Börsipäev 27. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Venemaa on lõpuks astumas oodatud rada, olles suurtest turgudest selle aasta parim esineja. Sarnaselt eelmise aasta Brasiiliaga on välisraha leidnud tee Venemaa turule ning momentumi kadumist ei ole märgata.

Mai algusest on RTS tõusnud ca 14%, samal ajal kui teised arenevad turud on tõusnud keskmiselt 3% ja Dow Jones on langenud 3%. Põhjuseid on mitu: naftahind on teinud läbi kiire tõusu, valitsus on paigas ning finantsreformid ja naftasektori maksude vähendamine on investoritele meeltmööda olnud.

Venemaa 08 P/E on ca 12, Brasiilial 17.5, Hiinal 19 ning Indial 21. Hinnataset võib pidada odavaks ning kuigi oma osa on siin toorainesektoril, peetakse ka sektorit ennast odavaks.

Loodetavasti suudavad turud ülestrendi jätkata, head eeldused selleks on loodud. Ohuks võib pidada väga järsku naftahinna langust ning kasvavat inflatsiooni. -

Milliseid vene aktsiaid osta läbi traderi?

Olen jälginud VIP liikumist ..... -

dol, lisaks veel MTS (MBT), Mechel (MTL), Will-Bimm-Dann (WBD) ja Rostelecom (ROS).

-

küll juba mõned päevad vana jutt: Meredith Whitney mingis Iisraeli lehes

-

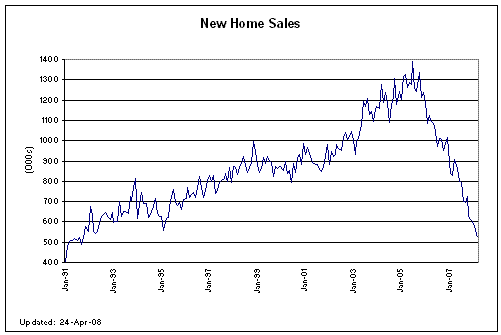

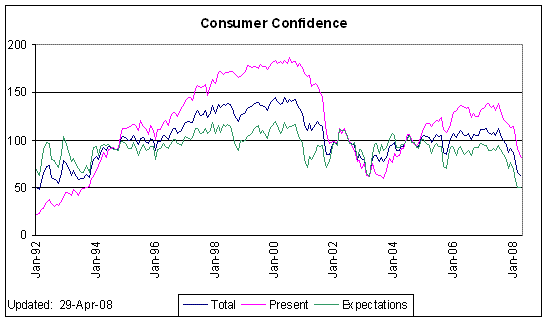

Eesti aja järgi kell 17.00 on oodata USA maikuu tarbijausaldusnäitu (eelmine kuu 62.3 punkti, maikuu ootus on 61 punkti) ning uute majade müüginumbrit (eelmine kuu oli 526 000, praegune ootus 520 000). Kuna majade ehituslubade ja ehitusobjektide arv on viimasel ajal tõusnud, on äärmiselt oluline see, kuidaslähevad sellega kaasa majade müügid. Kui ehitamisaktiivsus tõuseb ilma müügi suurenemiseta, on tulemuseks kinnisvaraturul probleemide kuhjumine. Seega just reaalseid müüginumbreid tasub nii uute kui olemasolevate majade puhul jälgida.

Ja tarbijausaldus:

-

Kas LHV on teinud mingi nihke macro poole? Enne küll selliseid eelvaateid ei kirjutatud ja graafikuid ei upitud.

-

Barronsis oli üks tore lugu FTI kohta. Tegu on ettevõttega, millest on ka LHV seminaridelgi tegelikult vähemalt ühel korral juttu olnud. FTI tegevused on seotud nafta ja gaasisektorile seadmete tootmise ja teenuste pakkumisega ning musta kulla viimase aja ülikiire hinnatõus on ka FTI aktsiat korralikult lennutanud. Nii Lehmanni kui Citigroupi analüütikud peavad aktsia eest välja käidavaid hindu kalliteks ning vähimgi vääratus tooks kaasa müügilaine. Selline negatiivne artikkel Barronsis võib FTI'd ka täna korralikult suruda.

Barron's reports shares of FMC Technologies (FTI) may be priced for perfection. FMC's shares are discounting 20%-plus growth well into the future, when 9%-10% growth is more likely based on rig capacity, according to Geoff Kieburtz, who analyzes the oil and gas equipment and services industry for Citigroup Global Markets. "We think the 20% growth embedded in the valuation of FMC is unlikely to be achieved unless there is a dramatic increase in prices, and historically that has not been the case," he says. Also, FMC's valuation overlooks the fact that about 15% of its earnings are derived from two non-core units -- Food Tech, which makes food-processing systems, and Airport Equipment & Services, which makes gate- and ground-support equipment for airports. Both are scheduled to be spun off sometime this summer. "It's the most fully valued of any stock I cover," says James Crandell, an oil-services analyst at Lehman Brothers. "I wouldn't recommend the stock here."

-

momentum, ei ütleks, et mingit nihet tahtlikult tegemas oleksime. Aga makro on kindlasti oluline ja väärt kajastamist. Ja graafikuid oleme ikka mõnikord ka üles laadinud, sest pilt ju ütleb teadagi rohkem kui.... Ning on silmale ka niisama ilus vaadata.

-

Lisaks USA-s kaubeldavatele leidub rida tuntud vene ettevõtteid euroopast. Lisan siia mõned koos Traderi tickeriga:

AFLT - AEROFLOT GDR.

MSNG - AO MOSENERGO

AVAZ - AVTOVAZ GDR

CMST - COMSTAR-UNITED TELESYS-GDR

SIBN - GAZPROMNEFT ADR

IRGZ - IRKUTSKENERG

NNIA - JSC MMC NORILSK NICKEL-ADR

LKOH - LUKOIL-SPON ADR (likviidsus rahuldav)

NVTK - NOVATEK OAO-SPONS GDR REG S

GAZA - OAO GAZPROM ADS (likviidsus rahuldav)

PCZL - POLYUS GOLD-ADR-W/I

ROSN - ROSNEFT ADR

CHMF - SEVERSTAL - GDR REG S

ENCO - SIBIRTELECOM-SPONS ADR

SNGS - SURGUTNEFTEGAZ (likviidsus rahuldav)

VZRZ - VOZROZHDENIE BANK ADR

WBDF - WIMM-BILL-DANN FOODS-ADR

KUBN - YUZHNAYA TELEKOM ADRArvestada tuleks üsna kehva likviidsusega võrreldes MICEX-l kauplemisega.

-

S&P Case Shiller Composite-20 y/y -14.4% vs -14.2% consensus, prior -12.7%

-

Saksamaa DAX -0.51%

Prantsusmaa CAC 40 -0.70%

Inglismaa FTSE 100 -0.45%

Hispaania IBEX -0.92%

Venemaa MICEX -1.77%

Poola WIG +0.22%

Aasia turud:

Jaapani Nikkei 225 +1.48%

Hong Kongi Hang Seng +0.64%

Hiina Shanghai A (kodumaine) +0.32%

Hiina Shanghai B (välismaine) +1.74%

Lõuna-Korea Kosdaq +0.51%

Tai Set -0.14%

India Sensex -0.45%

-

Bear-Market Pain

By Rev Shark

RealMoney.com Contributor

5/27/2008 8:19 AM EDT

Act quickly, think slowly.

-- Greek proverb

Just a week or so ago, the market was embracing the idea the stock market was ready to shake off a potential recession and the worst debt and housing markets in decades. The thinking was we had already priced in all those negatives and were ready to look ahead to better days.

Unfortunately, that optimism was tripped up as a relentless rise in oil suddenly moved to the forefront of concerns. The rise in oil, which has been steady for years, hasn't matter in the past but has now reached a tipping point. Oil is now raising fears of inflation and even stagflation down the road. The whole idea that "the worst is behind us" now seems rather naive as new worries and concerns suddenly pop up.

This action is very typical of what you'd expect to see in a bear market. There is always a point where premature optimism blossoms and draws in many who are tired of the negativity. They want to put the bad news behind them and start looking forward to better days. Unfortunately this causes them to overlook and prematurely dismiss many of the negatives that still exist.

When the reality of the economic situation becomes clear and hopes are dashed, the real pain of a bear market sets in. That is the stage we are entering now. Those who rushed in with great optimism that we were going to quickly and easily overcome some of the worst economic problems in our lifetime are starting to realize that it may not be that easy. That is awfully discouraging, and the market action is likely to reflect that in the days ahead.

Both Warren Buffett and Alan Greenspan are on the wires this morning talking about the likelihood of recession. Oil prices continue to rise, financial stocks like Goldman Sachs (GS) and Morgan Stanley (MS) are downgraded and technicians are warning about the breakdown in the indices.

We are a little oversold right now, and that may give us some sort of relief bounce, but make no mistake -- the bears are back in control of this market. Be quick to protect your capital but slow to believe that the worst really is over.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CEDC +2.1%... Select Chinese Telecom names showing continued strength from telecommunications industry reorganization reports: CN +10.5%, CHU +8.9%, CHA +4.6%... Select solar stocks showing modest strength: ASTI +6.5% (initiated with an Outperform at Cowen), SOLF +2.7%, ESLR +2.6%, CSUN +2.5%, LDK +2.3%, CSIQ +1.3%... Other news: CEM +15.4% (Blackstone and Apollo in talks with Chemtura - FT), LEI +14.8% (announces 150% increase in PV-10 for full fiscal year ended march 31, 2008), SPF +9.9% (receives MatlinPatterson equity commitment totaling in excess of $530 mln), STP +3.4% (announces strategic investment in Shunda and 7GW wafer supply agreement), BUD +1.3% (InBev may start Anheuser bid talks Tuesday - Reuters)... Analyst upgrades: NGAS +5.0% (upgraded to Outperform from Market Perform at BMO Capital), LCAV +4.3% (upgraded to Sector Perform at RBC), NFX +2.6% (upgraded to Buy at Keybanc), AG +2.0% (upgraded to Outperform at Credit Suisse), WLP +2.0% (upgraded to Outperform from Market Perform at BMO Capital), AXL +1.1% (upgraded to Buy at Citigroup).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: FTK -15.1%, VOD -1.8%... Select financial names showing weakness with UBS (-13.9%) saying more mortgage losses possible - Bloomberg.com and BofA slashing ests on select firms: CS -3.6%, LEH -3.4% (estimates cut at BofA), RBS -2.9%, MER -1.8% (estimates cut at BofA), DB -1.1%... Select metals/mining stocks showing weakness with modestly lower spot prices: PAL -4.4%, AUY -3.6%, RTP -2.9%, HMY -2.3%, MT -2.2%, BHP -1.7%, GOLD -1.3%, GLD -1.1%... Select oil/gas names trading lower with slight pullback in crude: STO -4.1%, BP -1.6%, E -1.3%, TOT -1.3%... Other news: CHL -5.5% (WSJ reports the restructuring of China's telecommunications sector would put pressure on CHL's competitive edge; also hearing downgraded to Sell at tier 1 firm), IFX -5.1% (WSJ reports that CEO to step down; also STM says buying Infineon wireless ops wouldn't make sense - DJ), IOSP -4.6% (discloses the U.K.'s serious fraud office notified Innospec Limited that it had commenced an investigation), ERIC -2.6% and NOK -2.2% (still checking for anything specific), AMCP -1.1% (receives notice from Florida office of insurance regulation regarding excessive profits filing)... Analyst downgrades: MRVL -3.7% (hearing downgraded to Neutral at tier 1 firm), GSK -2.0% (downgraded to Underweight at Morgan Stanley), GM -2.0% (downgraded to Hold at Citigroup), BWA -1.8% (downgraded to Hold at Keybanc). -

Nafta on üle hulga aja tervenisti poolteist protsenti miinuses ning barreli eest tuleb välja käia hetkel täpselt $130. Saame näha, kas selline langus ka naftapulle närviliseks teeb või mitte. Aktsiaturud on eelturu miinusest nafta langus igaljuhul väiksesse plussi vedanud.

-

New Home Sales 526K vs 520K consensus, +3.3% m/m; prior revised to 509K from 526K

May Consumer Confidence 57.2 vs 60.0 consensus, prior 62.8 -

Fed-i liige Yellen kõnelemas:

Fed's Yellen says Fed should not be 'complacent' about inflation

Fed's Yellen sees some 'rays of hope' for market conditions

Fed's Yellen says financial markets are 'still far from normal'

Fed's Yellen says inflation 'disappointing,' but no stagflation seen

Fed's Yellen says amid uncertainty, econ likely to revive in 2H

Fed's Yellen says Rate Policy, Fiscal Stimulus Will Lift Economy

YELLEN SAYS REAL FED FUNDS RATE NEAR ZERO; SHOULD BOOST GROWTH ALONG WITH FISCAL STIMULUS

YELLEN SAYS TOTAL AND CORE INFLATION WILL MODERATE IN NEXT COUPLE OF YEARS

YELLEN SAYS U.S. CONSTRUCTION SPENDING, HOUSE PRICES TO KEEP FALLING INTO 2009

YELLEN HOPEFUL U.S. TAX REBATE PROGRAM TO HAVE "SUBSTANTIAL" EFFECT IN 2ND AND 3RD QUARTERS -

Pullid nädalavahetuse puhkusest ja toornafta hinna -2.85% langusest ajendatult $128.43 tasemele on vägagi optimistlikud ning turgudel korralik ostusurve. Nasdaqi volatiilsusindeks VXN on juba languses.

-

Lehman Brothers (LEH) Greenlight Capital's Einhorn appears on CNBC discussing his thoughts on LEH; says disclosures in 10-Q were inconsistent with what was said on earnings call.

Kas tõesti? -

Bear Stearns bankruptcy ruling barring US protection upheld

Bloomberg reports Bear funds sought protection while liquidating in Caymans. Judge says Bear funds can't shield assets from US lawsuits and funds. BSC funds lose bid to reverse bankruptcy court ruling.