Börsipäev 3. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Täna avaldatakse USA märtsi tööjõutururaport, millelt oodatakse 670000 töökoha kadumist ning töötusemäära tõusmist 8.1% pealt 8.5%-ni. Mäletatavasti üllatas veebruariraport negatiivselt, kui töötusemäär tõusis 7.6% pealt 8.1%-ni, kuigi turg oli oodanud 7.9%.

Positiivse poole pealt võib ära märkida ajaloolisi rekordmadalaid tasemeid vallutav hüpoteeklaenude intressimäär, mis aitab nii mõnelgi perel oma kodu alles jätta. Fed on selles suhtes oma tööd hästi teinud - lubadus täidetud.

Kuigi turud lõpetasid eile üle 2.5% plussis, ootaks lähiajal pigem müügisurve saabumist. Tõus on põhjadest olnud väga võimas ning paljud tähtsad sündmused (G20, mark-to-market, ECB) seljataha jäämas. Trendi jätkamiseks peaks vähemalt kasumit võtma.

-

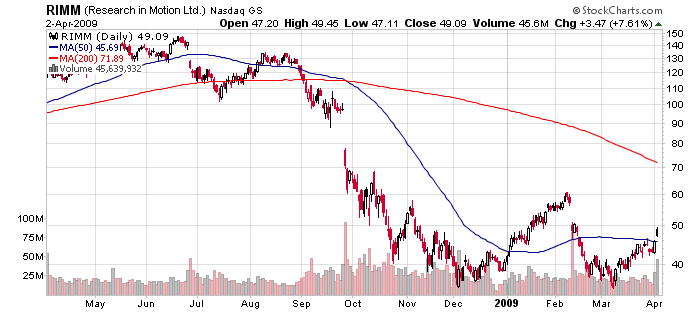

Blackberry'de valmistaja Research in Motion rallis järelturul 23% 60 dollarile, kui veebruaris lõppenud majandusaasta tulemused ületasid analüütikute ootusi, mida jõuti varasemalt kasumihoiatuse tõttu madalamale kärpida. Neljanda kvartali käive kasvas pea 25% 3.46 miljardini ( vs oodatud 3.41 mld USD) ja kasum samas ulatuses 90 sendini aktsia kohta (oodati 84 senti). Julgustavalt mõjusid RIM-i kommentaarid tuleviku osas, kummutades analüütikute hirmu uute toodete tagasihoidlikus vastuvõtus. Esimese kvartali kasumiks oodatakse 88-97 senti aktsia kohta versus konsensuse nägemus 82 senti ning käibeks 3.3-3.5 mld USD versus turu prognoositud 3.37 mld.

Kuigi neljanda kvartali gross margin kukkus 51.4%-lt 40% operaatoritele makstud subsiidiumite tõttu, võib marginaal juba esimese kvartali lõpuks põrgata 43-44% vahemikku. Seda eelkõige tänu väiksematele tootmiskuludele, kui osa tootmisest võiks analüütikute arvates minna Hon Hai Precision Industry kätte. Viimane aitab muuhulgas valmistada ka Apple'i iPhone'i.

-

Järelturu 23% tõus oli seda võimsam, et RIMM lõpetas päeva 7% plussis.

-

Hiinas tegutsev online-mängude tootja, mis tegi just IPO... Sounds dangerous?

Kui oht on teie keskmine nimi, siis tõenäoliselt olete leidnud omale uue aktsia, mida Baidu (BIDU), Sohu (SOHU) ja teiste toredate Hiina internetiaktsiate kõrval vaatluse alla võtta.

Eile tegi IPO Changyou.com (CYOU), kus Sohu (SOHU) omab enamusosalust. Aktsiad märgiti täis pakkumisvahemiku ülemise ääre ($16) juures, kuid lisaks tõusis CYOU päeva jooksul veel 25%. Kokku kaasas ettevõte $120 miljonit, kuid suurimaks aktsionäriks jäi siiski Sohu.

-

Credit Suisse on teine analüüsimaja viimase paari nädala jooksul, kes tõstmas oma nägemust Euroopa autotööstuse suhtes. Overweight reitingu saanud sektor meeldib madalate valuatsioonide ning liigselt negatiivseks muutunud ootuste pärast. Riskidest rääkides, ei saa muidugi üle ega ümber GM võimalikust pankrotist ja edasikanduvatest mõjudest pakkumisele ning nõudlusele. Lemmikuteks on välja valitud BMW (täna +3%), Volvo (+2.7%) ja Peugeot (+1.05%).

-

dshort.com vahendusel värske update neljast karust. Millise mustri järgi võiks tee edasi kulgeda?

-

kõik kokku äkki?

-

Kõige loogilisem jätk (mis ei tähenda, et maailma asjad vaid loogika järgi käituvad) oleks korrektsioon. Tulemas tulemuste hooaeg - sealt midagi head ei saa veel tulema, vbl. mõningate eranditega, aga massis peaks väga kehvad tulema.

-

Miks peaks see karuturg lõppema kiiremini, kui kõik varasemad? Et mull oli kõige väiksem:), pigem ikka vastupidi!

-

March Unemployment Rate 8.5% vs 8.5% consensus

March Nonfarm Payrolls -663K vs -660K consensus, prior -651K

March Average Hourly Earnings m/m +0.2% vs +0.2% consensus, prior +0.2%; Average Hourly Earnings y/y +3.6% vs +3.5% consensus, prior +3.6%

March Average Weekly Hours 33.2 vs 33.3 consensus, prior 33.3 -

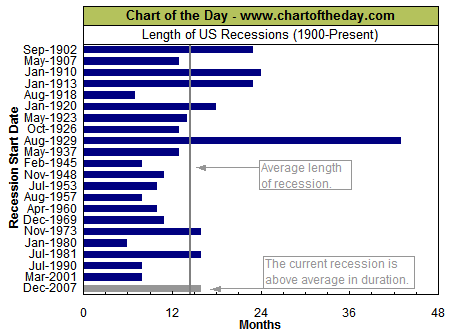

Täienduseks Erko graafikule toon veel ära USA majanduslanguste (recession) kestused alates 1900. aastast.

Nagu näha, siis 5 kõige pikemat langust toimusid kõik enne 1930. aastat. Käesoleva majanduslanguse kestus on juba ületanud keskmist ning on võrdne kõige pikemate langustega pärast 1930. aastat.

-

Can We Consolidate?

By Rev Shark

RealMoney.com Contributor

4/3/2009 7:51 AM EDT

Character, not circumstances, makes the man.

-- Booker T. Washington

After the move of the last two days, the big question for investors is whether the market has undergone a sustained change in character. Has the bear market ended, at least for a little while? Do we have signs of better action in front of us?

The bulls have a number of fundamental arguments to support them right now. Yesterday they celebrated some changes in the mark-to-market accounting rules and optimism that the G-20 economic conference may actually be a bit ahead of the curve in addressing some of our most pressing problems.

Probably the biggest potential fundamental positive is all the stimulus money and liquidity that is being plowed into the economy in the near term. Even those who are not very optimistic about longer-term prospects expect that this could give us a short-term boost in spending.

Technically, the indices have now moved back toward their February highs. The move yesterday came on particularly good breadth and volume, and we saw some leadership in technology stocks, which was a refreshing change. One thing we have been missing from this market for a very long time is good leadership. Banks have led the bounce off the March low, but that smacked more of a dead-cat bounce rather than the emergence of a new leading group. Hopefully we'll see some leaders like Research In Motion (RIMM) , which had a great report, develop further and take other stocks along with it. We had a little taste of that last night as Apple (AAPL) and Palm (PALM) were up in sympathy with RIMM.

The big problem we face on a technical basis is that after the quick bounce off the March lows and the fast and furious action of the last two days, we have a lot of extended charts that need to consolidate. They haven't been consolidating because suddenly there are a whole lot of folks who are worried about being left out, and they are chasing stocks higher.

It presents a real conundrum for prudent investors who have been burned repeatedly in this bear market whenever they have chased bounces. Rather than throw caution to the wind, the best approach is to stay selective and to practice good money management. Use stops, and if things start to act poorly, don't hesitate to do some cutting.

Once again the market is at a particularly interesting juncture as earnings season starts in earnest. While RIMM had a good report, I'm not so sure we can count on such positive results across the board. We should hear plenty of comments about how the economy is affecting business. That won't necessarily send us lower, but the recent rally is going to increase expectations, and that will make for a bit more danger.

This morning we have the monthly jobs report which is expected to show losses of about 670,000 jobs. The market is not expecting good news here, and we have been quick to shrug off bad news lately. I suspect traders will be looking to buy a dip on worse-than-expected results.

After the jobs numbers, the key to the market should be financials, which showed some relative weakness yesterday as traders sold down on the mark-to market accounting news. RIMM will also be important, not only individually but as an influence on the overall technology sector.

The bulls should have the edge to start the day, but there is overhead resistance to deal with, and progress should start to slow as profit-taking competes with dip-buying.

------------------------------------------------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: RIMM +24.9%, KIM +6.9%... M&A news: JAVA +4.0% (WSJ reports IBM and JAVA are in the final stages of negotiations of a deal in which IBM would pay $9.55 a share for JAVA)... European banks showing notable strength: AIB +47%, IRE +41%, RBS +16%, ING +12%, LYG +8.9%, BCS +8.3%... Other news: BBI +31% (announces amendment of revolving credit and term loan facility), LVS +9.8% (CEO bought another 4.7 mln shares at $3.01), PALM +8.4% (following strong RIMM earnings/guidance), MGM +8.2% (showing continued strength following yesterday's 19% gain), S +9.8% (stock gained yesterday following a Silicon Alley Insider story suggesting the possibility of a CMCSA takeover; Collins Stewart this morning said CMCSA reiterated that it has no interest in buying Sprint), AAUK +6.0%, GILD +4.0% (Phase III study of Gilead's darusentan for resistant hypertension meets primary endpoints).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: BABY -10.7%, BTH -6.1%... Select gold stocks trading lower on modest decline in spot prices: AU -7.0%, GFI -6.3%, DROOY -6.0%, HMY -4.5%... ... Other news: NVO -8.7% (the FDA came to a split vote on whether data on a type of thyroid tumors seen in rodent studies permitted marketing of Liraglutide), FITB -5% (still checking for anything specific)... Analyst comments: AKAM -4.9% (Citigroup downgraded to Hold from Buy). -

RIMMi juhtkond launches eile uue spetsiaalse toote RIMMi shortidele:

http://www.sh-womenstore.com/catalog/Anal+Pleasure/Other+Interesting+Butt+Plugs/Assberry_Blackberry.html?osCsid=jf81idp2c9pc2vkeckssdq17d3

"From the people who brought us the Rock Chick and Rude Boy; here comes the latest addition to the Rocks-Off family! Please meet Ass-Berry! Fruity fun for your bum!

This juice little Blackberry is perfect for both beginners and more advanced bum-players alike. It’s discreet, 100% waterproof and cute too!" -

Saksamaa DAX +1.6%

Prantsusmaa CAC 40 +0.8%

Inglismaa FTSE 100 -0.2%

Hispaania IBEX 35 +0.8%

Venemaa MICEX -0.2%

Poola WIG +3.1%

Aasia turud:

Jaapani Nikkei 225 +0.3%

Hong Kongi Hang Seng +0.2%

Hiina Shanghai A (kodumaine) -0.2%

Hiina Shanghai B (välismaine) -0.4%

Lõuna-Korea Kosdaq -0.2%

Tai Set 50 +0.9%

India Sensex 30 N/A

-

March ISM Services 40.8 vs 42.0 consensus, prior 41.6

-

DNDN sõbrad lahingusse!