Börsipäev 15. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Saksamaa majandus langes esimeses kvartalis võrreldes 2008. aasta neljanda kvartaliga 3.8%, analüütikud olid prognoosinud 3.2% suurust langust. Võrreldes eelmise aasta sama ajaga ulatus langus 6.9%-ni. Tasub meenutada, et USA esimese kvartali majanduslangus oli 6.1%. Kui ka teises kvartalis vahe Saksamaa kahjuks tiksub, peaks see andma üsna ammendava vastuse ECB tegevuse(tuse) kohta.

-

Makroraportite osas on täna päev üsna rikkalik. Kell 12.00 saabuvad euroala 1Q SKT ja aprilli THI numbrid ning USA-s kell 15.30 aprilli THI ja kell ca 16.55 Michigani tarbijasentimenti indeks

-

Täna teatab enne USA turu avanemist oma kvartalitulemused jaemüüja JC Penney (JCP). Aktsiapõhist kasumit oodatakse $0.10 ning müügitulu $3.877 mld.

-

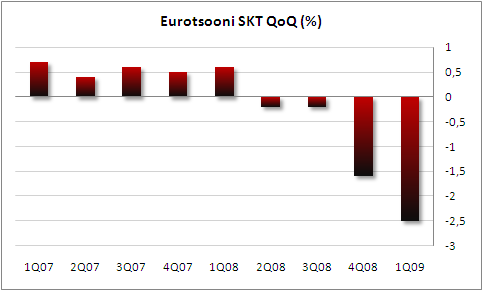

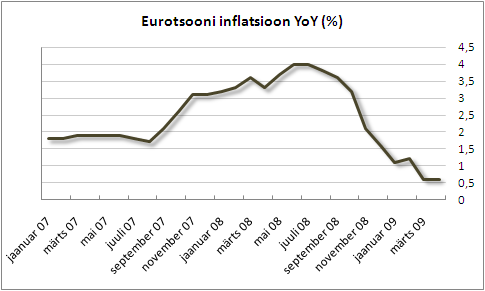

Hommikul avaldatud Saksamaa ja Itaalia oodatust kehevemad SKT näitajad andsid mõista, et sügavaim sõjärgne kriis võib Eurotsoonis olla suuremate tagajärgedega kui esialgu arvati ning lõunal avaldatud numbrid kinnitasid seda hirmu. 16 riigi sisemajanduse kogutoodang kahanes esimeses kvartalis 2008.a neljanda kvartaliga võrreldes -2.5%, ületades analüütikute -2%-list prognoosi. Eelmise aastaga võrreldes kukkus kogutoodang -4.6%. Aprillikuu inflatsioon oli 0.6% vs 0.6% märtsis ning 3.3% aasta tagasi.

-

Euroopa turgusid jättis uudis külmaks ning Stoxx 600 jätkab 0.66% kõrgemal eilsest tasemest

-

JC Penney beats by $0.01, reports revs in-line; guides Q2 EPS below consensus - Reports Q1 (Apr) earnings of $0.11 per share, $0.01 better than the First Call consensus of $0.10; revenues fell 5.9% year/year to $3.88 bln vs the $3.88 bln consensus. Co issues downside guidance for Q2, sees EPS of ($0.25)-($0.15) vs. ($0.09) consensus; sees total sale down 7-10%, comparable store sales down 9-12%. Co says it is raising guidance for FY10, sees EPS of $0.50-0.65 vs. $0.76 consensus; expects full year comparable store sales to decrease approximately 9%. Co said, "Looking to the balance of the year, we expect consumer spending and mall traffic to remain weak, which will be particularly evident against tough comparisons in the second quarter. As these conditions persist, we will continue to deliver newness and excitement in our merchandise assortments while maintaining a vigilant focus on the areas of the business we control."

-

April CPI Y/Y -0.7% vs -0.6% consensus, prior -0.4%

April CPI M/M 0.0% vs 0.0% consensus

N.Y. Empire Manufacturing -4.55 vs -12.00 consensus, prior -14.65

April Core CPI Y/Y +1.9% vs +1.8% consensus, prior +1.8%

April Core CPI M/M +0.3% vs +0.1% consensus -

Goldman Sachs on täna hommikul tõrksalt tõstmas oma hinnasihte mängurlussektorile, kuid ütleb, et sihtide tõstmisest hoolimata on sealsed aktsiad ülehinnatud:

Goldman sachs raises Wynn resorts (WYNN) price target to $39 from $26; Las Vegas Sands (LVS) to $8.25 from $4.50; and MGM Mirage (MGM) to $6.50 from $1; Boyd Gaming (BYD) to $8 from $5. Goldman says gaming stocks are overvalued at current levels and discounting a too sharp recovery. -

USA aktsiaturud on tänasel optsioonireedel avanemas ca poole protsendise miinusega.

Saksamaa DAX -0.57%Prantsusmaa CAC 40 -0.10%

Inglismaa FTSE 100 -0.60%

Hispaania IBEX 35 -0.26%

Venemaa MICEX -0.96%

Poola WIG +0.20%

Aasia turud:

Jaapani Nikkei 225 +1.88%

Hong Kongi Hang Seng +1.51%

Hiina Shanghai A (kodumaine) +0.20%

Hiina Shanghai B (välismaine) +0.85%

Lõuna-Korea Kosdaq +1.26%

Tai Set 50 +1.81%

India Sensex 30 +2.53%

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ADY +25.7%, WX +9.1% (also upgraded to Outperform from Neutral at Credit Suisse), EXAR +8.0% (light volume), MIDD +6.9%, FUQI +6.3%, JWN +1.8% (also upgraded to Buy at Piper)... Select insurers showing strength following reports that the Treasury Dept. will make federal bailout funds available to a number of U.S. life insurers: HIG +13.2% (has preliminary approval to tap $3.4 bln in federal funds), LNC +9.6% (receives preliminary approval for $2.5 bln from Treasury's Capital Purchase Program), GNW +8.2%, PRU +7.1%, PFG +5.0%, PL +4.0% (prices a 13.5 mln share common stock offering at $9/share)... Select European financial related names trading higher: BCS +4.5% (shares surge on hopes for $10 bln BGI sale - Financial Times),DB +2.7%, ING +1.7%... Other news: EXEL +38.0% (drug shows promise in brain cancer, according to study - Reuters.com), BCRX +19.4% (announced long-term data from a Phase 2 study of forodesine), YGE +9.9% (enters into supplier framework agreement with AES Solar), HGR +8.0% (will replace GVHR in the S&P SmallCap 600), ENZN +6.7% (confirms Cimzia approved in the U.S. for adult patients suffering from moderate to severe rheumatoid arthritis), LVS +6.0% (plans HK IPO of Macau assets, according to source - DJ), MGM +4.9% (up in sympathy with LVS), ZGEN +4.4% (reports final phase 2 results for IL-21 in renal cell cancer show tolerability and enhanced efficacy of Nexavar combination), YHOO +3.0% (Cramer makes positive comments on MadMoney), F +1.6% (Holders OK issuance of common stock in excess of 20%.

Allapoole avanevad:

In reaction to disappointing earnings/guidance: BBI -22.8%, OESX -15.5% (light volume), GU -12.1%, PDO -7.5%, ANF -6.1%, JCP -5.1%, A -3.2%, VSAT -2.5%, ITW -1.3%... Select drug related names showing early weakness: NVS -2.0% (In talks with govts for potential swine flu vaccine - DJ), SNY -2.0%... Select oil/gas related names trading lower: TOT -1.4%, RDS.A -1.4%, BP -1.3%, PTR -1.1%... Other news: CHE -10.9% (discloses its VITAS subsidiary received an administrative subpoena from the U.S. Department of Justice), OSIP -7.8% (announces preliminary data from two Phase I dose escalation studies of oral OSI-906), IRE -7.8% (still checking for anything specific), FIG -7.2% (announces pricing 40 mln share follow-on offering at $5/share), SMTB -6.7% (priced a 2.8 mln share common stock offering at $10/share)... Analyst comments: FE -10.8% (downgraded to Hold at Jefferies & Co and downgraded to Equal weight at Barclays), ZZ -6.9% (downgraded to Market Perform from Strong Buy at Raymond James and downgraded to Sell at Stifel Nicolaus), BT -3.9% (downgraded to Sell at UBS), AFL -1.6% (downgraded to Equal Weight at Morgan Stanley), PCAR -1.4% (downgraded to Underweight at HSBC). -

no nii, meie kullakallis valitsus hakkab lõhki minema? See tähendab seda et et 2-3 päevaga näeme ES-i alla 840!