Börsipäev 29. august

Log in or create an account to leave a comment

-

Eurotsooni inflatsioon oli augustis 3.8% (konsensus ootas 3.9%). Oodatust madalam inflatsioon oli positiivne üllatus, kuid ärisentimienti mõõtev indeks (business climate indicator) langes augustis rohkem kui prognoositi (88.8 p., konensus ootas 89.3 p). Varasemast skeptilisemalt suhtutakse tööstuse ja jaemüügi suhtes.

-

See tarbijausaldus mis täna tuli on üldiselt nonevent. IFO olulisem.

-

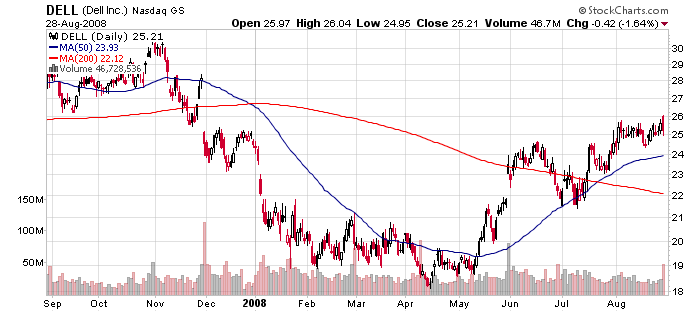

Dell’i (DELL) eile pärast turu sulgemist avaldatud tulemused valmistasid pettumuse: peamiseks mureallikaks oli brutomarginaal, mis jäi 17.2% tasemele võrreldes konsensuse 18.3%-lise ootusega.

Reports Q2 (Jul) earnings of $0.31 per share, $0.05 worse than the First Call consensus of $0.36; revenues rose 11.2% year/year to $16.43 bln vs the $15.95 bln consensus.

Marginaalide osas oli allajäämine tingitud agressiivsema hinnapoliitika tõttu EMEA regioonis, mis oli pigem ühekordse loomusega ja peaks juba järgmises kvartalis paranema. Tegevuskulusid on suudetud kenasti kontrolli all hoida ja restruktureerimine sujub samuti plaanipäraselt.

Dell on viimasel ajal kenasti turuosa suutnud haarata ja enne tulemusi olid ootused üpriski kõrgele keritud, mida näitas ka aprilli põhjadest 38% võrra kerkinud aktsiahind. Täna on aga eelturul aktsia 10%-lises languses. Nii Citigroup kui ka Morgan Stanley usuvad, et möödalask oli ühekordse loomusega ning soovitavad tänast nõrkust kasutada ostmiseks.

Citi: We believe both short and long-term investors should buy DELL shares on yesterday’s weakness. 2FQ’s gross margin shortfall was self inflicted and should largely reverse in 3FQ.

MS: We are buyers of DELL shares on a pullback post the July quarter EPS miss.

-

Kuuldavasti on mõningate raportite järgi Venemaa kaalumas lõpetada nafta müümine Euroopa lääneriikidele. Mainitud eelkõige Saksamaad ja Poolat. On siis tegu kuulujutuga või lihtsalt ähvardusega, aga reaalsete sammudeni, kus nädalaid nafta ei voolaks, minekut on raske uskuda. Nafta Saksamaale mitte müümine oleks uueks külma sõja algust tähistavaks sündmuseks ning pealegi - kui Venemaa Lääne riikidele naftat ei müü, siis kellele veel? Seni pole ka nafta futuurid neile kuuldustele reageerinud.

The UK's Telegraph reports that fears are mounting that Russia may restrict oil deliveries to Western Europe over coming days, in response to the threat of EU sanctions and Nato naval actions in the Black Sea. Any such move would be a dramatic escalation of the Georgia crisis and play havoc with the oil markets. Reports have begun to circulate in Moscow that Russian oil companies are under orders from the Kremlin to prepare for a supply cut to Germany and Poland through the Druzhba (Friendship) pipeline. It is believed that executives from lead-producer LUKoil have been put on weekend alert. "They have been told to be ready to cut off supplies as soon as Monday," claimed a high-level business source, speaking to The Daily Telegraph. Any move would be timed to coincide with an emergency EU summit in Brussels, where possible sanctions against Russia are on the agenda... A supply cut at this delicate juncture could drive crude prices much higher, possibly to record levels of $150 or even $200 a barrel. With US and European credit spreads already trading at levels of extreme stress, a fresh oil spike would rock financial markets. The Kremlin is undoubtedly aware that it exercises extraordinary leverage, if it strikes right now.

-

Philip Morris International (PM) increases quarterly dividend 17.4% to $0.54/share from $0.46/share.

Dividendimäär tõuseb seega 4%-ni, mis on igati arvestatav tootlus praeguse keerulise turu taustal.

-

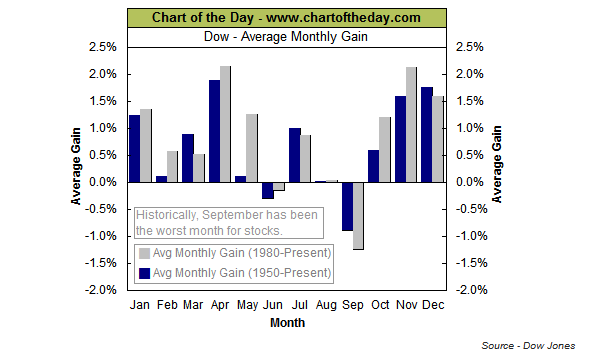

Koos järgmisel nädalal algava septembriga algab ka ajalooliselt kõige kehvem kuu börsi jaoks.

-

Ülespoole avanevad:

In reaction to strong earnings/guidance: JRJC +5.0%, PETM +4.8%, ARUN +3.3%... Other news: PMI +3.2% (reaches agreement for sale of Asia operations to QBE), LDK +2.3% (signs seven-year wafer supply agreement with Hyundai Heavy Industries), ABB +1.8% and IBN +1.7% (still checking)... Analyst comments: ELN +2.2% (initiated with Overweight at Morgan Stanley).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: LAVA -11.4%, DELL -9.6%, SIGM -7.9%, OVTI -1.3%, MRVL -1.0%... Select mortgage/financial names pulling back: FNM -5.0% and FRE -4.2% (Bank of China flees Fannie-Freddie - FT), RDN -4.1%, ABK -3.0%, MBI -2.5%, LEH -1.8%... Select airlines trading modestly lower with crude higher: UAUA -5.5%, DAL -3.5%, JBLU -3.3%, CCL -2.8%, CAL -2.5%, LCC -2.5%... Other news: FRPT -12.5% (to restate interim consolidated financial statements for first and second quarters 2007), NOK -3.5% (still checking), QCOM -1.8% (Federal Judge finds Qualcomm in contempt of injunction on 3G cellular and push-to-talk products previously found to infringe Broadcom patents), RIMM -1.3% (still checking)... Analyst comments: ENER -1.0% (downgraded to Neutral at Piper). -

Euroopa ja Aasia indeksid plussis:

Saksamaa DAX +0.05%

Prantsusmaa CAC 40 +0.49%

Inglismaa FTSE 100 +0.42%

Hispaania IBEX 35 +0.17%

Venemaa MICEX -1.09%

Poola WIG +0.73%

Aasia turud:

Jaapani Nikkei 225 +2.39%

Hong Kongi Hang Seng +1.38%

Hiina Shanghai A (kodumaine) +2.00%

Hiina Shanghai B (välismaine) +3.98%

Lõuna-Korea Kosdaq +0.04%

Tai Set 50 +0.24%

India Sensex +3.67%

-

Midagi pullidele:

Chicago PMI 57.9 vs 50.0 consensus -

(WB) Wachovia new CEO Steel says dilutive capital raise not planned, and should not be necessary given what he knows now, according to Sandler O'Neill - Reuters

-

First Hour Strength:

Crude/WTI oil- OIL +2.1%, USO +2.0%, Nat Gas- UNG +1.9%, Gas- UGA +1.9%, Solar Power- TAN +1.4%, Ag/Chem- MOO +1.0%, Commodities- DBC +1.0%, GSG +0.90%First Hour Weakness:

Semis- IGW -1.6%, SMH -1.5%, Internet HLDRS- HHH -1.4%, NASDAQ 100- QQQQ -1.4%, Base Metals- DBB -0.70%, REITS- ICF -0.90%, Cons. Disct.- XLY -0.80%

Financial Services- IAI -0.80%, IYG -0.80% -

Turule jõudis kohale, et valitsuse SKP statistikat tuleb võtta läbi huumoriprisma ja nüüd siis alustati laiapõhjalist müügikampaaniat.

-

Freddie Mac (FRE) to sell 3-, 6-month bills, to sell $1 bln of bills in each maturity - Bloomberg

-

martk, pigem on müügi taga teade sellest, et Palin valiti McCaini asepresidendiks. Ootamatu valik ja selline ebamäärasus vähendab McCaini võidušansse...

-

One of the more candid analysts tracking Wall Street is sticking with his buy rating on Lehman Brothers, saying the firm will either tackle the challenges it confronts, or face a hostile takeover.

Tegemist siis kaua bullish olnud BOVE-ga ning uudis ennegi läbi käinud ja ei mõjuta hetkel enam aktsia hinda.

Finantssektor tänagi ülejäänud turu taustal suhteliselt tugev, kuid tehnoloogia mo-mo staarid saavad tugevat müüki. Kas tegemist sektorite vahelise rotatsiooniga?

Eile oli turgudel käive juba tunduvalt parem, kui viimasel ajal näinud oleme. -

The S&P is down 0.92% to 1289, the Dow is down 0.99% to 11600, and the Nasdaq is down 1.82% to 2368. Leading sectors include: Homebuilding +2.2%, Regional Banks +1.4%, Investment Banking & Brokerage +0.9%, Oil & Gas Refining & Marketing +0.8%, and Health Care Facilities +0.7%. Lagging sectors include: Thrifts & Mortgages -4.1%, Paper Products -3.6%, Semiconductor Equipment -3.1%, Internet Retail -3.0%, and Application Software -2.8%. The morning action has come on below average volume (NYSE 255 mln, vs midday avg at 485 mln; NASDAQ 630 mln, vs 843 mln avg), decliners outpacing advancers (NYSE advancers/decliners 939/1973, NASDAQ advancers/decliners 794/1819), and with new lows outpacing new highs (NYSE new highs/new lows 4/10, Nasdaq new highs/new lows 10/14).

-

Midday Sector ETF Strength:

Gasoline- UGA +1.6%, WTI/Crude oil- OIL +1.2%, USO +1.1%, Nat Gas- UNG +0.90%, Heaating Oil- UHN +1.0%, Solar Power- KWT +0.70%, Commodities- DBC +0.60%Midday Sector ETF Weakness:

Semis- SMH -2.6%, IGW -2.6%, Tech.- QQQQ -2.4%, XLK -1.7%, Software HLDRS- SWH -1.9%, Internet HLDRS- HHH -1.8%, Industrials- DIA -1.2%, XLI -0.80%, Cons. Dicrt.- XLY -1.0%, Small Caps- IWM -1.1% -

Finantssektor üritab turgu tõusule viia, ehitajad on samuti hommikused suured miinused seljataha jätnud ning toornafta futuurid on samuti langenud +0.2% tasemele, kuid tehnoloogia on väga raske.

-

Toornafta futuurid käisid hetkeks languses, mis on turgudele andnud jõudu ülespoole trügida. Finantssektor koos ehitajatega veab võimsalt ka kogu turgu, kuid tehnoloogia on jätkuvalt väga raske.

-

Gustav on kimbutamas turge:)

Gustav seen as category 3 hurricane when hits U.S., according to U.S. emergency management agency - Reuters

FEMA says Gustav expected to be accompanied by 15-30 foot storm surges at U.S. coast

Gustav regains hurricane strength, winds rise to near 75 mph, according to NHC - Reuters

-

Sector ETF Strength in Late Trading:

Solar Power- KWT +0.70%, TAN +0.40%, Livestock- COW +0.50%, Regional Banks- KRE +0.60%, Homebuilders- XHB +0.40%Sector ETF Weakness in Late Trading:

Semis- SMH -2.2%, IGW -2.2%, Tech.- QQQQ -2.0%, XLK -1.4%, Software HLDRS- SWH -1.6%, Internet HLDRS- HHH -1.5%, Oil HLDRS- OIH -1.3%, Energy- IYE -1.2%, Gold Miners- GDX -1.2% -

U.S. oil reserve release capacity is 4.4 mln bpd, more than U.S. gulf production, according to Energy Dept. Official - Reuters

U.S. more able than ever to respond to "oil disruption scenario"