Börsipäev 15. august

Kommentaari jätmiseks loo konto või logi sisse

-

Vilniuse börs täna suletud - taevaminemispüha

Täna on optsioonireede. Leedu optsioonid arveldatakse eilsete sulgemishindade järgi. Tallinna ja Riia aktsiate ja indeksite väärtused fikseeritakse kell 12:00 ning seejärel algab rahaline tasaarveldus. -

Eile avaldas Berkshire Hathaway oma positsioonid Q2 lõpu seisuga. Enim tähelepanu on pälvinud täiesti uus investeering vanameister Buffetti portfellis – NRG Energy (NRG). Lisaks on osalust suurendatud Union Pacific’us (UNP) ja Ingersoll-Rand’is (IR). Uudis Buffetti ostudest suutis antud aktsiaid ka järelturul kergitada:

Companies trading higher in after hours in reaction to news: NRG +5.1% (Berkshire held 3.2 mln shrs NRG Energy at June 30 -- DJ); IR +2.2% (Berkshire stake of 5.6 mln shares as of June 30 vs 936,600 previously -- DJ); UNP +0.5% (Berkshire Hathaway discloses increased stake of 8.9 mln shares, up from 4.45 mln share stake as of Mar 31).

Lähemalt saab Buffetti liigutustest lugeda Bloombergi artiklist.

-

Nael on siis täna tegemas 11. järjestikust languspäeva dollari vastu - pikim langustsükkel viimase 37 aasta jooksul. Link Bloombergi loole siin.

-

Goldman Sachs on täna langetamas reitinguid Euroopa autotööstuse ettevõtetel:

Daimler, the world's largest truckmaker and No. 2 in luxury cars, had its rating cut to ``neutral'' from ``buy.'' Renault, France's second-biggest carmaker, was reduced to ``sell'' from ``neutral,'' as was Sweden's Volvo, the world's second-ranked truckmaker, which was added to the ``conviction sell'' list.``

Although the European car market appeared remarkably resilient for a large part of the first half of 2008, June marked a tipping point, not only for west European car sales, which fell 8 percent, but for the European consumer in general,'' Goldman analysts Stefan Burgstaller, Shane McKenna and Tim Rothery said today in a note to investors. Link.

Tööstusharu soovitus tervikuna langetatakse Underweight tasemel, kuid leidub ka erandeid - veoautode valmistaja MAN lisatakse Conviction buy list’i, mille toel on aktsia täna Saksa börsi +3%. Samuti tõstetakse turvavarustuse tootja Autoliv’i reiting neutraalse peale.

-

SunPower (SPWR) teatas eile, et on sõlminud lepingu päikesepaneelide tarnimiseks koguvõimsusega 250 MW. Ettevõtte aktsia on eelturul tõusnud 11% võrra, sealjuures on täna ka Merrill Lynch SunPower’i reitingut tõstmas "Osta" tasemele.

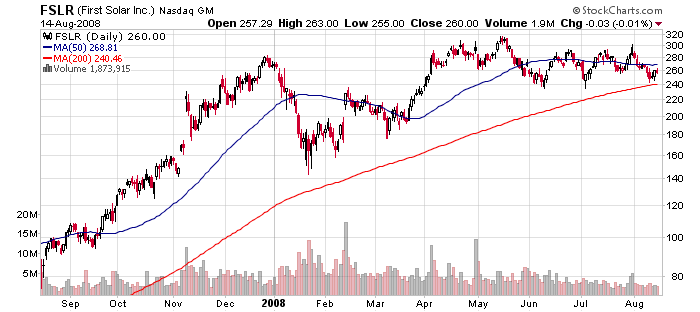

Samas on täna mitmed analüüsimajad SPWRi tehingu valguses positiivselt kommenteerimas First Solar’it (FSLR). Citi arvates võib FSLR teatada lähiajal samuti suuremahulisest lepingust, kuid sealjuures paremate kasumimarginaalidega:

Buy FSLR, not SPWR; a deal could be coming soon — While the market willalmost certainly take this positively for SPWR and may even draw a negativeconclusion for FSLR, we would be buyers of FSLR on the news and not SPWR.

Positiivne on ka Thomas Weisel:

The firm views the win as a positive for SPWR and for the large scale systems market. The firm notes that this is not a negative for FSLR and would recommend buying shares on any weakness.

Seega võib ka FSLR täna tugevat ostuhuvi nautida. Eelturul on aktsia kerkinud 1.5% võrra.

-

Euroopa ja Aasia põhiindeksid kindla suunata:

Saksamaa DAX -0.04%

Prantsusmaa CAC 40 +0.62%

Inglismaa FTSE 100 -0.61%

Hispaania IBEX 35 +0.17%

Venemaa MICEX +0.35%

Poola WIG -0.36%

Aasia turud:

Jaapani Nikkei 225 +0.48%

Hong Kongi Hang Seng -1.09%

Hiina Shanghai A (kodumaine) +0.56%

Hiina Shanghai B (välismaine) +0.13%

Lõuna-Korea Kosdaq N/A Suletud

Tai Set 50 +0.39%

India Sensex NA/ Suletud

-

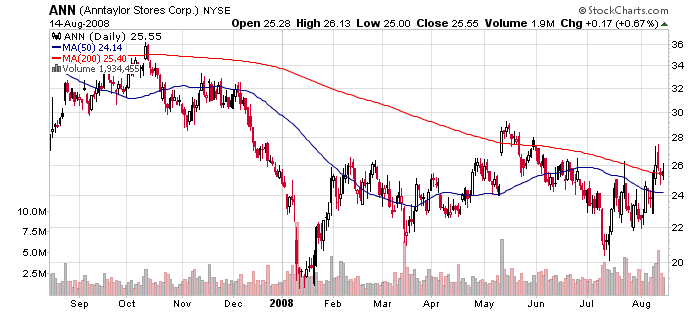

Ann Taylor (ANN) saab jätkuvalt negatiivseid kommentaare analüütikutelt. Täna on soovitust langetamas Banc of America:

BofA downgraded ANN to Neutral from Buy. Firm says mgmt changes and guidance updates suggest reduced expectations for the 2H. Given also a challenging macro/less attractive valuation, firm prefers to step aside. Firm is shaving their '09 est to $1.94 from $1.99 (consensus $1.83) and their tgt to $26 from $29.

Nii Citi kui ka Piper Jaffray langetasid nädala alguses ANNi soovituse "Müü" peale. Uued hinnasihid olid vastavalt $21 ja $23.

-

July Capacity Utilization 79.9% vs 79.8% consensus

July Industrial Production +0.2% vs 0.0% consensus -

Oil and the Dollar Make Their Presence Felt

By Rev Shark

RealMoney.com Contributor

8/15/2008 9:15 AM EDT

Never celebrate until you are really out of the woods. They might be behind the last tree.

--Unknown

There are only two things that really matter in the market right now, oil and the dollar. Oil and commodities prices are continuing their recent decline this morning as the dollar moves higher once again. That is giving us a positive tone on this option expiration Friday. There are some earnings reports from retailers on the wires that look OK, but it's oil and the dollar that will determine our course today.

As is so often the case, the collapse in oil and commodity prices has been faster and gone further than many have thought reasonable. That causes some panic and hastens the selling even more. What is interesting is that there have only been very brief bounces since the collapse began.

The bulls are downright giddy over the impact of this and have been piling into consumer-related stocks. The thinking is that all problems will be cured by a higher dollar and lower energy and commodity prices, as it will kill inflationary pressures, make the U.S. a better investment vs. the rest of the world and give the Fed flexibility to deal with slowing growth. That is the theme that is driving this bounce.

The question, of course, is whether this theme really means that the market will regain its health and continue to rally from here. After the run we have already had, and with looming technical resistance coming in a seasonally slow time of the year, a test is coming.

Even though the indices have been acting quite well lately, there sure are a lot of cranky traders out there. There are an unusually high number of failed breakouts and quick reversals. A good example is Monolithic Power Systems (MPWR) , which was my Stock of the Week, after breaking out nicely on Monday, it reversed sharply the next couple days before rebounding a bit on Thursday. That sort of action has not been at all unusual, and I've heard the comment that chart plays simply aren't working the way that they should.

Even a group like retailers, which have been strong on weaker gas, are not moving smoothly. There is a lot of skepticism about the market, and that is driving some very quick profit-taking into strength and is frustrating those who are trying to build positions.

Once again, the bulls have the wind at their backs with lower oil. Give them room to run further, but keep in mind that this bounce is becoming extended and doesn't have the best internal support.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: FFHL +25.6%, APP +8.6%, ADSK +8.5% (also upgraded to Buy at Needham), KONG +4.7%, KSS +3.2%... Select mortgage/financial names showing strength boosted by S&P ratings affirmations: ABK +23.2% (Ambac's 'AA' rating affirmed by S&P), SCA +17.4%, MBI +8.0% (MBIA Insurance 'AA' ratings affirmed and taken off creditwatch; outlook negative at S&P), MTG +6.4%, PMI +4.3% (Fitch affirms PMI Mortgage Insurance & QBE Insurance Group; PMI's outlook revised to stable), WB +3.4%, LEH +3.5% (Soros boosts Lehman stake to 9.5 million shares - Reuters.com), FNM +2.3%, WM +2.3%, FRE +1.9%, UBS +1.5%, MER +1.3%, BAC +1.1%... Select airline names trading modestly higher with crude lower on continued strength in dollar: LCC +7.2%, AMR +5.4%, UAUA +5.0%, JBLU +3.7%, CAL +3.1%... Select solar stocks trading higher: SPWR +10.7% (PG&E signs 800 MW photovoltaic solar power agreements with OptiSolar and SunPower; also upgraded to Buy at Merrill), SOLF +3.5%, YGE +3.0%, TSL +2.3%, CSIQ +2.1%, FSLR +1.8%, JASO +1.3%, STP +1.3%, ESLR +1.1%... Other news: EMIS +19.1% (Icahn Capital reports 86,430 Emisphere Tech shrs - DJ), NRG +6.2% (Berkshire held 3.2 mln shrs NRG Energy at June 30 - DJ), CROX +3.3% (Gates Foundation reports 1 mln shares of Crocs at June 30 - DJ), GM +1.8% (will announce a multi-mln dollar investment into its Lordstown Complex on August 21)... Analyst comments: PCLN +3.5% (upgraded to Buy at Citigroup), EMKR +3.4% (initiated with Buy at Stanford).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: HAR -10.5% (also downgraded to Neutral at Baird), DV -4.2% ANF -1.6% JCP -1.0%... Select metals/mining stocks showing weakness with lower spot prices on continued strength in dollar: SLV -9.3%, AAUK -5.0%, GOLD 4.9%, KGC -3.8%, GFI -3.3%, HMY -3.2%, GG -3.1%, GLD -3.0%, ABX -2.9%, HL -2.5%, AUY -1.4%, RTP -1.3%... Other news: CMVT -23.5% (discloses business update in letter to employees; recent business environment indicates slower momentum in the second quarter; also downgraded to Neutral at JPMorgan), YRCW -2.3% (appoints Paul Liljegren Interim Chief Financial Officer), DB -1.7% and HBC -1.2% (checking for anything specific). -

Kulla hind on langenud $775 dollari juurde untsi kohta. Erinevalt tänasest müügisurvest on BCA bullish kulla suhtes.

-

August University of Michigan Sentiment-prelim 61.7 vs 62.0 consensus

-

Nafta teeb uusi põhju. Hind käis ära alla $112 barrelist.

-

Kvaliteetnafta hind ei saa langeda.

-

TaivoS

Sa mõtled ikka kvaliteetbensiini. Eesti bensiini. -

FATAL ERROR

-

Mida arvate firmast MOSAIC COMPANY ( MOS ) ? Viimased 2 päeva langenud !!! Millised on firma perspektiivid?

-

Midday Sector ETF Leaders:

Solar Power- KWT +3.8%, TAN +3.4%, Homebuilders- XHB +3.2%, Base Metals- DBB +2.1%, Commercial Banks- KBE +1.8%, Regional Banks- KRE +1.6%, RKH +0.70%, Retail- XRT +0.90%, RTH +1.1%, Cons. Disct.- XLY +1.2%, VCR +0.80%, Insurance Brokers- KIE +1.3%

Midday Sector ETF Laggards:

Silver- SLV -9.0%, Ags.- DBA -4.0%, Ag/Chem- MOO -3.2%, Steel- SLX -3.0%, Coal- KOL -3.0%, Gold- GLD -2.8%, Gold Miners- GDX -2.8%, Heating Oil- UHN -2.5%, Metals/Mining- XME -2.3%, Oil HLDRS- OIH -2.2%

-

Fed's Evans says inflation risks at time of economic weakness pose tough policy challenge

Sees U.S. growth in second half 2008 "extremely sluggish" but risk of severe downturn averted. Sees real GDP growth back to near-potential rate of 2.5-3% by 2010. Says inflation should moderate over medium term; headline pce near 2 pct by 2010 says risks for inflation "elevated" and a concern

-

Fed-i liige Lockhart sõna võtmas:

Lockhart says 'would not rule out any action' on Fed rate; reasonable debate likely to be whether to raise rate

Lockhart says 'I like Fed policy where it is' on Fed rate

Lockhart says inflation 'creeping higher,' and is worrisome

Lockhart says housing market, prices still have some way to go downward

Lockhart says fall in oil prices 'helps a great deal' -

Mis võiks olla selle põhjuseks, et täna natuke peale seitset börsil käive sisuliselt kadus?

-

Asi pigem optsiooni reedes kinni.

-

On see alati niimoodi?

-

rehatrader,

Päris alati loomulikult niimoodi ei ole, kuid optsioonireedetel kiputakse üldiselt ümmarguste numbrite juurde liikuma. Põhjuseks nn pinning action, mistõttu kui mingeid erakorralisi uudiseid/sündmusi päeva jooksul ei ole, on tavaliselt suund ümmarguse strike poole. Kuid kindlasti ei ole see alati niimoodi.