Börsipäev 4. märts

Kommentaari jätmiseks loo konto või logi sisse

-

Eilne S&P500 indeksi sulgumine allpool 700 punkti oli esmakordne alates 1996. aasta oktoobrist. Järelturu ametlik teadaanne Google'ilt, et ka nemad pole majanduslanguse ees kaitstud (üldiselt see peaks tänaseks juba ammu kõigile teada olema eranditult kõigi ettevõtete kohta) ning Palmi teadaanne fiskaalaasta 3. kvartali prognoositavatest tugevalt alla turu ootuste tuludest viisid PALMi üle 10% miinusesse ning ehmatasid järelturul ka turu ära.

Palm prognoosib 3. kvartali tuludeks $85-$90 mln vs turu keskmine ootus $157.8 mln (!). Ettevõtet katvate analüütikute kõige pessimistlikum prognoos on olnud $102 mln, kuid reaalsuses saab olema keerulisem. Tulude languse peamiseks põhjuseks tuuakse väga kiiret nõudluse langust Palmi vana nutitelfonide portfelli vastu ning oodatust hilisema Treo väljatulemisega USA turul. Kuna ettevõte on kahjumlik, siis kerkib üha tõsisemalt üles likviidsusriski oht.

-

Hiina aktsiaturg ja Hiinas kõik, mis Hiina majanduses toimub, on oluline ka muule maailmale. Võimalik, et Hiina on välja tulemas täiendava majandust stimuleeriva abipaketiga eelmisele $586 miljardilisele (ehk ca 7.5% SKPst PPP põhjal) paketile lisaks.

-

Bloomberg UK jargi arvab enamus analuutikuid LSE-l et tegemist on "dead cat bounce "

-

analüütikud LSE-l? palun selle uudise originaalteksti

-

Bloomberg UK raporteeris uks reporter "most analyst believe it to be "dead cat bounce " "

Jutt kais siis tanasest kahe protsendilisest rallist.

Arvasin et voib huvitada investoreid, kes pohja otsivad ja nende voibolla liigset tormakust ettevaatlikusele kutsuda. -

"Enamus analüütikuid" on sellises koosluses ja kontekstis täiesti väärtusetu infoallikas.

-

Kas "enamus analuutikuid " on raske aru saada ?

Minul on jalle "sellises koosluses" raske aru saada !!

"Enamus analuutikuid" tolgiks mina nii:

50 %

"vaartusetu infoallikas" ?

Ja mina arvasin et investorid vaatavad iga laua ja iga kapi taha , kuulavad nii poolt kui vastu argumente, kooritavad nii pulli kui karu, janest ja rebast, kaaluvad ja vaagivad, et millal ja kuidas.Arvamus ei ole ju neutraalne, et mingi vaartus vast ikka on ? -

Sorry

"Enamus analuutikuid" tolgendus :

50 %X< "Enamus analuutikuid " < 100 % X

X=analuutikud -

"enamus analüütikuid" selle uudise kontekstis on tõenäoliselt enamus 4-5 head of trading või head of brokerage nimelisest ametimehest, kellele reporter hommikul helistas, analüütikud üldse ei avalda oma arvamust päeva liikumiste kohta ja tõsiseltvõetavamad küsitlused on kuised ning küsitletuid ikka 100 ringis

-

"Enamus analüütikuid" või "konsensus" vms on enamasti täielik sea ja käo aritmeetiline keskmine. Kui keegi viitsib tõesti 4-5 tähtsamalt treiderilt midagi küsida, siis pole sealt loomulikult hetkel miskit muud tulemas, kui nutt ja hala. Vendadest pooled on kinga saanud, ülejäänud pooltel on põlenud isiklikud investeeringud ja usk tulevikku. Tegelaste elus on hetkel ainsaks heaks asjaks ilmselt enne uinumist õlle peale võetav Xanax. See ei ole analüüs, see on snapshot sentimendist.

-

batsu, vale uudis

"enamus analüütikuid arvab, et põhi on tehtud" oleks siin palju paremat vastukaja leidnud -

Snapshot sentimendist on hasti oeldud.Seda ma just tahtsingi teada anda.Harrased LSE-l sentiment negatiivne !

-

Sain hiljuti margin calli pikk olles, voibolla selle parast hoiskangi negatiivse sentimendi peale ?

Psuhholoogid kas tegu selles et naudin sadistlikult teiste rahapolemist ?Voi akki olen hoopis hea sudamega samariitlane, soovides fellow investoriteid negatiivse sentimendiga hoiatada ?

Vihjeks vaadake mida tahendab "batsu" jaapani keeles.

P.S. see on kokkusattumus. -

罰ゲーム - mängija...???

-

"batsu game" tolgitakse "karistusmang"

http://www.google.ee/search?hl=et&q=batsu&btnG=Google+otsing&lr=&aq=f&oq=

"batsu" omaette tolgendub kui : "kattemaks "

Leidsin Youtube "batsu" sisestades uhe Jaapani TV show.

Krt ei leia uhte head 2 tunnist seeriat, on vist maha voetud, kull leidsin uhe verivarske seeria, pole veel nainud aga julgen selletagi soovitada :

http://www.youtube.com/watch?v=pnOclGmddjE

Tegemist 5 sobraga,kes panevad uksteist naljakatesse situatsioonidesse, kus naeratada ei tohi.Kui oma naeruhimu siiski valja naitad saad karistada ja valusalt.Enne USA turgu usa meestele (pikkadele) soovitatav. -

WSJ reports 20% of all U.S. residential properties that had a mortgage on them were underwater at the end of December, with mortgage debt greater than what the homes were worth

majade hinnad on sellest hetkest saadik veel alla tulnud, nüüd on very tricky ... kas underwater mortgages number kasvab oluliselt kiiremini kui majade hinna languse taga olevad sundmüügid seda vähendada suudavad? -

Fiscal easing'u kohta sai hommikul toodud Hiina näide. Monetary easingu kohta tooks nüüd India näite:

India's Central Bank says to cut repo rate by 50 basis points to 5% with immediate effect -

Reedel avalikustatakse tund aega enne turgu USA veebruarikuu tööjõuraport. Ootused on üpriski nutused (-650 000 veebruaris vs jaanuari -598 000). Tänane ADP Employment raport annab alust arvata, et negatiivne raport reedel ka reaalsuseks saab.

February ADP Employment Change -697K vs -630K consensus, prior -522K -

USA teeb täna võimsa avanemise. S&P500 eelturul +2.5% @ 707 punkti, Nasdaq100 +2.3% @ 1097 punkti ning nafta 6.5% @ $44.4 barrelist. Üldiselt on gap up päeva alguses toonud kiiresti kohale lühikeseks müüjad ning gap down jälle põhjaõngitsejad. Hiina aktsiaturu tänasele positiivsele reaktsioonile võimaliku lisa stimulus package'i kohta, tasuks aga tähele panna. Sel ajal kui S&P500 on ytd -22%, on Shanghai +20%...

Saksamaa DAX +2.93%

Prantsusmaa CAC 40 +2.23%

Inglismaa FTSE 100 +1.55%

Hispaania IBEX 35 +0.95%

Venemaa MICEX +3.99%

Poola WIG +2.42%

Aasia turud:

Jaapani Nikkei 225 +0.85%

Hong Kongi Hang Seng +2.47%

Hiina Shanghai A (kodumaine) +6.11%

Hiina Shanghai B (välismaine) +6.44%

Lõuna-Korea Kosdaq +3.49%

Tai Set 50 +1.29%

India Sensex 30 +0.29%

-

Stuck in a Skittish, Mistrustful Market

By Rev Shark

RealMoney.com Contributor

3/4/2009 8:07 AM EST

Winning breeds confidence and confidence breeds winning.

-- Hubert Green

Anyone who pays even mild attention to technical analysis understands that the major indices are "oversold." There are a lot of complex ways to determine that mathematically, but basically it means that we have gone down so far, so fast that we are very likely to see some sort of bounce. Markets just don't move in straight lines for very long. When selling is highly intense for a while, it eventual burns out and brave buyers step up and give us a bounce.

The great difficulty is that trying to time a bounce can be extremely difficult. There is always a crowd of folks calling for a reversal during a downtrend. Very few nail it precisely, and a whole slew of them will claim to be right even if they still have losses from their premature predictions.

So the big question is whether this market is finally ready to produce some upside. It has been trying to recover but is being plagued by one major problem: There is very little confidence out there. We need confidence to feed on confidence to actually get some momentum going.

Simply put, there is no trust. Every little upside move is viewed as an opportunity to flip for a quick profit. The more we have to quickly flip to make profits, the more we look to quickly flip for profits.

As I discussed yesterday, we are lacking catalysts. The market is extremely unhappy and skeptical about everything coming out of Washington lately. Neither Ben Bernanke nor Tim Geithner could excite buyers on Tuesday. They just are not capable of giving us the confidence and clarity that is needed to turn the tide right now.

The great danger in a market as stretched to the downside as this one is that you become overanxious to try to bottom-fish and end up with some fast losses in uncooperative stocks. If you tried to buy GE (GE) lately, for example, you know what I mean.

The market continues to be set up for some sort of upside, but we need that spark and some confidence to get things rolling. At the moment there isn't any trust, and the news flow continues to be quite poor -- even stalwarts such as Google (GOOG) are saying they aren't immune to a poor economy.

We have a positive open shaping up this morning, but as I noted yesterday, the market's inclination has been to fade the opening move. We then have to wait and see how things develop from there. We were down sharply overnight but have recovered on news of stimulus plans in Asia. It is still a very skittish environment, but the degree of the negativity suggests at least some minor relief may be due soon.

-----------------------------

Ülespoole avanevad:

Gapping up In reaction to strong earnings/guidance: LZR +22.6%, JOYG +15.0%, AFAM +13.0%, LIZ +12.6% (light volume), ALTH +10.2%, PAY +7.9%, GB +5.4%, BIG +4.5%, ASML +2.9% (light volume), MASI +2.1%... Select financial related names rebounding: BX 6.3%, USB 5.6% (reduces quarterly dividend to $0.05/share from $0.425/share), PRU 4.7%, BCS 4.5%, DB 4.4%, MTU 4.3%, ABB 4.2%, C 4.1%, UBS 3.8%, AEG 3.5% (upgraded to Neutral at UBS), WFC 3.1%, JPM 3.0%, BAC 3.0%, COF 2.6%, FITB 2.4%, MS 2.4%, GS 1.5%, MET 1.3%, HIG 1.1% (reportedly in talks to sell life insurance unit to Sun Life - RTT News)... Select drybulk shipping names showing strength: DRYS 7.5%, FRO 7.3%, EGLE +4.2%, DSX 2.6% (announces time charter contract for m/v Coronis; gross rate of $14K/day for minimum 11 to maximum 13 month period)... Select oil/gas names trading higher with strength in crude: PTR 4.4%, RDS.A 4.3%, TOT 3.9%, VLO 2.9%, BP 2.1% (BP to pay dividend despite oil's drop - WSJ), SLB 2.0%, XOM 1.1%... Select metals/mining names showing strength: MT 5.7% (upgraded to Hold at Citigroup), RTP 5.4%, RIO 5.1%, FCX 4.5%, BBL 4.3%, AUY 1.5% (announces record reserves and resources)... Select iron/steel names showing early strength: AKS 7.5%, X 5.3% (further consolidates operations for greater efficiency), NUE 2.4%... Select chemical/ag related names showing strength: MOS 3.1%, AGU +2.7%, POT 2.3%, MON +2.1%... Other news: RMBS 18.5% (U.S. court finds in Rambus' favour in Hynix case - Reuters.com), MGG 8.3% (MMP and MGG announced a definitive agreement to simplify capital structure by transforming the incentive distribution rights and ~2% economic interest of MMP's general partner into MMP common units), TS 6.0% (still checking for anything specific), FDO 2.7% (Cramer makes positive comments on MadMoney)... Analyst comments: MDR +9.9% (light volume; upgraded to Buy from Hold at Natixis Bleichroeder), BMRN +4.2% (upgraded to Buy at Citigroup), T +2.6% (added to Analyst Focus List at JPMorgan), FSLR +2.5% (resumed with Buy at BofA/Merrill).

Allapoole avanevad:

Gapping downIn reaction to disappointing earnings/guidance: PALM -7.7% , SCO -7.3%... Other news: MGM -27.9% (files to delay 10-K, still in the process of assessing its financial position and liquidity needs; also downgraded to Hold at Keybanc and target lowered to $0.60 at Citigroup), ABK -10.4% (Moody's reviews Ambac's ratings for possible downgrade), RDWR -5.6% (still checking), HMC -4.8% (Honda Motor seeking govt loan assistance - WSJ), NVS -1.6% (still checking), GOOG -0.8% (CEO says 'we are not immune' to economic situation - DJ). -

Nagu ennist kirjutasin, teatas Google eile, et ka nemad käimasoelvast majanduslangusest puutumata ei jää. Barclay on väljas ja kinnitab sellest hoolimata aktsia Top Pick staatust, kuna usub, et turg on sellega juba arvestanud ning et võrreldes väga paljude teiste ettevõtetega elab Google languse ikkagi paremini üle.

Google: Among best positioned to weather recession; remains "Top Pick" - Barclays (322.64 -1.84). Barclays says GOOG remains their "top pick" as they continue to think it is among the best-positioned cos to weather the current recession, the backdrop for secular growth remains intact, cost controls give increased confidence in bottom-line, and GOOG could grow FCF 14% in '09. GOOG shares traded off last night on CEO comments at investor conference, but firm would take advantage of near-term weakness in the stock. Firm doesn't view Schmidt's cautious macro comments as new news, nor do they think comments on low/no search switching costs represent material mkt share concerns. Firm's checks suggest SEMs heavily focused on e-commerce have indicated double-digit y/y spending declines, but SEMs with more diversified client bases suggest limited overall pricing pressure. Firm's top picks in rank order: GOOG, AMZN, NFLX, & NILE.

-

wow

unustage ära oma ralli

GE! -

Tasub jälgida GE'd jah...Ühtlane ja pidev müügisurve ning olgem ausad, ega keegi täpselt ei tea, kas ja kui palju common stock ikkagi väärt on. Kui kukutakse allapoole $5, hakkab asi hapuks muutuma.

-

GE alla 6$

tänasest on tulemas päev, mis kõigile kauaks meelde jääb -

oleneb kunas laiale yldsusele teatatakse mida keegi obviously juba teab. Esimese poole tunniga müüdud 3 kuu avarage volume sisse

-

Buffett ütles hiljuti, et 18 on igati õiglane hind GE eest? Keegi teab jälle midagi mida teised ei tea. Varsti siis mingi haisev uudis ka väljas.

-

Citadel Investment Group's flagship hedge funds are up in the first two months of the year - NY Post

NY Post reports after being left for dead last year, Ken Griffin's Citadel Investment Group is rising from the ashes. Griffin's flagship hedge funds Kensington and Wellington, which maintain about $10 bln in assets, are up nearly 8% for the first two months of the year, sources told The Post. According to one source, Griffin's funds gained about 5% in January and about 2.6% last month. The funds are believed to have done particularly well in market-making funds and equity-arbitrage investments, sources said. The results stand in stark contrast to last fall, when losses brought on by the financial crisis triggered frantic investor withdrawal requests, known as redemptions, and led many hedge funds, including Citadel, to suspend redemptions in order to preserve cash. Given its scale and ties to other bank powerhouses, the situation was particularly delicate for Citadel and was a cause for concern on Wall Street and on Capitol Hill, according to sources.

-

Toornafta varud vähenesid 750 000 barrelit vs oodatud tõus 1.0 mln, mootorkütuste varud kasvasid 168 000 barrelit vs oodatud langus -0.8 mln ning distillaadid kasvasid 1.66 mln vs oodatud langus 1.0 mln. Päris segane pilt ühesõnaga.

-

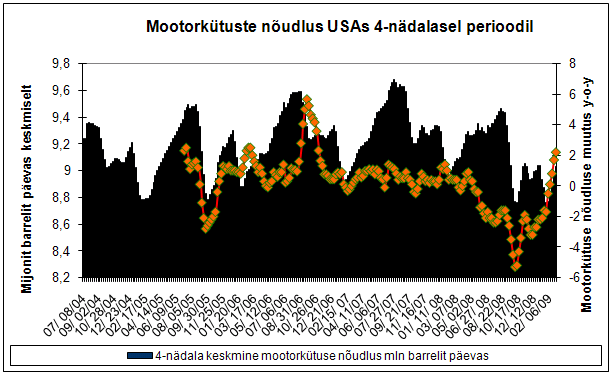

Aga paneksin siia veel ühe graafiku. Mootorkütused on tänase aastatagusest ca 40% odavama hinna juures nõudlust leidmas. Yoy muutus positiivne neljandat nädalat järjest (oranž joon):

-

Noh, kui turgudel veidi lahkem ilme, on foorumis vaikus. Kas ainult veri avab keelepaelad? :)

-

Kel igav, tulge palun siia :

http://www.playok.com/et/male/

seal on uks ulbe tegelane nimega "jumpandimout", andke talle tibake opetust.

Seda saab edukalt ka traderi ja bloombergi taustal teha, toas tuleb kull vist siin kokku leppida, leidub julgeid ? -

room: radosty

-

Ukraina grivna tugevnes täna eesti krooni vastu 9,3% ! Baltikal ja OEG-l seis paraneb.

03.03.2009 1,4574

04.03.2009 1,5929

-

marct

ei ütleks, et sel turul ilgelt hästi läheks, finants on ikka veel selge underperformer

finants koos GE'ga võib kõik alla tõmmata -

speedy conzales

Nojah, kuid selle asjaga on viimne kui üks turuosaline juba ammu ära harjunud. Lihtsalt sidrunipress, mis hetkeks üles tõsteti, laseb korraks hingata. Või ütleme nii, et tüüp, keda uputatakse, lasti korraks pinnale õhku võtma :D -

pärast 2 nädalat praktiliselt otse allatulekut on põrge loogiline,

aga kui seda suurel pildil vaadata, paistab teine üsna mannetu -

Sidrunipress surub kätte ja verd lendab ning see tüüp keda uputati on juba novembrist koomas.

-

praegu sp +13 punkti ja faz +7%, palju on faz kui turg veel nulli jõuab?

-

nii, reit läks ka punaste poolele üle

hetkel need kaks vist ainuksesed punased sektorid vaibal -

kolmas punane sektor on GE ;)

-

Fed's Beige Book says everything is fucked up

-

Fed's Beige Book says housing mostly "in the doldrums"

Fed's Beige Book says spending slow; autos 'exceptionally sluggish

Fed Beige Book says US economy eroded further through

Fed's Lockhart says prepared for bad February jobs report Friday

-

ja selle peale liigume ilusti ylespoole...

-

http://www.youtube.com/watch?v=4qLqs8oDVqA

-

....Uskumatu isegi finantsi pull FAS tuleb punasest välja. Tule taevas appi!

-

paistab siiski päris korralik tõusupäev tulevat

kuigi viimase tunniga on varemgi nalja saanud -

LHV lingilt Äripäeva enam ei näe! Kas see on ajutine või saabki nüüd ainult pealkirjasid lugeda!?

-

Mark-to-market hearing tentatively set for March 12, according to source - Reuters

House Financial Services subcommittee expected to hold hearing on mark-to-market accounting. -

Minul ÄP linkidega probleeme ei ole (kuigi ÄP-l endal on täna mitmeid probleeme olnud seoses mingi hiigelreklaamiga)

Pead silmas ikka seda ÄP sektsiooni seal Finantsportaali alumises otsas? -

Jah. Kustutada seda ei saa. Nagu Jonnipunn kaob ja tuleb tagasi!