Börsipäev 8. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Tänane börsipäev Euroopa aktsiaturgudel lubab tulla igati huvitav.

Saab näha, kuidas reageeritakse pärast halbu uudiseid Aasiast ja Ühendriikidest. Eileõhtune kauplemine oli muutusterikas. Volatiilsus kasvas, kuna investoreid hirmutas üha enam finantssektori kriis. San Francisco Föderaalreservi President Janet Yellen ütles, et finantsturud muutuvad hullemaks ja alles siis on oodata olukorra paranemist. Viimase tõuke USA aktsiaturgude languseks andis Lehman Brothersi analüütik, kes väitis, et Fannie ja Freddie (USA valitsuse poolt toetatud kaks hüpoteeklaenuandja firmat) peavad tõstma kapitali krediidikriisi jätkumise tõttu. Fannie Mae aktsia langes 16.2%, Freddie Mac langes 17.9%. Ühendriikide suurimad pankade Citigroup Inc., JPMorgan Chase & Co. ja Bank of America Corp. aktisad samuti langesid.

-

Morgan Stanley on tõstmas Mastercardi (MA) hinnasihti $320 peale. Mõned põhjused, mille poolest teistest analüüsidest erinetakse:

Consensus estimates may be missing: 1) in 3Q08, advertising expenses could pull back sharply, fueling upside to consensus forecasts; and 2) declining professional fees (5% of 2008e net revenue) post the American Express and Discover settlements could fuel 2-3% incremental earnings growth in 2009. Admittedly, our 2Q08 estimates are modestly below consensus, likely driven by the timing ofadvertising expenses.

Kuigi finantssektori nõrkus kasuks ei tule, avanetakse täna arvatavasti kõrgemalt. Kuigi valdav enamus analüütikutest on MA suhtes positiivsed, tekitab Morgani nimi kindlasti ostuhuvi, kaasa aitab viimase kuu tugev allamüük.

-

Positiivne sõnum ka poliitikutelt. G8 liidrid suutsid hommikul kokkuleppida, et kasvuhoonegaasi mahtu vähendatakse poole võrra aastaks 2050. Praegu tuleb G8 riikidelt 62% süsihappegaasist.

-

Madise postitusle lisaks: 07:30 MA MasterCard upgraded to Outperform from Market Perform at Raymond James.

Kui esimesed kiiremad said eelturul osta $245.45-.60 juurest, siis nüüdseks on aktsia hind juba kerkinud $247.50-ni. -

Majandusteemadest rõhutasid G8 liidrid nafta- ja toiduainehindade tõusu mõju maailmamajanduse halvenemisele. Teemaks olid ka valuutakursid. Liidrid leidsid, et Hiinal on viimane aeg renminbi fikseeritud kursist loobumiseks. Valuuta kallinemine aitaks hiinlastel võidelda ka rekordkõrge inflatsiooniga.

Homme avalikustatakse ka Hiina juuni kaubandusbilanss, mis suure ülejäägi korral survestab veel enam renminbi kallinemist

-

Mikk, kuidas kasvuhoonegaaside piiramise kokkulepe täpselt turgude kontekstis positiivne on? Majandusele laiemalt ja seega ka turgudele tervikuna ei kipu tavaliselt kasuks tulema, kui poliitikud otsustavad hakata ohjama mingeid protsesse, millest nad päris täpselt aru ei saa ning mille "ohjamise" tagajärgedele nad praegu mõtlema ei pea.

-

Äkki läheb kohe läheb üks suur arendamine käima, et eesmärke täita.?

-

Karumõmm, näiteks kokkuhoiu pealt. Kõige tähtsam on Ameeriklaste suhtumist muuta. Nende meelest on Euroopas väiksemad autod sellepärast, et Euroopa tänavad on kitsamad.

-

Positiivne jah rohkem inimestele ja eks taastuvenergia tootjatele samuti. Aga ma nii pessimistlik selle kokkuleppe suhtes ei oleks. Praegu sai küll eesmärk paika pandud aga aeg on näidanud, et ilma eesmärgita ei toimu tihti midagi. Kui täpne tegevuskava paika saab, siis saab ka põhjalikuma hinnangu anda.

-

Positiivne on juba see, et G8 milleski kokku suutis leppida ;-)

ja 2050 on just parasjagu nii kauge tulevik, et tegelikult ju midagi tegema ei peagi... -

Selle kokkuleppe põhjal ei hakka küll midagi sündima ja selle mõju turgudele lühiajalises perspektiivis peaks üsna nullilähedane olema.

Minu arusaamist mööda on see jätk eelmise aasta kokkuleppele "to consider seriously". Sel aastal pigem lepiti kokku, et tulevikus lepitakse kokku juhul, kui Hiina ja India ka kokku lepivad. Jäeti küsimata, kas Hiina ja India on nõus kokku leppima.

Ka juhul kui midagi tulevikus kokku lepitakse, võib suvaline osapool igakell põõsast teha. Viimane pullis USA ju Kyoto kokkuleppest välja 4 aastat peale selle kokku leppimist. Ütles, et USA majandusele pole see hea ja globaalne soojenemine pole üldsegi kindel ja tõestatud sündmus. -

Euroopa ja Aasia põhiindeksid:

Saksamaa DAX -1.34%

Prantsusmaa CAC 40 -1.45%

Inglismaa FTSE 100 -0.93%

Hispaania IBEX 35 -0.63%

Venemaa MICEX -1.03%

Poola WIG -0.93%

Aasia turud:

Jaapani Nikkei 225 -2.45%

Hong Kongi Hang Seng -3.16%

Hiina Shanghai A (kodumaine) +0.81%

Hiina Shanghai B (välismaine) +0.67%

Lõuna-Korea Kosdaq -3.42%

Tai Set 50 -1.30%

India Sensex -1.30%

-

Bottom-Calling Is a Fool's Game

By Rev Shark

RealMoney.com Contributor

7/8/2008 8:46 AM EDT

The more unpredictable the world is, the more we rely on predictions.

-- Steve Rivkin

Although crude oil prices are down, overseas markets were very weak and the U.S. market is off to another rocky start. Worries continue to grow over problems in the financial sectors and a sputtering worldwide economy. Confidence in the market is extremely low, and when we do get some sort of bounce, many investors are using it as an opportunity to exit.

The problem here isn't a complicated one. The market discounts the future, and many are now coming to the realization that we may have underestimated the extent of the issues in the financial sectors. There has never been great clarity over the extent of the problems faced by banks and brokers, and then when we hear about the extend of off-balance-sheet issues at Fannie Mae (FNM) and Freddie Mac (FRE) , market players start to realize that we really don't know what the truth is when it comes to the financial sector.

The great difficulty of this market right now is that we are obviously in a very ugly downtrend but oversold enough that many are looking for a bounce. We aren't getting quite enough panic or fear, so we end up with a series of feeble rallies that quickly fade. We are seeing a particularly good example this morning, as a spike in the last hour yesterday is being undone by a weak open this morning.

There are a number of ways to approach this market, but the key thing is to be very respectful of the fact that the major trend is down. That is not going to change if we he have a bounce and a few days of positive action. It is going to take a series of positive days to change the trend, and the most dangerous thing you can do is to anticipate that action.

Unfortunately there isn't much else for market pundits to focus on other than the chances of some sort of bounce. Wall Street is like Pavlov's dog when it comes to calling bottoms. As soon as there is a downtrend, the reflexive action is to proclaim that we have a great buying opportunity and that a bottom is at hand. The vast majority of the time, those predications are dead wrong, but that doesn't stop the pundits from making them. Unlike real investors managing their own money, there isn't any cost to constantly making incorrect predictions, so they just keep on doing it until they finally can proclaim they were right.

Make sure you keep the right perspective about the bottom-calling game. It is not going to disappear, and it can be very hard to resist. As long as you are aggressive and respect the fact that the overall trend is down, you can play the short-term bounce game and keep losses contained if your timing is off. The easy way to get in trouble is to start believing the pundits that it's time to buy for the longer term before the market provides some evidence to confirm that.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: GBX +10.6% and GMXR +5.3% (light volume), BPHX +4.5% SSI +4.3% PBG +1.6% (light volume)... Select airline names ticking higher with crude continuing to slip: ALK +6.3%, UAUA +4.5%, CAL +4.4%, NWA +4.4%, AMR +3.9%, LCC +3.6%, DAL +2.0%... Select European drug stocks trading higher: GSK +4.3%, SNY +3.0%, NVS +2.9%, AZN +1.9%... Other news: OPWV +11.5% (appoints Karen Willem as Chief Financial Officer), CTDC +8.2% (signs LOI to co-develop the Xiamen Bay Solar City), BEXP +5.9% (announces high rate main pass production test and new Southern Louisiana discovery), ENER +5.3% (announces UNI-SOLAR laminates to power rooftop solar system for General Motors), YGE +4.8% (signs five new sales contracts in Korea), MDVN +3.7% (announces positive top-line results from Phase 2 Dimebon study in Huntington's Disease; also upgraded to Outperform at Rodman & Renshaw), TRLG +3.5% (will replace Helix Energy Solutions in the S&P SmallCap 600), UBS +1.6% (still checking for anything new -- stock is higher after initially trading down overseas)... Analyst comments: WDFC +1.4% (upgraded to Neutral at JPMorgan), MMC +1.3% (upgraded to Buy at Citigroup), TEVA +1.1% (added to Conviction buy List at Goldman), MA +0.9% (upgraded to Outperform at Raymond James).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ODP -13.5%, UMC -2.1%, PSMT -2.0% (light volume)... Select European financial names showing continued weakness: AIB -6.5%, LYG -2.6%, HBC -1.5%, CS -1.3%... Select metals/mining stocks trading lower spot prices: GOLD -4.3%, LMC -3.6%, MT -2.5%, AAUK -1.5%, ABX -1.2%, NEM -1.0%... Other news: BRLC -89.1% (announces asset purchase agreement, files voluntary petition or Chapter 11 reorganization to facilitate sale), IMB -36.6% (hasn't been successful in raising added capital, regulator says firm no longer well capitalized; says it won't accept new loan submissions - Bloomberg; also target cut to $0 at FBR), HK -5.1% (still checking), GDP -4.9% (announces it has commenced an underwritten public offering of 3.0 mln shares of its common stock), AOB -4.0% (proposes offering of $85 mln of convertible notes), SPLS -3.7% (down in sympathy with ODP), CENX -3.4% (announces plans to offer 6.5 mln new shares of common stock), TS -3.4% (still checking), HOGS -1.6% (files Form 424B3 related to 12 mln share offering by selling stockholders)... Analyst comments: SNV -9.2% (downgraded to Market Perform at Morgan Keegan), GYMB -3.6% (downgraded to Market Perform at FBR), WSH -3.5% (downgraded to Hold at Citigroup), RATE -1.3% (downgraded to Neutral from Buy at SunTrust). -

Turul igaljuhul oodatust nõrgem pending home sales raport ralliisu vähendas. Muidugi erilise uudisena housingu nigel olukord mitte kellelegi enam küll tulla ei tohiks.

May Wholesale Inventories +0.8% vs +0.7% consensus, prior +1.4%

May Pending Home Sales m/m -4.7% vs -3.0% consensus; prior +7.1%

-

"Turul igaljuhul oodatust nõrgem majaderaport ralliisu vähendas."

Lauseehituses keele eesti tähtis järjekord sõnade on. -

Samuti ei kasutata nimede sees suuri tähti.

:) -

"Turul igaljuhul

oodatust nõrgem

pending home sales raport

ralliisu vähendas"

PeaLik, ilus neljarealine luuletus ju. Kuid tõepoolest, paraku kipub vahel niimoodi olema, et mõtte ja andmete foorumis kiiresti edasi andmisel esineb grammatilisi ebatäpsusi. Aga siinkohal on mõte siiski tähtsam. -

Ega ma paha pärast. Niisama nokin. Jaapani haiku 5+7+5 silbireeglite järgi peaks börsiuudiseid vormistama nii:

Majaderaport

ralliisu vähendas

oodatust nõrgem.

:) -

Homsed börsipäevauudised kõik luulena vormistada?

-

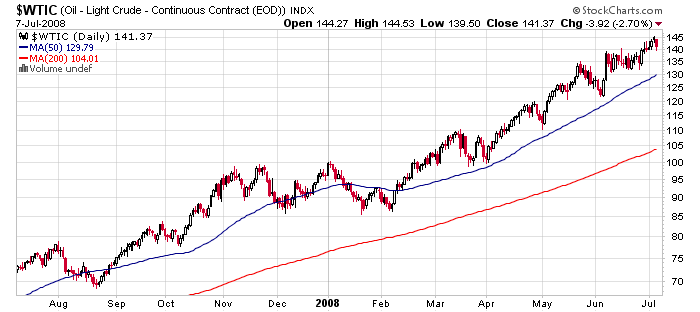

Must kulla hind on vimasel ajal õige närviliselt liikuma hakanud. Täna üle 4% allpool $135.3 eest barrel.

-

Kas kellegil on käepärast nafta hinna (nt. 1 aasta) graafikut? Sooviks natuke tehnilist pilti vaadata

-

Medal:

siit leiad - http://www.boursorama.com/graphiques/graphique_histo.phtml?symbole=CLAU08

Parameetrite menüü alt saad stiili muuta jaapani kuunaldeks - Chandelier ja lisada indikaatoreid

Erinevate ajavahemike vaatamiseks muuda graafiku paremas alumises nurgas journalier (päevane) hebdomadaire (nädalane) mensuel (kuine) graafik -

Tänud!

-

VIXist on viimasel ajal, nagu iga turu suurema languse ajal ikka, palju räägitud. Sedapuhku pole languse ajal VIX eriti tõusnud. Helene Meisler on RealMoney all päris hea seletuse välja pakkunud:

VIX

Okay, I finally have come up with a theory on the VIX and why it hasn't gotten jumpy. There is real selling going on.

While this may sound ridiculous to many, think of it like this: we've gotten so much in the way of redemptions in mutual funds that there has been real selling going on. Instead of buying protection against a downturn (ie. options) they are really selling. That's why volume has been high.

It's been a long time since we've had this much selling. The good news is that real selling ends up bullish in the long run. If you have sold, then there are no sellers above when we finally do rally.

Thus, the panic is in mutual fund liquidation.