oli see number keskmiselt 416 000 (taaskord %na elanikest oleks täna see 440 000). -

Bernanke says Fed not actively involved in bond insurer talks, says Fed watching impact of bond insurers on banks

May Philadelphia Fed -15.6 vs -19.0 consensus -

Joel,

kus kohast sa nopid neid avanevaid ülespoole ja allapoole tulemusi enne turgu. kust üldse võiks leida majandustulemuste kuupäevasid millal keegi avaldab?

tänud

Rainer -

Kõige lihtsam koht selleks on briefing.com. Ettevõtete tulemuste kalender näiteks siit.

-

Nafta on kiiresti kukkunud $126 pealt $122-le.

-

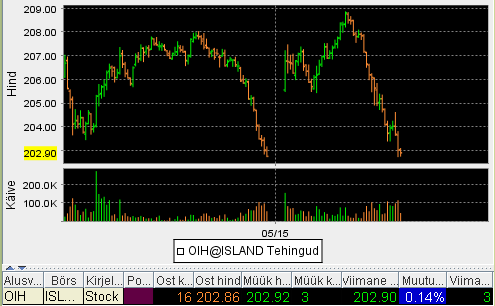

Energia ettevõtted on jõudnud eilsete põhjade juurde. Huvitav, kas langus kandub uuesti ka tervele turule üle või jääb see ainult harusiseseks...

Väike pilt LHV Traderist:

-

MarketWatch: Factory output sees biggest drop since Hurricane Katrina

Uskumatu! Samal ajal kui "Industrial output sinks 0.7% in April", rühivad USA börsiindeksid visalt üles. -

Ouna Ants

Börs vaatab nii pool aastat ette.... -

investoril oleks kasulik dramaatilistest pealkirjadest mitte end segada lasta ja vaadata sisulist külge

tööstustoodangu langus on kindlasti väga halb, aga kuu lõikes näitab üles teatud volatiilsust, viimase 12 kuu jooksul on tööstustoodang 8 kuul tõusnud ja 4 kuul langenud, aasta lõikes on tööstustoodang kasvanud, majanduslangustele on eelnenud tavaliselt igakuine tööstustoodangu langus ca 12 -14 kuud järjest, lisaks on andmeid, mis ei lase küll täie kindlusega seda loota, kuid viitavad, et mais võib tööstustoodang olla jälle tõusus - manufacturing orders ja eksport tugevad, tööturg flat -

Kui jällegi vaadata lühemat perioodi, siis 3 kuu jooksul 2 kuud on langenud ja 1 tõusnud. Veebruaris langes 0.7%, märtsis tõusis vaevu 0.2% ja aprillis vajuti jälle 0.7%.

-

Hea näide minu eelpool toodud väite ... kuidas ei tohi end dramaatilise sisuga pealkirjadest segada lasta :)

eilne MarketWatch: Factory output sees biggest drop since Hurricane Katrina

tänane Reuters: US April housing starts rise best since Jan 2006

Õuna Antsu postitusest tuleneva loogika järgi on USA housinguga siis täna kõik super? -

Äärmiselt nauditav on jälgida, kui keegi siin Eesti investorite karuaias suudab säilitada objektiivse ja kaine mõõdukalt positiivse vaate börsidele. Hea vaheldus äärmuslike maailmapiltide kõrvale:).

-

housing starts-i tõus suurendab ainult pakkumist, kui nõudlus ei kasva muudab see olukorda ainult hullemaks!

-

Housing starts tähendab seda, et ostjaid ikka leidub. Milleks muidu teha präänikuid, mida ei osteta? Inimesed, kas vanad ( liiga kallid ) kodud maha jätavad, peavad ju kuskil elama ( odavamas ).

-

Ups.

kas = kes