Börsipäev 29. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Uuendasin taaskord tulemuste tabeli ära (link siin). Eilne ralli aktsiaturgudel aitas pilti tabelis ilusamaks muuta. Tänasel eelturul taaskord väga palju ettevõtteid oma numbreid teatamas. Majandusraportite poole pealt avalikustatakse kestvuskaupade tellimuste, esmaste töötu abiraha taotlejate ning uute müüdud majade number.

-

Green Mountain Coffee Roastersi (GMCR) eile avaldatud tulemused olid väga head. Jõuluhooajal korraldatud reklaamikampaania on ennast ära tasunud, single-cup Keurigi kohvimasinaid müüdi 711000 (+121% yoy). Paljudel edasimüüjatel said ka varud otsa, põhjus peitub tarbija kõrges rahuolus ning odavas müügihinnas (mistõttu langes ka brutomarginaal), mis oli mõeldud K-Cupide (kohvipakk ühe tassi kohvi valmistamiseks) müügi suurendamiseks. K-Cup'e müüdi kvartali jooksul 357 miljonit (+55% yoy), oluliselt aitas sellele kaasa jaemüügikohtade suurendamine ning lainemine Kanadasse. Kokkuvõttes laieneb ettevõte jõudsalt ning hoolimata sellest, et kaubeldakse 31-kordsel juhtkonna poolt prognoositud 2009. aasta non-GAAP kasumil, oli lühikese idee kasumiga sulgemine õige.

GMCRi aktsia on kahe kuuga tõusnud ca 70% ning kuigi tulemustejärgselt võidakse lähiajal kasumit võtta, ei imestaks, kui peagi suunduks aktsia $45 lähedal tehtud tippude poole. -

Intervjuu J. Granthamiga, sissejuhatava S. Forbes'i osast võib kohe edasi järgmiste osade juurde klikkida.

-

Morgan Stanely on alustamas American Public Education'i (APEI) katmisega, hinnasihiks antakse $48 ehk 25% üle eilse sulgemishinna. Analüüsis tuuakse välja ettevõtte vähem tsükliline äri, kuna keskendutakse sõjaväelastele hariduse pakkumisega.

We are initiating coverage of APEI with an Overweight rating and a $48 price target. APEI is an early-stage niche operator, which provides exclusively online postsecondary education with a focus on serving the military, both on-duty and reserves, and public service professionals, including first-responders and educators.

APEI’s superior, defensive business model should drive the highest earnings growth rate in our for-profit education coverage and we view this as more than just a recession play. Our 5-year model calls for a roughly 30% CAGR in revenues, net course registrations, and EPS, the highest among its peers, led by strong secular trends in the company’s unique end markets.

-

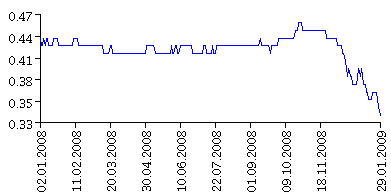

Rubla langus on hoogustumas - kahe päevaga üle 5% nõrgenenud.

Rubla ja krooni suhe alates 01.01.08st:

-

Huvitavat tuhnimist:

SP500 P/E tasemed http://www2.standardandpoors.com/spf/xls/index/SP500EPSEST.XLS

Pisike analüüs:

As reported earnings (sisaldab mahakirjutamisi jms erakorralisi kulusid/tulusid)

2006-1418-EPS81,51$-PE17,4

2007-1468-EPS66,18$-PE22,91

E2008-903,25-EPS46,86$ -PE17,66

E2009-874,09-EPS41,88$-PE20,87

Viimase 20 aasta keskmine PE on olnud 22,69 (ajalooline keskmine minuteada18-19) ja madalaim 88-ndal 11,69

novembris käisime tasemel 740 selle aja jooksev EPS 45,95 (1Q2007+3q2008) PE 16,1

Infoks veel, et madalaimad PE tasemed on jäänud 7-10 juurde (30-ndatel ja 70-ndatel aastatel) -

Mis sa siis teed, kui kasum langeb, aga aktsiahind ei lange?

-

Grantham on väga hinnatud pikaajaliste mõtetega investor. Ratsionaalne, tagasihoidlik, konservatiivne. Haldab ca $100 miljardit. Väga hea link kristjan! Soovitan ka teistel kuulata.

-

Initial Claims 588K vs 575K consensus, prior revised to 585K from 589K.

December Durable Orders, Ex-Tran -3.6% vs -2.7% consensus, prior revised to +0.6% from +1.2%.

December Durable Goods Orders -2.6% vs -2.0%, prior revised to -3.7% from -1.0%. -

Lisasin Pro alla kommentaari RHI tulemustele, arvestades eilset aktiivsust, peaks see paljudele huvitav lugemine olema.

-

Stifel Nicolaus downgrades GMCR to Sell from Hold. The firm notes that they are concerned that the deterioration of K-Cup attachment rates or K-Cups sold per brewer indicates Keurig brewer usage rates are declining and note GMCR's razor/razor blade business model is highly dependent on K-Cup sales to drive future earnings.

-

http://www.youtube.com/watch?v=42IUg2NXwoU

-

USA alustab päeva miinuspoolelt. S&P500 -1.3% @ 860; Nasdaq -1% ning nafta -3.6% @ $40.6.

Saksamaa DAX -1.59%

Prantsusmaa CAC 40 -1.69%

Inglismaa FTSE 100 -2.15%

Hispaania IBEX 35 -1.88%

Venemaa MICEX -1.00%

Poola WIG -0.78%

Aasia turud:

Jaapani Nikkei 225 +1.79%

Hong Kongi Hang Seng +4.58%

Hiina Shanghai A (kodumaine) N/A (börs suletud)

Hiina Shanghai B (välismaine) N/A (börs suletud)

Lõuna-Korea Kosdaq +0.64%

Tai Set 50 -3.53%

India Sensex 30 -0.23%

-

Stimulus Is a Short-Term Confidence Game

By Rev Shark

RealMoney.com Contributor

1/29/2009 8:28 AM EST

Politicians feel a need to validate their own political authority, and they feel they have to do something.

-- Robert Romano

Yesterday we saw progress on three major initiatives to help save our economy:

1.The House passed an economic stimulus plan;

2.the Treasury began to flesh out a "bad bank" bailout plan; and

3.the Fed made further comments about the purchase of long-dated treasury bonds.

The "bad bank" discussion had the biggest impact on the market and drove up the financial sector strongly. The rest of the market went along for the ride, and we had a very good day, but the big question now is whether this was just another short-lived bout of excitement and hope or the beginning of something more sustainable.

Unfortunately, the market action over the past year following governmental initiatives has not been very positive. The first attempt at turning the economy was the Bush tax rebate in February 2008. We handed out $168 billion, and it obviously didn't do much, if anything, to save the economy last year.

Since then, we have had the Fed cut rates to nearly zero, TARP I and TARP II, direct bailouts such as that of American International Group (AIG) and a slew of new moves by the Fed and the Treasury. So far, none of these programs has been able to turn the economic tide.

After reading a summary of the provisions of the economic stimulus bill passed by the House last night, I am very doubtful that it is going to have any great positive impact. In fact, in the long run, it will probably do more harm than good, but in the short term, it will probably provide some increased hope and confidence, and that is important.

Sooner or later, the economic cycle is going to turn back up because that is simply the way it works. After considering the events of the past year or so, it is hard to believe that the government is really capable of changing the reaction to the gross excesses in liquidity, leverage and lending that we indulged in for so many years. We have to pay the price for it, and there just isn't anything anyone, especially the government, can do about it.

That is my long-winded way of saying that I'm not very optimistic that all this government action is going to have any meaningful impact on the economy. The economy will turn when it is ready to do so, and all we are going to do by spending trillions of dollars is cause some blips along the way.

Given how the market has fared after other governmental moves over the past year, we have to be very skeptical about believing that this time we are going to see the big turn. The biggest problem is that the promise of these programs is always undermined by their actual execution. They always sound better in theory than they end up being in practice.

So where does the market go from here? The technical pattern is a bit overbought now, and we have not seen really strong momentum, although we are up four days in a row now. Volume has been lackluster, although breadth has been pretty good. The most promising scenario is that we stay in a trading range for a while and then attempt a more vigorous bear market rally after some basing action. We may see a little more follow-through from yesterday, but this is not a particularly promising setup for much upside.

We have some profit-taking kicking in this morning as yesterday's excitement wanes. The dip buyers are going to have a chance, and they will probably keep up volatility again, especially late in the day.

Will the big money start moving in to support this market? We haven't seen much evidence of that yet, and that is the key.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ISSC +43.9%, SEPR +15.2%, CRUS +11.1%, VRTU +9.4% (light volume), CAVM +8.3%, GFI +5.7%, HBI +4.3%, AN +4.1%, SYMC +3.6%, RCL +3.5%, MMM +2.9% (light volume), WDC +2.8%, MTW +2.3%, CNX +1.9%, OTEX +1.8%... Other news: POZN +13.5% (light volume, informed by FDA that endoscopic gastric ulcer incidence continues to be an acceptable primary endpoint), SQNM +1.8% (announces new positive data on Down Syndrome detection and unveils DNA approach to prenatal diagnostics).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ABFS -16.3%, RHI -11.8%, FLEX -11.0%, ALL -10.6% (also Allstate Corp and operating companies downgraded at S&P; Outlook Negative), FO -10.4%, BDK -9.7%, EK -9.5%, NSR -9.3% (also announces the amendment of its contracts with the North American Portability Management; also downgraded to Neutral at JPMorgan, tgt cut to $12 at Jefferies), ZMH -9.2% (also downgraded to Hold at Stifel), LSI -8.3%, LRCX -7.9% (also downgraded to Average at Caris & Company and downgraded to Underperform at Credit Suisse), TXT -7.8%, AFFX -7.6% (also downgraded to Underweight at JPMorgan), ITW -6.8%, CTXS -6.6% (also downgraded to Neutral at Credit Suisse, downgraded to Neutral at BofA/Merrill, and downgraded to Hold at Benchmark), AZN -5.4%, QCOM -5.4%, PSSI -5.3% (also downgraded to Market Perform from Outperform at Raymond James), OSK -5.3%, TROW -4.2% (light volume), GMCR -3.8% (also downgraded to Sell at Stifel Nicolaus), SRDX -3.4%, SBUX -3.2%, NTY -3.0%, FIC -1.2% (light volume, downgraded to Sell at Wedbush Morgan)... Select financials pulling back: AIB -20.5%, LYG -19.6% (Lloyds TSB to review offers for parts of life business - FT), IRE -16.9%, BCS -12.5%, UBS -10.5% (UBS legally bound to pay bulk of CHF2 bln bonuses - DJ), FITB -7.9%, GNW -7.8%, STI -5.6%, DB -5.2%, HIG -5.1%, CS -4.9%, WFC -4.7% (Wells Fargo says that commercial real estate loans show "signs of stress" -- DJ), CIT -4.6%, STT -4.4%, BAC -4.2% (outlines approach to track lending and investing activity), ING -3.8%, PRU -3.7%, HBC -3.4%, MS -3.0%, JPM -2.2%, GS -2.1%... Select drybulk shippers trading lower following DRYS offering and financial update: DRYS -25.9% (filed for a $500 mln at-the-market offering of common shares, discloses discussions concerning waiver and amendment of loan agreement covenants; also downgraded to Underperform at Oppenheimer), TBSI -9.3% , EXM -9.3% , OCNF -8.1% , DSX -7.0%, EGLE -6.3%, GNK -5.9%, NM -4.5%... Select metals.mining names showing weakness: MT -5.7%, RTP -5.1% (moves to raise cash - Times of London), AAUK -4.0%, FCX -3.8%, BBL -3.1%, NEM -2.4% (prices 30.0 mln common share offering at $37.00/share), BHP -2.0%... Select oil/gas names trading lower: SLB -2.4%, COP -2.3% (target lowered to $50 at Credit Suisse following earnings), TOT -1.7%, CVX -1.3% (announces $22.8 billion capital and exploratory budget for 2009)... Other news: SAY -11.0% (Seven suitors line up for Satyam - Economic Times), CENX -5.2% (priced a 24.5 mln share common stock offering at $4.50/share), ASML -4.9% (still checking), NVS -3.5% and GSK -2.2% (still checking for anything specific), DT -2.7% (T-Mobile USA, the U.S. operation of Deutsche Telekom announced fourth quarter and full year 2008 customer results)... Analyst comments: ACAS -6.6% (downgraded to Underperform at Keefe Bruyette), NWS -5.2% (downgraded to Sell at Pali Research), ETFC -4.7% (downgraded to Underperform at Raymond James ), NYX -3.6% (downgraded to Neutral at Piper), AMAT -2.2% (initiated with Sell at Auriga), XOM -2.0% (downgraded to Neutral at Goldman - DJ), APD -1.4% (downgraded to Neutral at JPMorgan). -

December New Home Sales declines 14.7% m/m to 331K vs 397K consensus, prior revised to 388K from 407K

-

Kas tõesti CHK võlakirjade müügimahu suurendamine on hea uudis ?

-

Uute majade müüginumber üleeile avaldatud olemasolevate majade trendi ei kinnitanud, varud tõusid kõigi aegade kõrgeimale tasemele (12.9 kuud).

-

arvon,

tõus pigem tänasest maagaasivarude raportist tulenevalt, mis näitas oodatust suuremat varude vähenemist. Aga võlakirju müüdi $500 mln asemel ca $1 miljardi eest ning 10%lise yieldi juures nõudlust oli. Likviidsuse lisamine bilanssi on täna esmatähtis. -

Mu meelest, kui varude vähenemine on positiivne, siis langevate väljamüügi hindadega turul võlakoorma suurendamine peaks olema justkui negatiivne, veel eriti CHK jaoks, kes niigi liigse võimendusega kimpus, aga eks turg teab vist paremini järelikult.

-

Refinery strike looms as contract expiration nears - Reuters.com

Reuters.com reports some 30,000 refinery workers that operate half of the U.S. fuel-making capacity could go on strike if they fail to renew a union contract that expires early Sunday, union officials said. Talks between the United Steelworkers union and the lead refiner negotiator, Shell Oil Co (RDS.A), continued on Thursday, Shell and USW representatives said, though both declined to disclose details of the talks. The union rejected a third contract offer from Shell, according to a memo from USW International Vice President Gary Beevers posted on a local union website. "It is the USW's position that the continued failure of the industry to deal with the issues presented by the (union's) proposals poses a real threat of strike action," Beevers wrote. -

Paistab, et täna müüakse homme avaldatav GDP ka turgu sisse:D

-

Obama ja Geithner hakkavad varsti capitol hillil esinema.

-

Pärast turu sulgemist teatab oma tulemused kõrgetel kordajatel kauplev Amazon. Ootustele pole alla jäädud juba viimased 9 kvartalit. Fookuses kommentaarid Kindle kohta. Väike eelvaade tulemustele Briefingust:

Amazon.com (AMZN) is set to report Q4 earnings after the closes followed by conference call at 5:00pm ET. Current consensus is for Q4 EPS of $0.39 on revs of $6.44 bln. Note the consensus for EPS covers a wide range of expectations (low of $0.30 to $0.53)... Last qtr, co issued Q4 guidance below consensus and lowered FY08 guidance. Co sees Q4 revs of $6.0-7.0 bln and operating income of $145-305 mln (between 46% decline and 13% growth YoY). Before this past fiscal year, the co's history had been for them to provide conservative annual guidance and then gradually raise it throughout the year (last qtr the co lowered FY08 operating income to $716-876 mln from Q2's FY08 of guidance $745-920 mln, Q1's $740-940 mln and initial guidance for FY08 of $785-985 mln). We expect FY09 to be both conservative (likely below current consensus estimates) and a very wide range for both revs and operating income. Co does not usu give EPS but rather issues guidance for operating income. The street is looking for Q1 operating income of ~$175 mln on revs of $4.6 bln and FY09 operating income of ~$830 mln on revs of $21.2 bln... Lowered prices on merchandise and discounted (or even free) shipping with purchases may have somewhat alleviated the slowdown in the top-line but at the cost of margins (and EPS). Margins should come under pressure that will likely continue throughout 2009. Street consensus for gross margin is 20.20%, down from 23.40% last qtr and down from 20.62% a year ago (operating margins is 3.6%, nearly flat from last qtr and down from 4.8% a year ago). Note that third party merchant sales have lower gross but higher operating margins (the effect could limit some erosion in gross margin, but with the mix of third party sales is expected to be nearly unchanged)... Look for any Kindle updates (although co has been reluctant to give figures in the past) such as number sold or potential for an updated version... Although AMZN is expected to outperform overall e-commerce sector, it is worth noting that ComScore reported online holiday spending declined 3% from the same period last year, which marks the first time it has seen negative growth for the holiday season since the company began tracking e-commerce in 2001... Briefing.com note: AMZN options implied volatility is 23% higher than its historical volatility (based on 30 day period) indicating greater expectation for stock movement in the near term. The implied one-day change is 5%, or ~$2.50 -

American Express (AXP) Director bought 50K shares at $17.76 on 01/28

-

AMZN Amazon.com prelim $0.52 vs $0.39 First Call consensus; revs $6.7 bln vs $6.44 bln First Call consensus

-

Amazon.com (AMZN) spikes 3.50 following headline beat

Hetkel kauplemas juba $54 tasemel. -

BRCM Broadcom misses by $0.19, beats on revs; guides Q1 revs below consensus

Reports Q4 (Dec) earnings of $0.08 per share, excluding a cumulative $0.40 in charges, $0.19 worse than the First Call consensus of $0.27; revenues rose 9.7% year/year to $1.13 bln vs the $1.07 bln consensus. Co issues downside guidance for Q1, sees Q1 revs of $800-875 mln vs. $953.14 mln consensus. "... As we look into the first quarter of 2009, we believe the current economic slowdown will continue to negatively impact our business as demand continues to decrease and settle into new levels and channel inventory adjusts accordingly..."