Börsipäev 12. september - Freeraise Friday

Kommentaari jätmiseks loo konto või logi sisse

-

Hommikust!

Täna paistab tulevat positiivne börsipäev. Vahelduseks äkki Freefall Friday'le.

BTW, püüan addida EEH-d. -

"Aktsiate hinnad pole ostmise alustamiseks kunagi liiga kõrged või müümise alustamiseks liiga madalad"

J. L. -

EUR/USD praegu alla 1.40-ne.

-

Börsipäeva hommikul on ülihea ennast Coca-Colaga turgutada. Edukat kauplemist!

-

Btw, long:

Sümbol: KOIK

Tüüp: call

Aktsia sümbol: KO

Tähtaeg: september 2008

Strike: 55.00 USD

Stiil: ameerika

Alusaktsiate arv: 100.0000 -

ÄP: Dollari pöörane tõus

Tellisin möödunud nädalavahetusel internetikaubamajast Amazon.com ühe raamatu, mis maksis koos postikuludega kokku 290 krooni. Oleksin ma seda teinud kaks kuud varem, saanuksin raamatu kätte enam kui 30 krooni võrra odavamalt, aga täna läheks teos maksma juba üle 300 krooni. -

Üks huvitav eilne kommentaar UTXilt:

"Commercial construction orders is a much advertised and telegraphed problem that we have not seen," /-/ A crisis in financial services over the last year has spread across the industrial economy, "but not quite as rapidly or as seriously as the media would have us believe." -

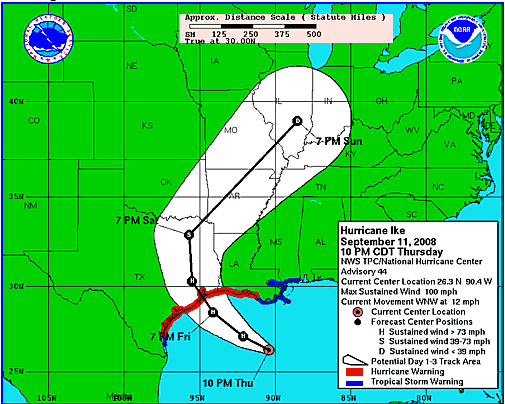

Panen siia ka graafiku ja lingi orkaan Ike kohta, mis Houstoni poole tüürib. Hetkel veel katastroofiliselt tugev orkaan pole ja kui jäädakse kategooria 2 kuni 3 piiresse, siis peaksid väga tõsised tagajärjed tulemata jääma

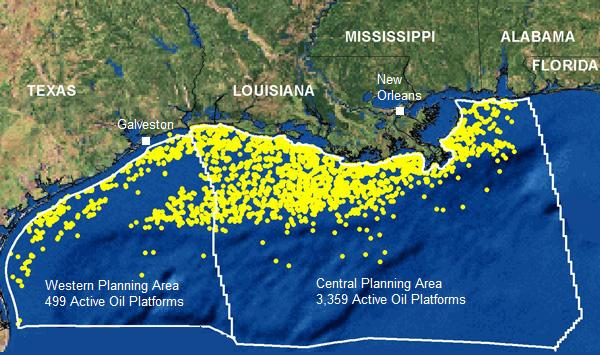

Ja graafik nafta platvormidest Mehhiko lahes:

-

Venemaa aktsiaturg on kenasti plussis, Micex +3%.

Long VTB, kohe hommikul. -

Ralli Venemaal jätkub:

Micex 10 Index: 1836.23 Muutus: 5.59%

Micex Composite Index: 1125.77 Muutus: 4.92%

(LHV lehelt) -

Panen siia väikese kokkuvõtte RenCapi hinnangust Venemaa turule:

The 7.3% drop in the RTS Index on Tuesday (9 Sep) puts it on 4.9x our 2008 EPS estimate and a miniscule 4.6x our 2009 EPS estimate. According to our real-time equity risk premium model, the market is implying 13.2% for the ERP, vs our estimate of 5.5%. An ERP of 7%, 1 ppt above the level we used in the YUKOS crisis, implies an RTS target of 2,068, or 48% upside potential to the RTSI. However, we maintain our ERP estimate at the sub-YUKOS level of 5.5% and our RTSI target at 2,350, implying 68% upside potential.

Our oil-sensitivity model shows that a $5 change in the oil price changes RTSI earnings by just over 7%. Our oils team models its earnings based on $95/bbl Brent next year – if we assume $80/bbl oil, we chop about 22% off our forward earnings for the index overall, which implies an RTSI target of 1,827, or 31% upside potential. At $80/bbl and a 7% ERP, our RTSI target would be 1,613, or 16% upside potential. -

Kodumaine ÄP: Täna on Tallinna börsil vaid tõusjate rivi

Suurim tõusja oli täna kl 11.30 Tallinna börsil Eesti Ehituse, aktsia kosus 5,4 protsenti ning maksis 51,95 krooni ja käivet tehti ligi 114 000 krooni eest. -

TO:Alvar

Kas sa investeerid või kaupled EEH-d?

Nädala alguse seisuga oli sul ju tühine positsioon, oled sa siis vahepeal juurde ostnud? -

Anette,

114tuhhi eest ostis ju täna juurde... -

Mõlemat püüan teha.

Btw, VTB-st väljas. -

Kas LHV ka teenustasude osas saab veidi järgi anda. Oleksin nõus 10% allahindlusega, täna juba 10 tehingut koos ka. investeerimiskontolt läheb see lugu liiga kalliks. Oleksin nõus, et tänasest alates, kuni aasta lõpuni saan soodustust (n. 10%). Edasi võib suhelda juba personaalselt.

-

TO: Alvar

Ise ostad hinna üles ja siis viitad artikklile ÄP.

Khmm .... ! Eneseimetlus? -

Anette,

Alvar on Cuban'it lugenud

Cuban: "...I wasn't an investor. I just wanted to make money. The reason I was ready to try was that it was patently obvious that the market wasn't efficient. Someone like me with industry knowledge had an advantage. My knowledge could be used profitably. As we got ready to start, I asked Raleigh if he had any words of wisdom that I should remember. His response was simple. "Get Long, Get Loud"...."

http://www.blogmaverick.com/2008/09/08/talking-stocks-and-money/ -

Ma olen alati oma tehingutest rääkinud. Mõned õnnestuvad, teised mitte. Elus on siiski palju olulisemaid asju, kui seda on raha. Parim investeering on ikka 9-kuuse perspektiiviga.

-

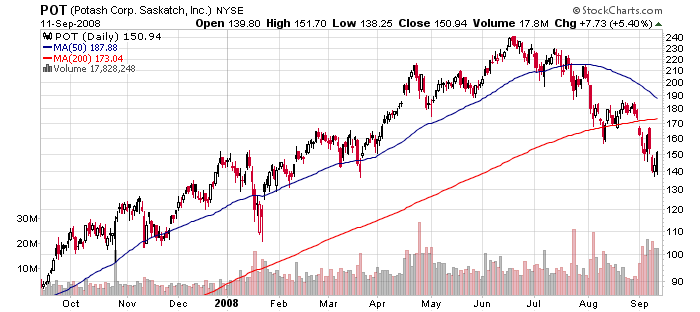

Väetisetootja PotashCorp (POT) teatas eile järelturul aktsiate tagasiostuprogrammi suurendamisest üpriski muljetavaldava mahuni:

POT announced that it has increased its stock buyback program by 15.7 mln shares after exhausting the existing 15.8 mln share authorization. At the end of 2Q, the company had repurchased a total of 10.9 mln shares (avgcost of $187.21/sh), meaning nearly 5 mln have been purchased so far in 3Q.

POT ja teised sektori ettevõtted on üsna agressiivselt alla müüdud, kuid viimasel paaril päeval on päris kenasti kosutud. Abiks on olnud ka analüütikute positiivsed kommentaarid (nt Merrill Lynch eile). Ootaks täna samuti positiivsuse jätkumist agri-nimedes.

Ettevõtete valuatsioonid on jõudnud tänaseks juba päris mõistlikele tasemetele, pakkudes pikema perspektiiviga investoritel, kes usuvad põllumajandusbuumi jätkumisele, soodsaid aktsiahindu. Näitena võib tuua Citi eilse note’i POTi kohta:

Top Pick – At 6.9x P/E and 3.9x EV/EBITDA based on our 2009 estimates, the recent sell off leaves POT shares trading at the lowest multiple in its public history, reiterating Buy and Top-Pick.

-

Usaldus LEHi vastu teiste investeerimispankade poolt on CNBC vahendusel väidetavalt punktseoses aktsiahinnaga...

LEH Lehman Brothers: Major firms say trade with Lehman continues but that could stop if shares fall under $3 -

POT aktsia on täna (peale mõnekuist 40% langust) 2x kallim kui augustis 2007 ja 4x kallim kui oktoobris 2006!

Kas firma käive ja kasum on tõusnud ka samas tempos kui aktsia hind?

Merrill ennustab: 2009 EPS goes to $23 with 2010 EPS going to $25.

Mis oli EPS 2006 ja 2007? -

2006. aastal $1.98, 2007. aastal $3.40, 2008. aasta prognoositav $12.8.

-

Jefferies on täna initimas kivisöesektori strong buy'ga. Arvestades seda, kui palju energiasektor peksa on saanud, kivisüsi veel eriti, siis peaks huvi tekitama küll. BTU on juuli alguse tasemetest allpool üle 40%, ACI üle 50%, CNX ka üle 50%...

-

Ouna Ants, POTi (ja ka teiste väetisetootjate) puhul käib peamiselt mäng ikkagi selle peale, kas praegune põllumajandussektori tõus on jätkusuutlik või on tegemist peatselt lõhkeva mulliga. Ma olen vist varem ka sellele viidanud, kuid järgnev argument on minu arvates Citi analüütikutel väga hea:

Materials Sell Off Indiscriminate, Misplaced in Ag – While we understand the demand linkage between industrial metals and global economic growth, our recent analysis of nearly 4 decades of global grain demand data indicates that grain demand has rarely declined YoY absent a major supply shortfall.

Konsensuse EPSi prognoos on 2009. aastaks $21.4. Citi vastav number on $22.3 ja 2010. aastaks $14.3. Osa EPSi kasvust tuleb muidugi tänu aktsiate tagasiostule.

-

Goldman Sachs on täna tõstmas Washington Mutual'i (WM) reitingu "Neutral" peale hinnasihiga $4. Analüütiku põhjendus peaks turule igati meelt mööda olema ning ostuhuvi tekitama, kuid eilne aktsiahinna 20%-line tõus võib siin kaarte segada natuke.

Goldman upgraded WM said Q3 results were worse than expected but not as bad as the decline in shares suggests. The analyst said WM's capital and reserves appear stable and that the company might be able to avoid another capital raise. Target to $4 from $5. -

Analüüsimajade ping-pong:

Friedman Billings on langetanud WM-i hinnasihti $4 pealt $2.5 peale ja ennustavad Q3 kahjumit aktsia kohta $1.20-1.30

Friedman Billings cuts their tgt on WM to $2.50 from $4, equal to 50% of estimated trough tangible book value based on firm's uncertainty in WM's future capital structure. On Sept 11, with ~three weeks remaining in the quarter, WM provided the market a 3Q08 earnings outlook, which implies a 3Q08 loss between $1.20 and $1.30. Firm remains comfortable with their slightly higher loss est of $1.40. EPS is highly dependent on credit costs, and firm's outlook for a $5 bln provision in 3Q08 is above mgmt's $4.5 bln outlook. WM expects single family residential loan cumulative losses of $19 bln, equal to 10% of loans. With losses of $2.2 bln in 2Q08 and firm believes another $6 bln likely in 2H08, WM is quickly realizing expected losses. If losses exceed guidance, WM could find itself in need of additional capital, which firm believes could be extremely dilutive to current shareholders. -

Sten, möh? Kuskohast see on. Minu meelest oli to Neutral ja tgt to $4 from $5.

-

Jah, siin lipsas viga sisse... uus reiting siis tõepoolest "Neutral" ehk varasemalt oli "Sell". Parandan ka algse postituse ära.

-

Kui ma poleks short Lehmanis, siis ma shordiks WM praegu. Shordid tunnevad ennast nii enesekindlalt, et hea meelega valiks nende poole. Aga topelt ei taha panustada.

-

Tootjahinnaindeks on vähenenud oodatust kiiremini (positiivne ettevõtete marginaalidele), kuid jaemüüginumbrid oodatust nõrgemad. Augustikuu jaemüüginumbrid langesid -0.3% vs oodatud +0.2% tõus.

August Retail Sales ex-autos -0.7% vs -0.2% consensus; prior revised to +0.3% vs +0.4%

August PPI y/y +9.6% vs 10.2% consensus, prior +9.8%

August Retail Sales -0.3% vs +0.2% consensus; prior revised to -0.5% from -0.1%

August PPI m/m -0.9% vs. -0.5% consensus; prior 1.2%

August core PPI m/m 0.2% vs. 0.2% consensus; prior 0.7%

August Core PPI y/y +3.6% vs +3.7% consensus, prior +3.5% -

Koige haigem on mingit 2$ aktsiat shortida.Ime siis moned maaklerid ei lase sellist diili l2bi

-

USA futuurid indikeerivad päeva algust ca 1% madalamatelt tasemetelt...

Saksamaa DAX -0.11%

Prantsusmaa CAC 40 +0.51%

Inglismaa FTSE 100 +0.42%

Hispaania IBEX 35 +0.55%

Venemaa MICEX +4.25%

Poola WIG +0.17%

Aasia turud:

Jaapani Nikkei 225 +0.93%

Hong Kongi Hang Seng -0.18%

Hiina Shanghai A (kodumaine) +0.04%

Hiina Shanghai B (välismaine) -1.93%

Lõuna-Korea Kosdaq +2.67%

Tai Set 50 +1.38%

India Sensex -2.26%

-

This Chaotic Market Isn't Giving Us Much

By Rev Shark

RealMoney.com Contributor

9/12/2008 8:05 AM EDT

It is useless for the sheep to pass resolutions in favour of vegetarianism, while the wolf remains of a different opinion.

-- Dean William R. Inge

The market continues to dance to the tune of the unwinding of Lehman Brothers (LEH) this morning. The bulls are hopeful that a resolution will help to put a bottom in the financials as well as the overall market, while the bears scoff at the notion that things are going to stabilize because of a panicked asset sale that may require governmental assistance.

The market is extremely chaotic right now, as evidenced by a number of sharp swings lately. On one hand, we have hope that some of the problems like Lehman and WaMu (WM) may be resolved, while on the other hand, we obviously have an unprecedented collapse of major financial organizations and a slew of financial challenges.

For those of looking to establish positions, the market is offering little. Aside from the drama in the financial sector, there continues to be no significant upside leadership. The charts are a mess, and if you want to trade, your only option is to engage in bottom-fishing or playing volatility in rumor-driven situations. You simply are not going to find many classic chart setups in this market right now, which is exactly what happens when there is a bear market.

The best trades lately continue to be shorting extreme strength or buying panicky weakness, as we have seen several times just this week. That is great if you have a time frame of a day, but it makes it nearly impossible if you want to build positions for anything more than a few days.

Even with the big reversal yesterday the technical picture of the major indices remains negative. We are still firmly stuck in a downtrend. While the July lows in the Nasdaq and S&P 500 held yesterday, another test has an increased likelihood of failing. We may bounce a bit more, but it looks very likely that those July lows will be revisited in the near future.

The LEH drama is going to preoccupy the media today, and we'll see the market jerked around as rumors fly. That short-term noise isn't going to change the overall picture, but it's going to excite the bulls. They'll try to convince you that the market really, truly, positively is going to find a bottom this time. Wait for some real proof rather than hope, and stay defensive.

Oil and commodity stocks look ripe for a bounce today as Hurricane Ike heads for drilling rigs in the Gulf of Mexico. In addition, the sectors have been finding some support for a few days now and have some base from which to turn up. There are positive comments about drillers and coal this morning, and the combination of things -- along with badly oversold charts -- might be enough to bring in some bottom-fishing.

We have a flat start on the way, but I suspect that trading will be quite choppy today with plenty of rumors to move things around.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CPSL +7.8%... Select metals/mining names showing strength with metals prices moving higher as the dollar pulls back: PAAS +4.9%, RTP +4.8%, BHP +3.9%, BBL +3.5%, GG +3.4%, ABX +3.2% (Barrick Gold squelches Kinross rumor - Globe and Mail), HMY +2.9%, GFI +2.9%, RIO +2.7%, AUY +2.5%, FCX +2.1%, GLD +1.3%... Other news: FWLT +5.5% (announces a $750 mln share repurchase program), HUN +5.2% (discloses it accepted two backstop proposals), LDK +4.0% (signs 11-year agreement for processing of solar-grade silicon for Q-Cells, coupled with MOU for up to 5 GW in additional wafer supplies), POT +3.1% (announces increase to share repurchase program; the ceiling to ~10% of the public float or 31.5 mln shares), E +2.6% (still checking)... Analyst comments: BTU +3.3% (initiated with Buy at Jefferies), GILD +2.1% (upgraded to Outperform at Baird), CNX +1.8% (initiated with Buy at Jefferies), RIG +1.7% (initiated with Buy at Citigroup), ACI +1.6% (initiated with Buy at Jefferies), NE +1.0% (initiated with Buy at Citigroup), SYT +1.0% (upgraded to Neutral at UBS).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PDGI -39.3% (also downgraded to Underperform at Jefferies), CMG -15.7%, DIOD -9.1%... Select mortgage/financial names under continued pressure: LEH -16.1% (multiple news stories speculating the fate of the co, with expectations for a deal to be put together by the end of the weekend), MER -7.0%, ABK -5.4%, IBN -4.5%, WB -3.0%, DB -2.0%, AIG -2.0% (WSJ reports that it is time for AIG to start selling assets), GS -1.5%, WFC -1.3%, MS -1.3%... Other news: ARAY -5.6% (announces resignation of Chief Financial Officer), ASML -2.9% (still checking)... Analyst comments: DHR -1.9% (downgraded to Hold at Deutsche Bank), UHS -1.0% (initiated with Sell at BofA). -

Hakkan LEH katma, magasin parimad hetked maha.

-

LEH kinni ära, ahnus pole hea :)

-

Kes aias, kes aias... vot just seda mängu on mängitud viimasel nädalal.

Esmaspäeval olid aias FNM ja FRE, teisipäeval LEH, kolmapäeval WM, neljapäeval jälle LEH ja reedel AIG (ja MER) : ) -

Muideks sõnal "trade" on inglise keeles väga palju tähendusi. Börsikeeles tähendab see tehingut, kuid mitte ainult. Sry, et veidi teemast mööda läheb.

-

Vip tahab päris lendu minna?

-

Paluksin LHV poolset professionaalset arvamust turgude käekäigust. Helistasin ka korra, kuid see oli selline poolik vastus.

-

mis seal klubis küll eile sisse söödeti...

-

Alvar esimene postitus 5.18.Raske ikka selle pohmakaga olla...

-

Mis privador ise teeb? Ostab või müüb jälle?

-

just, mis te seal LHV's magate, öelge, mis turgudest saab, teie seal ju oskate seda aktsia asja, mis te seal annate selliseid poolikuid vastuseid.

Sorry for off topic aga seda oli nii nii hea teha praegu :o) -

Jah, humoorimeel hakkab siinpool otsa saama.

-

Praegu tahaks kas niiviisi kihla veadada, et raha sealtpoolt ja kükid siitpoolt. Place your bets.

-

Ma vean kihla, et teen praegu 15 kätekõverdust, ilma, et ma vahepeal hingan. Ühesõnaga hinge kinnipidades.

-

Short some AIG kiire treidi mõttes. Paistab, et seda üritatakse nii alla tampida, kui vähegi võimalik, shordid valitsevad olukorda. Hinnaks sain $12.60.

-

Turud tõenäoliselt tõusevad või langevad. Eksisteerib ka võimalus, et jäädakse kauplema vahemikku.

Alvar, kas sa tõusid nii vara või pole eilsest hommikust saati magama saanudki, et meid nii raskete küsimustega pommitad?

:) -

Ma ärkasin üles ca 4 paiku hommikul ja praegu teeksin hea meelega 15 kätekõverdust hinge kinni pidades. Spordimees olen.