Börsipäev 2. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Alates tänasest Balti turud 2 tundi kauem avatud ehk siis kella 16:00-ni

-

Käesolev nädal toob kaasa mitme riigi intressimäärade muutmise. Teisipäeval oodatakse Austraalia keskpangalt määrade kärpimist 0.5% võrra 3.75%-ni, kolmapäeval Norralt 0.5% võrra 2.5%-ni (detsembris langetati 1.75% võrra). Neljapäeval kogunevad Inglise keskpank ning ECB, esimeselt oodatakse intressimääarde alandamist 1%-ni ning ECB peaks määrad 2% peale jätma (ajaline vahe eelmise kogunemisega liiga väike, oodatakse rohkem makroandmeid).

-

Nädalavahetuse WSJ kirjutab, et Euroopa Keskpank on koostamas valitsustele juhtnööre, mida järgides saaksid riigid ühistel alustel korjata pankade bilanssidest toksilised varad ning panna püsti nö halvad pangad. Ideeks oleks välistada olukord, kus finantssektori päästmisest kujuneks võidujooks ning ühed liikmesriigid oleksid teistest alati sammu jagu eespool. Initsiatiiv on tulnud just valitsuste poolt, kes vajaksid ühtset benchmarki, mille järgi toimuks laenude garanteerimisel varade hindamine.

-

Frank says Obama to force banks in TARP to lend more – Bloomberg

Barney Frank has said that the Bush administration “made a mistake” by not setting stricter rules for institutions getting funds from the $700bio package

Ja ikkagi juhtub see, millest ammu räägitud (ja mille eest ma olen ka peapesu saanuid), et lõpuks hakkab riik laenamisstandardeid ette kirjutama. -

nojah, kaugel see plaanimajanduski enam on.

-

Noh, kohalikud marksistidki juba ajaloo prügikastist välja roninud. Nõuavad ettevõtetele fikseeritud kasumimarginaale, astmelist tulumaksu jne...

-

Karum6mm, võib olla on laiemalt vaadates küsimus selles, et riik(idel) on kõrini olukorrast, kus pangad laenavad vastutustundetult raha välja riisudes koore ja jättes tekkivad sotsiaalsed probleemid riigi kanda - eelarve saab sotsiaalprobleemide tõttu lisakoormuse, kuid tulud jäävad muutumatuks.

Võib olla on veelgi üldisemalt küsimus selles, et kas siis nendele rumalukestele, kes ei suuda ise oma eluga hakkama saada ja langevad laenulõksu, tuleks täpsemalt ette kirjutada, mida nad teha ei tohi või tuleks neil lasta vabalt allavoolu minna. Ma ei tea, mis on õigem, ma ei tahaks ainult neid probleeme oma maksurahast kinni maksta, samuti ei tahaks olla mingil viisil häiritud nendest jamadest.

Siinkohal meenub üks hiljutine mõte (oli vist Neivelti poolt), et Eestis ei oleks tekkinud sellisel määral majandusbuumi (=kinnisvarabuumi), kui pangad oleks väljastanud ainult kohalikel hoiustel baseeruvaid laene.

Aga ma ei tea lahendusi. Ei ole ka marksistlike ideede toetaja. -

Sissetulekud/kulutused suuresti vastavalt ootustele.

December PCE Core y/y +1.7% vs +1.7% consensus

December Personal Spending -1.0% vs -0.9% consensus, prior revised to -0.8% from -0.6%

December PCE Core m/m 0.0% vs 0.0% consensus

December Personal Income -0.2% vs -0.4% consensus, prior revised to -0.4% from -0.2%

December PCE Deflator y/y +0.6% vs +1.0% consensus -

What to do in the face of economic ruin?

Fly to Cabo San Lucas, of course -- on the company jet.

Ex-Citigroup CEO Sandy Weill used one of his former company's multimillion dollar jets to whisk his family to Cabo San Lucas, Mexico, to ring in the New Year, according to the New York Post.

Järjekordne pankurite stiilinäide. Riigi abi kulub marjaks ära! -

USA turud alustavad päeva (taaskord) punastes toonides. S&P500 -1.6% @809 punkti, Nasdaq - 1.2% ning nafta -4% @ $40.0.

Saksamaa DAX -2.51%

Prantsusmaa CAC 40 -3.09%

Inglismaa FTSE 100 -2.40%

Hispaania IBEX 35 -3.70%

Venemaa MICEX -1.45%

Poola WIG -3.14%

Aasia turud:

Jaapani Nikkei 225 -1.50%

Hong Kongi Hang Seng -3.14%

Hiina Shanghai A (kodumaine) +1.05%

Hiina Shanghai B (välismaine) +1.40%

Lõuna-Korea Kosdaq +0.24%

Tai Set 50 -2.68%

India Sensex 30 -3.79%

-

Back to Square One

By Rev Shark

RealMoney.com Contributor

2/2/2009 8:17 AM EST

Vote for the man who promises least; he'll be the least disappointing.

-- Bernard M. Baruch

The market was disappointed last week as both the House's passed stimulus bill and the "bad bank" bailout program failed to provide hope for an easy economic solution. There was simply no confidence that these ideas as presently structured are really going to do much to help matters.

This week Congress and the Obama administration will go back to the drawing board and try to come up with some new ideas, but market players are starting to act as if they are losing confidence in the idea that government is going to rescue us. The response of the more cynical out there is, "What took you so long?" but many had been holding onto hope, and they are increasingly worried.

The key to the economy and the stock market is increased confidence, and last week did nothing to help. After one of the worst years on record, the first month of the new year was the worst January ever, but the real problem is that the high hopes that we would see some big, bold government action that would make a real change not only didn't happen -- we got the same spending and pork-barrel legislation that helped create the problems in the first place.

There is no question that we will hear some new solutions from government very soon, but after the way the first stimulus bill was handled, will market players be trusting? Will people really believe that there is some possible government action that is going to turn us around? I'm doubtful, but we still have a chance to rebuild some confidence, which would put a floor under the market. Sentiment needs to improve, and even if government can't help us all that much, maybe they can help to improve the mood and make people feel a bit more secure.

Technically the major indices are still holding above the November lows and are in a trading range. But the poor action on Thursday and Friday leave us very vulnerable to further downside action. Bulls who were trapped following the "bad bank" euphoria rally on Wednesday will serve as technical overhead for the S&P 500 should it move back toward the 850 area.

We have a poor start shaping up this morning, reflecting the attitude that government needs to go back to the drawing board with the bailout plans. It is gloomy out there, and there is little reason to rush in to buy.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: BEAV 7.5%, RYAAY +5.9% (light volume)... Other news: OMEX +27.8% (discloses that it discovered the shipwreck of HMS Victory lost in 1744), GGP +24.6% (announces that it had entered into Amended and Restated Forbearance and Waiver Agreements with its syndicates of lenders for the 2006 Senior Credit Agreement and the Secured Portfolio Facility), AIB +20.1% and IRE +8.0% (still checking for anything specific), HGSI +15.5% (begins delivery of 20k doses of its human monoclonal antibody drug ABthrax to the U.S. Strategic National Stockpile for use in the treatment of inhalation anthrax), SAY +11.1% (SEBI to amend open offer rules - Economic Times), GNW +9.9% (still checking), HIG +8.9% (mentioned positively in Barron's), CENX +5.6% (modestly rebounding from last week's 30%+decline), RTP +5.3% (Rio Tinto in asset-sale talks with Chinalco - WSJ), CRXL +2.3% (Sanofi to join Pfizer on acquisition trail; may take interest in CRXL - Financial Times)... Analyst comments: CVA +1.4% (upgraded to Overweight at JPMorgan).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ROK -20.5%, MAT -18.3%, CPO -9.6%, HUM -3.9%, HIT -3.8%... Select financial related names showing weakness: PUK -9.0% (Investors brace for losses on hybrids - WSJ), AXA -7.8%, ABB -7.3%, MI -7.2%, ING -6.7%, UBS -6.6%, DB -6.5%, HBC -6.3%, BCS -5.4% (Moody's downgrades Barclays Bank, senior to Aa3/stable, BFSR to C/negative), BAC -4.7% (group of angry Bank of America shareholders plans to demand that Chairman and Chief Executive Officer Ken Lewis get the boot - NY Post), UBB -4.5%, COF -4.4%, WFC -2.6%, JPM -2.3%, C -2.3%, GS -2.1%... Select oil/gas names trading lower with weakness in crude: PBR -3.4%, BP -3.1%, E -1.3%, RDS.A -1.2% (downgraded to Hold at Argus), COP -1.1%... Select metals/mining names showing weakness with lower spot prices: NG -4.3%, AUY -3.8%, BBL -3.1%, MT -2.8%, ABX -2.6%, SLV -2.6%, GLD -2.5%, GOLD -2.4%, RIO -2.2%, GFI -2.1%... Other news: SIG -14.6% (still checking for anything specific), DRYS -6.9% (DryShips faces fresh debt blow - FT), STEM -6.7% (puling back from last month's 60%+ jump), SNN -4.7% (still checking), QGEN -4.5% (still checking), DEO -4.4% (still checking)... Analyst comments: NYX -8.9% (downgraded to Sell at Goldman - DJ, downgraded to Market Perform at Raymond James), RMBS -7.0% (Legal outcome remains an overhang- BWS Financial), IP -6.8% (downgraded to Sell at Goldman - DJ), F -4.3% (downgraded to Underweight at Barclays), WU -3.8% (downgraded to Perform at Oppenheimer), LAB -3.8% (downgraded to Neutral at Goldman - DJ), SNDK -3.3% (initiated with a Sell at Auriga), MMM -1.5% (downgraded to Hold at Argus), PG -1.0% (downgraded to Average at Caris & Company). -

Eelturu tähtsamad tulemused on tabelisse kantud ning 4. kvartali viimase tulemustetabeli leiab siit.

-

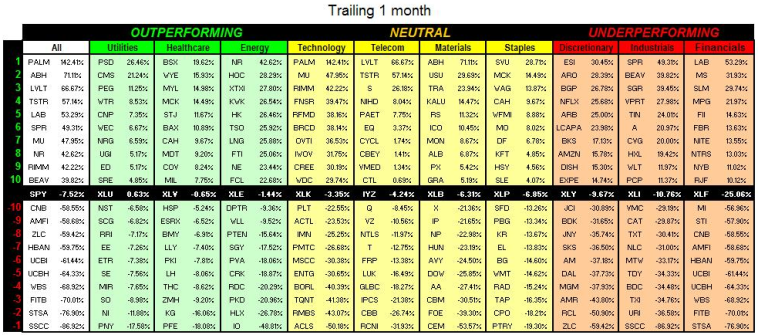

Briefing Swingtrader võtab möödunud kuu kokku niimoodi. Päris hea tabel:

-

Mida põrgut juhtus KCI-ga? Briefing ei seletanud asja lõpuni.

11:17 KCI Volume Alert: Kinetic Concepts drops ~2 pts on heavy volume (23.20 -0.90) -Update-

Weakness in the stock is being attributed to a court decision in a case involving KCI and Blue Sky Medical.

Vaatan, aktsi akukkunud kaks punkti ja nüüd põhjdest lennus viis punkti. Järelikult olid uudised head, või? -

stocker, kohtuotsus ise on siin. Aga ei ole juhtumiga kursis...

-

Tänud Joel.

-

paistab, et DJ teeb täna otsa lahti

edasi läheb libedamalt -

S&P500 kõige olulisem toetustase on vaieldamatult 800 punkti. Minu arvates on selle taseme juures kõigutud juba niivõrd palju, et sellest mitteläbikukkumine oleks minu jaoks oluliselt suurem üllatus, kui sellest allapoole liikumine.

-

keegi on chatis

-

uso hinnaks mul aknas 29.25 !!! ei ole ju oige ????

-

Kahtlane jah, mul on aknal lilled. Käisin kontrollimas, jääs. Ju su USO hind ka jääs on.

-

juba ilmus moistlikun number, oleks tahtnud muua selle hinnaga.Kahjuks polnud positsiooni, palun kas saaksite QLD-le uhe nulli loppu panna ?

-

to:urmasploom

:D -

pliis ?

-

To urmasploom

osta nt googlet ja sellele pannakse küll 1 nulli otsa -

või berkshiret :D

-

uso jalle 29.50 ja climbib !!!

-

täna, 3 veebruaril taksosõit tallinnas tasuta:

http://vaher.blogspot.com/2009/02/saksa-takso-soidutab-homme-tallinlas.html#links