Börsipäev 6. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Tervitus! Esiteks tänan omaltpoolt neid, kes eilsest seminarist osa võtsid.

Uuendasin äsja ära ka meie 4. kvartali tulemusi kajastava kolmanda tulemuste tabeli. Tabel asub siin. Tänasel eelturul on veel üksikuid ettevõtteid, kes tulemusi teatavad, kuid pearõhk eelkõige kell 15.30 avalikustataval jaanuarikuu tööjõuraportil, kust oodatakse ca 500 000 töökoha kadumist.

-

eriti vaikne algus :S

-

mõtlen balti börsidel käibe poolest

-

Olles eile turu viimasel minutil täis ropsinud, sh suure hulga Tallinki 0,32-ga magama pannud, on Evli täna Tallinki 0,33-ga ostmas. Beats me.

-

ega Evlil pole ainult 1 klient

-

Jajah, kellelgi ei ole vaid 1 klient. Lihtsalt pealtnäha jääb mulje, et eile kühveldati ühe kliendi konto tühjaks ja täna täidetakse teise ostuordereid. Võib-olla tõesti tuli sellel teisel alles täna idee Tallinkis posäng sisse võtta. Võib-olla...

-

Päris huvitav kokkuvõte briefingu poolt WSJ artiklile:

WSJ reports a growing number of states are running out of cash to pay unemployment benefits, a sign of how far social-welfare systems are being stretched by the swelling ranks of the jobless in the deteriorating U.S. economy. Unemployment filings have soared so high in recent months that seven states have already emptied their unemployment-insurance trust funds, which were supposed to see them through recessionary periods. Another 11 states are in jeopardy of depleting reserves by year's end, according to the National Conference of State Legislatures. So far, states have borrowed more than $2.3 billion in emergency funds from the federal government, money they are required to pay back. New York has already borrowed more than $330 million to pay unemployment claims, according to the U.S. Department of Labor. In the past, New Jersey borrowed from its trust fund to pay for other expenses, and now it has only a few months of payments in reserve. Even states with relatively flush trust funds such as Tennessee are warning that they could go broke in the next year if unemployment levels stay high. -

Jan Unemployment Rate 7.6% vs 7.5% consensus

January Nonfarm Payrolls -598K vs -540K consensus, prior revised to -577K from -524 -

Ladenburg Thalman on kiitmas BAC-i ja süstimas positiivsust ettevõtte rahavoogude osas. Aktsia eelturul pea 10% ülevalpool.

-

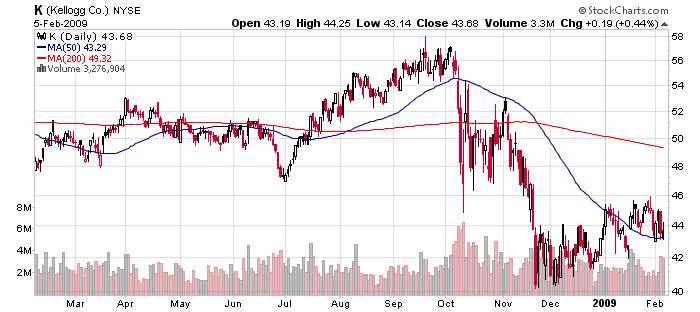

Citigroup on väljas huvitava analüüsiga eile enne turgu tulemused avaldanud Kellogg’i (K) kohta. Nimelt teeb analüütikut murelikuks ettevõtte turuosa langus USAs (-1% neljandas kvartalis), mis uue aasta alguses on AC Nielsen’i andmetele tuginedes veelgi kiirenenud. Ühtlasi viitavad andmed sellel, et Kellogg’i nõrkusest on enim kasu saanud General Mills (GIS).

Maintaining Hold Rating — Turning to valuation, at its current price of $43.68, Kellogg is trading at 14.1x 2009 earnings estimates. In comparison, General Mills, which has less exposure to negative FX and stronger US retail trends highlighted by its cereal market share gains at Kellogg's expense, is trading at 14.3x on a calendar 2009 basis. Thus, considering Kellogg's valuation and weakening sales trends, we do not see any compelling catalysts for the stock over the next 12 months and reiterate our 2L Hold rating.

-

kas BKC-st ka mõni sõna tulekul?

-

USA turud on hoolimata nõrgast jaanuarikuu tööjõuraportist päeva alustamas väikese optimisminoodiga. S&P500 +0.4% @844 ja Nasdaq +0.9%. Nafta on olulisest $40 tasemest läbi pudenenud ning kaupleb $38.6 peal, olles täna 6% punases.

Saksamaa DAX +1.81%

Prantsusmaa CAC 40 +1.55%

Inglismaa FTSE 100 +1.68%

Hispaania IBEX 35 +1.05%

Venemaa MICEX +2.85%

Poola WIG +1.87%

Aasia turud:

Jaapani Nikkei 225 +1.60%

Hong Kongi Hang Seng +3.61%

Hiina Shanghai A (kodumaine) +3.96%

Hiina Shanghai B (välismaine) +4.60%

Lõuna-Korea Kosdaq +1.42%

Tai Set 50 +3.19%

India Sensex 30 +2.31%

-

ktammin, tänase päeva jooksul kommentaar Pro alla ka kindlasti jõuab. Lühidalt võib öelda, et tulemused olid pisut pettumustvalmistavad, kuid usun sellest hoolimata, et BKC sarnaselt MCD'le käimasoleva majanduslanguse ajal väga palju pihta ei saa ning väärib antud konservatiivsest tulevikuprognoosist hoolimata portfelli kaasamist.

-

Waiting for Answers

By Rev Shark

RealMoney.com Contributor

2/6/2009 8:36 AM EST

He must be very ignorant, for he answers every question he is asked.

-- Voltaire

The market awaits the latest round of government answers to our economic woes. An economic stimulus bill should be passed shortly, and a bank bailout scheme is set to be announced Monday evening. In the meanwhile, we have the monthly jobs data, which are expected to reflect another increase in unemployment.

The question for investors is whether the market is going to embrace the governmental moves as effective solutions and finally generate a bit of a bear-market rally. So far, every prior program proposed has given us nothing more than a short-lived pop that eventually led to more downside. Unlike the latest bailout and bank programs which are highly anticipated the past moves by the Fed and the Treasury held some real surprises. That doesn't bode particularly well for a sustained rally on the news announcements.

Unemployment news is expected to be brutally ugly once again, but the market has been expecting all economic news to be poor and is inclined to buy weakness rather than panic. Buying bad news is a good sign, as it shows that expectations are low, but the market also needs some real positives as well to generate some lasting momentum. We continue to have an absolute dearth of anything that sounds very good. We have things like JPMorgan lowering the target of GE (GE) to $9 from $13 and talking about a credit downgrade and a big surprise in increased Canadian unemployment.

The problem we face is that there is that the market has already had plenty of time to consider what bailout and banking news is coming and doesn't seem to be overly confident about it. We'll see what happens after the jobs numbers are out. I'm looking for a few spikes of excitement as terms of the bank bill are leaked, but I suspect the market will remain skeptical and will have a tendency to sell off once the news is finally out by Tuesday morning. A lot depends on how we set up as we wait, but this sort of highly anticipated news event is not something that lends itself to a sustainable rally.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: BECN +17.6%, TSYS +14.5%, SNCR +12.4% (also upgraded to Accumulate from Source of Funds at ThinkEquity), DKS +12.3%, PBI +10.8%, SWKS +10.6% (also upgraded to Buy from Accumulate at ThinkEquity), AMX +2.2%, APKT +1.3% (also upgraded to Accumulate from Source of Funds at ThinkEquity)... Select financials showing continued strength: RBS +7.9%, BCS +7.2%, RF +7.1%, HBC +4.5%, BAC +4.3% (BofA is cash flow positive and not in danger of failure- Ladenburg Thalman), C +3.4%, MS +3.1%, BBT +2.7%, WFC +2.6%, BK +2.6%, JPM +1.6%, GS +1.5%... Select stem cell related names trading higher with Washington Times reporting that Obama 'guarantees' stem cell approval: ASTM +12.5%, STEM +9.8%, GERN +3.2%... Select drybulk shippers showing continued strength: EXM +5.7%, DRYS +4.8%, GNK +4.2%... Select metals/mining names trading higher: AU +3.9%, FCX +2.9%, MT +2.5% (denies intention to sell Brazilian assets - DJ), RTP +1.7%, RIO +1.7%... Other news: DAI +5.6% (still checking for anything specific), IDIX +4.8% (Idenix Pharmaceuticals and GlaxoSmithKline sign worldwide license agreement for IDX899, a novel NNRTI for the treatment of HIV), DLTR +3.3% (modestly rebounding from yesterday's 10%+drop)... Analyst comments: AKAM +3.1% (initiated with Buy at Wunderlich).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: SKX -22.2% (downgraded to Neutral from Positive at Susquehanna Financial and downgraded to Hold at Sterne Agee), HIG -19.9%, MFLX -13.2%, HWAY -11.9% (also downgraded to Sell from Neutral at Piper Jaffray), RATE -11.2%, ESLR -9.9% (also downgraded to Neutral at Piper), ULTI -9.8% (light volume), LMNX -9.0%, AINV -7.3% (light volume), SRCL -6.5%, BIIB -6.2%, VRSN -6.0%, JDSU -4.9% (also downgraded to Underperform from Sector Perform at RBC Capital Mkts), LQDT -1.9%... Select insurer-related names ticking lower in sympathy with HIG results: LNC -3.8%, ALL -2.8%, MET -2.2% (downgraded to Neutral at BofA/Merrill), GNW -1.7% ... Other news: ELN -8.2% (trading down in sympathy with BIIB), NMR -5.1% (to raise up to $3.3 bln in shares - Reuters), UBS -4.7% (still checking), QGEN -4.1% (still checking), AZN -2.1% (still checking), APOL -1.2% (Cramer makes negative comments on MadMoney)... Analyst comments: CUB -2.4% (downgraded to Hold at Needham), STO -2.0% (downgraded to Hold at Citigroup), ABMD -1.9% (downgraded to Neutral at UBS and downgraded to Equal Weight at Morgan Stanley). -

Credit Suisse sisendab enesekindlust Apple'i poolehoidjatele.

AAPL Apple: Credit Suisse came away from mgmt meetings increasingly comfortable (96.46 ). Credit Suisse notes they met with several senior executives at AAPL, and came away increasingly comfortable with Mr. Cook as a potential long-term replacement for Steve Jobs. They say AAPL believes guidance was appropriately conservative. They note that in recent weeks, investors have become increasingly concerned that the March quarter revenue guidance was too optimistic. Firm says CFO Peter Oppenheimer largely dismissed these concerns, noting that Apple is always conservative with its guidance and that they carefully consider all the data they have on demand and pricing trends before providing an outlook. -

miks bac-i ei saa lyhikeseks myya?

-

nu WN, paistab, et minu õlled

täna 800 ei tule, peab esmaspäevani kannatama ;)

Tenkeš ?

kui esmaspäeval on Stimulus pakett väljas, millised on daspidised võimalused asju kuidagi parendada/päästa ?

vahendid hakkavad otsa saama ning kui täna see veel kohale ei jõua, siis esmaspäeval saame sell the news -

tundub kyll et 800 jääb täna märjaks unistuseks :(

Ma siin suht kinni aga tuleme selle õlleteema juurde veel tagasi :)

mis värk selle bac-iga ikkagi on? -

näiteks see

Firm says BAC is cash flow positive and not in danger of failure -

sedand kyll aga miks shortida ei saa?

-

Peaks shorditav olema.

-

BAC shortijatele, vaadake mis toimus hiljuti HIG-ga, tuleb olla vāga ettevaatlik 100 % tōusu korral.

-

Apple (AAPL) on jõudnud täpselt $100 alla ning GS on oma mõne kuu tagustest põhjadest $50 peal tõusnud $95 juurde. Psühholoogiline vastupanu mõlema puhul + võimalik, et ilusasti mitme kuu tippudele tõusnud GSi ja MSi aktsiad panevad juhtkonda taaskord mõtlema kapitali kaasamise peale aktsiaturult...

-

Ja, kogu kauplemine meenutab loteriid , aga , siiski tundub , et BAC puhul vōib realiseeruda MS, GS ja HIG lāhitmineviku lend = 14 $ , uskumatu , aga mitte vōimatu.

-

STT kui oli ligikaudu 15 siis Madis arvas, et lähme uutele põhjadele. Praegu 30, mis mõtted on?

-

Njah, mida oligi arvata.. Karudele tehti tünga, vähemalt lühiajaliselt.

Mdeks, uus stimulus pakett tuleb hääletusele tn. alles teisipäeval. Esmaspäeval on kauaoodatud Geithneri pangadussektori päästeprogrammi tutvustuskõne. Järgnevad päevad börsil saavad olema omamoodi usaldushääletuseks uuele USA valitsusele ja nende programmile :D -

tänane Geithneri kauaoodatud (?) kõne on homsesse lükatud

Treasury Dept spokesman Isaac Baker said. Treasury Secretary Timothy Geithner will outline the bailout plan in a speech at 11 AM EST on Tuesday, the Treasury said. The announcement of the bank rescue plan -- which will seek to shore up some of the biggest commercial banks in the United States -- had been due on Monday. But the Senate is now expected to be focussed on that day on a massive economic stimulus ahead of a vote on Tuesday. For that reason, Geithner had postponed release of the bank plan, Baker said in a statement -

Kauaoodatud on ehk vale sõna nädala-kahe perioodi peale :D

Viimastel nädalatel on bank rescue plan turule väga suurt mõju avaldanud ning plaani väljakuulutamine tooks mõningast selginemist finantsektori saatusele. Vähemalt mõneks ajaks ...