Börsipäev 13. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Riskikartlikkus on viimasel ajal kõvasti kahanenud, see on ka üheks põhjuseks dollari langusele. Hetkel on euro kurss $1.37, dollar kaupleb seitsme nädala põhjade juures. Investorite riskijulgusest annavad aimu ka võlakirjade hinnalangus, aktsiaturgude tõus, samuti ei ole ettevõtetel hetkel raske kapitali leida. Nafta püsib $60 juures, rubla on põhjadest korralikult põrganud ning arenevate riikide aktsiaindeksid teevad uusi tippe - välisraha sissevool on möödunud nädalatel suurenenud.

-

Meie aja järgi kell 15.30 avaldatakse USA aprilli jaemüüginumbrid ning ehkki märtsi numbrid olid koledad, ootab turg tõenäoliselt positiivset üllatust (konsensus 0.0%). Vastasel juhul saadakse parajalt külma duši osaliseks. Kuigi kõik märgid viitavad paranemisele, siis ilma tarbijata ei lähe see majandus kuhugi.

-

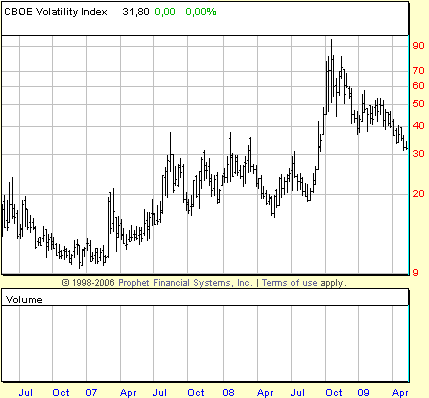

Lisaks riskikartlikkuse vähenemisele on samamoodi kukkunud ka volatiilsus. Liigne complacency tuleviku osas on teadupärast aga uinutav.

-

Hoolimata sellest, et nii Ühendriikides kui ka Euroopas oodatakse kriisi leevenemist juba selle aasta teises pooles, ei luba Suurbritannia majandus Inglise keskpangal samaga vastata. Täna avaldatud inflatsiooniraportis leiti, et taastumine kujuneb arvatust vaevalisemaks, kuna majanduslik aktiivsus jäi esimeses kvartalis oodatust kahvatumaks ning laenuturg vajab normaliseerumiseks tõenäoliselt rohkem aega. Märtsis 2.9%-le langenud inflatsioon vajub keskpanga sõnul veelgi madalamale ega ületa 2%-list läve järgmised kolm aastat. Globaalses kontekstis hoiatati, et maailmamajandus on jätkuvalt haavatav ning shokkide jätkumine pole välistatav.

-

Food looks defensive again; becoming more constructive on Packaged Foods group - Credit Suisse. Credit Suisse says they are returning their 2009 EPS ests for several packaged foods co's closer to consensus and posting an above-consensus est for Kellogg (K); firm also raises their tgt on General Mills (GIS 53.65) to $62 from $57. Firm is taking a more constructive view on the Packaged Foods group for the following reasons: Q1 consumption was not as bad as expected, inventory de-loading has tapered off, cost-cutting has provided a cushion to earnings, comparisons get easier in 2H09, investor sentiment is still very negative, and conservative stocks are looking cheap now.

Credit Suisse ütleb, et pakitud toiduainete sektorist, võib leida huvitavaid investeerimisvõimalusi. Olen nõus. -

April Retail Sales -0.4% vs 0.0% consensus, prior revised to -1.3% from -1.2%

April Retail Sales ex-auto -0.5% vs +0.2% consensus, prior revised to -1.2% from -1.0% -

Aktsiaturud liiguvad numbrite peale eilsetest päeva põhjadest madalamale...

-

Usutavasti annavad need andmed nüüd turule lähiajaks ka suuna.

-

Madisel vist lühikesed positsioonid räägivad :)

-

Pean tunnistama, et lühikesed positsioonid on küll ülekaalus, kuid need on võetud turunägemuse järgi, mitte turunägemus positsioonide järgi. Ja sellele, et ilma tarbijata ei lähe see majandus kuhugi, sai juba hommikul viidatud.

-

Eelturul on S&P500 -1.7% @ 891 punkti, Nasdaq100 -1.6% ning nafta pool protsenti punases.

Saksamaa DAX -2.27%

Prantsusmaa CAC 40 -1.83%

Inglismaa FTSE 100 -1.77%

Hispaania IBEX 35 -2.19%

Venemaa MICEX -5.06%

Poola WIG -1.76%

Aasia turud:

Jaapani Nikkei 225 +0.45%

Hong Kongi Hang Seng -0.55%

Hiina Shanghai A (kodumaine) +1.74%

Hiina Shanghai B (välismaine) +1.01%

Lõuna-Korea Kosdaq +1.86%

Tai Set 50 +1.62%

India Sensex 30 -1.14%

-

Start Looking for Some Broad Downside

By Rev Shark

RealMoney.com Contributor

5/13/2009 8:35 AM EDT

Wisely, and slow. They stumble that run fast.

-- Friar Laurence in Shakespeare's Romeo and Juliet

The market fought back late in the day on Tuesday and kept the Dow Jones Industrial Average in positive territory and the S&P 500 near the flat line. Technology stocks lagged, pushing the Nasdaq into the red, but losses were trimmed substantially by the close.

Late-day strength has kept the bears at bay and the uptrend intact. Nevertheless, we're seeing some strong indications that momentum is slowing. Over the past couple of weeks we've had some very strong moves in "secondary" stocks. Some of the lesser-known names have been very aggressively traded and saw jumps multiple days in a row.

This sort of momentum trading is an indication of restored confidence. We saw very little of this type of action last year and the early part of this year; we'd have some intraday action that would lead to some quick flipping, but there was very little sustained buying and/or chasing of stocks.

The positive market action has been fed by a short squeeze, good earnings reports due to low expectations and anxiety about underperforming. All of those factors helped create an environment promoting aggressive momentum trading, and that is what we saw. However, some signs are now emerging that the momentum may be cooling off. We have had the strong finishes that have kept the bears away, but the pockets of strong action are shrinking and the Nasdaq -- which is more speculative -- has been underperforming.

So does a slowing in momentum simply mean that the market will consolidate and eventually set us up for more upside, or will we roll over and start testing some support levels? The problem with momentum is that it works both ways. Things that go up on momentum will go down on momentum. Momentum traders have no loyalty to a stock. They will sell first and ask questions later when things stop going up. When momentum dies, the pullback can be quite severe, and "value" buyers usually aren't waiting nearby to jump in, because the stocks are far from being bargains.

Fighting the market uptrend has been a losing game lately. Every time it looks like we are starting to slip, we pop back up and squeeze the shorts. There has been no downside traction and bears have had little resolve.

With earnings season ended, shorts already squeezed and some slowing in the speculative frenzy in smaller stocks, I think it's time to look for a little more market downside. That doesn't mean you should sell everything and go short. There are still good-acting longs, and the bulls are still producing spikes up like we saw in the last hour yesterday, but taking some gains and maybe starting a few index shorts may be something to consider.

We have a little softness to start the day despite some positive news about orders from Intel (INTC) .

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ULTR +11.3%, DPS +10.5%, AUTH +7.5%... Select drug related names showing strength: SNY +3.5%, SHPGY +3.3%, AZN +2.0%, GSK +1.7%... Select semi related names trading modestly higher following INTC comments from investor conference: AMD +3.2%, INTC +1.9% (hold investor meeting; says Q2 is going 'better than expected')... Other news: ZGEN +9.0% (reports encouraging preliminary results from Phase 2 Study of IL-21 in metastatic melanoma conducted by NCIC), FTR +6.5% (to acquire ~4.8 mln access lines from Verizon; all stock transaction is valued at approximately $8.6 bln), ETFC +5.7% (reports monthly activity for April '09; DARTs increased 7.2% m/m), SAP +3.5% (SAP AG co-CEO, on CNBC, says can't comment on the MSFT-for-SAP rumor, but does say that a majority of their customers would rather see a 'strong, independent' SAP continue for many years), CPBY +2.9% (announces $6.6 mln in contract wins)... Analyst comments: JEC +2.4% (upgraded to Buy at Goldman - Reuters), UN +2.2% (upgraded to Buy from Neutral at Nomura), HD +1.9% (upgraded to Buy at Citigroup), STT +1.8% (added to Top Picks Live list at Citigroup).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: SOLR -17.6% (also downgraded to Neutral from Buy at Piper Jaffray), STV -14.0%, LIZ -11.8%, ING -10.1%, NCMI -6.4%, AZ -6.4%, BMC -5.6%, ESIO -5.2% (light volume), M -5.0%, AMAT -2.4%, MA -2.4%... Select financial names showing weakness: AIB -15.3%, RBS -13.1%, PUK -8.8%, BBT -6.7% (prices offering of 75.0 mln common shares at $20.00/share), HBC -6.3%, BCS -6.3%, LYG -5.4%, STD -5.2%, ABB -4.6%, WFC -4.4%, UBS -4.4%, C -3.8% (files amended S-4 related to $20.5 bln exchange offer; sees annualized earnings implications of $0.19-0.26), MBI -3.7% (announces tender offer for perpetual preferred shares), DB -3.0%, USB -2.9%, RF -2.8%, FITB -2.3%, BK -2.1%, MS -1.6%, JPM -1.4%... Select credit card related names trading lower following MA presentation slides: AXP -3.4%, V -3.3%, COF -3.1%, DFS -3.0%... Select metals/mining related names trading lower: RTP -4.7% (Rio shares drop as talk of a rights issue grows - Reuters), AAUK -4.6%, GOLD -4.2%, BBL -3.3%, MT -2.7%, BHP -2.5% (downgraded to Hold at ING)... Other news: MDCO -45.7% (discontinues Phase 3 CHAMPION clinical trial program of Cangrelor), MGM -12.5% (announced an 81 mln share common stock offering; also announced a $1.5 bln private placement offering of sr secure notes), PL -12.4% (announces 12.5 mln share common offering), KRG -12.0% (announces 25 mln share common offering), NAT -9.9% (prices 4.0 mln common share offering at $32.00/share), HTE -7.0% (announces C$116.8 mln trust unit financing), LVS -6.4% (down in sympathy with MGM), BMR -5.1% (announces public offering of 14,000,000 shares of common stock), CLF -3.1% (announces 12 mln share common offering and cuts dividend to $0.04 from $0.0875 to Result in over $20 mln in annual savings), BP -2.4% (trading ex dividend), LINE -2.2% (prices its public offering of 5.5 mln units of its limited liability company interests at a price of $16.25 per unit)... Analyst comments: IHG -5.1% (downgraded to Sell from Neutral at UBS), FLEX -4.3% (downgraded to Sell at Collins Stewart), REP -3.6% (downgraded to Neutral from Underweight at HSBC), FCL -3.5% (downgraded to Hold at Jefferies), INFY -3.0% (downgraded to Neutral from Overweight at HSBC), MRO -2.6% (downgraded to Market Perform at Bernstein), ED -1.5% (added to Americas Conviction Sell list at Goldman- Reuters). -

March Business Inventories -1.0% vs -1.1% consensus, prior revised to -1.4% from -1.3%

-

Küll on ilus punane kõik

-

USD Advance Retail Sales (APR) -0.4% vs 0% consensus, prior -1.3%

Sealt ka põhjus, miks USA punane on.