Börsipäev 1. august

Kommentaari jätmiseks loo konto või logi sisse

-

Börsipäev sai täna alguse tavapärasest pisut hiljem, aga pole hullu : )

Mis nüüd tänasesse USA turgu puutub, siis olulist liikumist näeme kindlasti kell 15.30 avaldatava tööjõuraporti peale. Eelmine kuu kadus esialgsete andmete kohaselt 62 000 töökohta, juulilt oodatakse ca 75 000 töökoha kaotamist. Eilsete esmaste töötu abirahade väga suure numbri taustal on kindlasti paljud kartmas negatiivset tööjõuraportit. Kui uudised on vähegi talutavad, siis usun positiivsesse reaktsiooni. -

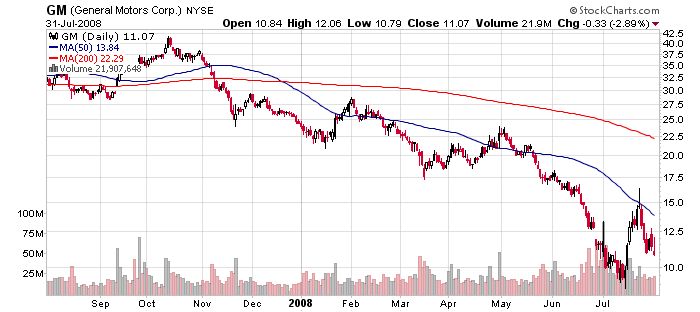

Turgudele on täna mõju avaldamas General Motors'i (GM) oodatust halvemad Q2 tulemused, mis on aktsia hinna saatnud ligi 8%-lisse langusesse. Ettevõtte teatas massiivsest $15.5 mlrd suurusest kahjumist, millest $9.1 mlrd moodustasid restruktureerimiskulud ja mahakandmised. Neid arvestamata oleks kahjumiks tulnud $6.4 mlrd ehk $11.3 aktsia kohta. Käive langes aastatagusega võrreldes 18% $38 miljardini.

Kuigi ettevõtte püüab kulusid kokku hoida tööjõu vähendamisega, keskenduda arenevatele turgudele ja täiustada tooteportfelli ökonoomsemate autode suunas, ei ole vähemalt seni see strateegia edu toonud. Siiski on GM'i finantsjuht investoreid rahustamas öeldes, et firmal on piisavalt likviidsust ($21 mlrd raha ja $5 mlrd krediiti) raskete aegade üleelamiseks.

-

Ja BW biitis...

Reports Q2 (Jun) earnings of $0.53 per share, excluding non-recurring items, $0.10 better than the First Call consensus of $0.43; revenues rose 5.6% year/year to $246.6 mln vs the $236.3 mln consensus. Co issues in-line guidance for FY08, sees EPS of $1.75-2.00, excluding non-recurring items, compared to previous guidance of $1.80-2.30, vs. $1.89 consensus. Co's Board of Directors has authorized the co to repurchase of up to 1.0 mln shares. -

Kohe pooles oluline event-risk: ninfarm payroll. Ootus -75k. 10:30 veel ISM manufacturing (49,3) (kuid see NFP tõttu natuke vähemoluline).

-

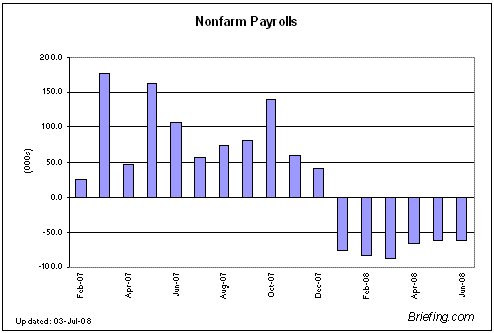

*Nonfarm payroll

-

Payrollid on kardetust paremad.

July Average Weekly Hours 33.6 vs 33.7 consensus

July Average Hourly Earnings m/m +0.3% vs +0.3% consensus; y/y +3.4% vs +3.4% consensus

July Nonfarm Payroll -51K vs -75K consensus, prior revised to -51K from -62K

July Unemployment Rate 5.7% vs. 5.6% consensus; prior 5.5% -

Kellel muidu pole silme ees, siis panen siia ka väikse Briefingu graafiku tööjõuraporti tulemuste kohta. Tänast numbrit siia veel lisatud pole:

-

Euroopa ja Aasia põhiindeksid:

Saksamaa DAX -0.03%

Prantsusmaa CAC 40 -0.54%

Inglismaa FTSE 100 -0.30%

Hispaania IBEX 35 -1.28%

Venemaa MICEX +0.03%

Poola WIG -0.08%

Aasia turud:

Jaapani Nikkei 225 -2.11%

Hong Kongi Hang Seng +0.58%

Hiina Shanghai A (kodumaine) +0.94%

Hiina Shanghai B (välismaine) +0.88%

Lõuna-Korea Kosdaq -1.31%

Tai Set 50 +0.36%

India Sensex +2.10%

-

Patrick Schultz on RealMoney all Venemaa negatiivset palet demonstreerimas:

Lenin is smiling in his grave these days as the "commanding heights" of the Russian economy are quickly coming back under government control.

Moscow has introduced yet another policy agenda to further renationalize major components of the economy. Mother Russia is forming a large state-owned grain company through the seizure of smaller privately held companies. It aims to recreate the former state-trading system that was dismantled with the fall of the Soviet Union.

Foreign diplomats in interviews to the media say that Moscow bureaucrats plan to use the current Agency for the Regulation of Food Markets and transform it into a major global trader. The new entity will control between 40 and 50 percent of Russia's grain exports.

In the Putin era, Russia has aggressively moved towards forming large state-owned giants in energy, metals, and even aircraft.

The only thing missing is the restoration of the hammer and sickle flag. -

Bear Claws Still Out This Morning

By Rev Shark

RealMoney.com Contributor

8/1/2008 8:15 AM EDT

The superior man perseveres long in his course, adapts to the times, but remains firm in his direction and correct in his goals.

--I Ching

The market mood continues to swing wildly and is quite grim this morning as we await the monthly jobs data. Yesterday's reversal put a damper on a big two-day move and we are contemplating a massive loss from General Motors (GM) this morning, and a number of somber earnings reports elsewhere.

The mid-week rally did what all good bear market rallies do: it sucked in some cash from the overly hopeful. Ultimately, what makes bear markets so agonizing is the cycle of false hope and disappointment.

Eventually, investors just get worn out, throw in the towel and give up. That is when the bottom finally comes, but it is grueling process. As I've often said, bear markets don't scare you out, they wear you out.

Our job in this sort of market is to persevere. I promise you that better times will eventually come and we will be nicely rewarded if we don't give up.

However we have to be zealous in protecting our capital and avoiding trouble. We can't get sucked into the serial bottom-calling or the premature hope that the business media loves to celebrate.

I have absolutely no idea how long this market will struggle, but I do know we will have some tradable rallies and some short term opportunities -- if we stay flexible and don't kid ourselves into buying for the long term too early.

In a market like this, it is tremendously important to have clarity as to your approach and time frames. The easiest way to get in trouble is to let investments that have gone wrong push you into thinking you should take a Warren Buffett-like approach to the market.

I don't want to sound overly grim as we await the jobs report. We may indeed see some further market upside in the near term. but we just can't lose sight of the fact that the market is still caught in a major long term downtrend and we are completely lacking in any good leadership right now.

Yes, financials have bounced and maybe some of those big banks have seen their lows, but that doesn't mean the overall market is going anywhere soon.

We have a rocky start this morning. Overseas markets are weak, oil and gold and trading down. Let's see what the jobs report gives us and we'll go from there.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: THOR +22.6% (also upgraded to Buy from Hold at Natixis Bleichroeder), BYD +21.2%, SWIM +19.6%, SCOR +12.4%, PAR +11.1%, TSYS +10.9% (light volume), CNXT +10.9%, GXDX +10.6%, VPRT +9.4%, VSEC +8.1% (light volume), SMG +7.8%, CHRD +5.6% (light volume), PEET +5.2%, GPRO +5.0%, JAVA +3.5%, USMO +3.4%, IR +2.8%, MPWR +2.4%... M&A news: ANR +6.8% (MT considers counter-bid for Alpha - Financial Times)... Other news: IDCC +18.5% (announces that the co prevailed against Samsung in ICC arbitration; confirms second Circuit reverses injunction preventing co from proceeding against Nokia), INCY +5.3% (announces pricing of public offering of 10,500,000 shares of common stock at $9.00), ASTI +4.8% (still checking), MTZ +3.6% (Cramer makes positive comments on MadMoney), RBS +3.3% (still checking), VOD +2.0% (still checking), OC +1.9% (Cramer makes positive comments on MadMoney), PFE +1.8% (still checking), TRN +1.8% (Cramer makes positive comments on MadMoney)... Analyst comments: MOT +2.8% (upgraded to Neutral at Piper), RFMD +2.8% (upgraded to Buy at UBS), AKAM +1.5% (upgraded to Neutral at Goldman - DJ).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: TOMO -43.2% (also downgraded to Neutral at Robert W. Baird and downgraded to Neutral from Buy Piper Jaffray), PAET -23.6% (light volume), NANO -17.6% (light volume), HNSN -12.8% (also downgraded to Neutral at Merriman), BOOM -10.7%, IMMR -9.6%, NT -7.1%, OSK -6.9%, VCLK -6.3%, NXG -5.4%, GFI -5.4%, STO -5.1%, NYX -4.9%, MIL -3.3%, CHK -3.3%, CLUB -3.1% (also downgraded to Hold from Buy at BB&T), ATVI -2.0%... Select metals/mining stocks showing weakness: RTP -3.7% (China should reject BHP bid for Rio, Steelmakers say - Bloomberg.com), HMY -3.7%, GOLD -3.3%, ACH -2.8%, BBL -2.8%, BHP -2.7% (China should reject BHP bid for Rio, Steelmakers say - Bloomberg.com), AU -2.5%, AUY -2.2%, MT -1.1%... Other news: ELN -47.4% (notified BIIB that relevant regulatory agencies of two confirmed cases of progressive multifocal leukoencephalopathy), MRNA -28.0% (announces phase 2 trial of PYY(3-36) does not meet weight loss endpoint), BIIB -22.6% (disclose 2 cases of PML in patients taking Tysabri; 2 multiple sclerosis patients develop complications), SGP -8.1% (announces they FDA has issued a "not-approvable" letter for sugammadex sodium injection), GM -7.0% (CEO Rick Wagner, on CNBC, says hopefully this is the worst its gets for GM), EPR -1.9% (announces it has agreed to sell 1.9 mln of its common shares)... Analyst comments: MNST -5.8% (downgraded to Neutral from Overweight at J.P Morgan), ENTG -5.2% (downgraded to Neutral at Merrill), RNR -1.4% (downgraded to Equal Weight at Morgan Stanley). -

Ja infoks siis veel tänase tööjõuraporti kohta - tervishoid ja kaevandus olid need valdkonnad, mis oma töökohtade liitmisega aitasid agregeeritud töökohtade kaotuse numbrit väiksemaks tõmmata. Tervishoiust ja farmaatsiast kirjutasin paar päeva tagasi siin.

-

ISM Manufacturing 50.0 vs 49.0 consensus

-

Ja tasapisi nafta taas vahepeal pead tõstmas ja turgu rõhumas - täna +1.4% ja hind $125.8

-

Panen siia väikese tabeli tänasest tööjõuraportist, näitamaks tervishoiu sektoris lisatavate töökohtade arvu.

Kogu raporti tabelit on võimalik näha siit.

-

Lihtsalt lugemiseks üks lugu:

This Indicator Is Right 95% of the Time... It Says Buy!

By Dr. Steve Sjuggerud

Since 1995, this stock market indicator has flashed "buy" on 41 days.

If you'd bought stocks the day it flashed, and simply held three months, you'd have made money 39 out of 41 times – that's 95% of the time!

The largest of the two losses was -1.7%. Meanwhile, the biggest gain was 33% – in three months. The average gain was an incredible 13% in three months. That's not an "annualized" number... 13% is what you would have made in three months.

I tell you this because the indicator flashed again on July 10.

Fortunately, you haven't missed the gains yet...

The stock market is only up about 2% since the indicator flashed. To equal their average 13%gain in "buy" mode, stocks still have to rise another 11% in just over two months.

The indicator is simple. It's from Jason Goepfert, who runs sentimenTrader.

The indicator is simply the difference in "Smart Money" Confidence versus "Dumb Money" Confidence. Jason says:

If the Dumb Money Confidence is at 100%, then that means that these bad market timers are supremely confident in a market rally. And history suggests that when these traders are confident, we should be very, very worried that the market is about to decline.

When the Dumb Money Confidence is at 0%, then from a contrary perspective we should be [buying stocks], expecting these traders to be wrong again and the market to rally.

Jason's "confidence indexes" are built based on real money – what real traders are actually doing.

---------- Advertisement ----------

"$20,000 a year in dividends"

For the next few days – until Monday, August 4th – S&A Research is giving interested DailyWealth readers FREE access to an income resource worth $249...

It's a simple, step-by-step Dividend Program that allows you to collect $2,000 or more in extra income every single month – for the rest of your life. All you need is 90 minutes right now to get started.

As one subscriber told us: "My monthly dividends offset my living expenses... I'm getting $18,000 to $20,000 a year in dividends."

Click here for details.

------------------------------------

In mid-July, the "Dumb Money" (essentially small traders) was remarkably scared. Jason's Dumb Money Confidence Index dropped to 17%. Readings this low are incredibly uncommon. Meanwhile, Smart Money Confidence stood at 67% – a whopping 50-point spread.

Whenever this spread hits 50 points, history says you have a 95% chance of making money over the next three months... with an average gain of 13%.

In general, I've found sentiment indicators are difficult to use as timing indicators. The results look good. But as they say, past performance is no guarantee of future results. It's better to use a sentiment indicator like this one from Jason as a "get ready to buy" or "get ready to sell" indicator.

Still, the timing this month wasn't bad... The indicator flashed on July 10, and the market appears to have bottomed just three trading days later, on July 15. Since then, the market has spent the last two weeks fighting its way into an uptrend. So far, the "up" move has been so weak, we can hardly call it an uptrend yet. But it's trying.

Actually, when you step back and size things up, we're very close to an ideal situation for making money in stocks:

1) Stocks are relatively cheap now... For example, the forward price-to-earnings ratio of the Dow is only 12.5 today.

2) Investors are scared, as Jason's Dumb Money Confidence Index shows.

3) We're just missing the uptrend.

But the market is trying... And Jason's indicator has a formidable track record. In short, we could be close to a great time to buy U.S. stocks.