Börsipäev 26. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Täna enne turgu teatavad oma tulemused CAT, DHR, MCD ning pärast turgu AXP ning TXN. Teise nädala terviklikumat tulemuste tabelit saab vaadata siit.

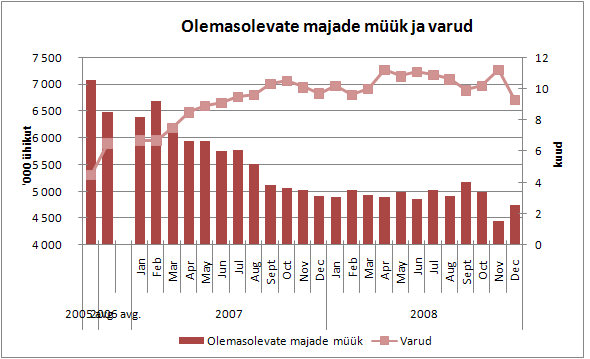

Täna kell 17.00 teatatakse olemasolevate majade müüginumbrid ning juhtivate indikaatorite detembrikuu muutus.

-

Täna kell 17 avaldatakse USA olemasolevate majade detsembri müügistatistika. Konsensus ootab aastasel baasil 4.4 miljoni maja müüki, novembri statistika oli 4.49 miljonit ja oktoobri oma 4.91 miljonit.

-

Barclays PLC (London Stock Exchange)

sector: Financials .

As of 4:14am EST

72.40GBp

Price Change

+21.20

Percent Change

+41.41%

Mis see nüüd siis on korrektsioon? -

Ei, see on paraku ainult volatiilsus! :-)

-

Megas, Barclay tõusu põhjus on siin. Tundub, et Barclay saab ilma täiendavate emissioonideta hakkama.

-

Citi on tõstmas Lennari (LEN) soovitust "osta" peale:

In our opinion, the recent sell-off in LEN following allegations of fraud and improper behavior made by Barry Minkow/Fraud Discovery Institute (FDI) is overdone. Since the allegations were made, LEN is down ~40% versus its peer group which is down ~19% We expect the stock to gain back much of its underperformance in the coming months.

-

Autotööstus kuulub koos finantssektori ja kinnisvaraga sellesse segmenti, mis on majanduslanguse tõttu kõige valusamalt pihta saanud. Toyota prognoosib 2009. aastal võrreldes 2008. aastaga mahtude 20%list langust. Arvestades maailma viimase aja lembust Aasia autotootjate vastu, siis huvitav, kui suureks kujuneb langus GM ja F poolt toodetavatele neljarattalistele?

-

Tänases Bloombergis on lugu ka treasury "billide" kohta.

Kuna linkida siin ei oska :(, cuttin vähe siia:

--------

Timothy Geithner, who may be confirmed as head of the Treasury today, will have the benefit of near record-low yields as he presides over auctions of as much as $150 billion of notes and bonds the next three weeks. Goldman Sachs Group Inc., one of the 17 primary dealers that are required to bid at the auctions, said last week the U.S. will likely borrow a record $2.5 trillion this fiscal year ending Sept. 30, almost triple the $892 billion in notes and bonds sold in fiscal 2008.

----

Falling Yields

Yields plunged in the past year as losses and writedowns at the biggest financial companies rose above $1 trillion. Two-year note yields ended last week at 0.81 percent, compared with the average of 3.49 percent this decade, while 10-year rates are 2.62 percent, versus the average of 4.56 percent.

The plunge is helping Geithner, the 47-year-old head of the Federal Reserve Bank of New York since November 2003, because government interest costs are falling even as the amount of debt rises. Interest paid by the Treasury in the last three months fell $18.3 billion as debt rose to $10.6 trillion in December from $9.23 trillion a year earlier, government figures show.

President Barack Obama, 47, and Geithner are counting on demand for Treasuries to finance a $1 trillion budget deficit inherited from the administration of George W. Bush and Paulson, who was chairman of Goldman Sachs before becoming Treasury Secretary in July 2006. -

Pfizeri (PFE) ja Wyethi (WYE) ühinemine on nüüdseks kindel, Pfizer ostab Wyethi ära $68 miljardiga, mis ühe aktsia hinnaks teeb $50.19. Tehingut finantseeritakse raha ja aktsiate kombinatsioonina. Arvestades aga, et Pfizer tuli just mitte kõige paremate tulemustega ning aktsia on eelturul miinuses, on WYE aktsionäridele makstav $33 rahas + 0.985 PFE aktsiat juba vähem väärt. See on ka põhjus, miks WYE't hetkel $46.45-ga osta saaks.

-

Arvestades, et Geithner kutsus Hiina valuutapoliitkat manipulatsiooniks (mitte midagi üllatavat, aga retoorikanihe võrreldes Bushiga) ning Hiina ostab suure osa USA võlakirjadest, võib hiinlaste huvi väheneda ning kõrgemate määradeni viia.

-

Caterpillar prelim $1.08 vs $1.31 First Call consensus; revs $12.12 bln vs $12.77 bln First Call consensus

Caterpillar sees FY09 $2.50 vs $4.32 First Call consensus; sees revs $40 bln, +/- 10%

Üsna nukrad numbrid. -

Minu ajalooline tabel Caterpillari müügitulude kohta:

Q2 07 kasvud Masinad (64% müügitulust) Mootorid (29% müügitulust) Põhja-Ameerika -14% -8% EAME +35% +27% Ladina-Ameerika +23% +12% Aaasia/Vaikne-Ookean +23% +18% Q3 07 kasvud Masinad (62% müügitulust) Mootorid (31% müügitulust) Põhja-Ameerika -12% -16% EAME +43% +26% Ladina-Ameerika +23% +6% Aasia/Vaikne-Ookean +35% +26% Q4 07 kasvud Masinad (66% müügitulust) Mootorid (28% müügitulust) Põhja-Ameerika -7% -23% EAME +32% +36% Ladina-Ameerika +29% -8% Aasia/Vaikne-Ookean +40% +31% Q1 08 kasvud Masinad (64% müügitulust) Mootorid (29% müügitulust) Põhja-Ameerika +3% +3% EAME +27% +33% Ladina-Ameerika +18% +33% Aasia/Vaikne-Ookean +35% +40% Q2 08 kasvud Masinad (63% müügitulust) Mootorid (31% müügitulust) Põhja-Ameerika +8% +9% EAME +15% +34% Ladina-Ameerika +23% +42% Aasia/Vaikne-Ookean +50% +57% Q3 08 kasvud Masinad (62% müügitulust) Mootorid (32% müügitulust) Põhja-Ameerika +3% +7% EAME +5% +19% Ladina-Ameerika +44% +25% Aasia/Vaikne-Ookean +37% +22% Q4 08 kasvud Masinad (59% müügitulust) Mootorid (34% müügitulust) Põhja-Ameerika -9% +8% EAME -13% +3% Ladina-Ameerika +38% +30% Aasia/Vaikne-Ookean +41% +55% *EAME = Euroopa, Aafrika ja Lähis-Ida

2009. aasta kohta öeldakse niimoodi:

"We expect 2009 will be the weakest year for economic growth in the postwar period. We are expecting recessionary conditions to persist in most of the world throughout the year, with no growth in the world economy."

Caterpilla: "We expect 2009 will be a dismal year for the world economy, but conditions for much better growth are developing, particularly in industries we serve. Interest rates throughout the world are at historically low levels and should eventually be favorable for investment. Despite a higher level of spending over the past few years, capacity in the world's infrastructure, mining and energy industries is still inadequate or outdated. Reduced investment in 2009 is going to leave future capacity even more strained. Government stimulus plans are a step in the right direction and should help economic growth." -

Väike kommentaar ka toormaterjalide hindade kohta:

"Most commodity prices dropped below investment threshold levels in late 2008, and producers are reducing and delaying investments. We expect this unfavorable environment to persist throughout the year."

Seega energiasektori osas suhteliselt sarnane sõnum sellega, mis tuli reedesel konverentsikõnel Schlumbergerilt (SLB). Suuri investeeringuid lükatakse edasi, kuna: 1) toormaterjalide hinnad ei soosi investeerimist; ja 2) oodatakse, et vastav infrastruktuur ja masinad odavamaks läheksid, enne kui uusi investeeringuid tegema hakatakse. Ning et toormaterjalide väga suurt hinnatõusu 2009. aastal ilmselt ei näe, kuid kui nõudlus ühel hetkel taastub, siis seisab maailm omajagu katkise ja alainvesteeritud küna ees...

-

Caterpillari tulemustes prognoositakse maailma majandusele väga musta 2009. aastat. Müügimahtude langust ooodatakse 2008. aastaga võrreldes 20%-25%, töösuhe lõpetatakse ca 20 000 inimesega ning kui 2009. aasta lõpuks teenitaksegi EPSi $2.50 või vähem, siis selle eest boonust töötajatele ei maksta. tundub, et CATi sõnum investoreile on see, et ka sel väga raskel aastal võivad nad arvestada vähemalt $2.50lise EPSiga, mis tähendaks praeguse $31lise aktsiahinna juures 12.5x hinna ja kasumi suhet. Polegi ju väga paha.

As a result of sharply declining sales, we expect 2009 profit to drop significantly from 2008, and we are taking actions to deliver our "trough" profit target of $2.50 per share, excluding redundancy costs, at $40 billion in 2009 sales and revenues. We have initiated actions which will remove about 20,000 workers from our business and every indirect spend dollar will be heavily scrutinized. These actions support lowering our production costs in line with a 25-percent decline in sales volume and reducing SG&A and R&D costs supporting our Machinery and Engines business collectively by about 15 percent.

-

S&P Says GE Ratings Unaffected By Q4 Earnings.

-

Rõhku tuleks sellele lausele pöörata:

Still, for GECC there are signs that 2009 will be even more difficult than we assumed when we revised the outlook on both companies to negative on Dec. 18, 2008 -

Credit Suisse cuts their ests and tgts on the homebuilders, saying they thought it would be difficult to cut sales ests further, but tough market conditions dictate that they must. They see '09 as a waiting game for the homebuilders, as they expect weak sales along with further price declines and impairments while waiting for the overall housing market to work through the excess supply. Firm cuts 2009 and 2010 ests for TOL, PHM, NVR, DHI, MDC, CTX, LEN, KBH, RYL, MTH and HOV.

Firm cuts their TOL tgt to $19 from $20; NVR tgt to $475 from $550; DHI tgt to $7.50 from $9; MDC tgt to $31 from $36; CTX tgt to $12 from $13; LEN tgt to $7.50 from $10; KBH tgt to $10 from $15; RYL tgt to $16 from $19; MTH tgt to $12.50 from $14; HOV tgt to $1.25 from $2.

-

USA alustab päeva S&P500 indeksi 1%lise ning Nasdaqi 0.8%lise plussiga. Nafta -1.5% ja maksab $45.7 barrelist.

Saksamaa DAX +1.38%

Prantsusmaa CAC 40 +1.70%

Inglismaa FTSE 100 +1.90%

Hispaania IBEX 35 +1.58%

Venemaa MICEX +7.36%

Poola WIG +1.17%

Aasia turud:

Jaapani Nikkei 225 -0.81%

Hong Kongi Hang Seng N/A (börs suletud)

Hiina Shanghai A (kodumaine) N/A (börs suletud)

Hiina Shanghai B (välismaine) N/A (börs suletud)

Lõuna-Korea Kosdaq N/A (börs suletud)

Tai Set 50 +0.87%

India Sensex 30 N/A (börs suletud)

-

We'll Pay Plenty for the 'Free' Lunch

By Rev Shark

RealMoney.com Contributor

1/26/2009 8:14 AM EST

There is no such thing as a free lunch.

-- Milton Friedman, economist

Economic stimulation, tax rebates, TARP programs, bad asset aggregation, increased regulation and a variety of other government programs designed to bolster the economy will be the primary focus of news this week. This is the first full week of President Obama's administration, and the energy and zeal to come up with some solutions is going to be great.

While the news media certainly has plenty to talk about, whether all this activity benefits the economy or the stock market remains quite questionable. Almost all the various programs and ideas are already widely known. We have even implemented a number of them already, albeit with little positive effect to show for the efforts.

The big problem with all this sound and fury that will hopeful spark the economy is the old saying by Milton Friedman -- there is no such thing as a free lunch. None of these government efforts are creating anything new. They are simply shifting money from one pocket to another and hoping that it will somehow be used in a more productive manner. The arrogance of government is that it is somehow superior in determining the best ways to spend money.

What is particularly sad about the whole process is how much it resembles the way aggressive mortgage lending and high leverage was so completely and universally embraced by government and banks just a few years ago. No one questioned what was being done. It was as if there really was not choice in which direction we went. That same mindset is exactly what we are seeing once again.

Unfortunately the economic discussions don't help us very much as stock market investors. The situation is a mess and the markets obviously indicate that there isn't much optimism that the government is going to do the right things to help us.

If you step back and look at the big picture, you see little reason to want to anticipate that the great bear market is close to an end. Banks are still stumbling around trying to survive, earnings reports and estimates are poor, technical patterns are negative, confidence and sentiment is unsupportive and there just isn't any good reason to be rushing into this market, especially with your very precious capital.

It is a depressing time for the stock market, and while many will offer recommendations and complaints about the economic situation, there just isn't much to do but to wait it out and see how things develop. That is simply the way it goes in the market at times. We go through cycles of good and bad, and right now, it's bad.

The government is going to try to help by handing out some "free" lunches, but the likelihood is that they will end up costing us plenty down the road. We won't be able to change that at this point, so let them do what they are going to do, and we'll find ways to make money from it down the road. For now, the best approach continues to be to respect the fact of the bear market and not to trust government to quickly fix it.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: SILC +18.6%, PHG +6.3% (light volume), COV +5.8%, HAL +4.1% (light volume), FCX +2.1%... M&A news: WYE +5.2% (Wyeth confirms it will be acquired by Pfizer in a cash-and-stock transaction currently valued at $50.19 per share; co also reported earnings)... Select financials trading higher following strength overseas: BCS +44.6% (Barclays to report early to calm investors - WSJ; Reuters reports co said it did not need to raise fresh funds and that it had seen a good start to 2009 with high customer activity), IRE +37.0%, ING +20.7% (ING Group to cut 7,000 jobs - NY Times; Reuters reports co said it would tap into government guarantees, and Barclays, which said it did not need fresh funding), LYG +17.3%, AIB +16.3%, RBS +13.1%, DB +5.2%, HBC +5.1%, CS +4.9%, IBN +4.7%, GNW +2.9%... Select metals/mining names showing strength with higher spot prices: GFI +5.8%, AU +5.1%, HMY +4.9%, AUY +3.6%, SLW +3.1%, GG +2.5%, KGC +1.6%... Other news: SAY +16.4% (Satyam Computer to look at funding options, L&T stake - Reuters.com), GERN +8.6% (continued momentum from Friday's 30%+jump), CRA +7.1% (Cramer makes positive comments on MadMoney), DRYS +6.1% (still checking for anything specific)... Analyst comments: GSK +3.0% (initiated with Buy at Jefferies), JPM +1.7% (resumed at Buy from Sell by Goldman Sachs- DJ), TOT +1.1% (upgraded to Buy at BofA/Merrill).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CBAK -13.7%, CAT -8.7%, ETN -5.9%, KMB -3.3%, MCD -2.6%, FCX -2.5%... M&A news: ROH -19.5% (Rohm and Haas been advised by Dow Chemical that Dow does not intend to close the pending acquisition ), CRXL -15.2% (Discussions on a combination of Crucell and Wyeth discontinued), PFE -4.6%(Pfizer will acquire Wyeth in a cash-and-stock transaction currently valued at $50.19 per share; co also reported earnings/guidance)... Select construction/machinery related names trading lower following disappointing CAT earnings/guidance: TEX -6.6%, DE -6.5%, CMI -4.3%, JOYG -3.1%... Other news: PBR -2.2% (to pump $28 bln into pre-salt fields - FT), VOD -1.5% (India declines VOD unit appeal - WSJ)... Analyst comments: ASGN -5.1% (downgraded to Hold at Stifel Nicolaus), USB -4.4% (cut to Sell from Neutral by Goldman-DJ), CNH -4.1% (downgraded to Underweight at JPMorgan), BBBY -2.9% (light volume, downgraded to Underweight at JPMorgan), STO -2.1% (downgraded to Neutral at Goldman - DJ), LECO -1.6% (downgraded to Sell at Piper). -

Dec Existing Home Sales 4.74 mln vs 4.40 mln consensus; prior revised to 4.45 mln from 4.49 mln

-

Dec Leading Indicators +0.3% vs -0.2% consensus

-

Kuigi üsna kindlalt võib väita, et suur osa müügist tuli forecloser'ite arvelt, näitab see ometi nõudlust. Varude langus 9.3 kuu peale on just see, mille ootamatult kiired muutused paljudele üllatusena tulevad. Eelmisel kuul ulatusid vaurd veel 11.2 kuuni. Pikaajaliste järelduste tegemiseks oleks siiski ka järgnevate kuude tulemusi vaja, kuid paranemise märgid on need ometi.

Lennar (LEN) heade numbrite ning Citi ug peale +25%, Hovanian +14%, Meritage Homes (MTH) +11% ning Standard Pacific (SPF) +10%.

-

surnud kassi paranemine?

-

Iga päevaga tuleb rohkem teateid töökohtade kärpimisest. Kui eelmisel nädalal hiilgasid tehnoloogiaettevõtted, siis täna jätkab seda rida Sprint Nextel (S), teatades 8000 töötaja koondamisest. Ühtlasi on ka Home Depot (HD) teatanud 7000 inimese koondamisest.

-

rams, võib-olla küll, aga võib-olla ka mitte. Juba varem viitasime detsembris tugevalt langenud hüpoteeklaenude intressimääradele, osaliselt on see rolli mänginud. Neljapäeval avaldatakse uute majade müüginumbrid ning kuigi sealt sellist hüpet ei maksa oodata, võiks konsensuse prognooside ületamine kinnitada suurenenud huvi.

-

Indeksid võtsid igal juhul makrouudised hästi vastu ja ei ole seni vee nõrkust näidanud.

Päeva ühed peategelased Pfizer (S&P puts Pfizer 'AAA' rating on watch negative) ja Wyeth vastavalt -9% ja +0.23%. -

Töökohtade jutu jätkuks:

According to CNBC, GM is planning 2000 job cuts in Michigan and Ohio; extra down time at 14 plants -

Peale turgu avaldab tulemused Texas Instruments (TXN). Arvestades, et televiisorite kõrval toodab ettevõtte kiipe ka mobiiltelefonidele, ei paista TXNi tulevik just eriti päikeseline - Nokia, Apple, Ericssoni ning RIMMi 2009. väljavaade on ootustele pigem alla jäänud. Kui Intel ja AMD on juba teatanud töökohtade koondamist, võiks äkki sama oodata ka TXN'ilt.

TXN on juba kvartaliprognoose kärpinud, seega ei tohiks analüütikute oodatud $0.12 suuruse EPSi osas olulisi üllatusi tulla. -

Enne sai kirjutatud Geithneri negatiivsest hoiakust Hiina valuutapoliitika suhtes. Täna on Valge Maja avaldust pehmendamas, viidates, et tegemist ei ole nende ametliku poliitikaga. Mis Hiinat ennast puudutab, siis sealsed ametnikud eitasid reedel, et riik valuutaga manipuleerib... Kui piisavalt kaua ühte sõnumit edastada, siis võib ka ise seda uskuma jääda.

-

Texas Instruments prelim $0.08 may not compare to the $0.12 First Call consensus; revs $2.49 bln vs $2.37 bln First Call consensus

Texas Instruments sees Q1 $($0.11)-0.03 vs $0.04 First Call consensus; sees revs $1.62-2.12 bln vs $2.10 bln First Call consensus

Tulemused sisaldavad $0.13 ulatuses restruktureerimsikulusid, muidu oleks EPS olnud $0.21. See on ikka way over juhtkonna poolt antud prognoosi. Kui arvestada, et Q1 prognoos sisaldab $0.03 restr. kulusid, siis seda kõrvale jättes EPSi vahemik -$0.08 - $0.06 nii halb ei tundugi. Ühtlasi kaotatakse ära 3400 töökohta - "tore" päev USA tööjõuturul. Aktsia esialgu +2%.