Börsipäev 16. september

Kommentaari jätmiseks loo konto või logi sisse

-

Nafta hind on jätkamas oma ülikiiret kukkumist ning hetkel kaubeldakse hinna peale $92 barrelist. Kui 9. septembri börsipäeva foorumis arutlesime pisut mootorkütuste hindade üle Eesti tanklates, siis nüüd võin arvutustele tuginedes küll julgelt väita, et vähemalt 50 sendine hinnalangus liitri pealt on ees ootamas kõiki kütuseliike. Tõenäoliselt juba täna, maksimaalselt ehk homse päeva jooksul.

Rõõmustage autojuhid!

-

Eilne börsipäev, muideks, oli DOW Jones indeksi 4.4%lise ehk 504-punktilise kukkumisega kõige punasem kauplemispäev pärast 2001. aasta 11. septembri järel toimunud terrorirünnakuid WTC tornidele. Tänased S&P500 futuurid on vahepeal ära käinud ka 1.7% punases, kuid on praeguseks hetkeks ülespoole tagasi nihkunud ja 'vaid' 0.2% languses...

-

Täna mõjutavad turgu kindlasti kell 21.15 avaldatav Föderaalreservi intressimäära otsus ning sellega kaasas käiv retoorika ning enne börsipäeva avanemist oma tulemused teatav Goldman Sachs (GS). Morgan Stanley (MS) kvartalitulemused teatatakse homme enne turgu.

-

Ei pruugi see bensiinihind niikohe langeda midagi. Neste hulgimüügis on hoopis tõusnud viimastel nädalatel. Täna on 95 liitrihind 16,72. Tavaline vahe letihinnaga on olnud nii 1-1,3 krooni. Diisli ja 95 vahe on küll vähenenud 30 sendile.

-

Joel, nagu Sa ka oma arvutustes tookord ütlesid, oli bensiinil kukkumisruumi siis juba 50-60 senti. Nüüd on nafta veel 15 dollarit allapoole tulnud sellest ajast.

-

USD tugevneb ... kas selle uudise peale?

The Wall Street Journal reports Lehman Brothers (LEH) Monday night was negotiating a last-minute plan to sell large portions of itself to Barclays (BCS). -

Jättes kõrvale ranged definitsioonid, võib öelda, et Venemaal on (täna) börsikrahh.

-

hullult spekulatsioone ..

CNBC commentator says he's hearing a likely scenario is that GS could buy a bank; says maybe something happens with WFC CNBC commentator says it's also possible that MS could be bought by a bank.

ja GS credit default swapide spread laienes vahepeal päris hoogsalt -

Aga kes on selles süüdi? No muidugi, USA :-)

-

Tulebki välja, et elutõde "käsu peale ei tõuse" peab paika. Ainult et Pisike ei taha sellest aru saada :)

-

Eile vaidlesime kontoris veel teoreetiliselt, et kuidas defineerida börsikrahhi. Lihtsustatult jäin väite juurde, et kui kahe päevaga langevad indeksid rohkem kui 20%. Venemaa aktsiaturule on selle definitsiooni kohaselt krahh saabunud.

-

Fed lubab uut likviidsust täna.

-

enam Venemaa põrkele ei panustata ?

-

GS prelim $1.81 vs $1.71 First Call consensus; revs $6.04 bln vs $6.23 bln First Call consensus

Ja GS aktsia -10%... -

Freemanter, panustatakse ikka, riskid peaksid ainult teada olema.

-

FED lisab 1päevase $50 bln repoga likviidsust

http://www.ny.frb.org/markets/omo/dmm/temp.cfm

Intressifutuurid näitavad 25 bps cutti -

Tarbijahinnaindeksi muutus vastavalt ootustele:

August CPI y/y 5.4% vs 5.5% consensus

August CPI m/m -0.1% vs -0.1% consensus

August Core CPI y/y +2.5% vs +2.6% consensus

August Core CPI m/m +0.2% vs +0.2% consensus -

UBS: Trading in UBS shares stopped - DJ (16.95 )

Briefing.com note: This is most likely in Europe as it is still trading in the US.

ja nüüd siis tuleb milline uudis? -

run forest run!

-

UBS shares resume trading after trade stop, down 18.9 percent

-

Kes ei ole veel tähele pannud (ma ei teagi, kas seda oleks võimalik mitte tähele panna) volatiilsus tõusu, siis graafik VIXist ka siia, mis indikeerib üle 30se näiduga ekstreemsusi:

-

Ega keegi pole täheldanud päevil mõningate meie pankade makseraskusi?

-

RJR

mul oli küll jama, vahetasin USD ja öeldi et raha pole lubati käbisid anda! -

said siis lõpuks v? käbisid

-

MICEX-l peatati kauplemine!

-

Börsikrahh on alanud...

-

Venemaa MICEX üle 15% punases...

Saksamaa DAX -3.23%

Prantsusmaa CAC 40 -3.39%

Inglismaa FTSE 100 -4.61%

Hispaania IBEX 35 -2.14%

Venemaa MICEX -16.60%

Poola WIG -2.69%

Aasia turud:

Jaapani Nikkei 225 -4.95%

Hong Kongi Hang Seng -5.44%

Hiina Shanghai A (kodumaine) -4.46%

Hiina Shanghai B (välismaine) -7.80%

Lõuna-Korea Kosdaq -8.06%

Tai Set 50 -3.16%

India Sensex -0.09%

-

Sit This One Out

By Rev Shark

RealMoney.com Contributor

9/16/2008 8:11 AM EDT

Banking establishments are more dangerous than standing armies.

-- Thomas Jefferson

Extreme leverage, bad judgment and a horrible real estate market has caused unprecedented problems for some of our biggest banking and financial institutions. As a result, the market has suffered some of the worst selling since the bear market of 2002.

The bad news is that there are still plenty of unresolved problems out there that can drive us down further. The good news is that we needed to embrace these problems before we could begin the process of finding a bottom.

As investors, our primary goal is to survive this chaos with the least amount of damage. Unfortunately, many on Wall Street will continue to urge us to jump in and gamble that a turning point may be at hand. They want us to gamble with our hard-earned capital, because they are desperately hoping that maybe things will turn and help bail them out.

One of the most important things to realize about a market like this is that objectivity tends to become impaired when you are suffering extreme losses. Some people panic and sell stocks indiscriminately, some freeze and are unable to do anything, and others rationalize and hope.

The best move for most investors isn't to jump in and try to catch the turn, but to stand aside as we undergo a once-in-a-century revamping of the financial sector. I have been consistently preaching the message that trying to anticipate bottom and turning points is fine for Wall Street pundits who have nothing better to do, but it's poor strategy for typical investors. The key to success is to wait for the action to improve before you start building positions. Just stay patient for now -- if you are inclined, do some short-term trading. You'll be fine if you don't play the bottom-calling game like so many others like to do.

Not only do we have continued chaos in the financial sector today, but the Fed is scheduled to make an interest rate decision this afternoon. There has been increased speculation that a rate cut is forthcoming, and that may attract some buyers. I'm not sure that a cut will have a very long-lasting impact, but it's going to cause some short-term volatility.

We are off to a weak start as overseas markets struggle and the news flow continues to look quite poor. Buckle on the trading helmet and adjust your goggles -- it's going to be a tricky one.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CPSL +5.6%, PLL +3.2%... M&A news: DSCP +5.0% (Getinge agrees to acquire co for $53 per share in cash)... Select airline stocks ticking higher with crude lower: LCC +5.9%, UAUA +5.2%, CAL +4.2%... Other news: LEH +14.3% (in talks to sell assets to Barclays - WSJ), MNKD +5.3% (reports positive data from a Ph. 3 clinical study of Technosphere Insulin in Type 1 diabetes; also the co and Pfizer announce collaboration for certain Exubera patients to transition to MannKind's inhaled insulin therapy), ASML +3.3% (still checking), SJM +3.3% (announces declaration of one time special $5 Dividend), WFC +3.2% (confirms Q3 non-cash charge for Lehman Brothers structured notes, preferred securities), HRS +2.9% (will replace LEH in the S&P 500 after close on 9/19), PLXS +1.6% (awarded manufacturing contract with Kirby Lester)... Analyst comments: SAP +2.9% (upgraded to Outperform at Credit Suisse).

Allpoole avanevad:

In reaction to disappointing earnings/guidance: RBCN -17.7%, LWSN -8.9%, OI -8.5%, GS -7.6%, BBY -6.2%... Select financial-related news showing continued weakness: AIG -32.1% (ratings lowered and kept on CreditWatch Negative at S&P), UBS -13.6%, MS -13.0% (credit default swaps rise 275 bps to 750 bps, according to Phoenix Partners - Reuters), RBS -12.0%, WM -10.0% (downgraded to 'BB-/B' (junk status) from 'BBB-/A-3'; Outlook Negative at S&P), RDN -8.2%, WB -6.9%, NCC -6.5%, SCA -6.3%, ABK -5.4%, ING -5.2%, SNV -4.5% (Fitch downgrades Synovus Financial Corp's ratings; outlook negative), BAC -2.4%, JPM -1.6%... Select oil/gas names showing weakness with crude lower: STO -3.6%, RDS.A -3.3%, BP -1.8%, TOT -1.6%, E -1.3%... Select solar names trading lower: ESLR -13.2%, JASO -6.1%, CSIQ -5.6%, FSLR -3.0%, LDK -1.9%, SPWR -1.8%... Select tech names trading lower following cautious comments from DELL: DELL -8.3% (sees further softening in global information technology demand), NOVL -5.2%, EMC -5.0%, YHOO -3.2%, INTC -2.4%, MSFT -2.3%, GOOG -2.1%, SYMC -1.8%... Other news: TRGT -40.9% (the co and AstraZeneca announce top-line results from Phase 2b Study of AZD3480 in Alzheimer's disease were inconclusive), SPNC -6.1% (VIVA has elected to temporarily suspend enrollment in the study after being contacted by the FDA about a potential safety concern), NOK -2.6% and INTC -2.4% (still checking for anything specific)... Analyst comments: WPI -4.3% (downgraded to Sell from Neutral at Goldman- DJ), NBR -3.5% (downgraded to Sector Perform from Outperform at RBC), PTEN -3.5% (downgraded to Sector Perform at RBC), AAPL -3.2% (removed from Conviction Buy List at Goldman - Bloomberg), BRCM -3.1% (downgraded to Sell at UBS), BIG -2.7% (downgraded to Neutral at JPMorgan), MU -2.1% (downgraded to Market Perform at JMP). -

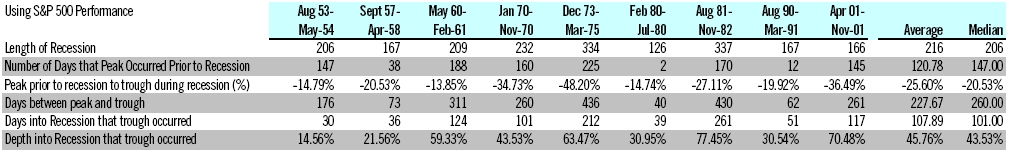

Citi analüütikud on koondanud tabelisse aktsiaturu tootlused eelmiste majandussurutiste ajal. Hetkel on S&P 500 langenud 9. okt 2007 saavutatud tipust 24%, mis on juba üsna lähedal ajaloolisele keskmisele.

-

Kolmandik eilsest C positsioonist kinni pandud.

-

Panin kõik eile ostetud Citi positsiooni kinni. Kardan, et siit tuleb lühiajaline põrge ja panustasin callidesse päevasiseselt.

-

Citi analüütikud oleks võinud ikka 1930.-ndate alguse ka sisse võtta.

-

Ja teine kolmandik ka kinni, tahab minna short squeezeks.

-

lukus..

-

Ja flat C, kaasa arvatud putid.

-

Kuuldus CNBCs AIG päästmise kohta pani aktsia tõusma 40% mõne sekundi jooksul.

-

C short uuesti $15.7 pealt.

-

Citi Call müüdud 20% käes. Võtsin Citi pute. Külla rallib edasi-tagasi.

-

Hakkan C katma.

-

Kas keegi oskab öelda,miks C putid on oluliselt odavamad kui WB putid nt.Kas tõesti volatiivsus on WB kordades suurem ja see on sinna sisse arvutatud

-

AA ka nyyd C paadis,aga see kord 12.5putid

-

Pool kaetud.

-

Siin läheb kauplemispäevikuks.

Aga mul näitab bookmarkides LHV logona hoopis tarkinvestori oma. Assa lepik. -

Flat C.

-

mul võimutseb bookmarkides LHV küljes hoopis omx värvides ja kirjaga logo

-

Olgem ausad... Finantssektori ettevõtete beetad kerivad juba üle 2...päevasisesed liikumised on 10% kuni 30%. VIX üle 30... Neis tingimustes saavad investeerimine ja kauplemine käsikäes kokku. Ning volatiilsetes tingimustes tehingute tegemisel kasvab risk kordades.

-

Võtsin $2.45 AIG pikaks, tegemist väga riskantse positsiooniga ja olen nõus kogu raha kaotama. Tegemist ka üsna väikse positsiooniga, kuid usun et AIG probleemile leitakse lahendus ja üsna pea.

-

sain hea õppetunni mida tähendab põhja püüdmine sellisel volatiilsustasemel (ja üldse) ilma stop-lossi-ta:

RSX long@32.45

RSX praegu 27

Madis, istud ka sees või müüsid ära? -

2.27-->2.70out uuesti in 2.20--->2.90out

-

to:Leiko

Kenad AIG treidid