Börsipäev 22. august

Kommentaari jätmiseks loo konto või logi sisse

-

Euroala majanduskasvu aeglustumisest annab märku tööstustoodangu tellimuste jätkuv vähenemine. Võrreldes eelmise kuuga vähenes tellimuste arv 0.3% võrra (konsensus ootas hullemat). Aastaga on tellimused vähenenud juba 7.4%.

Lisaks hinnati väiksemaks Suurbritannia majanduskasv. Selgus, et UK teise kvartali SKP kasv oli olematu (0.0 qoq ja 1.4 yoy). Varem hinnati 2Q SKP kasvuks 0.2 qoq ja 1.6 yoy.

-

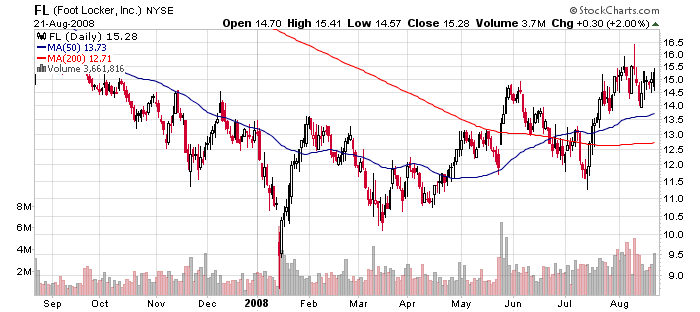

Eile avaldas oma tulemused peamiselt jalanõude pakkumisele keskendunud jaemüüja Foot Locker (FL). Ettevõte suutis tugevalt analüütikute ootusi ületada, mis on eriti tubli tulemus arvestades praegust keerulist tarbija olukorda.

Reports Q2 (Jul) earnings of $0.25 per share, $0.23 better than the First Call consensus of $0.02; revenues rose 1.5% year/year to $1.3 bln vs the $1.27 bln consensus. Co issues in-line guidance for FY09, sees EPS of $0.70-0.85 vs. $0.72 consensus.

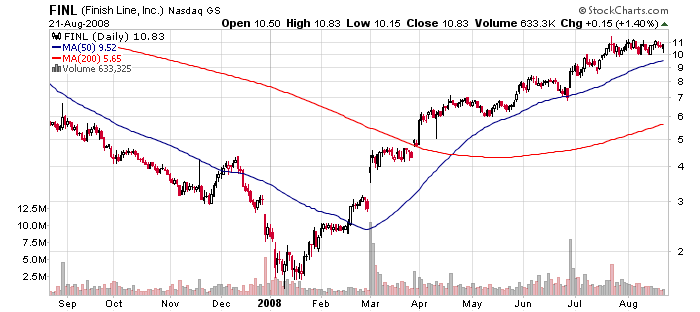

Konverentsikõne algab täna kell 16 Eesti aja järgi ja tähelepanu tasub suunata eelkõige juhtkonna põhjendusele, miks teise poolaasta prognoose ei tõstetud. Järelturul kerkis FL-i aktsia 8% võrra. Täna leiab ilmselt ostuhuvi ka ettevõtte väiksem konkurent Finish Line (FINL).

-

Lisan ka Finish Line'i (FINL) graafiku... aktsia on jaanuari põhjadest kerkinud muljetavaldavad 732%.

-

Sattus täna silme ette Venemaa RTSi viimase nelja aasta aktsiagraafik (valge joon) ja trailing P/E (rohelised tulbad) ja oodatav P/E (punane joon).

Korrektsioon on sealsetel turgudel nafta hinna languse, Mecheli afääri ja Venemaa-Gruusia sõja tagajärgedel olnud igaljuhul päris tubli. Valuatsioonid on muutumas üha odavamateks, aga kuna minu arvates on Venemaa-Gruusia sündmuste järgselt mõneks ajaks turu poolt nõutavad riskipreemiad tõusnud, ei tasuks kindlasti oodata viimase kolme aasta kauplemisvahemiku 12-14 korda kasumit kiiret taastumist. Aga eelpoolnimetatud sündmused on igaljuhul valusa jälje investorite taskuisse tänaseks jätnud.

-

Naftahind on langemas. Naftahind tegi paari päevaga järsu põrke, kuna pinged Venemaa ja Lääneriikide vahel kasvasid, dollar kallines ja USA naftavarud langesid.

Täna pandi uuesti tööle Baku-Tbilisi-Ceyhan naftatoru ja pakkumine jätkub sõjale eelnenud tasemel.

P.S Graafikul on naftahinna langust põhjustanud USA inventuuride vähenemine. Nõudlus on küll suurenenud, kuid on endiselt 3% madalam eelmise aasta tasemest.

-

WSJ pajatab täna sellest, kuidas FRE (ja ehk ka FNM) on üritamas leida huvilisi lisakapitali tõstmiseks, kuid turul valitsevad hirmud muudavad selle ülesande äärmiselt keeruliseks. Kes see ikka raha julgeb süte peale visata, kui kardetakse, et varsti see patakas seal heleda leegiga põlema läheb. Ja samas - kui kapitali üldse ei õnnestu tõsta, siis võimalik, et tekibki meil isetäituv ennustus, kus USA riik peab mingil hetkel ikkagi FNM'le ja FRE'le appi minema.

According to the WSJ, Freddie Mac executives are sounding out private-equity firms and other investors about the possibility of buying new common or preferred shares in the mortgage company. But that effort is running up against what may be an insurmountable hurdle: Many investors fear any money they invest now in Freddie or its main rival, Fannie Mae (FNM), will be lost later if the U.S. Treasury bails out the companies through a purchase of equity in them. Investors believe such a purchase would likely involve terms that would wipe out the value of previously issued shares. "Senior management has been talking with a wide array of possible investors this week," said David Palombi, Freddie Mac's chief spokesman. He noted that the company remains above its current regulatory capital requirements but has pledged to raise $5.5 billion of capital "given appropriate market conditions."

-

Aga mis see siis ikkagi täpsemalt tähendab, et kui riik nendele appi läheb?

Kas siis investorid kaotavad isegi praeguste hinna tasemete juures?

Ise just mõtlen, et võiks osta Freddie Mac-i pikaajaliseks positsiooniks. -

Juhul kui riik teeks kapitalisüsti nendesse firmadesse, siis praeguste aktsionäride osalus lahjeneks oluliselt. Freddie Mac'i ja Fannie Mae turuväärtus on hetkel vastavalt $2 mlrd ning $5 mlrd. Oletame, et riik ostaks Freddie aktsiaid $10 mlrd eest, siis väheneks praeguste aktsionäride osalus ettevõttes 16.6%-ni. Samas paljud spekuleerivad, et isegi $10 mlrd võib olla peenraha ja tegelikkuses vajaksid nad kapitalisüsti suurusjärgus $50 mlrd.

-

Soovitan soojalt lugeda ka Douglas Kass'i intervjuud Reutersile (link), kelle juhitav hedge fund on suurepärast tootlust näidanud. Kassile meeldivad endiselt jaemüüjatega seotud lühikeseks müügi ideed ning samuti on ta endiselt short FRE ja FNM:

"There will be some de facto government rescue of the companies, probably in the form of a series of terribly dilutive financings," Kass said. On Monday, weekly financial newspaper Barron's asserted that a government bailout is likely and could wipe out the value of common shares in Fannie and Freddie.

Kass' last short sale on Fannie was made at $31.50 per share while Freddie was sold at $30.48. Fannie is now trading at $5.85 and Freddie at $4.10. Kass said he believes the shares will go to zero.

-

Samuti on hetkel CNBC-s teemat kommenteerimas vanameister Warren Buffett:

DJ reports Fannie Mae (FNM) and Freddie Mac (FRE) have recently sought investment from private sources, investor Warren Buffett told CNBC on Friday, although he hasn't personally been approached by the struggling government-backed mortgage financiers. "I'm not getting called on that specific aspect of it, but they're looking for help, obviously," Buffett said in an interview. He added that "the scale of help needed" by Fannie and Freddie "is such that I don't think it can come from the private sector." While saying he has no inside knowledge of any plan for the two government-sponsored enterprises, Buffett advised, "I think you'll see some action fairly soon." On the U.S. economy, the Berkshire chairman said he believes the slowdown "could easily go beyond" the next six months and be deeper than many people think, but he sees an eventual rebound as certain, once the "ripples" from deleveraging due to past provision of excessive credit have abated. "The country will be doing better five years from now, but not five months from now," he said.

-

Märkuseks, et inventory = varud. Kahtlen, kas loendite vähenemine naftahinda mõjutab.

-

Korea arengupank on avaldanud ostusoovi Lehmanni (LEH) vastu - ja turg lendab terve protsendi headline'i peale üles.

-

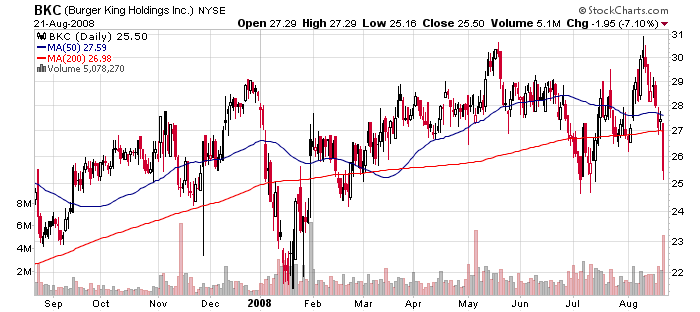

Burger King (BKC) saab vastuolulisi kommentaare analüütikutelt pärast eilseid Q2 tulemusi ja selle järgnenud 7%-list langust. UBS on aktsia retingu alandanud "Hoia" peale hinnasihiga $28 (varasemalt "Osta" ja $35), märkides aeglustunud võrreldavate poodide tulude kasvu ja suurenevat sisendhindade survet. Goldman Sachs samas kinnitab "Osta" soovitust hinnasihiga $31 ja näeb eilses languses suurepärast ostuvõimalust. Samuti tõstetakse FY09 kasumiprognoose ja endiselt on BKC Goldman'i Conviction Buy List'is.

-

Korea ja Hiina pankade huvist Lehmanni vastu kirjutasime ka eilses foorumis teises ja kolmandas postituses.

-

Warren Buffet, on CNBC, says he has bought more of either American Express or Wells Fargo (won't say which one)

AXP, WFC

Siit ka korralik toetus aktsia hindadele ning finants saab veelgi tuge. -

Dick Bove poolt jällegi julge avaldus LEH suunas:

Lehman Brothers: Ladenburg Thalmann analyst Dick Bove believes CEO Fuld has played his hand to long; taking too long to come up with a solution

Says if he doesn't do something this weekend, then next week the 'game is on'. Thinks the price will be $20/share.

-

Discipline Makes Money, and Predictions Don't

By Rev Shark

RealMoney.com Contributor

8/21/2008 12:51 PM EDT

I'm getting ready to take my first vacation in quite some time and have been thinking about what I might want to impart to readers before I hit the road. Unfortunately, too many people who write about the stock market think that their primary job is to make predictions. Day in and day out, they attempt to predict dramatic events and major turns, and sometimes they even get them right.

The problem with this approach to stock market punditry is that it usually doesn't make readers money. It is great for the ego, and if you make enough predictions, you are going to get some right just as a matter of chance, but it is not a money maker, and that is first and foremost what this job should be about.

What is being forgotten is that making money in the market is primarily a function of having a systematic approach and being disciplined. Prediction and even stock-picking are secondary to a good solid style. In fact, what messes up most people is when they forget style and focus instead on predictions. Keep in mind that there is no style that is inherently superior. Lots of approaches will work, but you have work hard at it and not let emotions influence you unduly.

So rather than make some grand predictions about where this market is headed next week while I'm out, I'm simply going to remind you to stay disciplined and not let hopeful predictions about the state of the market drive you to take rash action.

The market paints some very clear pictures for us, and all we need to do is look at what is in front of us. We don't need to predict bottoms and turns. If you take a couple steps back and look at the picture that has been painted of the major indices, it is pretty poor. While we may enjoy some countertrend bounces and spikes, there is nothing at all in the picture to indicate that a meaningful low is upon us.

We will read lots of commentary telling us why the worst is over for financials or why the consumer is going to start spending again, but there is no hard evidence to support it. Forget the predictions and just look at the picture, and you'll know what to do.

I'm going to be checking in from the road, but I'll be out until Labor Day. Good luck.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CSUN +12.8%, BCSI +11.2%, FL +10.5% ... M&A news: ALO +41.4% (KG proposes to buy for $33/share in cash)... Financials trading higher following Lehman and Fannie/Freddie news: LEH +12.8% (Korea Development Bank saying buying LEH a possibility - Reuters), ABK +9.1%, FRE +7.9% and FNM + 7.2% (shopping to private-equity firms on buying new shares - WSJ), MER +4.8%, WB +4.4%, MBI +4.3%, WM +3.8%, JPM +2.6%, GS +2.3%, MS +2.0%... Select airlines stocks showing strength on lower crude prices: LCC +7.2%, DAL +6.2%, UAUA +5.9%, CAL +5.3%, AMR +4.3%... Solar stocks trading higher on CSUN earnings & YGE contract: SOLF +5.9%, YGE +4.0% (announces plans to construct a solar power plant in Beijing, China), SPWR +2.7%, SOL +2.45, STP +1.1%.

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PSUN -26.1% (also downgraded at Roth, BB&T, Baird and Friedman Billings), NDSN -21.1% (also downgraded to Hold from Buy at Keybanc), NED -11.0% (also downgraded to Perform from Outperform at Oppenheimer), VRGY -8.7%, FMD -7.8%, DRYS -4.0%, ZUMZ -3.1%... Select gold stocks showing weakness on pre-market strength in the dollar and profit taking: GFI -4.3%, AUY -3.1%, HMY -2.7%, ABX -2.4%, KGC -2.4%, AU -2.3%, DROOY -1.9%, GLD -1.4%, GOLD -1.4%... Dry bulk stocks trading lower on DRYS earnings: TBSI -3.7%, NM -2.1%, EXM -1.8%, EGLE -1.6%, GNK -1.6%... Analyst comments: LVS -4.5% (downgraded to Sell from Neutral at Banc of America). -

Saksamaa DAX +1.77%

Prantsusmaa CAC 40 +1.67%

Inglismaa FTSE 100 +1.81%

Hispaania IBEX 35 +1.97%

Venemaa MICEX -1.31%

Poola WIG +1.30%

Aasia turud:

Jaapani Nikkei 225 -0.68%

Hong Kongi Hang Seng N/A (börs suletud)

Hiina Shanghai A (kodumaine) -1.09%

Hiina Shanghai B (välismaine) -1.34%

Lõuna-Korea Kosdaq -2.36%

Tai Set 50 +0.96%

India Sensex +1.11%

-

Bernanke says U.S. inflation outlook highly uncertain

Bernanke says fed to keep reviewing liquidity measures

Bernanke says crisis 'softening' growth, raising joblessness, says Fed's job one of most challenging in memory

Bernanke says U.S. growth to fall short of potential for a time, will help curb inflation

Bernanke 'to act' as needed for 'medium term' price stability -

First Hour Sector ETF Leaders:

Commercial Banks- KBE +3.6%, Regional Banks- RKH +3.5%, KRE +3.2%, Financial Services- IAI +3.4%, IYG +3.3%, Finance- IYF +2.7%, XLF +3.3%, Transports- IYT +2.6%, Insurance Brokers- KIE +2.0%First Hour Sector ETF Laggards:

Commodities- GSG -3.0%, DBC -1.5%, Silver- SLV -2.9%, Gas- UGA -2.6%, Heating Oil- UHN -2.3%, Oil- USO -2.2%, Nat. Gas- UNG -1.9%, Base Metals- DBB -1.9% -

Moody's Cuts Fannie Mae's And Freddie Mac's Preferred Stock Ratings; Affirms Aaa Senior Debt

-

Finantssektor annab FNM, FRE uudise peale tagasi ja punasesse on jõudnud veel AIG, WM ja BK.

-

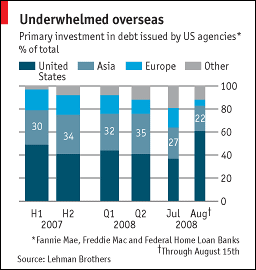

Graafikult on hästi näha, kuidas Aasia ja Euroopa keskpankadel ning fondidel on alates augustist USA kodulaenajate võlakirjade isu täis saanud. Huvitav kauaks ameeriklastel isu jätkub?

-

Sector ETF Leaders @ Midday:

Financial Services- IAI +2.3%, IYG +1.8%, REgional Banks- RKH +2.1%, KRE +0.40%, Software- SWH +2.0%, Finance- XLF +1.9%, IYF +1.5%, Commercial Banks- KBE +1.8%, Solar Power- KWT +1.6%, Tech= KLX +1.5%Sector ETF Laggards @ Midday:

commodities- GSG -3.5%, DBC -2.0%, Gas- UGA -3.0%, Nat Gas- UNG -2.9%, Oil- USO -2.7%, Heating Oil- UHN -2.5%, Base Metals- DBB -2.4%, Coal- KOL -2.3%, Silver- SLV -1.4% -

U.S. Treasury's priority remains any GSE backstop would aim to keep shareholder-owned status according to source- Reuters

Ja finants saab tuge ning FRE ja FNM tulevad ilusti ülespoole. -

$3 bln fund operator Ore Hill Partners international fund has halted redemptions, so many redemptions have triggered an automatic gate to stop them; other funds are not impacted - CNBC

-

NY Fed says making "minor technical adjustment" to daily securities lending program; will take only securities with 13 or more days of maturity remaining vs prvs 6 days - Reuters

-

Toon Ore Hilli hedge fondi kohta pikema artikli ka siia välja:

"Hedge fund Ore Hill Partners, a $3 billion credit specialist, has barred clients from redeeming their money, imposing a freeze just as investors clamored for an exit, the company said on Friday. The firm, half owned by Man Group Plc, the world's largest publicly traded hedge fund, put up a so-called gate provision on its flagship portfolio this week, limiting the amount of withdrawals after investors sought the return of roughly $300 million, said an investor who asked not to be identified. Heavy redemptions for September triggered an automatic gate, said Sophie Sophaon, a spokeswoman for the fund. Fund directors are considering what measures to take that will be in the best interest of all investors, she added. Through July, the portfolio lost 6.5 percent this year, unnerving many investors enough to ask for their money back sooner rather than later, said the investor, who asked to remain anonymous because he did not want to be publicly identified speaking about the private offering. The fund returned 1.8 percent last year after gaining 13.3 percent in 2006 and 1.8 percent in 2005."