Börsipäev 21. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Kui eile suutis IBM (IBM) hoolimata analüütikute prognoositud tuludele allajäämist kasumi osas ootusi korralikult lüüa, siis täna õhtul on enam jälgitavamaks tulemuste avaldajaks Apple (AAPL). Turg ootab tulusid $9.98 miljardit ning EPSi $1.43. Tulemustega võrreldavat tähelepanu pööratakse guidance'le, kuid Apple juhtkonna konservatiivsuse tõttu jääb see arvatavasti ootustele alla. Aktsia on tugevalt mutta tambitud, viimase aja langus on Jobsi puhkusest vaid hoogu juurde saanud. In-line tulemused ning guidance'i kerge allajäämine suudaks tõenäoliselt positiivselt mõjuda.

-

General Electric (GE) on saanud kahe päeva jooksul mitu hinnasihi alandamist. Eile langetas Goldman Sachs hinnasihti $17-lt $15-ni, kuid analüüsi kohaselt suudab ettevõte säilitada tugevate industrial tulude tõttu säilitada dividendid. Üsna julge pakkumine, arvestades, et suur osa ettevõtte rahavoogudest makstakse välja dividendidena. GE on tulude oodatust suurema languse tõttu iga kell kaitsmas pigem AAA-reitingut, kuna reitingu langetamine muudaks kapitali kallimaks ja oleks kokkuvõttes kahjulikum. Mõlemat aga arvatavasti ei suudeta, mistõttu dividendide vähendamine või AAA-reitingu langetamine 2009. aastal tõenäoliselt juhtub. Ühtlasi kärpis GS neljanda kvartali prognoose konsensusele lähemale. Kui enne oodati EPSi $0.45, siis uus prognoos on $0.36 (konsensus $0.37).

GSi kõrval langetas ka Oppenheimer GE hinnasihti $17-lt $15-ni.

GE avaldab oma tulemused reedel enne turgude avanemist. Täpsemalt saab ettevõtte kohta lugeda LHV Pro alt. -

Uuenemist jätkab tulemuste tabel ja link sellele on siin.

-

Enne turgude avanemist avaldab oma tulemused veel Citi 2009. aasta top-pickide hulka kuuluv Philip Morris International (PM). Analüütikud ootavad aktsiapõhiseks kasumiks $0.66, fookuses on marginaalid (kulude kokkuhoid ja madalama kasumlikkusega toodetest loobumine) ning ebasoodsa valuutakursi mõjud (kvartaliaruanne dollaris, tulud teistes valuutades). Pikem kommentaar hiljem Pro all.

-

Alari juhtis eilse börsipäeva lõpus väga hästi tähelepanu USA finantssektori liikumist 3x võimendusega kajastavale FAS'le (baasiks on Russell 1000 Financial Services Index).

Kes otsib turu liikumist kajastavaid võimendusega instrumente, siis neil tasub sel silma peal küll hoida. Kui kogu finantssektor lõplikult kokku ei kuku, siis turg ilma selle tööstusharuta ülespoole eriti ei liigu ka.

-

Ma nägin öösel unes, et eilne exodus finantssektorist oli tingitud sellest, et mingi seltskond leiab, et suur osa sektorist läheb de fakto natsionaliseerimisele ning stokihoulderite supp jääb seetõttu erakordselt lahjaks. Tööstusharu kokku kukkumine ei ole täna teema. Tööstusharu edasine eksistentsivorm on teema.

-

Karum6mm, sa ei ole oma unenägudes üksi.

-

FNM, FRE, GM, F, AIG jne jne on tõestanud jah, et investorid peaksid leksikonid lahti lööma ja järgi vaatama, mida sõna 'common equity' ikkagi tähendab. Ehk et ettevõte iseenesest võib edasi tegutseda, kuid tavaaktsionäride supp muutub lahjaks nagu omal ajal Vene kroonus.

-

Ja kes tahab kuulda eilset Jim Crameri 10 nõuannet Mad Money's uuele presidendile Obamale, siis seda saab teha siit.

-

Finantsi muidu lühikeseks müüa saab üldse tänapäeval või ikka mingi keeld peal?

-

Hm. Tundub, et Joel teab palju Vene kroonust :-))

-

dol, raamatud/lood/ajaloo kirjutised sel kohal abiks. Nii nagu ka 1929-1932. aasta börsikrahhi on uuritud : )

-

Minu isa jutu järgi polnud vene kroonus söögil viga. Iga kord, kui ma defitsiidiajastul kondenspiimast unistasin, ütles ta, et seda oli sõjaväes nii palju, kui tahtsid. Üldse olevat süüa saanud korralik ning ainus kahtlasem asi oli sugutungi vähendav kissell. Samas ka see olevat olnud hea asi, sest siis olevat "mustad" teineteise vastu oluliselt vähem huvi tundnud. :-D

-

Tean inimesi, kes aitasid ladudes hernekotte täita, millest hiljem suppi keedeti. Kuna päris paljud kotid olid hiirte poolt auklikuks näritud, siis tuli põranda pealt hernejäägid koos hiiremustaga kokku ajada ja kottidesse ajada, et norm ikka täis saaks. Nii mõnigi loobus seejärel hernesupi söömisest. Ja liha loomulikult patta sõdurpoistele eriti ei jäänud, see läks kõrgematele ohvitseridele. Umbes sama seis on täna ka finantssektoris, kus common equity hoidjal on oht jääda selleks tavaliseks sõdurpoisiks, kellele eelpoolmainitud hernesuppi serveeritakse...

-

Koondamised toormaterjalide sektoris on madalate hindade tõttu hoogustumas - täna teatas BHP Billiton 6% tööjõu koondamisest.

-

Oioio, kui lõpuks recovery tuleb, siis mida toormehinnad teevad... oioioi...

P.S. Ilmselt hiires**a söömine oli tühiasi võrreldes näiteks nende psüühhiliste probleemidega, millega näiteks Afganistanist naasti. -

Credit Suisse on Venemaa telekomide kallal:

Credit Suisse downgrades Mobile TeleSystems (MBT) to Underperform from Outperform

Credit Suisse downgrades Vimpelcom (VIP) to Neutral from Outperform

-

Afgaani asi karm....õnneks oli mul õnne ja oidu, et sinna mitte jõuda...kuigi olin juba sinna teel poole 19xx aastal.

-

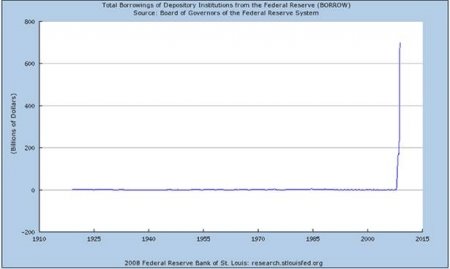

East Coast Economicsi vahendusel mõned huvitavad graafikud. Pankade päästmiseks vajaminevad summad panevad igapäevaga üha vähem imestama aga need kaks pilti ilmestavad hästi lõppenud aastat

USA pankade laenud FED-ilt kuni 2007.a detsembrini (hüpe 8 miljardini 80-ndatel toimus säästu ja laenu kriisi ajal)

USA pankade laenud FED-ilt 2008. detsembrini

-

Pankade laenugraafikuid vaadates tekib päris kõhe tunne?

-

Karum6mm...loe O. Ruitlase raamatut KROONU, aga mitte õõsel, muidu ei saa majas teised inimesed magada.

-

Briefing:

UBS adds GE to their Short Term Sell rating and cuts their tgt to $12 from $18 saying although they believe GE is fairly valued on a 12-month basis, they believe there is additional downside risk in the near-term. The firm says if their ests are correct, they believe that GE's ‘AAA' rating is at risk, and that GE might have to consider either cutting its dividend or raising additional capital. They also believe that GE's commitment to its dividend could result in underinvestment in its industrial businesses. The firm says despite a sharp drop in the stock's price they expect declining consensus ests, coupled with an intensification of the discussion about the dividend and credit rating, to drive the stock lower over the next few months.

-

USA turud alustavad päeva plussiga. S&P500 futuur +1.12% @ 815 punkti ning nafta +1.1% @ $41.3.

Saksamaa DAX +0.61%

Prantsusmaa CAC 40 -0.53%

Inglismaa FTSE 100 -0.74%

Hispaania IBEX 35 +0.42%

Venemaa MICEX +1.91%

Poola WIG -1.32%

Aasia turud:

Jaapani Nikkei 225 -2.04%

Hong Kongi Hang Seng -2.90%

Hiina Shanghai A (kodumaine) -0.46%

Hiina Shanghai B (välismaine) -0.23%

Lõuna-Korea Kosdaq -1.61%

Tai Set 50 -0.64%

India Sensex 30 -3.53%

-

Just Stand Aside

By Rev Shark

RealMoney.com Contributor

1/21/2009 7:58 AM EST

The secret of health for both mind and body is not to mourn for the past, not to worry about the future, or not to anticipate troubles, but to live in the present moment wisely and earnestly.

-- Buddha

The inauguration of Barack Obama made Tuesday a truly historic day, but it was the share price destruction of banks and financial institutions that may have a more immediate impact. Many banks are so troubled now, particularly in England, that nationalization is almost inevitable.

We are seeing something completely unprecedented in the financial institutions, and the government -- even with a new administration -- is so far behind the curve in dealing with the issues that we can have no confidence about how events will play out.

The only sensible way to deal with this crisis is to simply stay out of the way. Unfortunately, that is seldom the advice you will hear from Wall Street. The traditional folks will almost always encourage you to jump in and anticipate some change in conditions. They have been doing just that for over a year now, and there is no reason for them to change at this point. In fact, the worse things become, the more adamant they will become that a positive change is coming soon.

The great thing about being an individual investor is that you have the flexibility to go to very high levels of cash. You need not dwell on the past or try to anticipate the future. You can simple stand aside and contemplate what is going on. There is no need for you to be holding lots of positions like traditional money managers.

While it certainly is worrisome to see what is happening to our banking system and our economy, we don't have to put our capital into the middle of it. That is really a very simplistic statement, but so many investors just don't seem to understand that. They hold on to the belief that investing always means holding on to positions. It has been beaten into them by so investing professionals and the business media. Of course, at a time like this, they are going to feel some tremendous stress when the uncertainties are so great.

If you can throw off the shackles of conventional investment thought, a market as bad as this one can actually be quite liberating. If you are sitting here with little exposure, you can feel secure that eventually better opportunities will come. You need not worry about that right now. Just let today play out and the news evolve as it will.

The one thing we know for certain about the market is that it will play out in cycles. If we stay out of the way when it is bad and protect our capital, we can quickly capture gains when it's better. We are obviously in a bad cycle right now and we should embrace that fact. At this moment, you don't have to worry about being left out of the good times that will eventually come. All you have to do is worry about making sure you deal with today in a way that best protects you.

I wish I could offer something more inspirational, but there are already too many folks looking for reasons to use hope to make bad decisions. Hope and optimism are good things in many situations, but not when they push you to be passive and ignore the steps you should take now.

After the ugly action yesterday, we have a market that is oversold enough for some sort of bounce, but we also have badly broken technical conditions, shaken confidence and no clarity in the financial sector. It certainly is negative, but these aren't conditions that should have us thinking that it's so bad that we can't go lower. Stay very cautious.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: HCBK +18.3%, ERIC +15.3%, RVBD +13.9%, NTRS +10.9%, CREE +7.9%, SPW +5.7% (light volume), ABT +5.7%, WGOV +4.8% (upgraded to Outperform at Baird), SMTS +4.6% (light volume), IBM +4.1%... Select financial related names rebounding: CIT +15.3% (declared a regular quarterly cash dividend of $0.02 per share on its outstanding common stock, down from prior dividend of $0.10), C +10.0% (declares quarterly dividend of $0.01; down from $0.16 previously), MET +4.9%, STT +4.8%, PNC +4.5%, HIG +4.3%, DB +3.9%, BAC +3.7%, UBS +3.0%, GS +2.5%, WFC +2.2%... Select drybulk shippers showing strength: DRYS +5.6%, PRGN +5.5%, EXM +5.2% (announces the delivery of a newbuild Capesize vessel as well as the cancelation of a vessel purchase agreement), EGLE +4.6%, FRO +2.3% (upgraded to Neutral at Goldman - DJ)... Select metals/mining names showing strength: GFI +5.2%, MT +4.9%, AU +4.4%, HMY +1.7% (upgraded to Buy at Bofa/Merrill)... Other news: AVII +30.2% (announces "successful clinical trial" of AVI-4658 for treatment of Duchenne Muscular Dystrophy by Exon Skipping), TOMO +9.1% (TomoTherapy and Hitachi Medical Corporation enter into distribution agreement for Japan), SAY +6.9% (Genpact explores the possibility of acquiring SAY - Economic Times), MRO +6.4% (Cramer makes positive comments MadMoney), SI +4.2% (still checking), HPQ +2.3% (trading up in sympathy with IBM)... Analyst comments: F +3.3% (upgraded to Hold at Deutsche), FSLR +1.6% (initiated with Buy at Merriman).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: OMCL -27.2% (also downgraded to Sell at Auriga, tgt lowered to $7 and downgraded to Source of Funds at ThinkEquity), AMSC -12.2%, CSH -8.5% (light volume), MMR -7.2%, BLK -5.4% (light volume), ADI -2.8%... Select European financials under continued pressure: IRE -16.0% , AIB -14.5% , BCS -14.2% (Barclays may report results early to halt slump in shares - Guardian Unlimited), LYG -8.4% , RBS -6.6%... Select oil/gas related names trading lower: BP -3.7% , RDS.A -2.2% , E -1.4%... Other news: KGC -4.7% (announces a bought deal public offering of 20.9 mln common shares of Kinross at a price of US$17.25 per common share)... Analyst comments: WFR -2.8% (downgraded to Hold at Citigroup), GE -1.9% (Goldman cuts General Electric price target, Q4 EPS view- Forbes.com). -

Kuna PMi tulemused olid unconfirmed, siis enne turgude avanemist neid ei avaldatudki. Järgmist aega ei oska pakkuda.

-

S&P500 indeks kaupleb jätkuvalt 800 punkti piirimail. Nii nagu ikka tasemetega, mida kõik silmad jälgima kipuvad, on reeglina tõenäosus suurem, et see kas või ajutiselt läbi murdub, kui püsima jääb...

-

Viimased pool tundi on tehnoloogia futuur NQ kõige rohkem nõrkust näidanud, kas kardetakse tulemusi?

Ning lisaks veel: Apple: SEC opens inquiry into Apple disclosure on Jobs' health, according to source - WSJ -

S&P lowers Republic of Portugal ratings to 'A+/A-1'; outlook stable

NQ futuur on ka hoogu saanud->tulevik on helgemaks muutunud:D -

Pankade natsionaliseerimise teemal - Ladenburg usub, et see ei saa olla reaalne tulemus, kuna vastasel korral võtaks USA riik endale lihtsalt liigselt kohustusi:

The idea of banks being nationalized makes no sense. Ladenburg notes that in the current hysteria surrounding banking the idea has developed that the banks should be nationalized. The firm believes that this will never happen and that it makes no sense to speculate that it will occur. The firm notes the U.S. at last reading in Sep 2008 owed over $10 trln. The largest holder of this debt was the Social Security Administration and other govt pension funds. They held $4.2 trln of this debt. The remainder, or $5.8 trln, is held by the public. The firm notes that at the end of the Q3 there were 8,384 FDIC insured banking institutions in the U.S. They had $8.7 trln in deposits. Firm notes that if the govt nationalized the banks this debt would become govt debt and the government would be guaranteeing 100% of these deposits. -

Finantssektoris eilsega võrreldes pea peegelpilt:

-

Ka STT on täna korralikus plussis. Usun, et mõne aja pärast uus põhi.

-

STT uus põhi või kõigil ülevalpool mainitutel?

-

STT-d mõtlesin.

-

JP Morgan Chase CEO Dimon bought 500K shares at $22.92 on 1/16

ja päeval tuli veel välja, et Ken Lewis Bank of Americast (BAC) oli ostnud 200 000 BACi aktsiat. Väga julgustavad märgid tavaaktsionäri jaoks. -

AAPL Apple prelim $1.78 vs $1.39 First Call consensus; revs $10.17 bln vs $9.75 bln First Call consensus

-

Apple sees Q2 $0.90-1.00 vs $1.13 First Call consensus; sees revs $7.6-8 bln vs $8.20 bln First Call consensus

-

Nagu ka eelvaates välja tõin, siis need ootused on aktsiahinnas sees ning tulemused pakuvad põhjust rõõmustamiseks. AAPL aktsia kaupleb +17% $91 peal...

-

Eile IBM-ilt päris head tulemused, nii et suured tech-firmad siiski saavad hakkama praegustes majandustingimustes. Või on tegemist siis vaid teatud nimedega... Apple'i fenomen on ikkagi huvitav - bränd on end turule nii tugevalt söönud, et saavad jätkuvalt kõrgema hinnaga asju müüa ehk marginaale kõrgel hoida. Eks see edulugu võib praeguse tooteportfelli juures 2-3 aastat veel kesta, hiljem sõltub juba sellest, kuidas neil tootearendus edasi õnnestub. Aga praeguses majandustingimustes tõesti tugev tegija.

-

Quarterly iPhone units sold were 4,363,000, representing 88 percent unit growth over the year-ago quarter.

-

eile ja täna oleks SKF play olnud tõeline maasikas, kahjuks ei julgenud näppida:(

-

+17% liig Apple'le. Tulemused on minevik, Apple on high-end, Jobs on tõenäoliselt jäädavalt firma juhtimisest lahkunud. Homseni short 91 pealt oleks väga adekvaatne.

-

Usk on hea, kuid suht kasutu luksus :)

-

DreamWorks SKG, Mr. Spielberg’s boutique production company, is in advanced talks on a deal to distribute its movies through Disney, according to four people with knowledge of the talks but who asked for anonymity because negotiations are not complete. A deal with Disney, which could come as soon as Friday, would replace one Mr. Spielberg arranged with Universal Pictures just four months ago after an acrimonious divorce from Paramount Pictures.

-

millest naftahinna hüpe, keegi teab?

-

NEW YORK (CNNMoney.com) -- Oil prices clawed their way back near $42 a barrel Friday as Congress debated a massive economic stimulus package that investors hope will help restore the economy.

Juba leidsin. -

"massive economic stimulus package." See kõlab nagu mingi kliśee juba.

-

võtke 6.02 börsipäev, my bad, kaevasin ühe vana päeva välja ;)

-

hahaaaa :D

-

:D ma ei pannudki tähele, et jaanuar läbi :o