Börsipäev 2. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Eile pärast turu sulgemist teatas Blockbuster (BBI), et loobub Circuit City (CC) ülevõtmisest. Kuigi näiteks Citigroupi analüütiku arvates oleks olnud ühinemine pigem positiivne uudis, siis valdav enamus turuosalistest arvas siiski vastupidi. Seega võib ilmselt täna Blockbusteri aktsias ostuhuvi näha.

Samas väga suureks üllatuseks selliseid arenguid pidada ka ei saa, sest Circuit City aktsia oli viimase kuu aja jooksul langenud ligi 50% võrra ehk turg hindas ülevõtmist äärmiselt ebatõenäoliseks. -

Mis hinnani BBI võiks tõusta?

-

Nii täpselt küll ei oska ennustada, sest sõltub lisaks konkreetsele uudisele veel analüütikute kommentaaridest, turu üldisest meelestatusest jne. Ühes varasemas börsipäeva foorumis tõin välja analüütikute hinnasihid, kuid nendeni jõudmiseks ei piisa pelgalt Circuit City ostmise loobumisest, vaid need eeldavad ikka ka ettevõtte põhitegevuses pööret paremuse poole.

-

`Worst Is Over' for European Banks, JPMorgan Says

European banks won't need to raise capital in the coming months because credit-related writedowns have peaked, JPMorgan Chase & Co. said.

Zurich-based UBS AG may still need to write down 5.1 billion francs ($5.01 billion) and Credit Suisse Group AG may mark down 2.1 billion francs, analysts led by Kian Abouhossein wrote in a note to clients today. France's Societe Generale SA and Natixis may mark down 1.9 billion euros ($3 billion) and 1.4 billion euros respectively, he said.

Soovitaks siiski lugeda eilset artiklit USA pankade lubaduste ja IFY indeksfondi vahelisest seosest:

Aadress: http://seekingalpha.com/article/83427-wall-street-says-oops#comment_form

Wall Street Says 'Oops

'Wow…

On June 6th, I forecast a dramatic fall in the stock market. However, even I didn't expect things would get as bad as they have this quickly. The S&P 500 has fallen nearly 9% since then.

All told, stocks posted their worst June performance since the Great Depression. Many pundits seemed shocked by this, despite the fact virtually every guest commentator on their shows stated that this was, in fact, the worst financial crisis since the Great Depression.

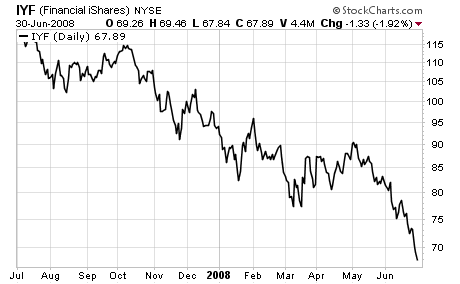

Leading the pack downward were financials. The financial ETF (IYF) fell an incredible 18% in a mere three weeks. Sector-wide financial firms hit new lows, led by Lehman Brothers (LEH) and Citigroup (C).

To me, this was deliciously ironic. These very firms were the first to pronounce the worst was over back in March. One by one, the big Wall Street CEOs made this claim. One by one they’ve had to issue rights offerings to raise capital. And one by one their stocks have fallen beneath the price of the rights offerings to new lows.

What’s truly incredible about all of this was that many firms were actually issuing buys in the sector a mere month ago. Goldman Sachs recently admitted to being “clearly wrong” on its recommendation of financials in early May. And Barron’s has admitted it was dead wrong to advise buying AIG (AIG) in February.

However, Merrill Lynch (MER) holds a special place for being the most schizophrenic firm on the street. Between June 2 and June 11, Merrill Lynch analyst Guy Moszkowski—who incidentally was the top ranked brokerage analyst last year—changed his tune regarding Lehman Brothers four times. He first shifted his stance to “neutral” from “underperform.” He then told clients to buy twice—June 4 and June 10—before shifting back “neutral” on June 11.

I have to tell you, this scares me. Rarely if ever will Wall Street retract an assertion. However, to my knowledge Wall Street has NEVER in its history publicly admitted to being wrong. God only knows how bad things are going to get if they’re doing this now.

So as badly beaten down as financials are today, I expect we’ll see greater carnage in future. Most of the 1Q08 profits in the sector came from either over the counter derivatives—non-regulated investments—or fuzzy accounting—counting debt write-downs as profit or moving rapidly depreciating assets to Level 3 to get them away from market valuations.

Given the recent action in financials stocks—as well as the self-deprecating admissions from Wall Street analysts—it's clear the market has caught on that the worst was definitely not over in March. It's not over now either. The primary revenue streams for financial firms—lending, M&A, and debt issuance—are drying up. I believe 2Q08 results will disappoint in the sector, pushing financial stocks even lower.

So as cheap as financials are getting, I say steer clear. Even Wall Street is telling people not to buy financials right now. It's nice to see a conflict of interest that actually helps investors for once.

P.S. Speaking of backtracking, Jim Cramer committed one of the most incredible self-contradictions I've seen in my entire life a few weeks ago. See for yourself: http://youtube.com/watch?v=_nkZ3eHeXlc.

I’m going to send Jim a mirror in the mail. I assume from his behavior that he doesn’t actually own one. Or if he does, he certainly doesn’t look himself in it.

-

Marks & Spencer teatas, et 13 nädala jookusul (enne 28.06) kukkus müügikäive UKs 5,3%. Aktsiahind kukkus Londonis 22% ja kaupleb hetkel -18% juures. Ettevõte vallandas ka tippjuhte, kuid analüütikud usuvad, et probleem on suuremas pildis ja M&S on suunanäitajaks teistele jaemüüjatele.

-

Pisut teie juures õpitut.

http://www.ap3.ee/Default2.aspx?ref=lastcomm&ArticleID=66734441-678a-4ee5-810c-2b8ba73c1141&readcomment=1#comment

Suurimad tänud. -

Bubble, eelturul on hetkel BBI $2.84 ehk +13% ning CC $2.35 ehk -8%.

-

Ei teagi kohe kas visata maha või veel oodata, bid juba 2,88 ja ask 2,89

-

Ei viska pragu midagi maha, sest "mõnusas Hansapangas" puudub väidetavalt võimalus eelturu hinnaga aktsiaid müüa...

-

June ADP Employment -79K vs -20K consensus, prior revised to 25K from 40K

-

Üks süüdlasi BBI 15%-lises eelturu tõusus on kindlasti 45% short interest. Ilmselt oli paljude lühikeste positsioonide omanike üks peamisi argumente, et Circuit City ost tähendaks Blockbusterile parajat raha põletamist. Eks näis, kas siit suudetakse suurem short squeeze korraldada või ei.

-

Yahoo Climbs Amid Optimism That Microsoft May Renew Overtures

Yahoo! Inc., the second most popular search engine, advanced in early trading on optimism that Microsoft Corp. may revive attempts to take over the Internet company.

The shares gained as much as 6.9 percent after the Wall Street Journal said Microsoft, the world's biggest software maker, approached media companies about trying to break up Yahoo. Microsoft talked with Time Warner Inc., News Corp. and others, the newspaper said, citing people familiar with the matter.

The report signals that Microsoft Chief Executive Officer Steve Ballmer is unwilling to abandon a deal that would more than triple his company's share of U.S. Web searches, helping him take on leader Google Inc. A transaction also may appease Yahoo investor Carl Icahn, who sought to oust the Internet company's directors after talks on a combination collapsed.

Yahoo climbed $1.40 to $21.60 in trading before exchanges opened after closing at $20.20 yesterday on the Nasdaq Stock Market. The stock had fallen 14 percent before today since June 12, when talks on a combination of the two companies collapsed. Microsoft rose 14 cents to $27.01. immediately return calls before regular business hours.

Under the discussions now taking place, Microsoft would buy Yahoo's search operations, the Journal said. Another company, such as Time Warner's AOL or News Corp.'s MySpace, would combine with the rest of Yahoo, the newspaper said. News Corp. owns the Wall Street Journal.

Microsoft representatives met with Icahn to encourage him in his proxy battle, the Journal said. The billionaire investor began an attempt to oust Yahoo's board in May, after Microsoft first walked away from a takeover of the whole company. Icahn accused Yahoo CEO Jerry Yang of sabotaging the deal.

Microsoft raised its initial bid of $44.6 billion to $47.5 billion, only to walk away when Yahoo demanded more money. Ballmer later sought an alternative transaction short of a full takeover, taking aim at Yahoo's search business.

Yahoo ended those talks after Microsoft made a final proposal to buy $8 billion of Yahoo shares for $35 each and acquire the search business. The same day, Yahoo forged an agreement to allow Google to sell some of the advertisements Yahoo runs alongside Internet search results.

Source: Bloomberg.

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aaSi4xzZ4sAo

-

To Bubble13: Aga miks mitte LHV? Eel ja järelturul saab Traderis ilma probleemideta müüa ning aeg ajalt oleme ka investeerimiskonto klientidele selles osas vastu tulnud.

-

olengi peatselt LHV-sse tulemas, hansa on ikka viimane koht aktsiatega kauplemiseks...

-

Euroopa ja Aasia põhiindeksid:

Saksamaa DAX +0,46%

Prantsusmaa CAC 40 +0,13%

Inglismaa FTSE 100 +0,56%

Hispaania IBEX 35 +0,67%

Venemaa MICEX +0,69%

Poola WIG -0,32%

Aasia turud:

Jaapani Nikkei 225 -1.31%

Hong Kongi Hang Seng -1,80%

Hiina Shanghai A (kodumaine) 0,00%

Hiina Shanghai B (välismaine) +0,76%

Lõuna-Korea Kosdaq -4,13%

Tai Set 50 -1,31%

India Sensex +5,42%

-

Market View: Dow pauses at first level resistance -Update- -Technical-

Noted initial resistance at 11425/11435 (this wk's high/congest) in The Technical Take and have seen the index hold on the latest extension attempt (session high 11429). Only a limited pullback thus far as Finance (JPM +3.7%, C +1.9%, AIG +1.2%, BAC +1.1%) has underpinned but the XLF has paused as well at a short term resistance at 20.67 after a 5.7% rally off yesterday's low (38% retrace of slide off last wk's low -- XLF session high 20.70) suggesting watching to see if some additional downticks develop in the Dow in the wake of its 2% jump. Intraday support is at 11385 followed by the 11345/11335 area

:D -

Dept of Energy reports that crude oil inventories had a draw of 1982K (Bloomberg consensus is a build of 500K); gasoline inventories had a build of 2100K (Bloomberg consensus is a build of 500K); distillate inventories had a build of 1264K (Bloomberg consensus is a build of 1500K).

Mootorkütused on igaljuhul juba mitmendat nädalat järjest oodatust suurema ülejäägiga võrreldes ootustega. -

hearing crude files for Chapter 11. Strong f...ing selll :D

-

Short madis43.

-

mis tasemetelt?

-

Mkt order, läbi levelite :)

-

ole valmis average'ima up :)

-

Kukkumise pealt saab marginit juurde.

Et asi päris ebahuvitavaks ei läheks, siis long Arch Coal (ACI) 68.8 avrg. Söeaktsiad on täna müügisurve all, kuna liiguvad kuulujutud, et söe hind on kusagil kukkunud. Ma isegi usun seda aga kuna reaktsioon on sellele nii valulik olnud, siis ma olen pigem ostupoolel siin veel. Esimene kord antakse ikka andeks..

Apollo Group (APOL)/ on siin short, 56.60 avrg hetkel. Ootamatult head tulemused aga veidi "hairy". Pealegi, kui DeVry (DV) 3 miljoni blokk müüdi 56 pealt, siis paneb see sektori valuationile ka mingisuguse capi peale.

Long some AXL ja DTG ka aga need on väiksemad positsioonid. DTG on jälle 25% all peale eilset suurt kukkumist . Avis (CAR) otsustas ka täna hoiatada. AXL elab siis ka edasi kui GM perse kukub. Ega autode tootmine seisma ei jää ka chap 11 korral. -

APOL ju rallib...enekk valmistu nutma ja katma:)

-

Aeg vist natuke seda ACI positsiooni suurendama hakata. hetkel keskmine 68.00

-

Viisin ACI keskmise 67.07 juurde.

In addition to a big drop in South African coal prices (see 10:48 comment), European coal prices declined the most in several years. According to Bloomberg, European coal prices saw their biggest decline in three years, with fuel for delivery to Amsterdam, Rotterdam or Antwerp with settlement next year retreating $22.50, or 10%, to $195/metric ton. That would be the biggest drop since Mar 2005. (MEE, JRCC, ACI, FCL, CNX, ANR, ICO, NCOC, BTU, FDG) -

Kas GIGM võiks olla hetke tasemetelt juba hea ost?

-

enek,

äkki viitsid selle lingi ka siia panna kust sa selle uudise said ja mis veel parem, kas oskad öelda kust ma saaksin vaadata edaspidigi coali kokkuostuhindade muutust (nagu naftal QM on). -

ACI avrg 64.97.

Sihin 66-67 taset ise siin. -

Sector Leaders:

Heating Oil- UHN +2.5%, Insurance Brokers- KIE +1.3%, Commodities- GSG +0.80%, DBC +0.70%, Base Metals- DBB +0.80%, Utilities- XLU +0.90%, Silver- SLV +0.70%, Oil- USO +0.60%

Sector Laggards:

Coal- KOL -8.8%, Steel- SLX -6.9%, Solars- KWT -6.2%, TAN -5.4%, Materials- IYM -4.8%, XLB -2.3%, Ag/Chem- MOO -3.8%, Clean Energy- PBW -3.0%, Homebuilders- XHB -2.8%, Transports- IYT -2.7% -

enek,

palju sa aci-d endale kokku kahmasid? -

1Hope... suurepärane küsimus. Mina olen GIGMit väga heaks investeeringuks pidanud juba ka paar dollarit kõrgemailt tasemeilt, kuid seni on turg mulle selgelt vastu vaielnud...

-

Aga sarnaselt eile päeval(SPY 126.3) ja õhtul(128.3) öelduga usun, et näeme päeva edenedes taaskord ülespoole liikumise jätkumist. Hetkel siis SPY 127.8.

-

Apollo short (APOL) kinni siit, 1 punkt kasumit. Ilmselt liiga vara aga ma ei tunne ennast väga kindlalt shortides mingil põhjusel.

Keegi veel võttis? -

Joel, tänud vastamast, lihtsalt nii meeletu kiirusega alla kihutamine tekitab kõhklusi, kas pole midagi firma endaga väga pahasti...GIGM saab kuidagi (kuigi turg üldiselt karune) eriti valusalt pihta. Välismaistes foorumites ennustatakse palju ikka alla 10$ minemist.

-

Autoliv (ALV) sai äsja kiidulaulu osaliseks CNN-s, kus väidetavalt on kogu tööstusharu parim ettevõte ja viimasel ajal kõvasti alla müüdud aktsia on muutunud valuatsioonilt samuti atraktiivseks. Põhjenduseks toodi globaalse automüügi kasv ning jätkuvalt tõusvas trendis liikuv liiklusõnnetuste koguarv.

-

Toornafta futuurid jälle tippudel ja turg annab jällegi käest vahepeal tagasi võidetud edu.

-

enek, pigistab juba? :D

(see sama nali) -

Hetkel uueks tipuks vormistatud $143.81 barrel.

-

Madis, tead kust mul tegelikult pigistab? :)

-

ma olen kehv sensitiiv:)

-

Lehman Brothers: CNBC commentator discusses recent rumors, notes that take under is not likely with LEH issuing stock to employees

-

Toornafta on jõudnud juba uueks tipuks vormistada $143.97 ning püsib $143.90 juures, kas murtakse ka $144 barrel tase?

-

Naftal $144 barrel tase murtud, uueks tipuks hetkel $144.13 ning püsitakse pealpool $144 barrel taset.

-

Ma pakun, toornafta murrab ära $150 taseme, enne kui korrektsioon tuleb.

-

See, et hoolimata nafta hinna tõusust on ka energia aktsiad sügavalt miinuses, on päris huvitav. Nagu öeldakse - turg ei saa tõusta enne, kui kuhugi pole enam võimalik peitu pugeda. Energiasektori aktsiad on seni olnud peidupaigaks, aga tänane ärakukkumine energia aktsiates hoolimata toornafta tõusust on huvitav.

-

kas see võib tähendada, et nt coal-i puhul ei pruugi põrget tulla lähipäevil? Et võib veel alla põrutada jah?

-

vaadates 2002 mai-august graafikut(DOW), siis näeme kuhu tee viib!

-

Kaks varianti, kas tuleb kiire taastumine commodity aktsiates või tuleb sell-off commoditytes. Selline erisuunaline liikumine ei saa püsiv olla.

-

Kas on joodud õlled põhjuseks või ongi NVDA alla 14 bargain of the day?

Ilma õlledeta ma vist ostaks alla 14 kõik aktsiad ära, mis antakse.